- NEAR could climb to $5.343 if it breaks the resistance at $4.476.

- Whales and retailers are both showing bullish sentiment.

Recent market activity has seen Near Protocol (NEAR) experience substantial growth, with increases of 5.52% per day and 10.19% per week. At press time, it was trading at $4.46.

This surge is tied to NEAR’s recent efforts to overcome a one-month bullish descending channel, although it continued to encounter strong selling pressure at this resistance level.

Is this rally sustainable? Could a breakout happen soon? AMBCrypto conducted an analysis on NEAR to find out.

Key factor preventing potential rise of NEAR to $5.34

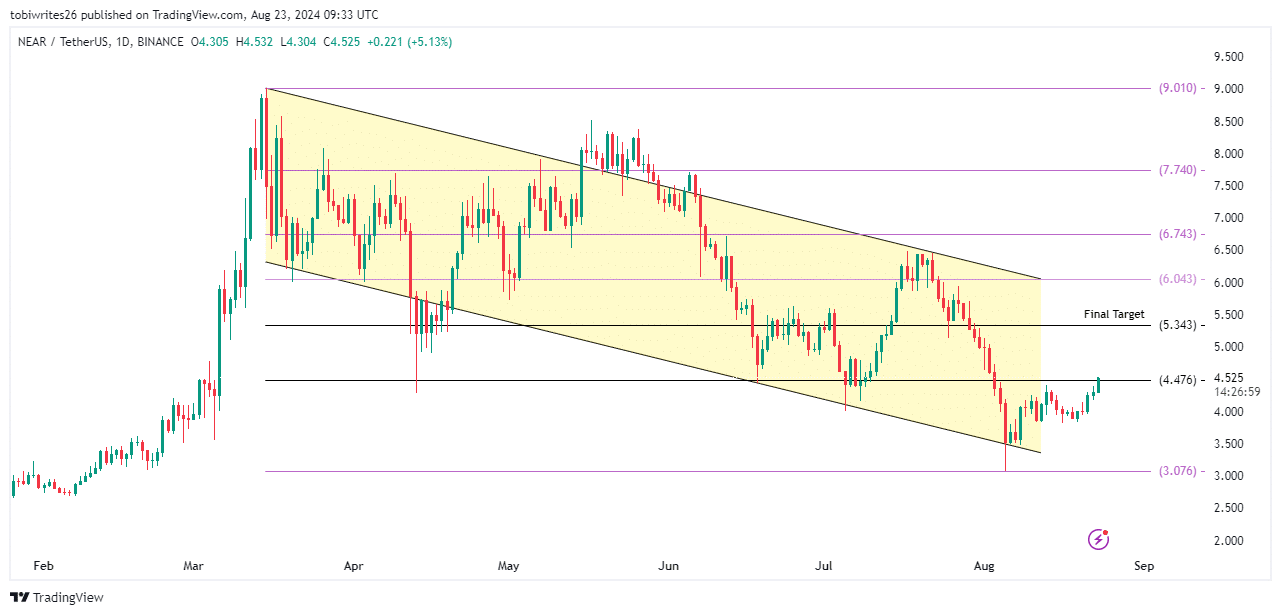

At press time, NEAR was trading within a one-month descending channel, which dates back to May.

This pattern, defined by its rectangular shape with upper and lower boundaries, typically precedes a rally after the asset bounces off the lower boundary.

NEAR recently bounced from the support zone, with a notable wick at the lower support level of $3.076.

The wick signifies a rejection of lower prices, indicating that buyers have regained control and are pushing the price higher, hinting at potential upward momentum.

However, NEAR faced a significant hurdle at the major resistance level of $4.476 at press time. For the recent rally to sustain, buying pressure must outweigh selling pressure.

Source: TradingView

If buyers manage to dominate sellers, NEAR is poised to break out of the channel and reach a new high of $5.343.

Otherwise, it could continue to move within the descending channel, potentially extending this pattern for weeks.

Short sellers feel increasing pressure from buyers

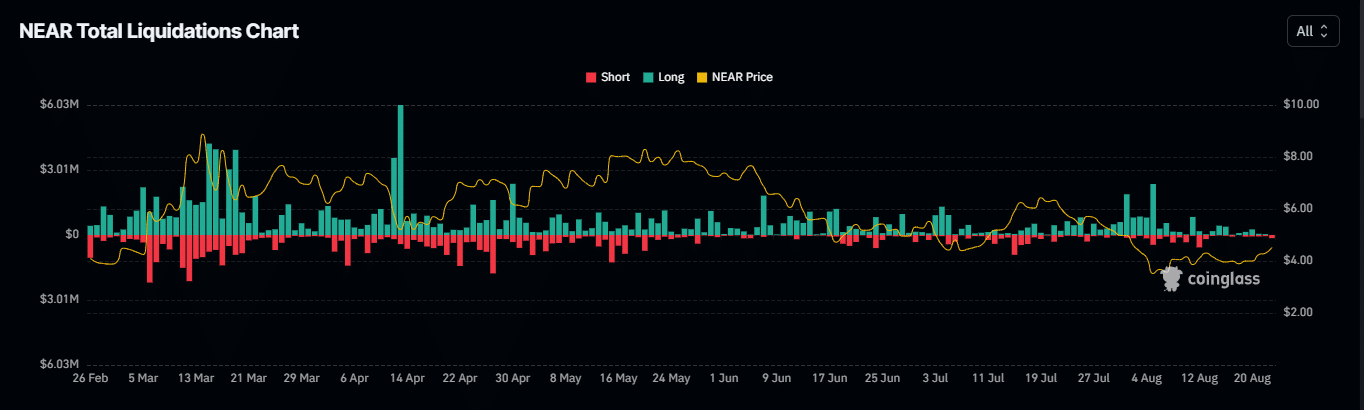

Further analysis by AMBCrypto indicated a high probability of breaking the $4.476 resistance level as buying pressure has intensified recently.

According to Coin glass, This burst of buying activity began on August 21, leading to a sharp increase in liquidations among traders betting against NEAR.

Over the past 24 hours, $182.65k of short positions have been eliminated from the market.

Source: Coinglass

Such events demonstrated increasing buying interest and the emergence of long-term traders as selling pressure diminished.

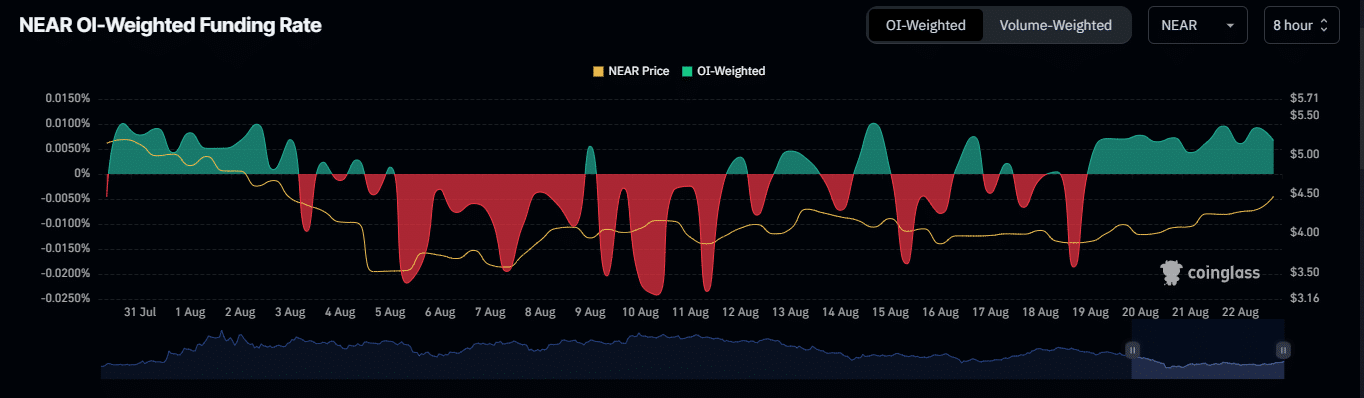

Since August 20, the OI weighted funding rate has remained positive, increasing steadily to reach 0.0066% at press time.

This indicated that long positions were prevalent, with long traders offsetting short sellers, a sign of strong buyer confidence and the potential for further upward momentum.

Source: Coinglass

If retail buying pressure persists, it could override existing selling pressure at the $4.476 resistance level.

Read the NEAR Protocol (NEAR) Price Predictions for 2024-2025

Whales maintain buying pressure

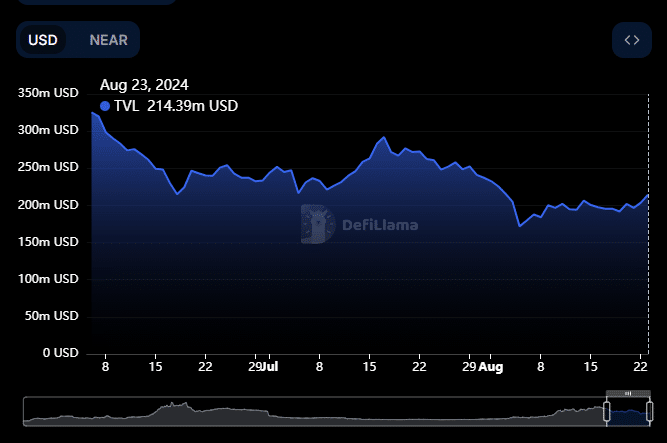

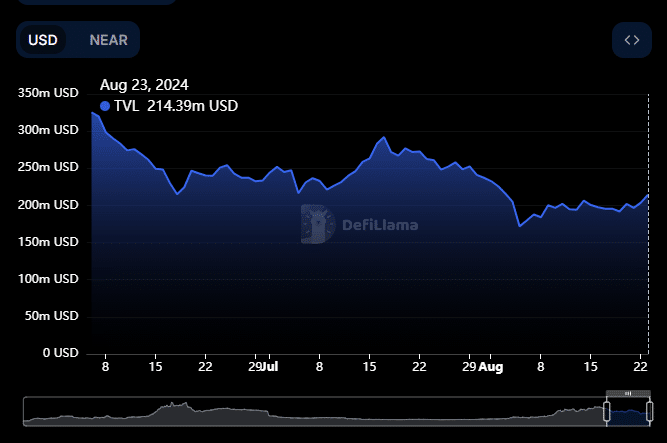

DeFiLlama Data indicated an increase in buyer confidence, as evidenced by the increase in total value locked (TVL), which stood at $213 million at press time.

Source: DefiLlama

An increase in TVL suggests that more NEAR is being invested into the protocol’s ecosystem. Typically, such an inflow predicts a continued price rise, reflecting continued investor interest and market strength.