- The Ethereum Foundation has defended itself after a recent ETH selloff drew scrutiny

- EF accused of ‘lack of transparency’

The Ethereum Foundation is in the news today after facing criticism from the crypto community following a recent surge to $35,000. ETH Kraken sell-off. Some community members were disappointed with the timing of the sale. They said the Foundation took advantage of Friday’s rally to cash in on its gains.

Some, like pseudonymous Ethereum core developer and evangelist Anti Prosynth, questioned how the Foundation could move funds without prior disclosure.

“Financial disclosures @ethereum, seriously. How the hell is this a convenient time to make these kinds of moves without even a word?”

Similarly, Eric Conner, another ETH core developer, also claimed that the Foundation’s lack of transparency was “extremely frustrating.”

“But the lack of transparency of the European Development Fund over the past 10 years is shocking and extremely frustrating. It is REALLY not much to ask for simple financial reports or clarity on the movements and use of funds.”

The Ethereum Foundation defends itself

On the contrary, Aya Miyaguchi, executive director of the Ethereum Foundation, clarified that the recent sale of 35,000 ETH was part of the organization’s “treasury activities” and that some only received payments in fiat currency. said,

“This is part of our treasury management activities. EF has a budget of about $100 million a year, much of which is grants and salaries, and some grantees can only accept fiat funds.”

She added that they could not share expected fund movements in advance, given the regulatory challenges they faced in early 2024.

“This year there was a long period where we were advised not to do any treasury activities due to regulatory complications, and we were not able to share the plan in advance… There will be planned and phased sales from here on out.”

To put things in context, in early 2024, EF was the subject of an intense investigation by the US SEC, which apparently began after the network switched to PoS (Proof of Stake) in September 2022. The agency was trying to determine whether ETH was a security, but later dropped the investigations and approved U.S. spot ETH ETFs in the second quarter.

Some like Marc Zeller, founder of Aave (AAVE)were not satisfied with Miyaguchi’s clarification, however.

Zeller claimed that some members of the Ethereum team, like Geth (Go Ethereum, the popular Ethereum client), earned little to justify the $100 million annual budget. He suggested dissolving EF after the next upgrades.

“$100 million a year for what? Geth Team… receives a meager salary despite essential work. Once the Purge & Verge upgrades are delivered, it will be time to seriously consider disbanding the EF.”

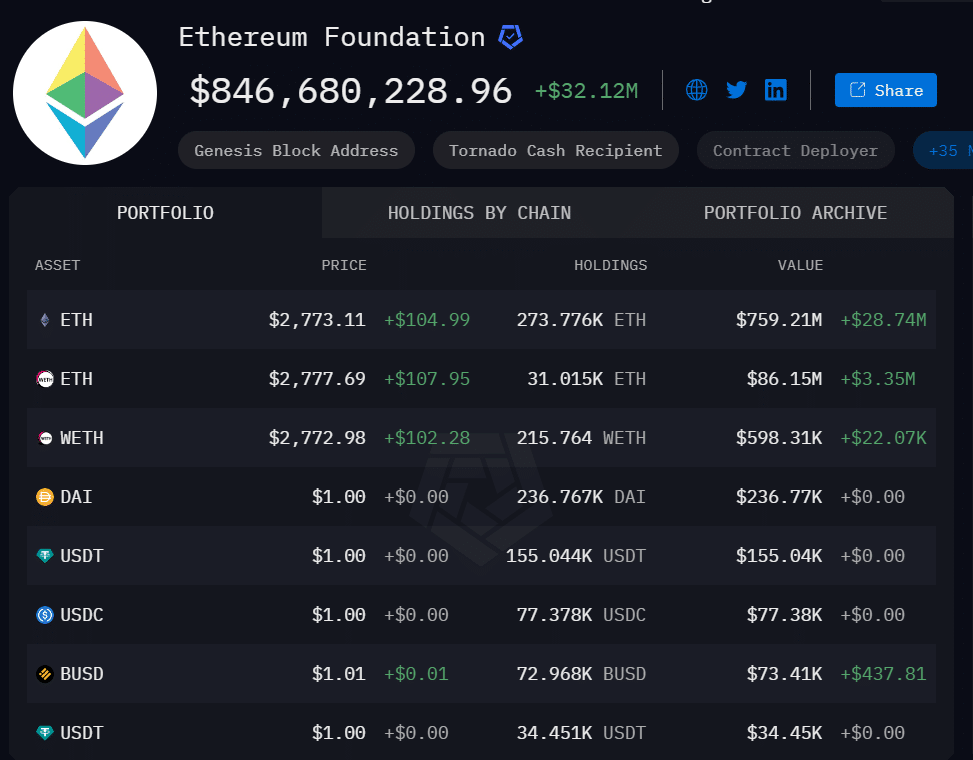

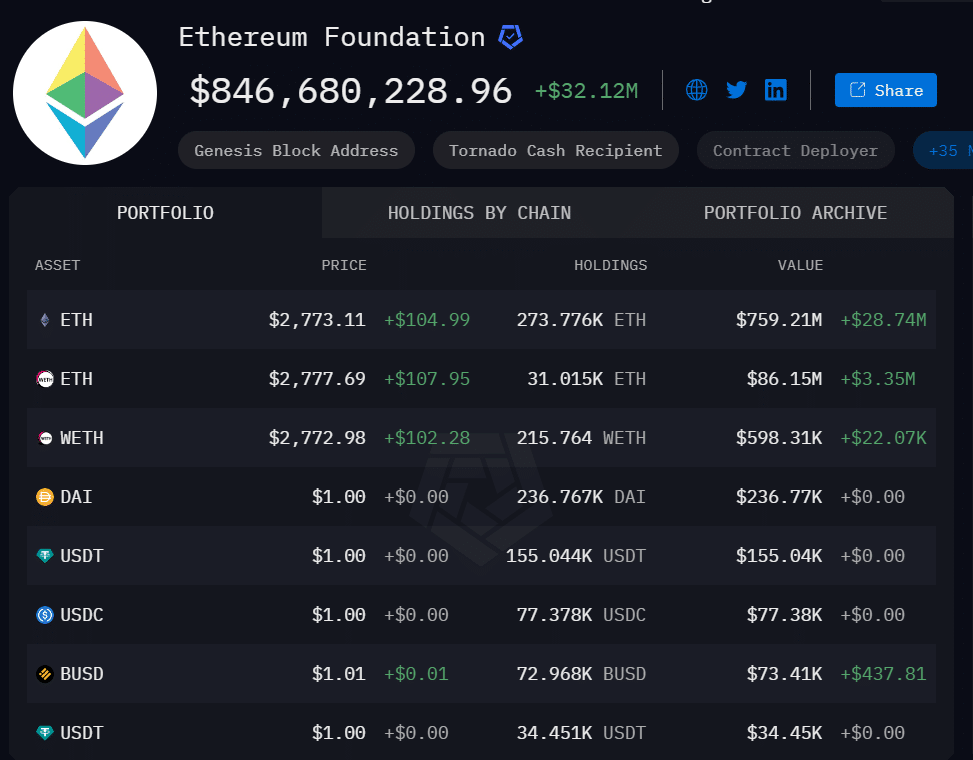

From Arkham dataThe recent sale reduced the Foundation’s ETH holdings to 273,000 coins, worth nearly $800 million based on current market prices.

Source: Arkham