- Solana was testing a multi-month support level at press time, following persistent selling pressure and a lack of buying interest.

- Despite the price weakening, on-chain data remained positive, with development activity on Solana increasing by 33% month-over-month.

Solana (SOL) The token has dropped nearly 4% in the past 24 hours as the bearish trend across the entire cryptocurrency market influences other headwinds. The token was trading at $139 at the time of writing.

SOL recorded the biggest decline among the ten largest cryptos by market cap. Trading volumes are also down 12% by CoinMarketCap data suggesting diminishing market interest and a lack of conviction among traders.

As Solana Tests Multi-Month Support Level, Is a Bullish Reversal Imminent or Will the Downtrend Continue?

Decreased buyer interest

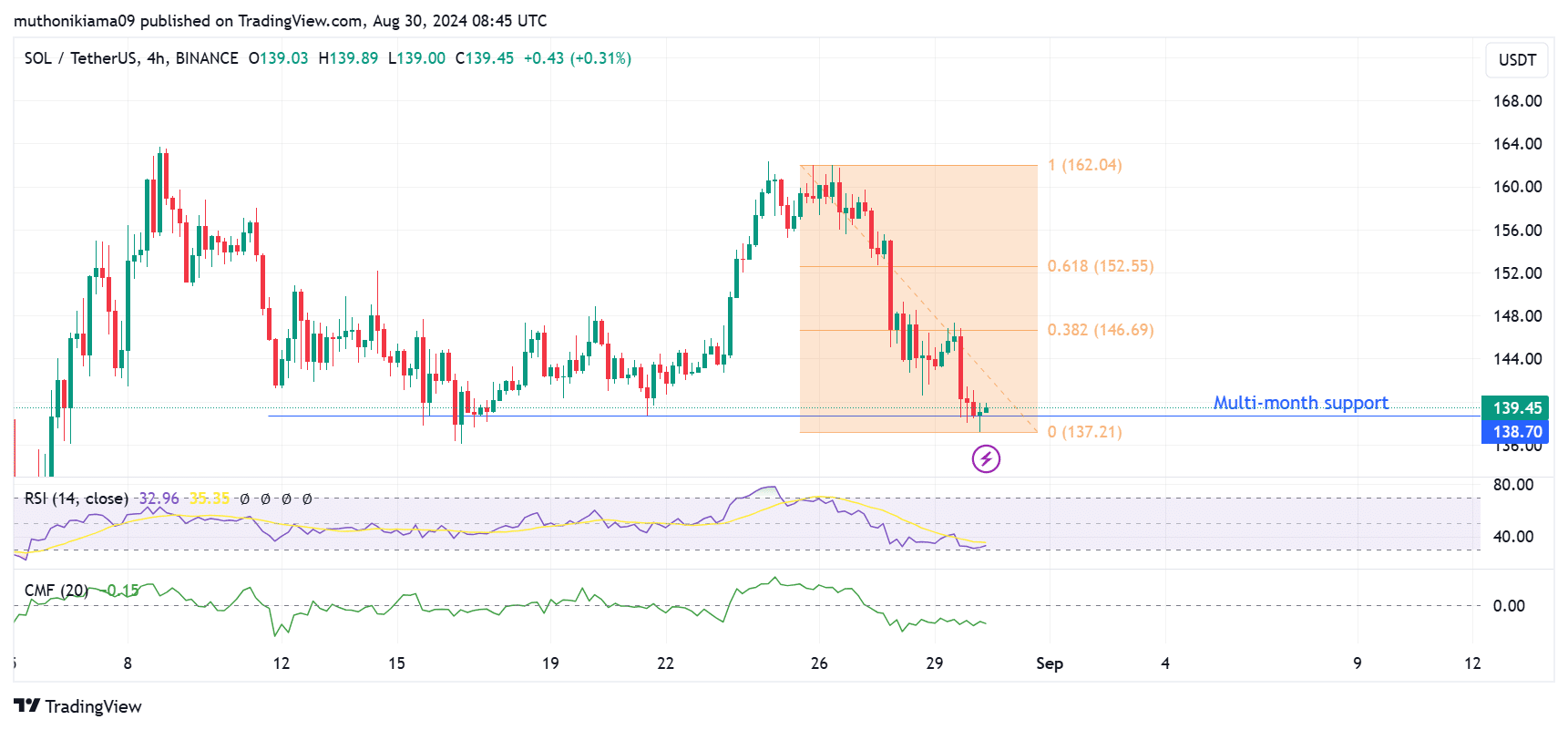

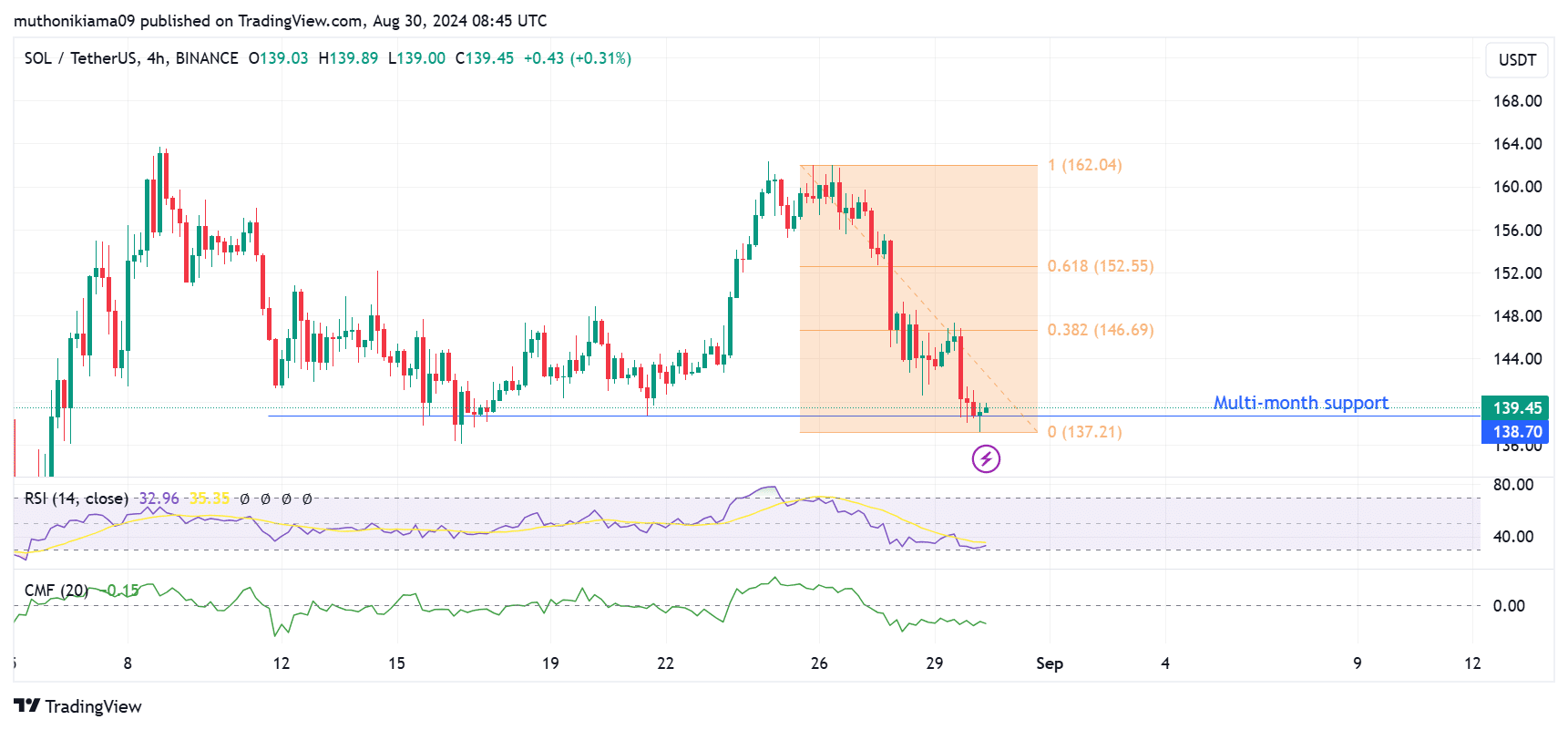

Solana’s technical indicators suggest a lack of buyer participation. The Chaikin Money Flow (CMF) on the four-hour chart has been hovering in the negative zone since the beginning of the week.

This trend indicates persistent selling pressure and a lack of adequate buying interest to absorb the tokens that have been dumped into the market.

The weak buying momentum around SOL is also reflected in the Relative Strength Index (RSI). The index was at 33 at press time, meaning bearish momentum was in play.

The RSI has been forming lower lows over the past week, showing that the bears have the upper hand. However, the RSI line was now attempting to make a bullish cross above the signal line.

The potential crossover also coincided with two consecutive green candles after the price bounced back from testing multi-month support at $138. Solana has held this support level since mid-August.

Source: TradingView

If Solana bounces off this support as it has done in the past, bulls will target immediate resistance at the 0.382 Fibonacci level ($146).

The other key level to watch is $152, as SOL needs to break above this price to confirm an uptrend. If the uptrend fails, SOL could consolidate and move in a range before deciding on the next trend.

Solana shows her strength

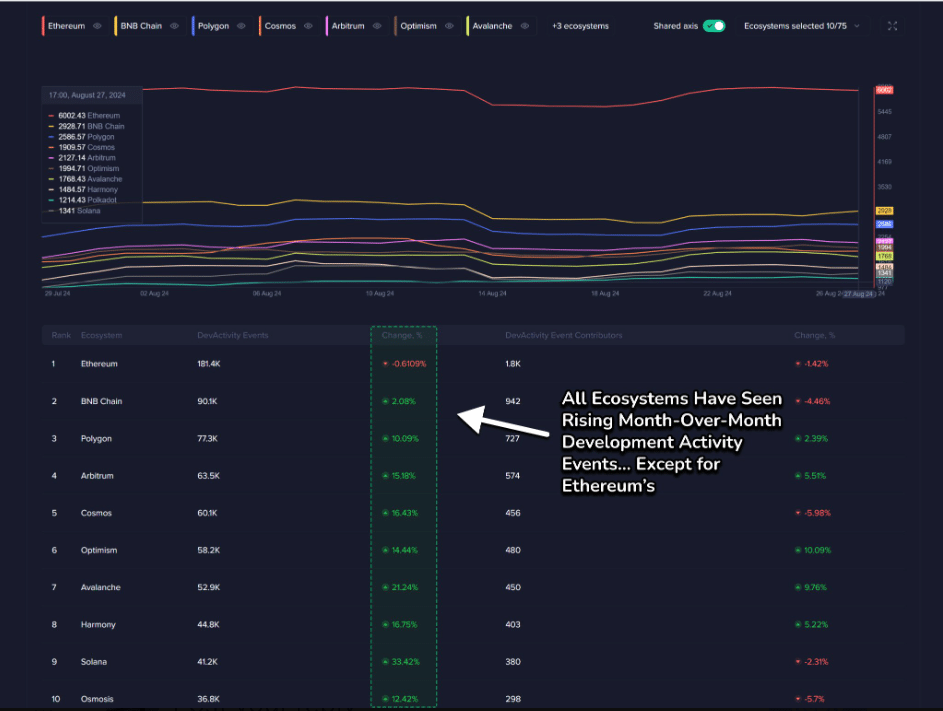

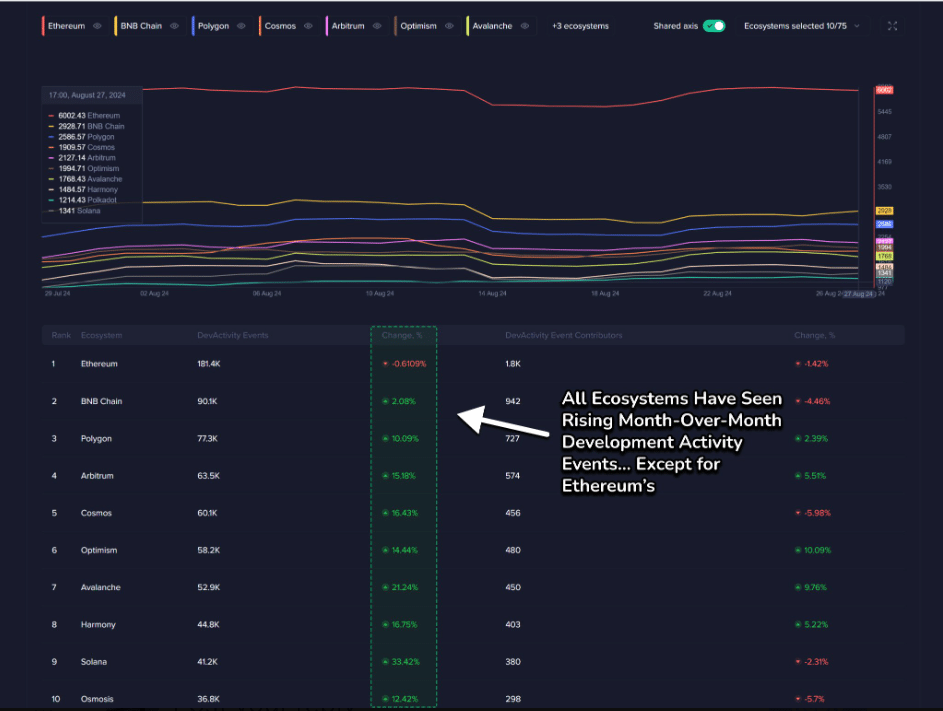

Although price action remains bearish, Solana’s on-chain metrics paint a bullish picture.

According to a recent X (formerly Twitter) post from Santiment, the Solana network saw the largest monthly increase in total developer activity.

This activity has grown by 33%, which is a positive sign of the growth and improvement of the network.

Source: X

Data from DefiLlama also showed an increase of over $1 billion in Solana’s total value locked (TVL) over the past month, despite price headwinds.

Read Solana (SOL) Price Prediction 2024-2025

However, the network’s positive indicators have failed to convince long-term traders.

In addition, the Long/Short ratio is less than 1 in Coin glass showed that short traders dominated Solana’s price action for most of the week.