- Positive movement on certain on-chain metrics does not necessarily suggest a bullish trend for AVAX.

- Whales and retailers are rapidly selling their AVAX holdings, but some hope remains.

Avalanche (AVAX) price trajectory has been sharply bearish, down 17.13% over the past week, and prospects for recovery appear slim.

Despite some encouraging signs, such as a 53.73% increase in trading volume over the past 24 hours and an increase in the number of daily active users and large transactions, AMBCrypto reports that these factors may not herald a reversal of the current trend.

Increased activity suggests exit from major holders

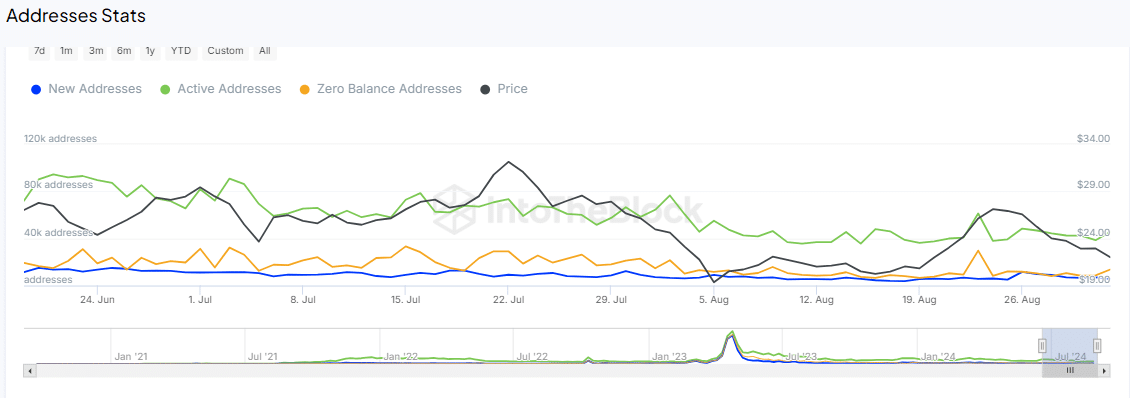

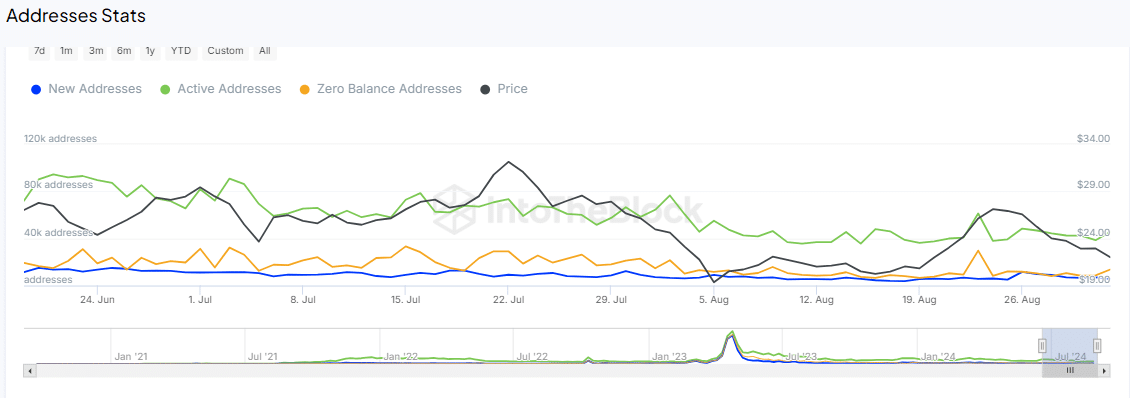

Data from IntoTheBlock reveals increased activity on AVAX, with the number of active addresses increasing from 38,58k to 45,69k in just 24 hours.

At the same time, the number of large transactions also increased, from 166 to 297 transactions during the same period.

Source: IntoTheBlock

Typically, such spikes might suggest a bullish trend, but the concomitant drop in AVAX price indicates otherwise.

This trend of increasing user engagement, coupled with falling prices, suggests profit-taking and distribution activities.

In simpler terms, it appears that whales, or large holders, are dumping their AVAX to cash out their profits, transferring their holdings to a broader pool of smaller investors, a move that often signals a potential further decline in price.

Further analysis by AMBCrypto confirms that this massive sell-off does not only involve whales but also retail traders.

Whales and Retailers Lose Confidence in AVAX

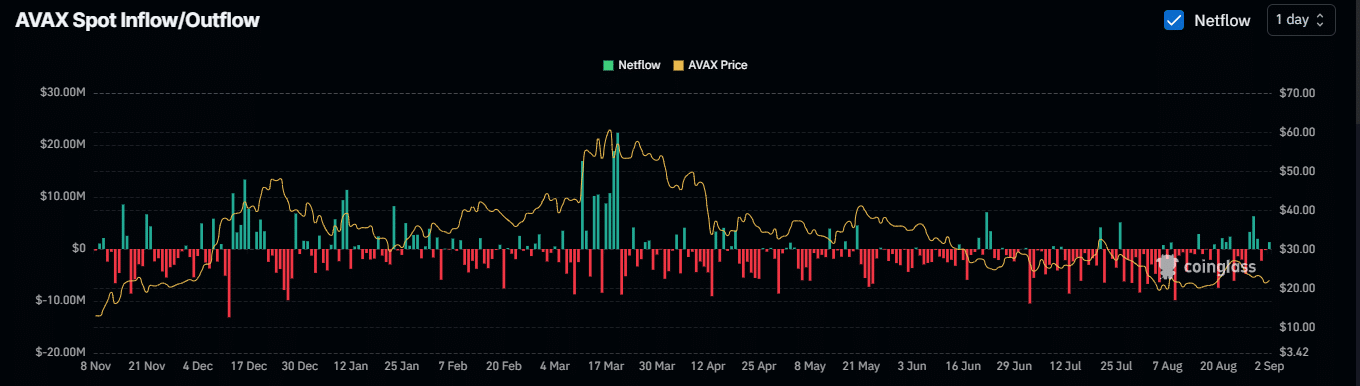

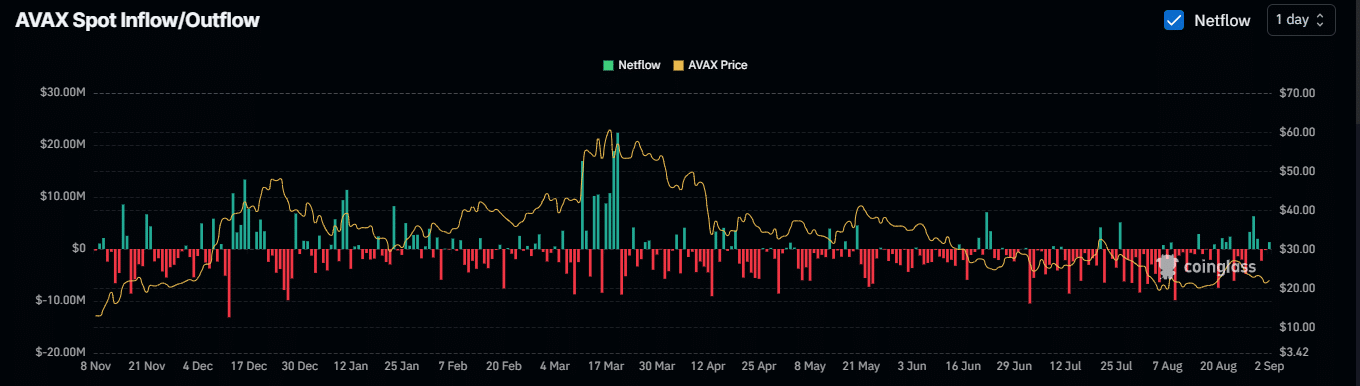

According to Coinglass, AVAX netflow across major centralized exchanges has been mostly positive, which generally signals a bearish outlook for the cryptocurrency.

A positive net flow indicates that the volume of AVAX deposited on these exchanges exceeds the amount withdrawn, suggesting an increased willingness by traders to sell rather than hold.

Source: Coinglass

This situation also means that an increase in inflows contributes to an increase in the supply circulating on the exchanges, which will put further downward pressure on prices.

Bearish sentiment is also evident among retail traders, as indicated by a negative open interest (OI)-weighted funds rate.

TThis negative indicator reflects a pessimistic outlook on futures and derivatives markets, with traders likely closing positions in anticipation of further price declines or to minimize losses.

AMBCrypto’s technical indicators analysis reveals persistent bearish patterns but a possible bounce is approaching.

A glimmer of hope remains for AVAX

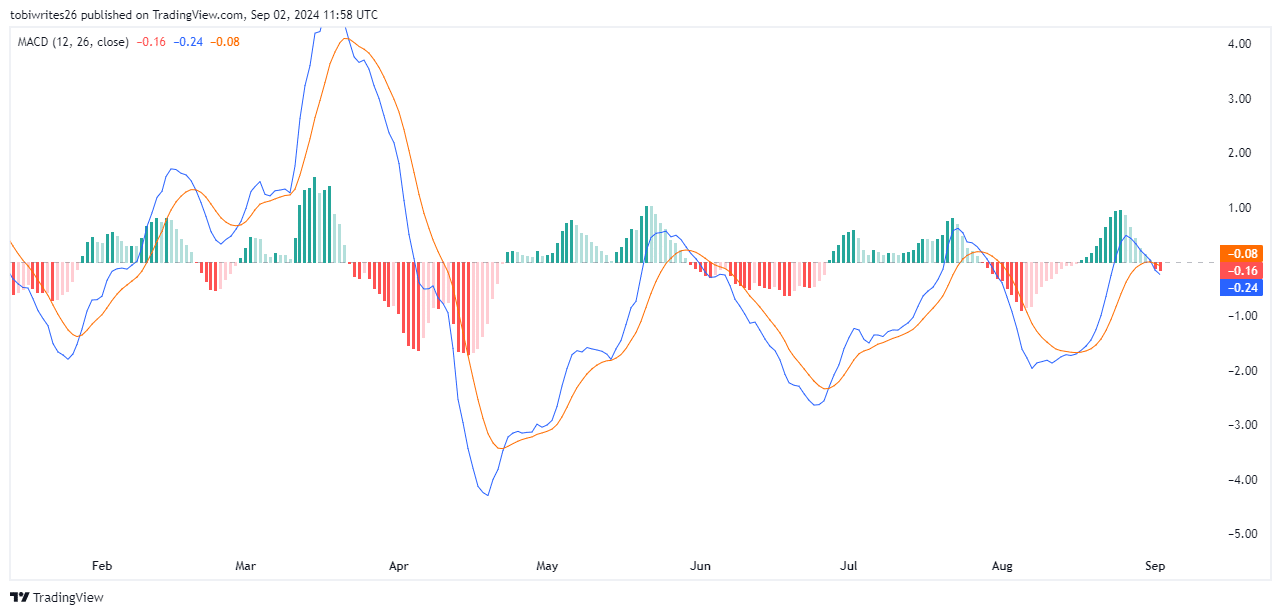

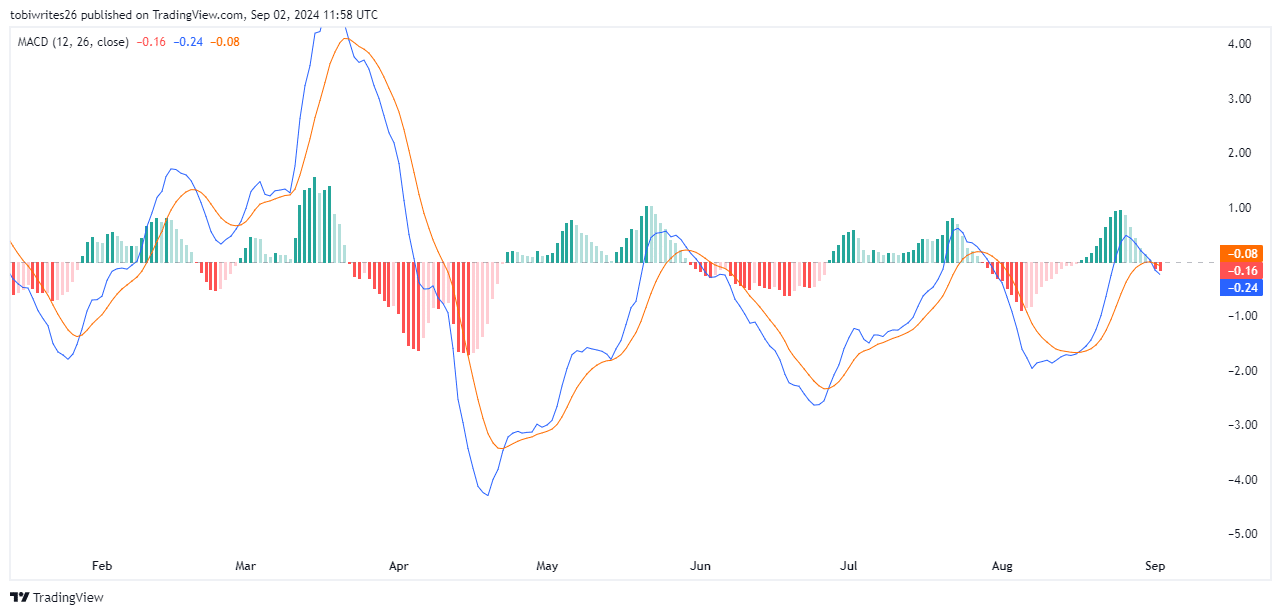

The Moving Average Convergence Divergence (MACD) indicator has intensified the bearish outlook for AVAX as the MACD line (blue) crossing below the signal line (red) suggests an upcoming decline in momentum and price.

Source: Trading View

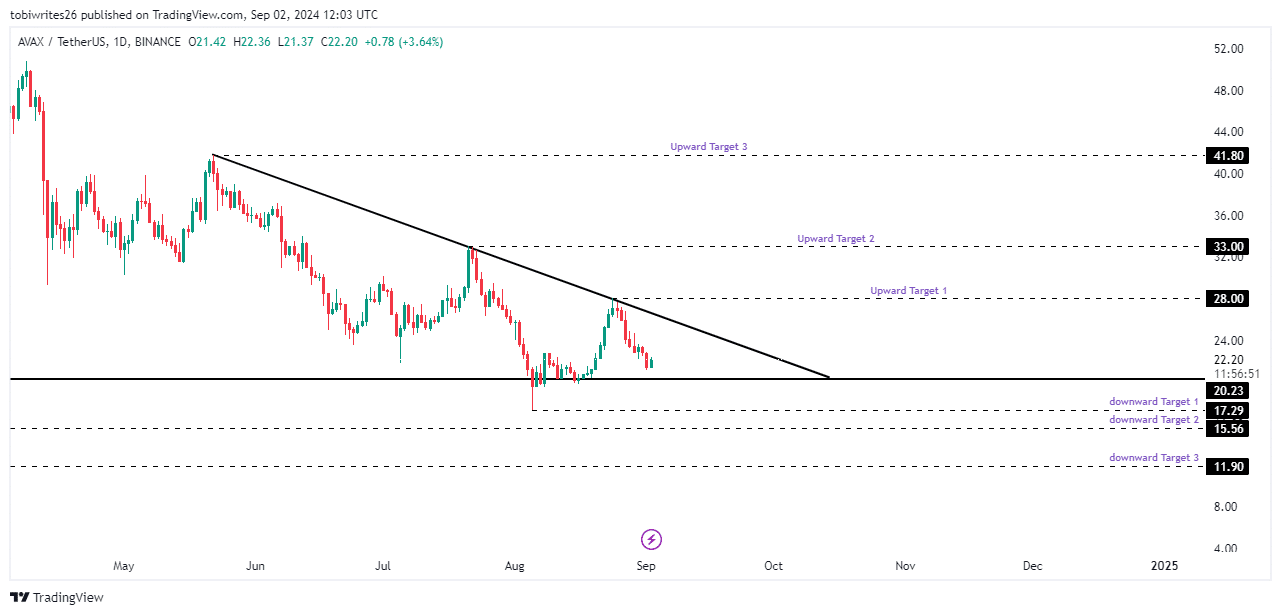

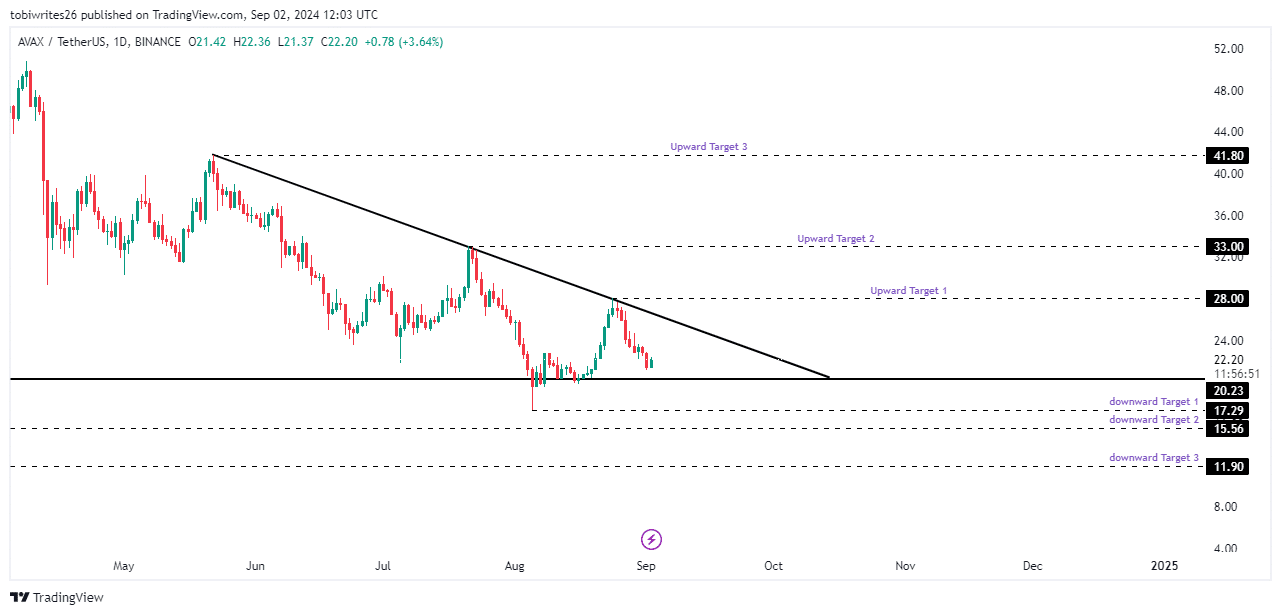

This trend suggests a potential decline in AVAX price in the short term. However, the presence of key technical patterns, such as local support and a descending trendline on the daily chart, suggests a possible bullish reversal ahead.

The recent selling pressure on AVAX could be a search for price to test its local support area at $20.23, a level historically associated with strong buying interest.

Is Your Portfolio Green? Check Out the Avalanche Profit Calculator

If this support holds, it could trigger a rally, pushing the price above the descending trendline towards a target near $28.

Source: Trading View

On the other hand, if bearish forces take over, AVAX could drop to the first lower support at $17.29. Further pressure could then push the price down to $11.90.