- The core market capitalization has just soared to a new all-time high, supported by strong volumes.

- The growth in TVL and transactions completes the picture of a healthy DeFi ecosystem.

Ethereum’s (ETH) Layer 2 ecosystem has been growing and Base has become one of the L2 networks on the fast track. Base has recently reached new milestones, including a new all-time high in stablecoin market cap.

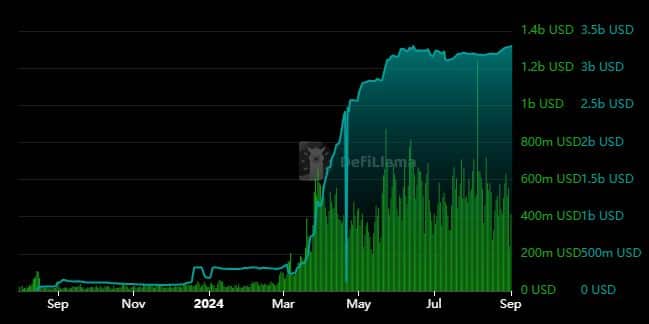

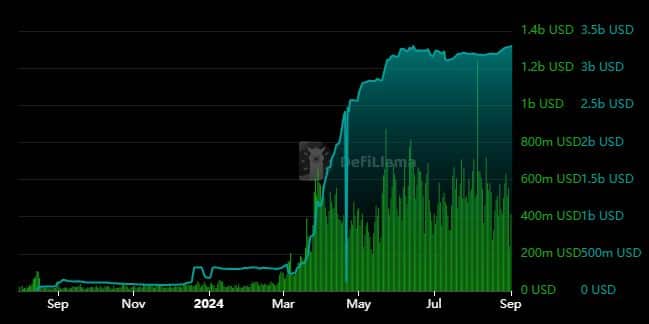

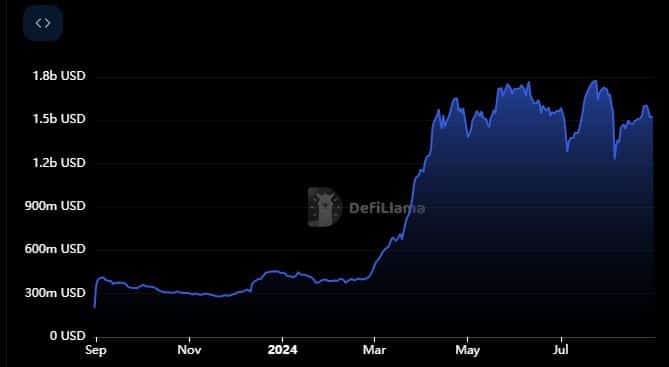

Base has been rising through the ranks of existing layer 2 Ethereum networks. This was particularly evident in its stablecoin market cap.

The latter recently reached a new all-time high of $3.28 billion. The market capitalization of the stablecoin Base grew exponentially between March and June. It continued to grow despite market headwinds in August.

Source: DeFiLlama

The growth of stablecoins in DeFi is typically accompanied by robust utility. In the case of Base, the growth in stablecoin market cap has been accompanied by an increase in volume.

For comparison, the Layer 2 network’s daily on-chain volume was less than $50 million before March. However, daily volumes surpassed $600 million before the end of March.

Assessing the impact of stablecoin growth Base

Since then, Base has maintained healthy on-chain volume above $200 million, even during the slowest market days. This combination of stablecoins and robust volumes confirms the presence of robust demand and utility.

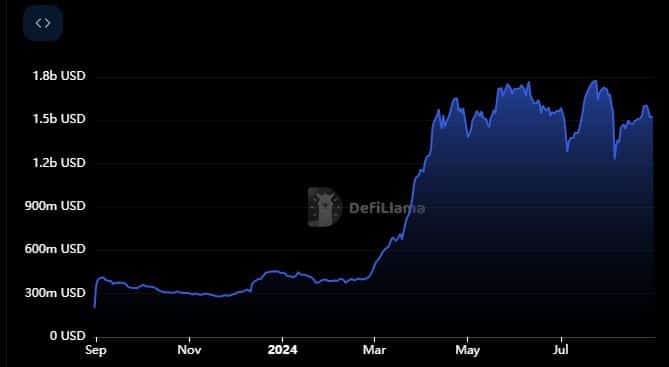

Therefore, the network’s TVL is on the rise. It currently ranks second in the list of major Ethereum layer 2 players in terms of total value locked.

Source: DeFiLlama

Base managed to hit an all-time high TVL of $1.77 billion during the same March-June period that the stablecoin market cap went parabolic. Its TVL has since pulled back slightly in recent months and is sitting at $1.51 billion at the time of publication.

TVL is more likely to be influenced by market volatility, which would explain declines in TVL from its peak. TVL growth also reflects the robust value flow within the BASE network.

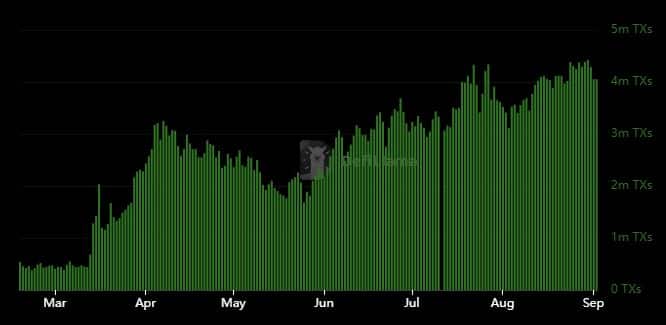

The Base Layer 2 protocol has sustained its impressive growth thanks to robust utility that is reflected in user activity. According to DeFiLlama, Base concluded August with the highest number of daily transactions ever recorded.

Source: DeFiLlama

Daily on-chain transactions on the network peaked at 4.42 million TX on August 30. Zooming out reveals that the network saw a surge in transactions starting around mid-March.

On-chain activity has since followed a steady growth trajectory, as confirmed by the number of transactions.

Base has yet to launch its own native token. However, it would be one of the most anticipated airdrops if it were to happen. In the meantime, the sharp rise reflects the state of the Ethereum ecosystem which is still very active.