- The TON blockchain has reached a record milestone of reaching 1 billion transaction volume.

- Does this signal an imminent price correction?

Toncoin (TON) has been on a downtrend since late August, falling 28% to $4.884 amid the Telegram controversy and the collapse of Bitcoin (BTC).

Despite this, a recent A surge of one billion transactions on the Toncoin blockchain prevented it from testing the $4.5 support level, which AMBCrypto said could have pushed it back to its February low of $2.06.

After the pullback, TON moved closer to the $9 resistance.

As TON approaches $4.5 again, AMBCrypto examines whether bulls can prevent a repeat of February’s decline or whether Bitcoin will push TON into a downtrend.

BTC Volatility Limits TON Rebound

Amid broader market volatility fueled by Bitcoin’s drop below the $57 support level, bulls may have to work harder for a TON rebound.

The TON blockchain has recorded 1.02 billion transactions, half of which occurred in the last three months, surely reflecting an increase in user engagement.

However, despite this historic milestone, daily buying volume remained below bullish expectations.

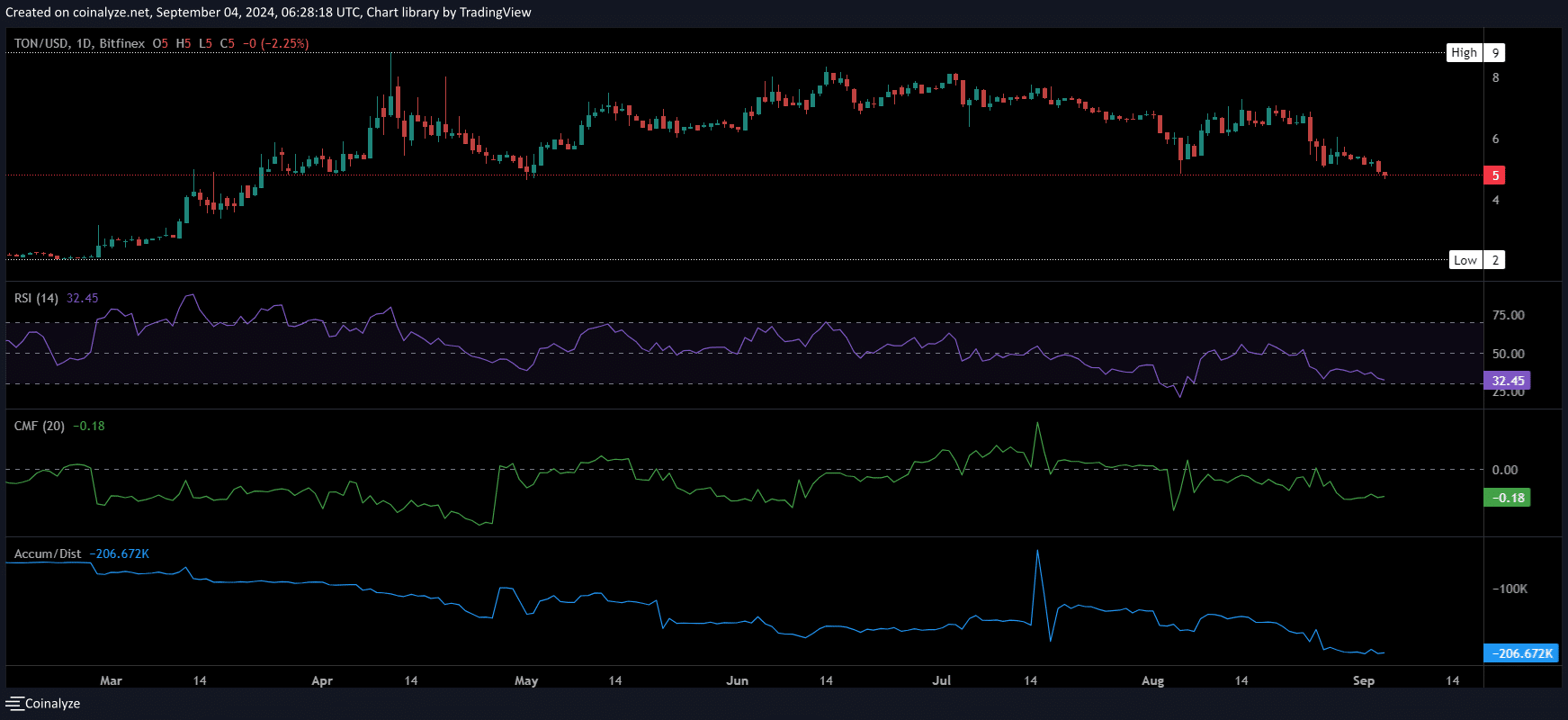

Source: Coinalyze

The chart showed a bullish rally in late February, pushing TON near $9 by mid-April, with the OBV climbing from 80,000 to 216,000 and the RSI reaching 80, signaling a strong overbought condition.

In early August, despite a bearish start, a surge in OBV and CMF led to a strong two-week surge in TON before BTC disrupted it.

In short, bulls have repeatedly pushed TON towards a price reversal, supported by strong volume data and the high transaction volume on the TON blockchain.

However, AMBCrypto noted that BTC-induced market volatility has made investors cautious, as evidenced by an oversold RSI, leading to reduced capital inflows despite these bullish efforts. So, is a rebound out of the norm?

Recent whale activity

Interestingly, whales hold 68.88% of TON’s significant holdings, totaling around $3.24 billion.

The remainder is split between retail and institutional investors, with the latter holding 26.53% of TON’s remaining large stakes.

For about five months, large holders have mainly consolidated their holdings, moving them infrequently.

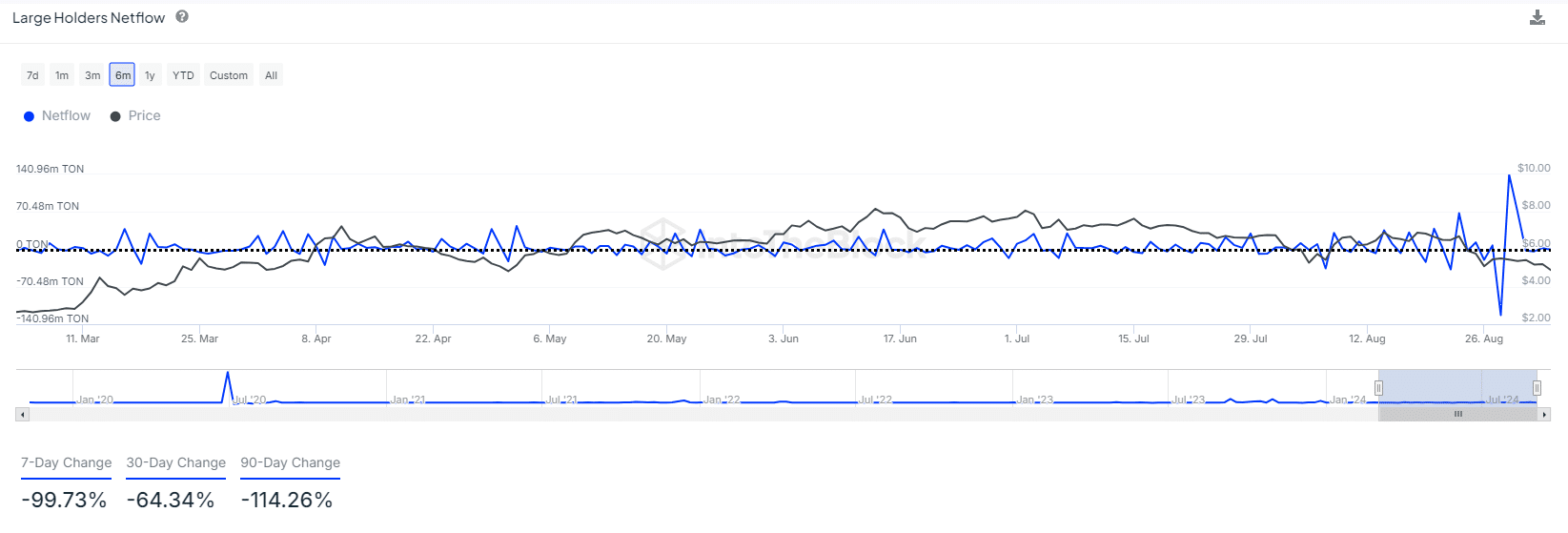

Source: IntoTheBlock

However, the chart revealed striking activity on the TON blockchain during the last days of August.

On August 29, large holders deposited approximately $140 million worth of TON onto exchanges, causing prices to drop by more than 2% the next day.

AMBCrypto noted that these net outflows coincided with the recent decline in BTC and the general perception of September as a particularly volatile month.

In short, the billion transactions on the TON blockchain were dwarfed by overall market volatility, forcing large holders to exit before it was too late.

Moreover, if the market remains volatile, the bears could consolidate their control, pushing TON below the $4.5 support level. Who do the odds favor?

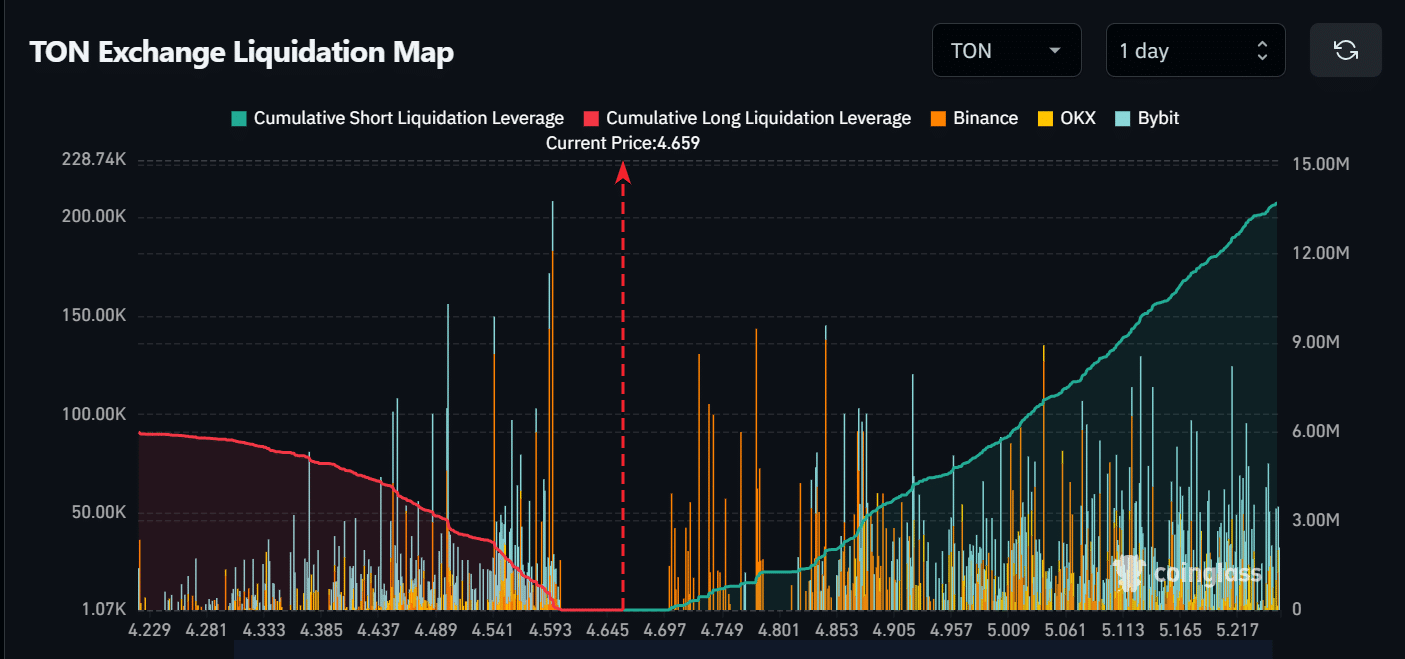

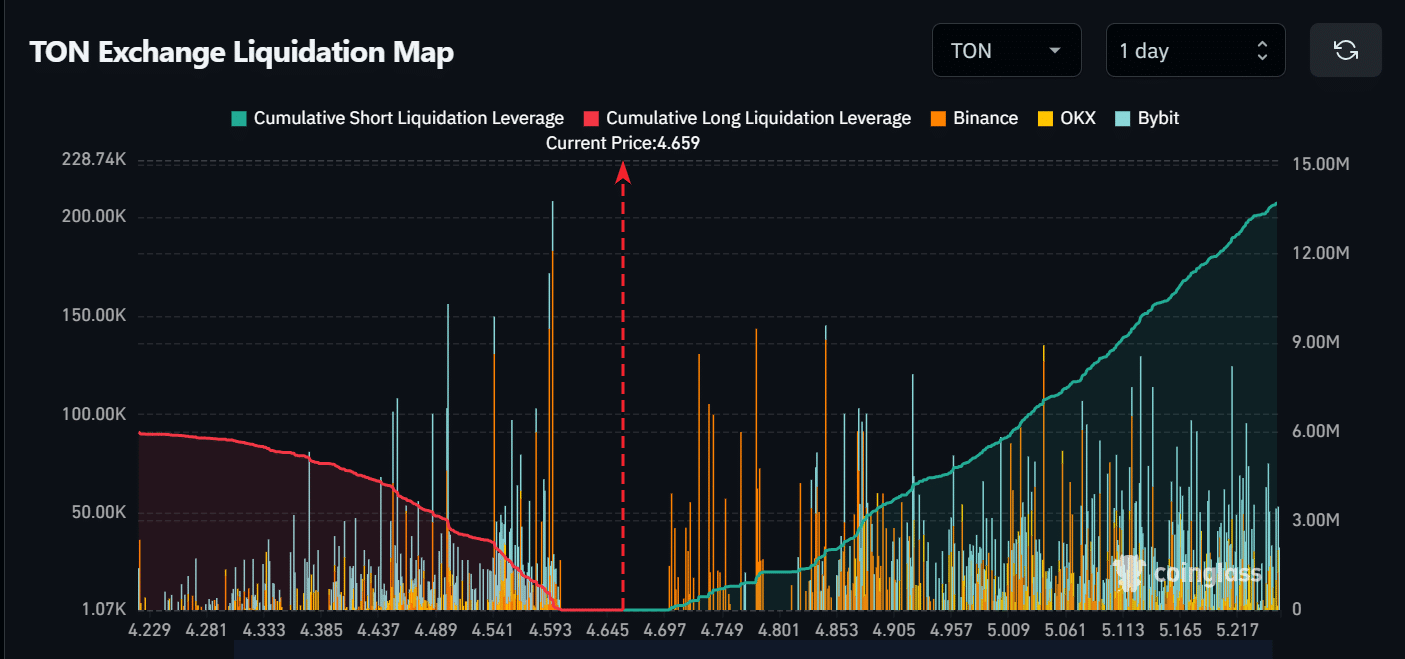

TON Blockchain Volatility Favors Short Positions

AMBCrypto’s analysis of the chart below revealed that if TON continues to decline, despite record transactions on the TON blockchain, $332,000 in long liquidations could occur when it tests the $4.5 support line.

Source: Coinglass

Realistic or not, here is the market capitalization of TON in terms of BTC

In short, if long-term market volatility persists, a TON recovery will be difficult. If the bulls succeed, TON could reach the $5.2 ceiling; if not, it could fall back to the $4.2 range.

Currently, the odds seem to favor short position holders.