- ETH accumulation has been decreasing in recent weeks.

- ETH saw a positive trend over the weekend.

Ethereum (ETH) has seen significant volatility over the past few months, with on-chain indicators showing mixed signals. Data indicates that some Ethereum whales have suspended their accumulation, suggesting a potential shift in sentiment among large holders.

However, despite this, Ethereum recently recorded a four-month high in network growth, a positive indicator of increasing activity and adoption on the network.

Ethereum whales reduce their accumulation

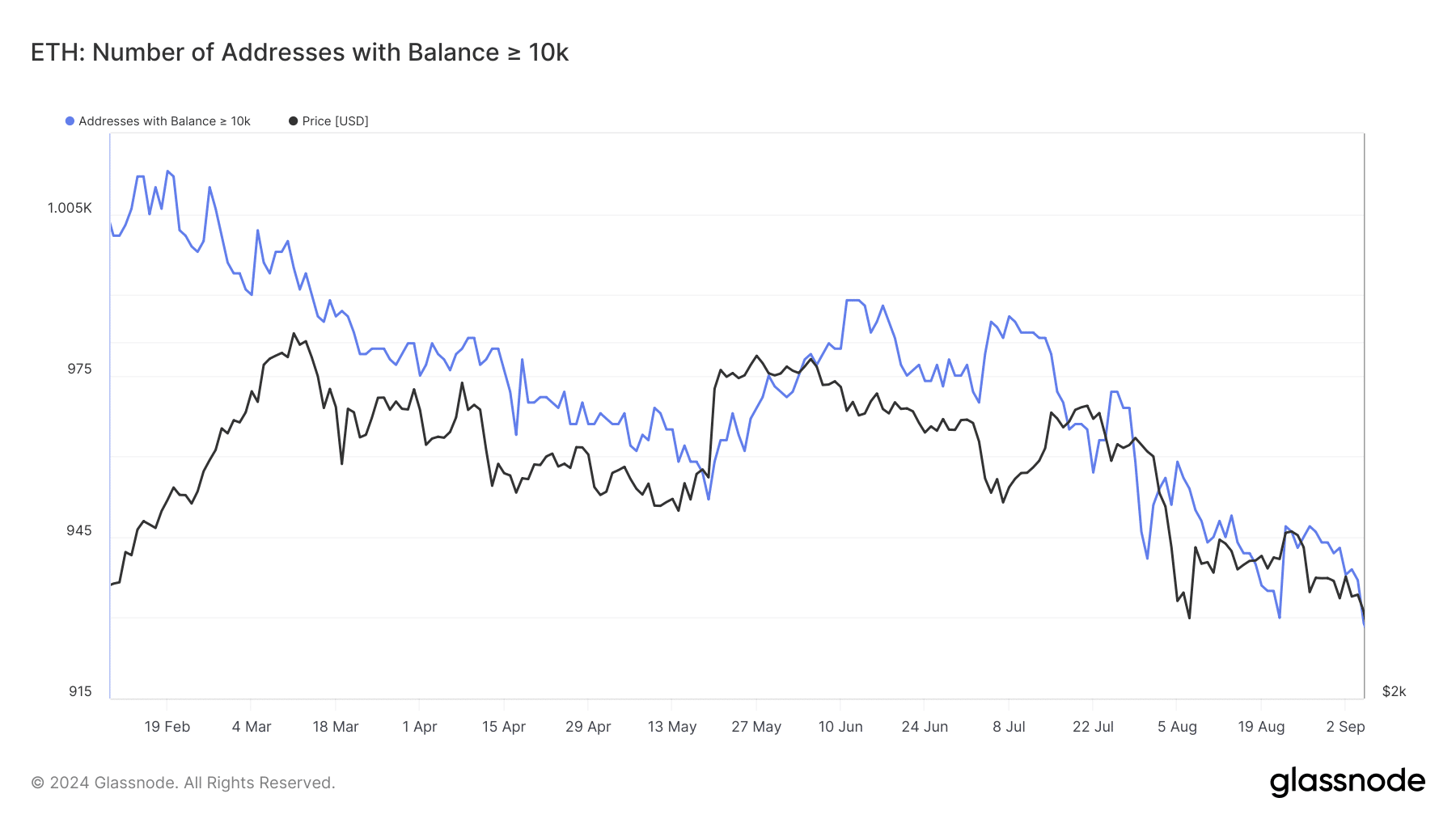

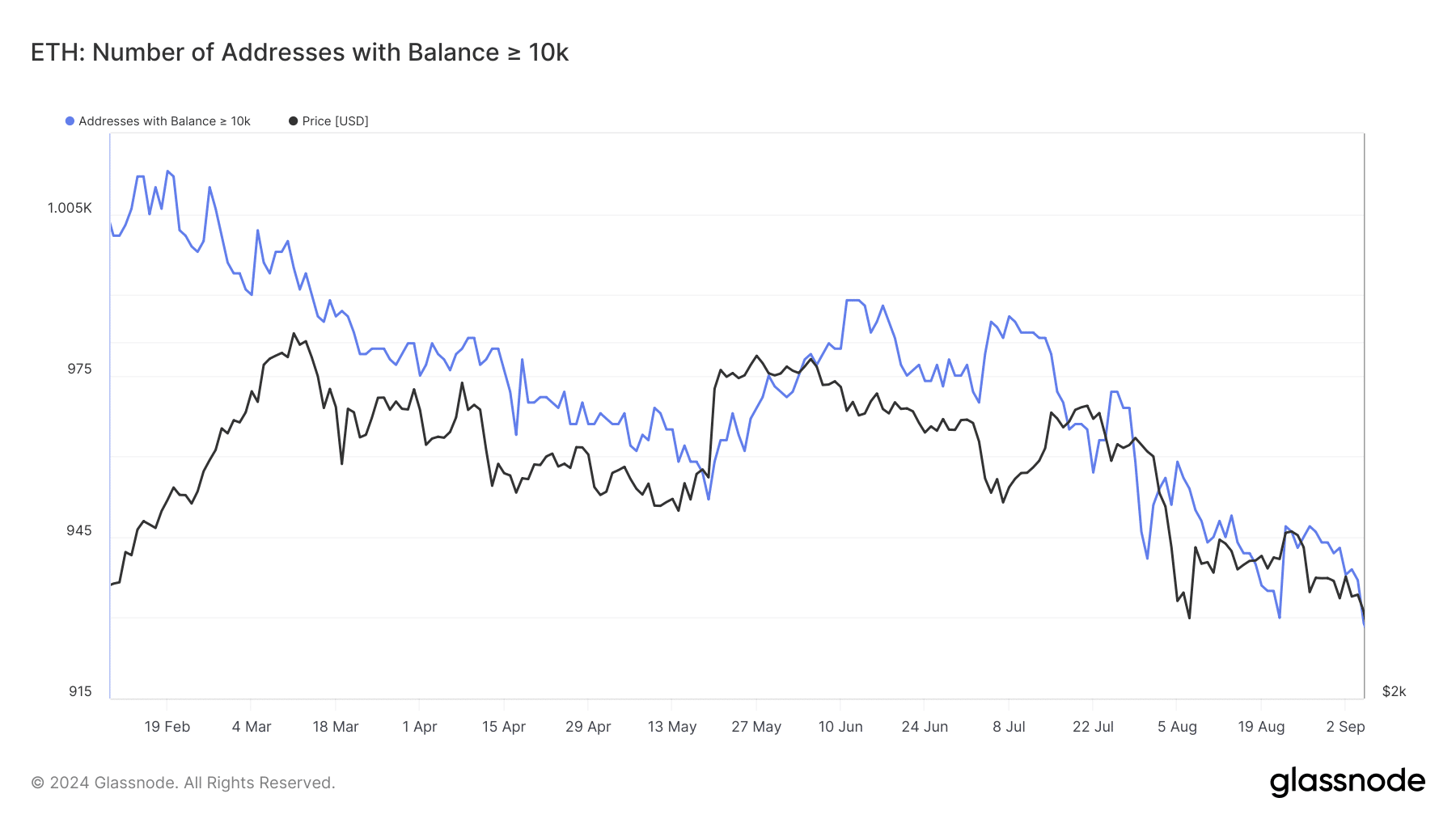

An analysis of Ethereum addresses on Glassnode reveals different reactions to recent price movements across holder categories. Addresses holding 10-100 ETH have remained relatively stable, indicating no significant selling or new accumulations.

However, larger movements were observed among the largest addresses. For addresses holding between 1,000 and 10,000 ETH, accumulation stopped towards the end of August.

In addition, there has been a notable decline in holdings since then, indicating a redistribution or selling. This change suggests that mid-level whales are reducing their exposure.

Source: Glassnode

Additionally, larger addresses holding 10,000 ETH or more reduced their accumulation even earlier.

Data shows that these addresses stopped accumulating around July, and like the 1,000 ETH addresses, they have also redistributed or sold their holdings since then.

Recent growth of Ethereum network sends positive signals

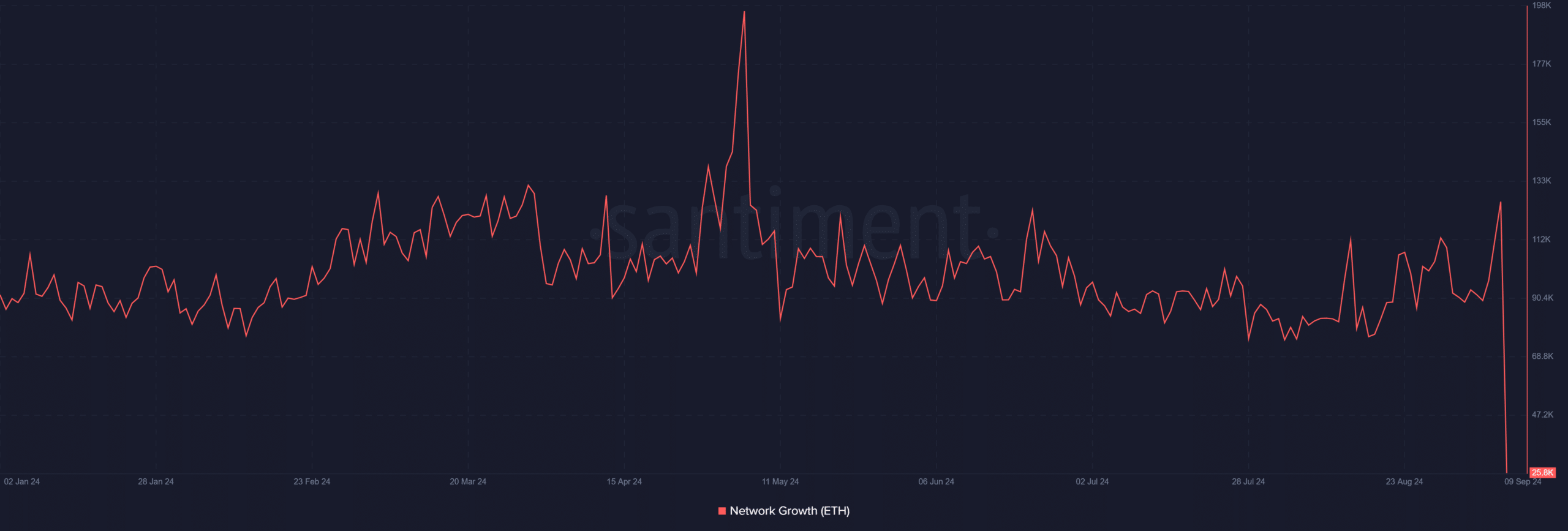

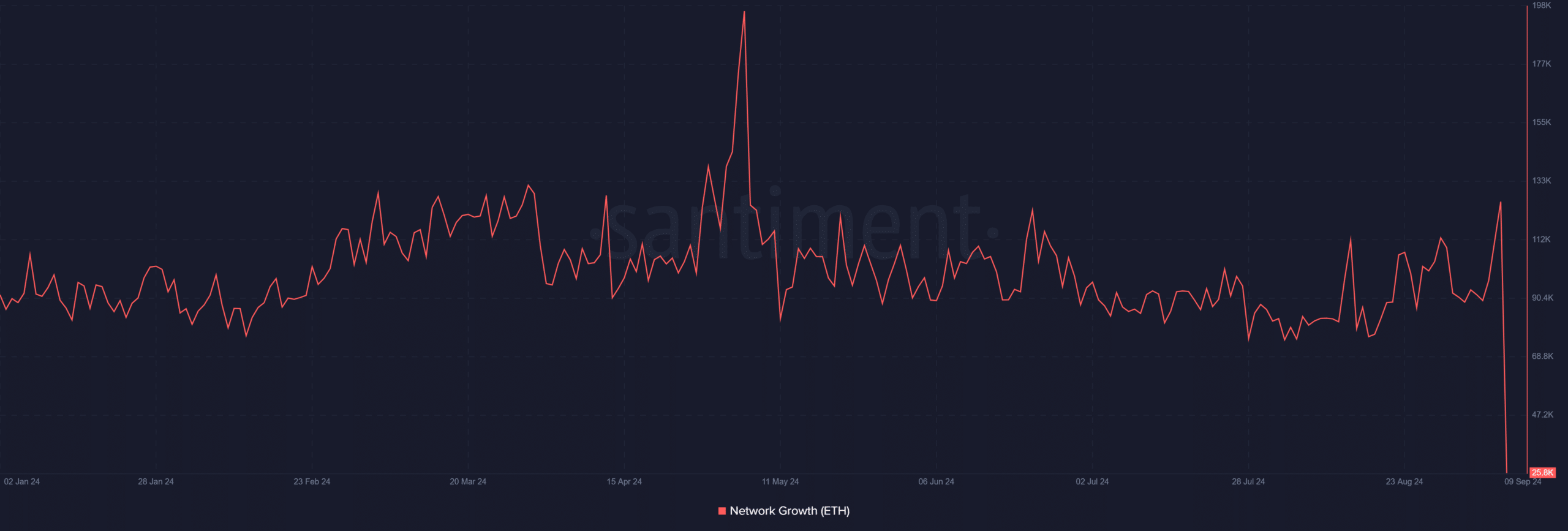

The recent decline in whale address accumulation could be interpreted as a negative indicator for Ethereum, signaling caution from large holders. However, the network’s positive growth in terms of new addresses offers a more optimistic outlook.

Source: Santiment

According to data from Santiment, Ethereum recently hit a four-month high in terms of new daily addresses, reaching over 126,000. This is the highest level since June and is notable because it occurred on a Sunday.

This day typically sees lower network activity.

ETH ends the weekend on a positive note

An analysis of Ethereum on the daily chart shows positive price action over the weekend. At the close of trading on September 8, ETH saw a 1% increase, trading around $2,297.

This follows a 2% increase in the previous session. At the time of writing, ETH has entered the $2,300 price range, with an increase of less than 1%.

The network’s recent growth spike, marked by an increase in the number of new addresses, highlights the growing interest in Ethereum, even amid market volatility.

Although whale accumulation has slowed, the increase in network participation suggests that smaller investors or new entrants are becoming more active in the Ethereum ecosystem. This renewed interest could help balance the overall market dynamics.

Read Ethereum (ETH) Price Prediction 2024-25

The interplay between slowing whale activity and increasing network growth will be critical in determining Ethereum’s future price movements and network strength.

If retail investors continue to show interest, this could offset some of the downward pressure from reduced whale accumulation, potentially supporting ETH price in the short term.