A British regulator has charged a Londoner with operating several cryptocurrency ATMs without a license.

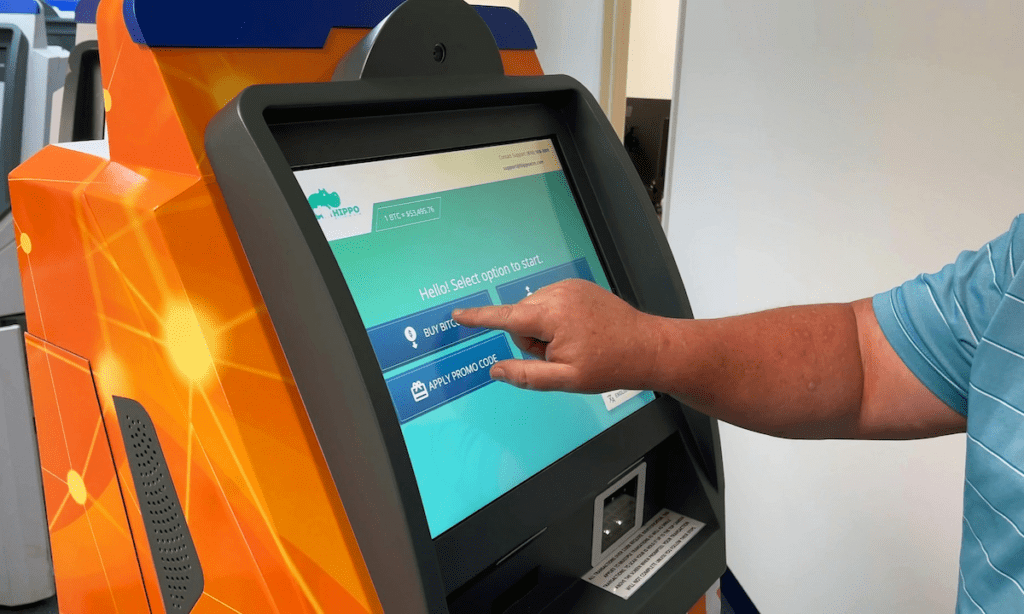

Olumide Osunkoya, 45, has been charged with operating a series of unlicensed machines that allowed users to buy cryptocurrencies or convert cash into crypto assets, the Financial Conduct Authority (FCA) said on Tuesday (September 10).

According to a press release from the FCA, Osunkoya processed $3.4 million in cryptocurrency transactions at multiple locations between December 2021 and September last year without proper registration. The UK does not have any legal cryptocurrency ATMs, the authority noted.

The FCA said this was its first criminal prosecution relating to unregistered crypto-asset activity under its 2017 Money Laundering and Terrorist Financing Regulations, and the first charges against a person for operating cryptocurrency ATMs in the UK.

“Our message today is clear. If you operate a cryptocurrency ATM illegally, we will stop you,” Therese Chambers, co-executive director of enforcement and market oversight at the FCA, said in the statement. “If you use a cryptocurrency ATM, you are handing your money directly to criminals. Criminals can exploit cryptocurrency ATMs to launder money around the world.”

The FCA’s announcement comes as regulators on both sides of the Atlantic are warning about cryptocurrency ATMs. Last week, the US Federal Trade Commission (FTC) released data showing that the amount of money consumers lost to bitcoin ATM scams soared to $114 million last year, a tenfold increase since 2020.

Cryptocurrencies have become a primary payment method used for many scams, the FTC said, adding: “Widespread access to bitcoin ATMs (BTMs) has helped make this possible.”

In other cryptocurrency crime news, the FBI announced this week that the number of cryptocurrency-related complaints accounted for 10% of all financial fraud complaints last year, but half of the total losses.

This is due in part to the use of cryptocurrencies in investment scams that see victims rack up “massive debts” to cover their losses, the FBI said in its report on cryptocurrency fraud.

Overall, losses from financial fraud involving the use of cryptocurrencies jumped 45% in 2023, reaching $5.6 billion, according to the report. The FBI’s Cybercrime Complaint Center received 69,468 complaints from the public related to the use of cryptocurrencies.

“The decentralized nature of cryptocurrencies, the speed of irreversible transactions, and the ability to transfer value around the world make cryptocurrencies an attractive tool for criminals, while creating challenges in recovering stolen funds,” Michael D. Nordwall, assistant director of the FBI’s Criminal Investigation Division, wrote in the report. “Once an individual sends a payment, the recipient owns the cryptocurrency and often quickly transfers it to an overseas account for withdrawal.”