- Analysts have warned that FTM’s $0.50 resistance could trigger a bullish trap, with a likely correction to $0.465.

- Rising open interest and whale activity signaled growing bullish momentum, but caution remained at $0.50.

Ghost (FTM) has seen significant upside recently, but analysts have issued warnings as the token approaches a key resistance level.

Negotiation at $0.4874 At press time, FTM has seen a slight decline of -0.76% over the past 24 hours, while registering a 25.29% gain over the past week. Its market cap stands at $1.36 billion, with 2.8 billion FTM in circulation.

Crypto analyst @CryptoJobs3 has expressed concerns about a potential bull trap as FTM approaches the $0.50-$0.5050 range.

Citing a bearish divergence on the RSI, the analyst said:

“A correction is possible; the price could return to the range of $0.470 to $0.4650.”

A break beyond $0.50 could push the price towards $0.5200, but the analyst remained cautious about entering long positions at current levels.

Bullish momentum with caution

Several key technical indicators point to near-term bullish momentum, but overbought conditions could lead to a pullback.

Bollinger Bands showed that price was close to the upper band, signaling potential overbought conditions.

Narrow bands indicate low volatility, suggesting a breakout may be imminent.

Source: TradingView

The MACD has shown a bullish crossover, with the MACD line above the signal line and positive histogram bars. This suggests increasing bullish momentum, even though the trend is still in its early stages.

Meanwhile, volume remains low, indicating low conviction behind the recent price increase.

Analysts have suggested that a break above $0.50, accompanied by increasing volume, would confirm a bullish trend, but failure to break above this level could lead to a pullback.

Fantom: Increased activity on the market?

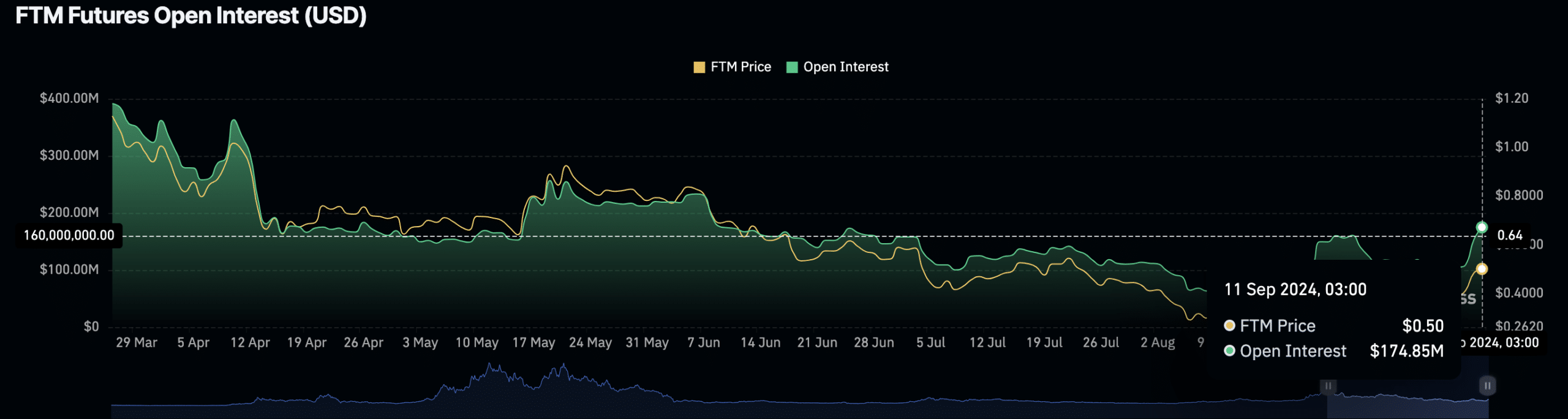

The FTM futures open interest chart revealed a notable increase in open interest, which reached $174.85 million as of September 11.

This increase in open interest corresponds with the FTM price moving towards the $0.50 mark, reflecting increased trader participation and speculative activity.

Source: Coinglass

For several months, open interest fluctuated between $100 million and $200 million, indicating limited trading activity.

The recent rise in price and open interest could signal growing confidence in FTM’s future price action, but it also suggests the potential for increased volatility.

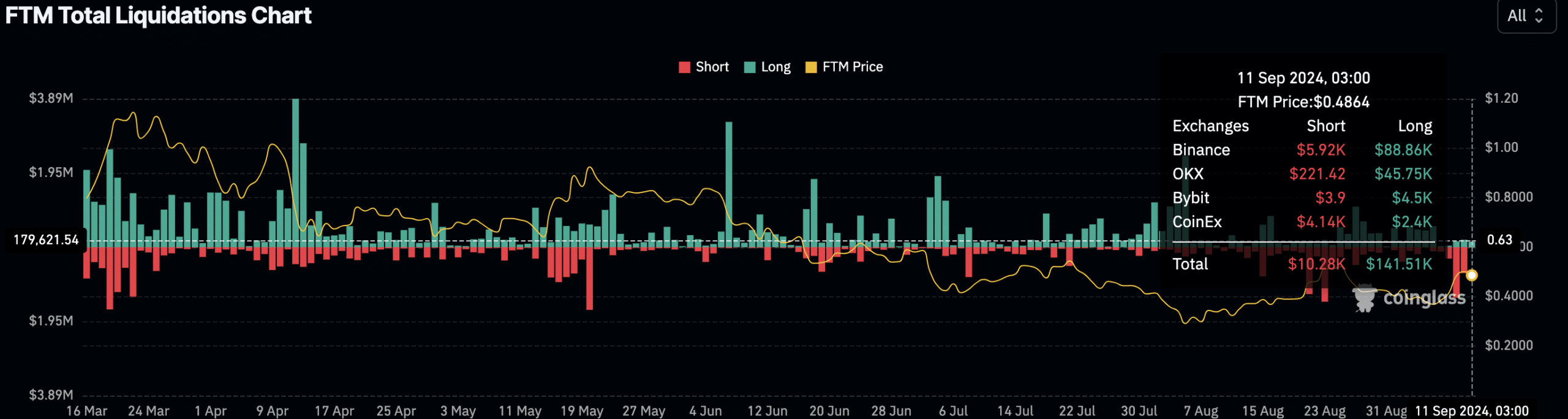

FTM’s total liquidations chart showed that as of September 11, $141.51K of long positions were liquidated versus $10.28K of short positions. Binance saw the majority of long liquidations at $88.86K.

Source: Coinglass

This wave of liquidations indicates that many traders were caught off guard by the recent price movements, especially as the price approached $0.4864.

Liquidation data suggests that long traders, in particular, were overly optimistic about FTM’s continued rise, leading to liquidations when price failed to break higher.

Continued uncertainty around the $0.50 resistance level means traders remain cautious.

Increased buying pressure

A recent report AMBCrypto highlighted increasing buying pressure. FTM’s supply on exchanges decreased, while its supply off-exchanges increased.

This trend suggests that holders are moving their assets off exchanges, which is generally a sign of long-term confidence in the asset.

Read Fantom (FTM) price prediction for 2024-2025

Additionally, whale activity around FTM has increased, as indicated by an increase in large transactions. This increase in whale movements and exchange outflows has likely contributed to FTM’s recent bullish momentum.

However, traders remain wary of a potential bull trap near the current price level.