Updated September 11 below. This article was originally published on September 10

Bitcoin

Bitcoin

Subscribe now to Forbes Crypto Asset and Blockchain Advisor and “Discover the blockchain blockbusters poised for 1,000%+ gains” following the Bitcoin halving earthquake!

The price of bitcoin has climbed back towards $60,000 per bitcoin after falling towards $50,000 as “extreme fear” gripped the market.

As traders now look for signs that the market could be headed for a recovery, analysts at the world’s largest asset manager and issuer of bitcoin cash exchange-traded funds (ETFs), BlackRock, warned that they see more “volatility bursts ahead” and predicted the Fed will not cut rates as quickly as markets expect.

Sign up now for free CryptoCodex—A daily five-minute newsletter for traders, investors, and the crypto-curious that will keep you up to date and ahead of the Bitcoin and cryptocurrency market bull run.

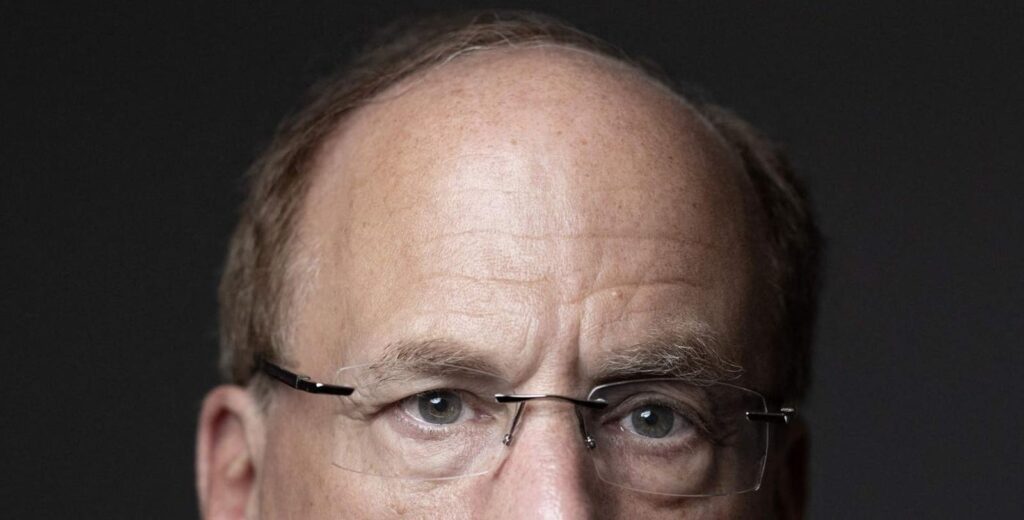

BlackRock CEO Larry Fink has led a bitcoin revolution on Wall Street this year, but … (+)

“We see several factors driving market volatility: resurgent recession fears on weaker economic data, U.S. pre-election jitters, and profit-taking as investors make room for new equity issuance,” BlackRock Investment Institute strategists led by Jean Boivin wrote in a note, adding: “We do not see the Federal Reserve cutting rates as sharply as markets expect.”

Bitcoin’s price jumped yesterday, alongside the stock market, as traders awaited more inflation data this week, which is likely to prompt the Federal Reserve to cut interest rates by 25 or 50 basis points next week.

The Fed is widely expected to cut interest rates when officials gather for a two-day policy meeting on Sept. 17, its first post-pandemic rate cut that could herald a new round of cheaper borrowing and fresh liquidity.

Last week, a weaker-than-expected U.S. jobs report sent bitcoin prices crashing as the slowing jobs market fueled fears that the Federal Reserve waited too long to cut interest rates and could have tipped the economy into recession.

“Even if inflation moves closer to the Fed’s target in the near term, higher inflation over the medium term will limit the Fed’s room to cut rates,” Boivin wrote. “Growth concerns and slowing inflation have pushed 10-year yields to 15-month lows as investors have priced in more than 100 basis points of cuts by year-end and about 240 basis points of cuts over the next 12 months, implying a Fed response to a recession.”

Register now for CryptoCodex—A free daily newsletter for the crypto-curious

The price of bitcoin has fallen from its recent all-time high of $70,000 per bitcoin, fueling … (+)

At the same time, analysts at brokerage Bernstein warned that the price of bitcoin could fall by almost 50% to around $30,000 if Vice President and 2024 Democratic Party candidate Kamala Harris wins the US presidential election in November.

However, they also believe that a victory for former US President and Republican candidate Donald Trump could mean that the price of bitcoin would surge to $90,000 thanks to Trump’s recent adoption of the technology.

Update 9/11: Crypto remained a looming specter during the presidential debate between Donald Trump and Kamala Harris, not being mentioned despite the crypto industry spending $119 million on the election so far.

Nearly all of the donated funds were raised through political action committees, with Fairshake PAC making up the majority of those funds, according to an August report from consumer advocacy group Public Citizen.

Trump is widely considered the crypto candidate after the former president embraced bitcoin and crypto this year, putting him at odds with Harris who is expected to continue the Biden administration’s hostile approach to crypto despite its recent overtures and olive branches to the crypto world.

A large majority of cryptocurrency holders in the United States (73%) said A Gemini survey indicates they will consider a candidate’s digital asset policies when voting in the US presidential election this year.

The debate evened the odds between the two candidates, according to the prediction platform Polymarket, which now places Harris and Trump at 49%.

“The market felt that Kamala Harris won the debate, especially in the early stages, which translated into a slight decline for crypto,” said Caroline Mauron, co-founder of Orbit Markets, a liquidity provider for digital asset derivatives trading. said The news.

“After the last three years of regulatory purge, a positive crypto regulatory policy can once again spur innovation and bring users back to blockchain financial products,” wrote analysts led by Gautam Chhugani in a note seen by Coindeskadding: “The election remains difficult to predict, but if you are long crypto here, you are probably taking a position on Trump.”

Cryptocurrency-based prediction platform Polymarket is currently in favor of Trump taking back the White House, with 52% of users betting on him winning.

“Broader factors, such as changes in Federal Reserve monetary policy or ETF flows, will also continue to influence market sentiment as the election approaches,” Yongjin Kim, chief executive of cryptocurrency trading platform Flipster, wrote in emailed comments.