- SOL continued its downtrend and fell below key resistance levels.

- Derivatives data reaffirmed this bearish trend, but many trader accounts on OKX and Binance are betting on a bullish reversal.

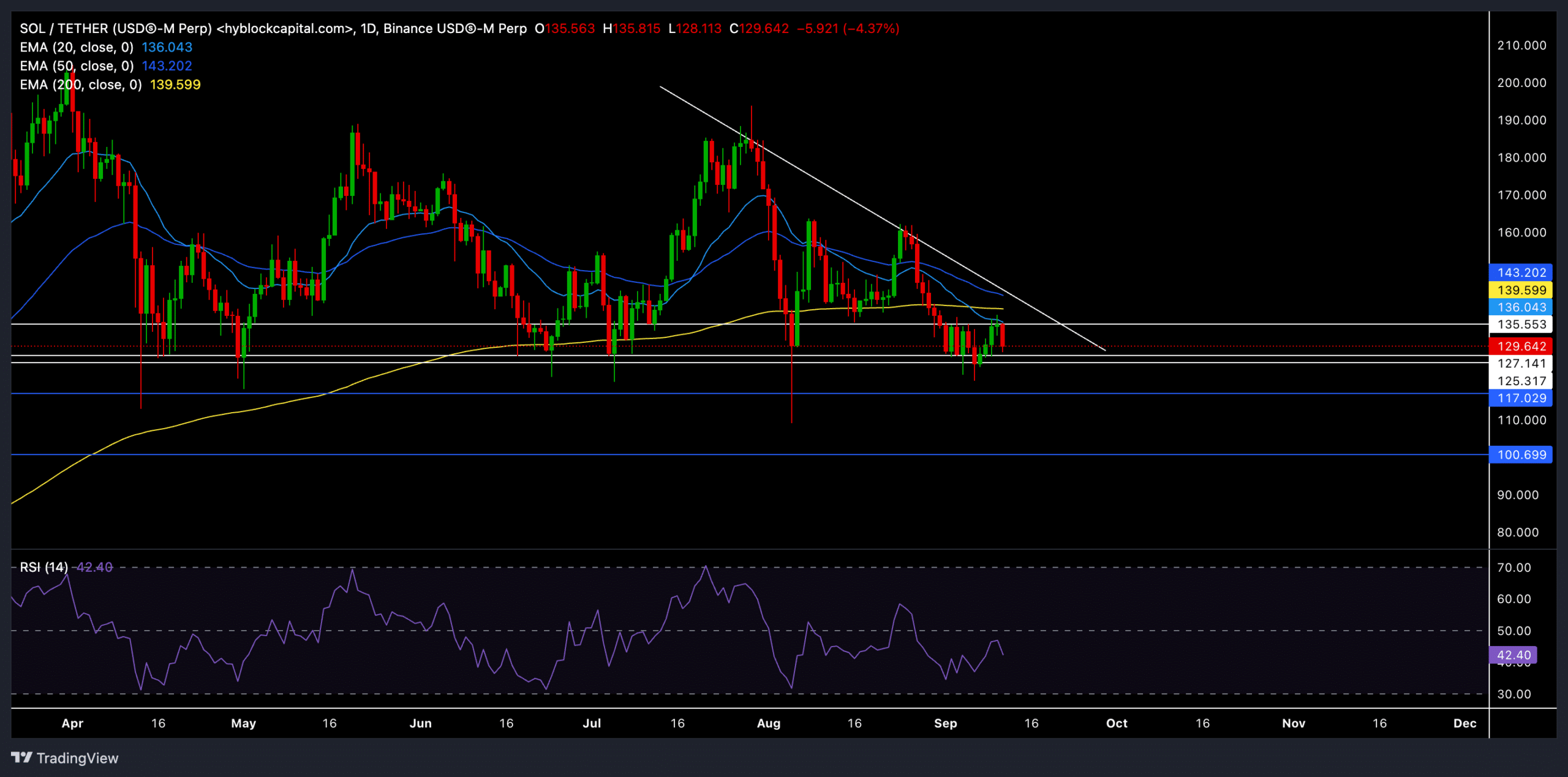

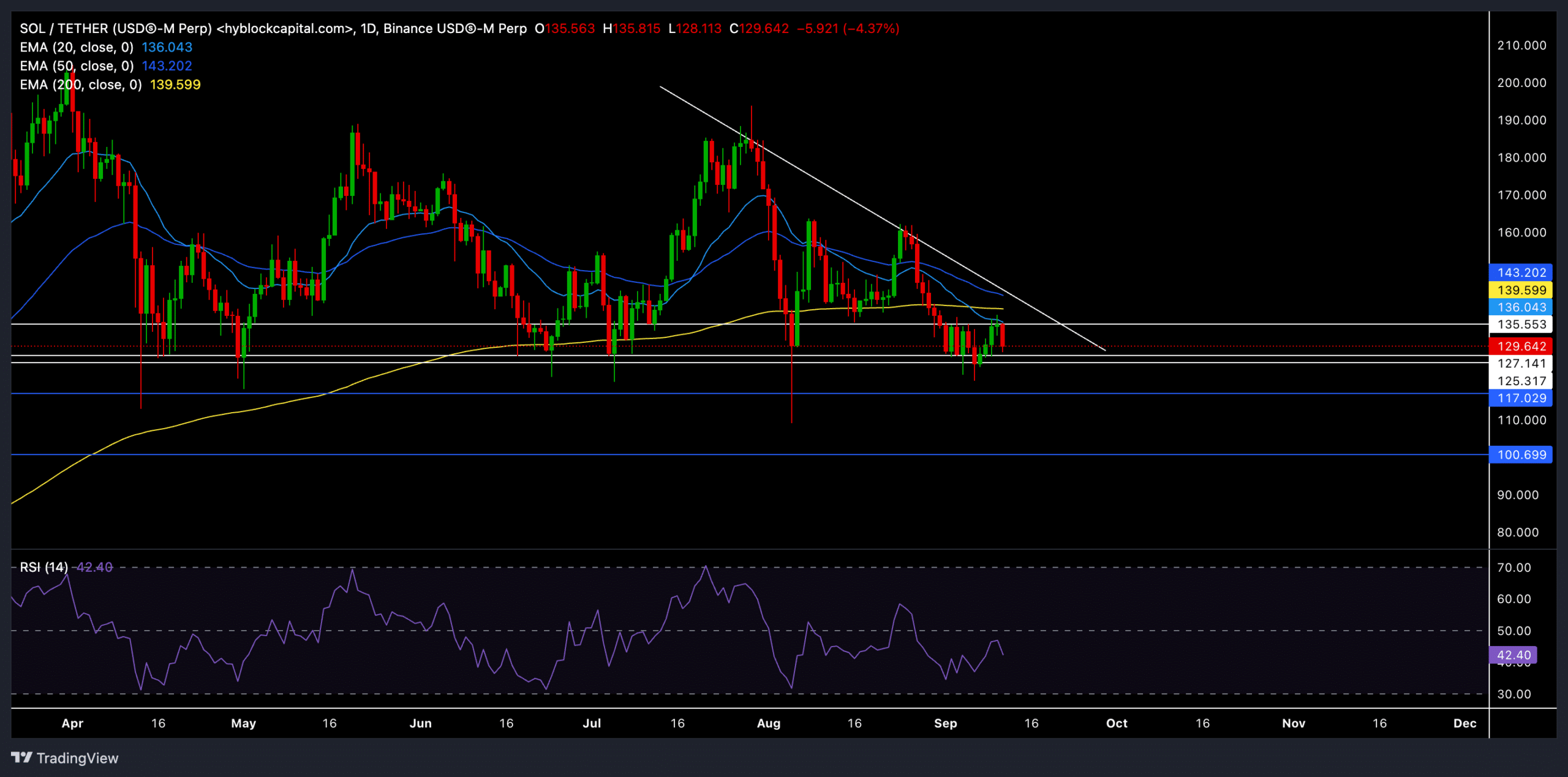

Solana (SOL) continued its long-term downtrend, with bearish momentum intensifying after the price recently fell below the crucial 200-day EMA.

The downtrend was confirmed by a death cross, a bearish technical signal where the 20-day EMA crosses below the 200-day EMA. Historically, Solana has seen extended periods of bearish pressure after a death cross.

At press time, SOL was trading at $129, down about 5% over the past 24 hours. Bears have been testing the $125-$127 support range for over five months, and a failure to hold this level could expose SOL to further decline.

Bearish signals persist for Solna after deadly cross

Source: TradingView, SOL/USDT

The $125-$127 support area remains critical for Solana. If the bears manage to push below this area, the next major support lies near $117 and could become the target in case of further declines.

On the upside, bulls need to break above the 20-day EMA ($135.92), 50-day EMA ($143.15), and 200-day EMA ($139.58) to initiate a possible recovery.

However, it will be an uphill battle given the current bearish sentiment in the market. Moreover, the long-term trendline resistance continues to limit any upward movement. SOL would need a strong break above this level to reverse the current trend.

The Relative Strength Index (RSI) was below equilibrium, which denotes a bearish trend. An immediate reversal is not assured as it has not yet reached the oversold mark. For a possible bullish reversal, the RSI would need to climb above the neutral level of 50.

Solana derives from data revealed THIS

Source: Coinglass

According to the latest derivatives data from Coinglass, SOL saw a 6.17% decline in trading volume, with total volume sitting at $5.97 billion. However, open interest edged up by 0.15% to $2.06 billion, indicating that traders remained active despite the bearish conditions.

The overall long/short ratio of SOL over the last 24 hours is 0.9342, reaffirming bearish sentiment among investors.

However, the data also showed some interesting divergences. On Binance, the SOL/USDT long/short ratio for top traders’ accounts was heavily skewed toward long positions at 3.817.

Similarly, OKX displayed a long bias with a ratio of 3.35. These readings indicate that some traders are still expecting a possible bullish reversal despite the overall market conditions.

Read Solana (SOL) Price Prediction 2024-2025

SOL price is currently uncertain, with the $125-$127 support range being the key level to watch. Failure to hold this support could lead to a decline towards the next major support level at $117.

Given current market conditions and bearish sentiment, a short-term bullish reversal for SOL seems unlikely unless Bitcoin experiences a sudden resurgence in buying.