- SOL attracted relatively moderate interest from traders over the weekend

- However, Santiment viewed the shift as a bullish signal for the altcoin.

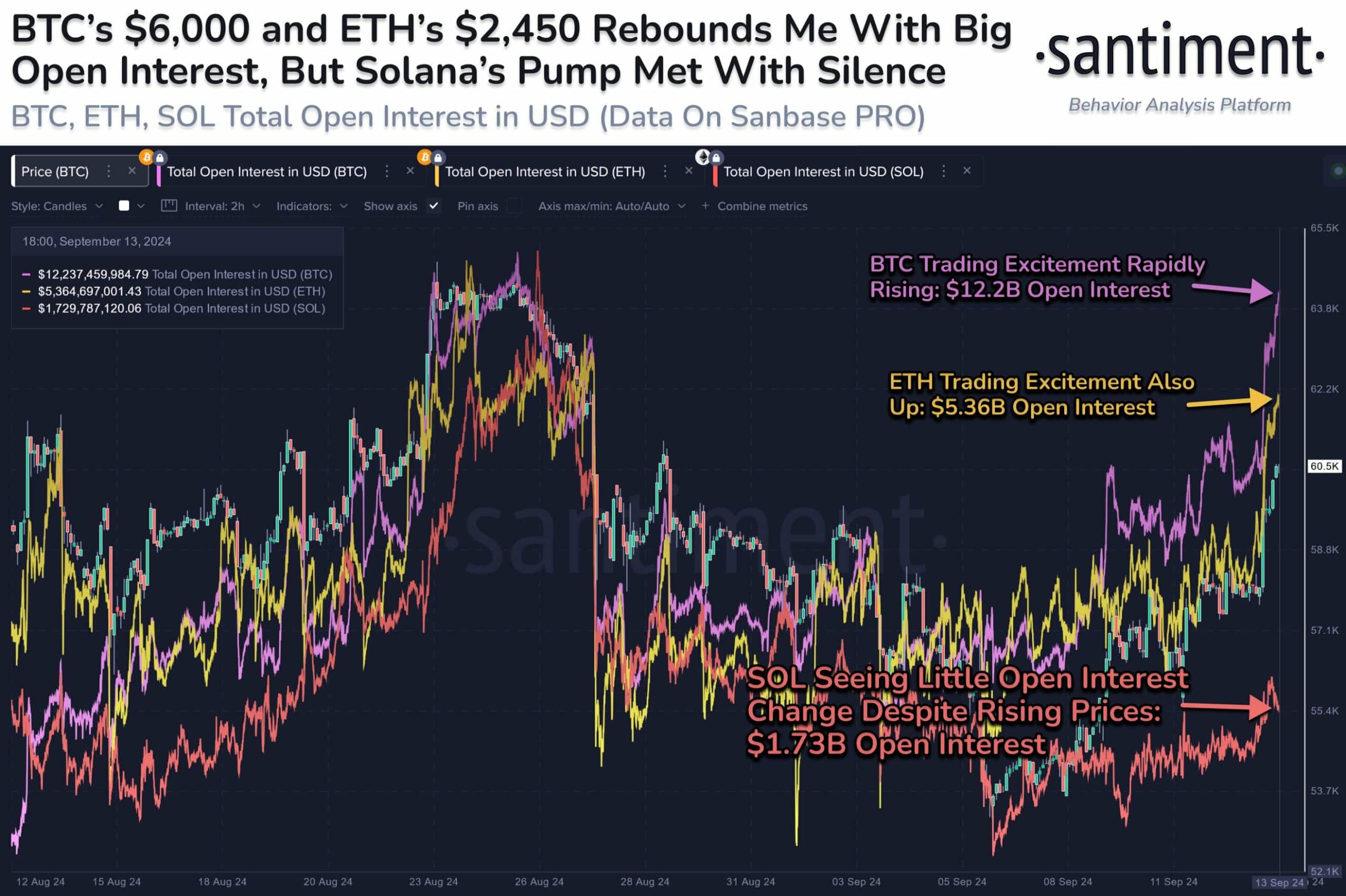

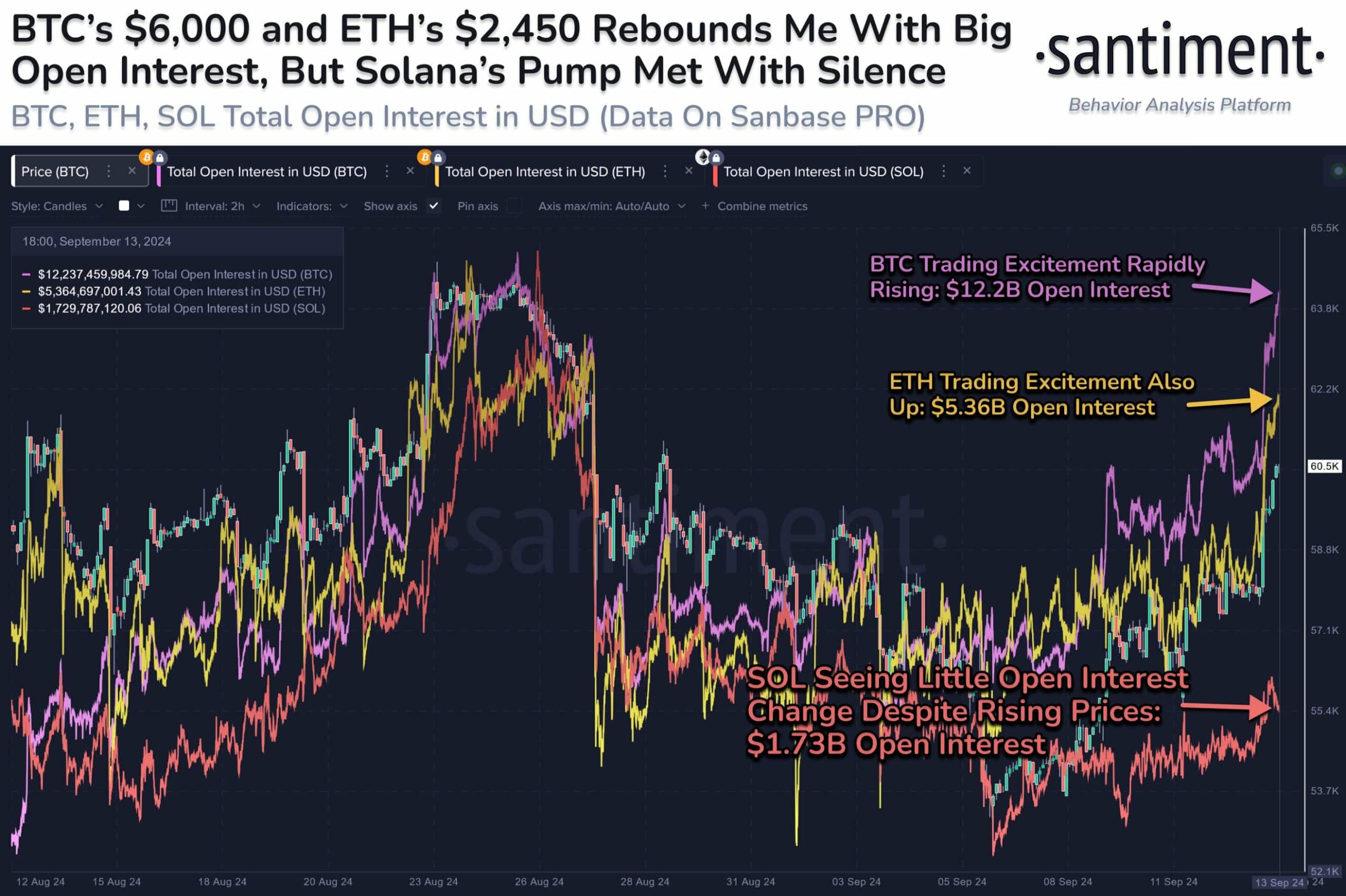

Friday’s market rebound sparked mixed interest from traders including Bitcoin (BTC), Ethereum (ETH)And Solana (SOL)SOL has lagged other cryptocurrencies in terms of open interest (OI), which tracks futures traders’ interest and overall liquidity injection. SOL has only recorded $1.7 billion in OI, compared to $12 billion for BTC and $5.3 billion for ETH.

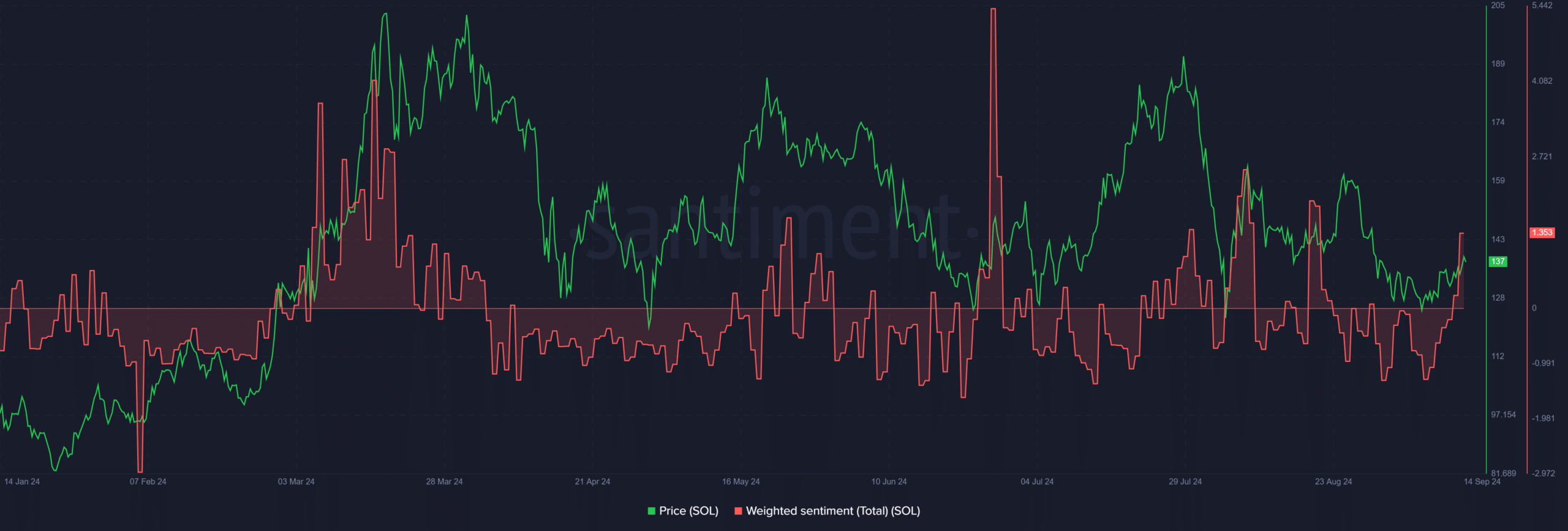

However, according to Santiment, this lag could be a bullish signal for SOL. The crypto analytics firm said,

“However, Solana’s return above $140 doesn’t look very promising. Consider this a bullish sign for SOL as euphoric traders look elsewhere.”

Source: Santiment

Speculators are positive about SOL

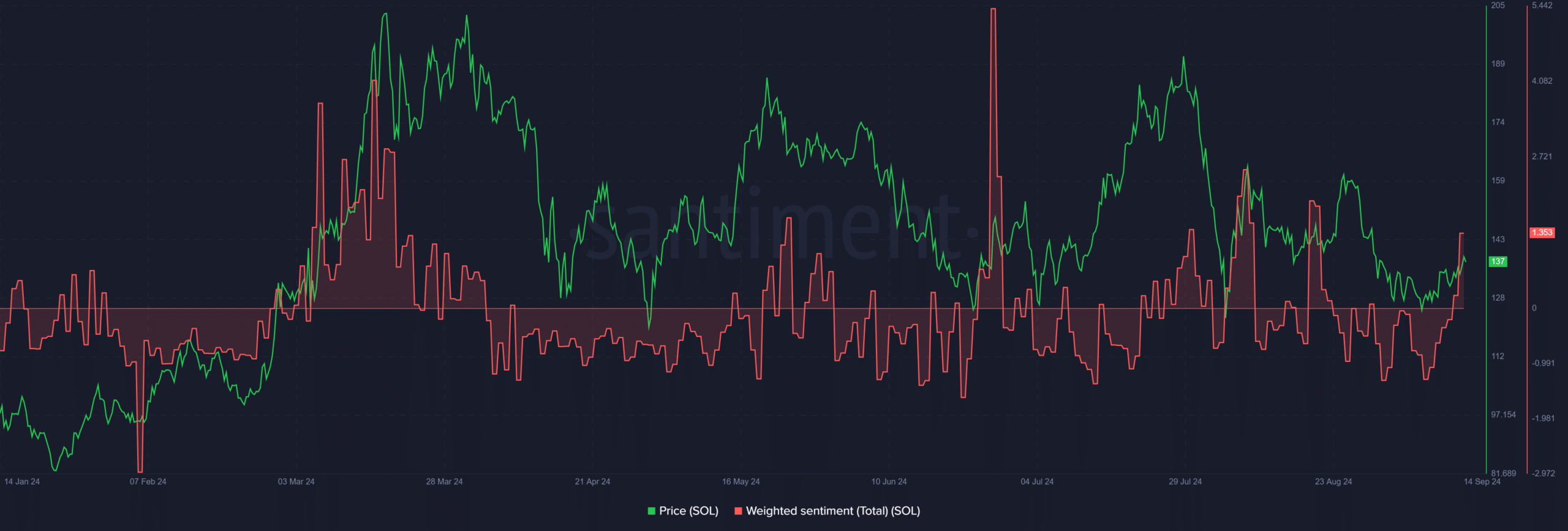

As with the broader market, the weekend rally has lifted SOL out of negative sentiment territory. At press time, speculators were very positive on the altcoin for the first time since late August.

Source: Santiment

This suggests that prices are higher than expected. However, shorter term charts suggest otherwise at the time of publication.

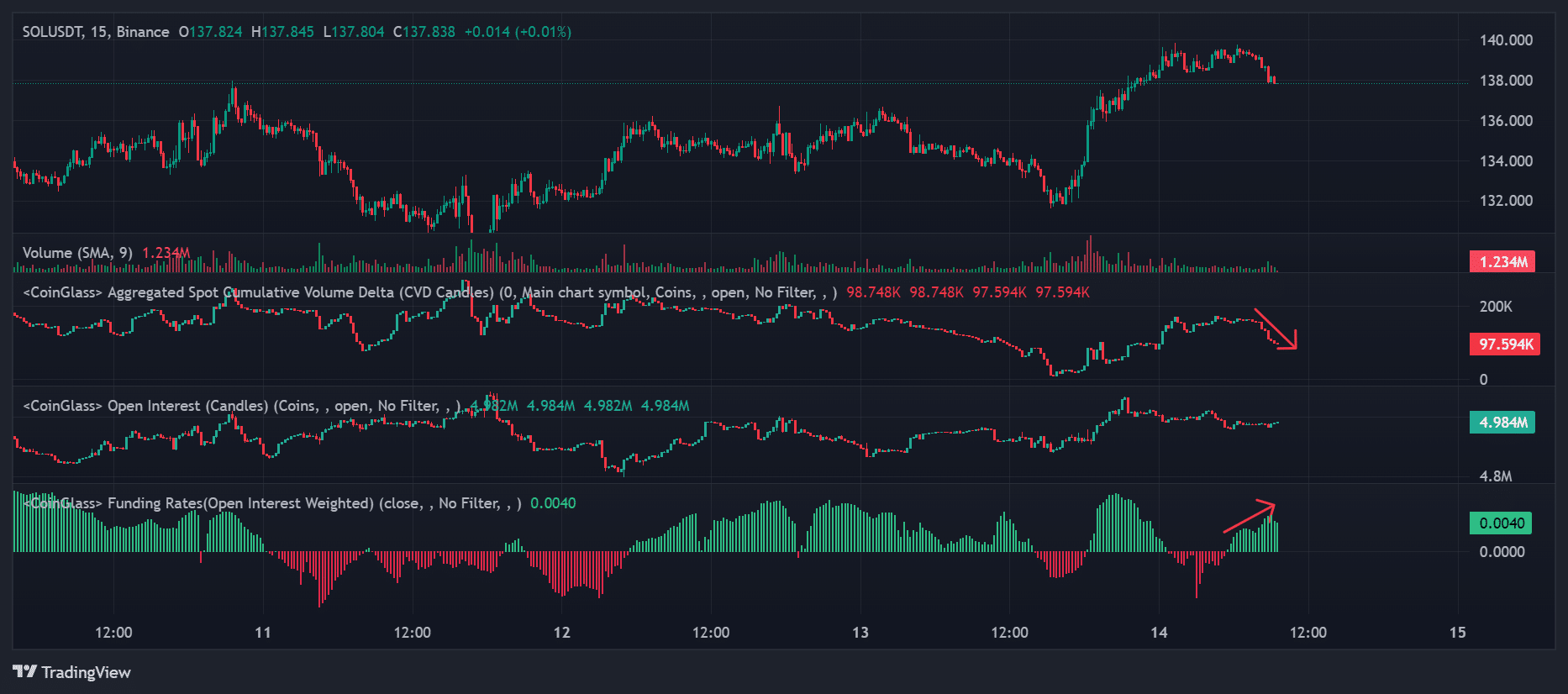

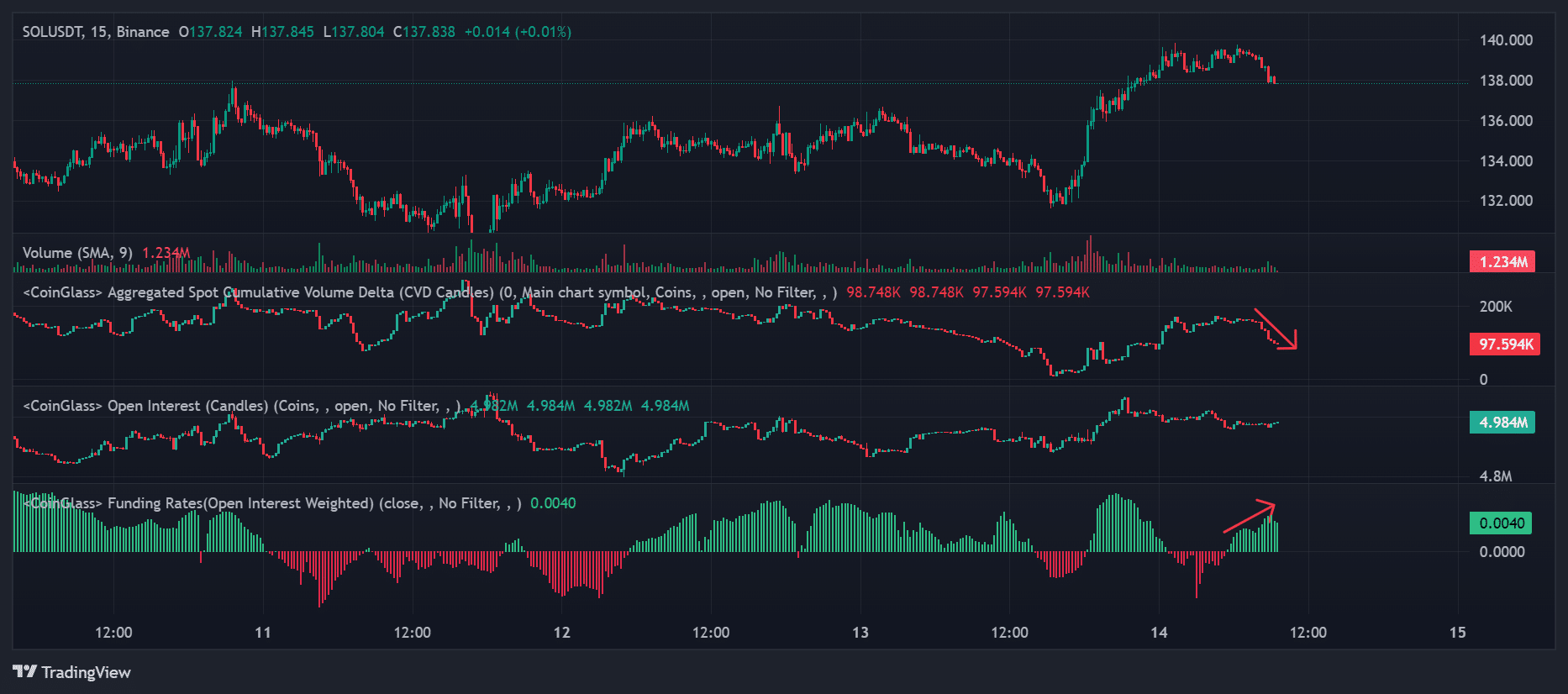

In fact, Spot Cumulative Delta (CVD) has been trending downward. This highlighted that SOL’s selling volumes have eclipsed its buying volumes, indicating that short sellers have been increasing as SOL has surged towards $140.

At the same time, the OI remained stable. This indicates that some speculators made short bets on the altcoin over the weekend.

Source: SOL/USDT, Coinglass

Additionally, funding rates have been fluctuating, showing that short bets could derail a strong weekend move above $140.

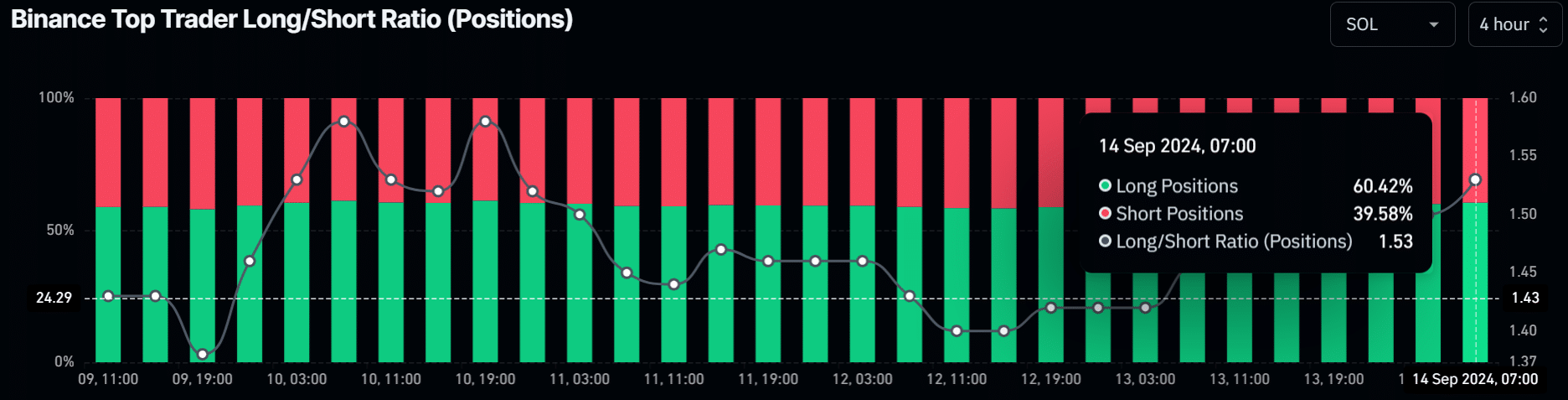

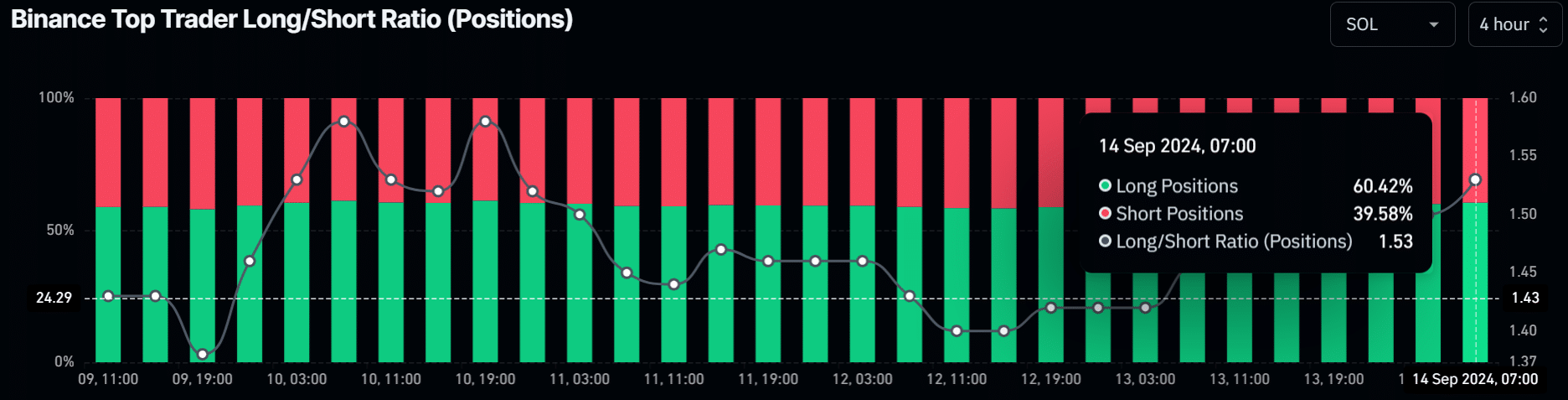

Despite retail traders’ short bets, savvy investors on Binance doubled down on their long positions. In fact, according to Binance Top Trader’s Long/Short ratio, long positions accounted for 60% of all positions.

While this demonstrates strong conviction in SOL’s upside potential, it could also mean hedging for spot positions.

Source: Coinglass

SOL was valued at $137 at press time, up 7.5% over the past seven trading days after hitting a monthly high of $139.8.

Overall, the next week will be eventful for the altcoin. In addition to the expected bullish pivot following the Fed’s rate cuts on September 18, Solana’s BreakPoint 2024 event could further induce momentum for the token.

The event will be held in Singapore on September 20-21 and is usually associated with a price increase. Especially since insiders often reveal the latest updates to the Solana ecosystem.