- Near Protocol has seen a massive increase in daily transactions, suggesting high network utilization.

- Network growth and high open interest suggest a bullish long-term outlook.

Near Protocol (NEAR) was trading at $4.47 at press time after a 12% price increase.

The surge was caused by bullish support for the broader market as most coins traded higher following the Federal Reserve’s interest rate cut decision.

NEAR’s transaction volumes have increased by over 90% at the time of writing. CoinMarketCap.

Such a parabolic increase in volumes suggests that recent gains are coming from buying activity, raising concerns about the sustainability of the rally.

However, on-chain data suggests that NEAR’s long-term outlook is positive.

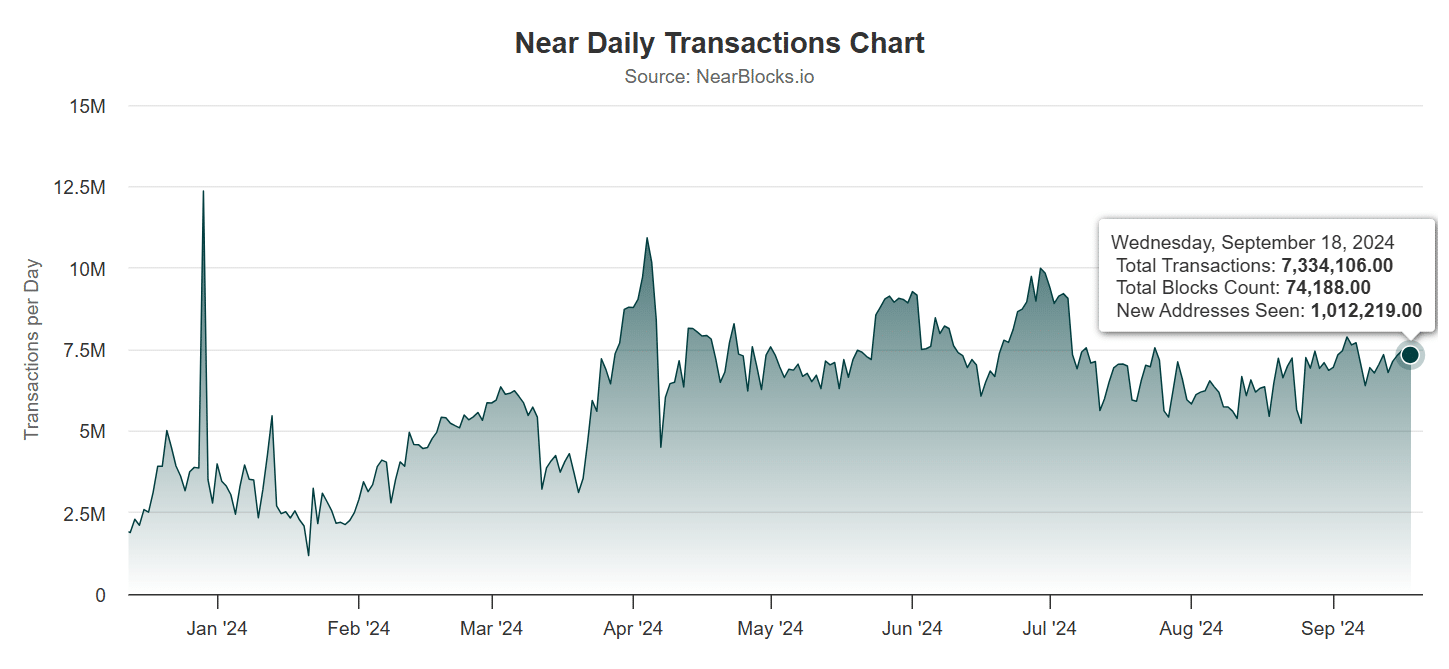

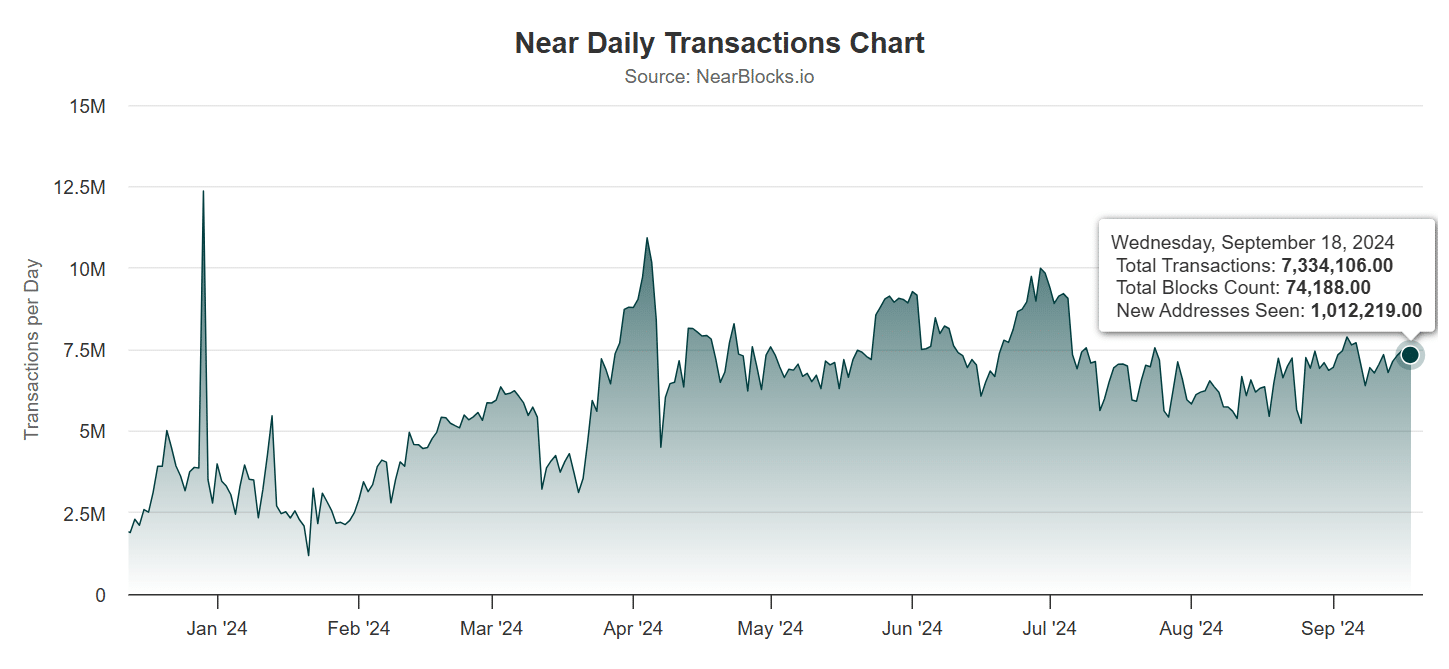

The number of daily transactions is increasing

Data from Near the blocks showed a significant increase in daily NEAR transactions, which were currently nearing a two-week high of 7.33 million.

Daily transactions on the protocol have been gradually increasing, considering that a week ago they stood at 6.7 million. It can be assumed that network engagement was high, which in turn fueled demand for NEAR.

At the same time, the number of new addresses on the blockchain has increased significantly. At the beginning of the month, there were 687,000 such addresses.

This figure has now increased, with 900,000 new addresses joining the network every day since September 5.

Source: NearBlocks

Data from DappRadar showed that the high number of transactions came not only from trading activity, but also from decentralized application (DApp) activity.

Monthly dApp transactions on the network increased by 14% to over $182 million. However, monthly dApp volumes dropped by 54%. This decline could be attributed to NEAR’s price changes.

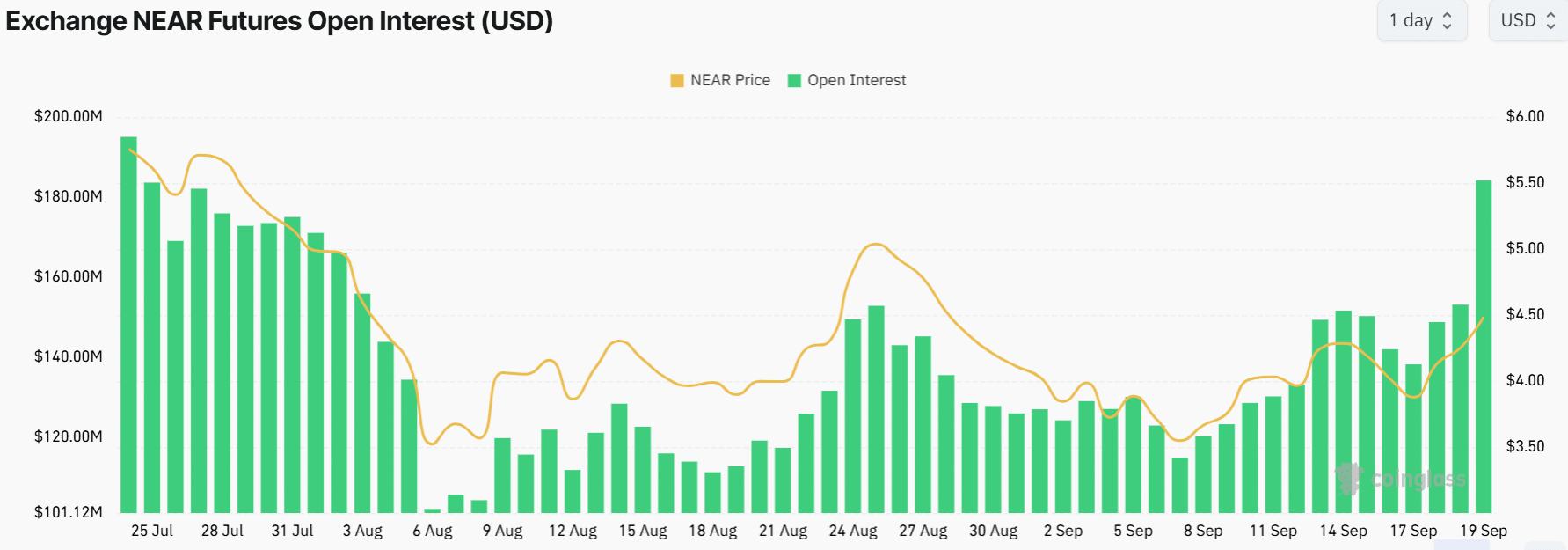

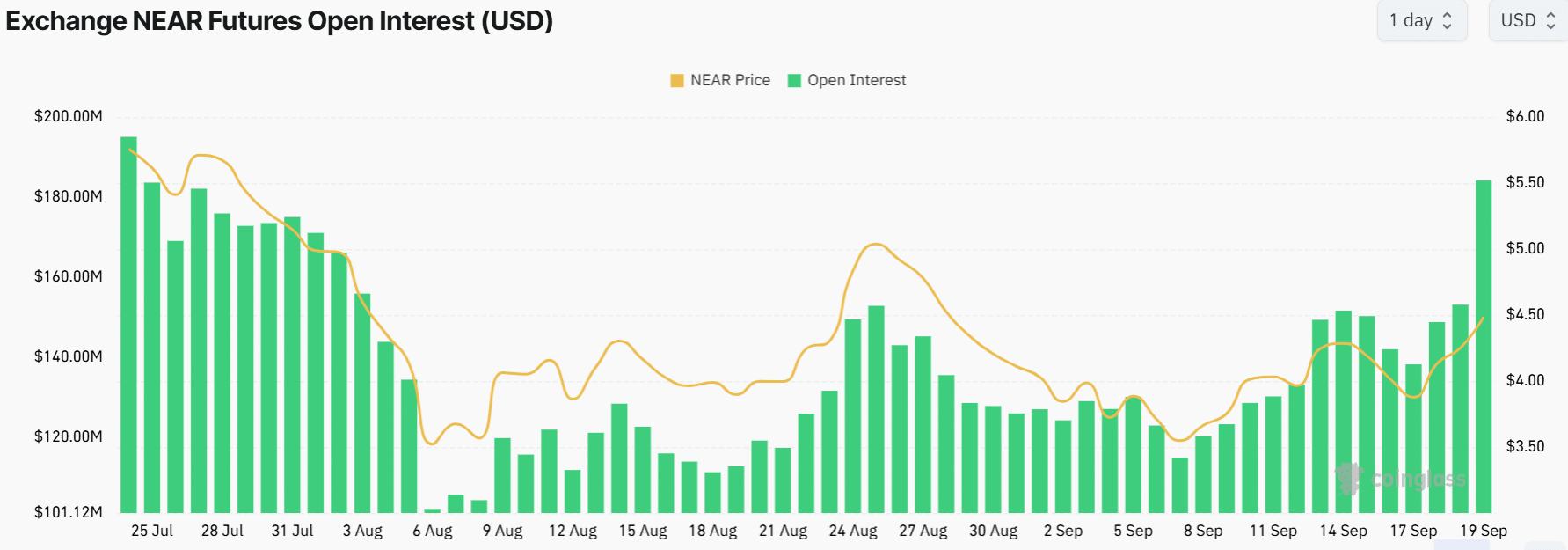

Open interest hits eight-week high

NEAR is also attracting the attention of derivatives traders as open interest (OI) had reached $184 million at press time, the highest level since July 25.

NEAR’s OI has been gradually increasing since early August, as shown by Coinglass. This suggests that traders are opening new positions as they speculate on future price gains.

Source: Coinglass

At the same time, NEAR funding rates were positive at 0.0112% and are at their highest level since June. This suggests increased demand for long positions.

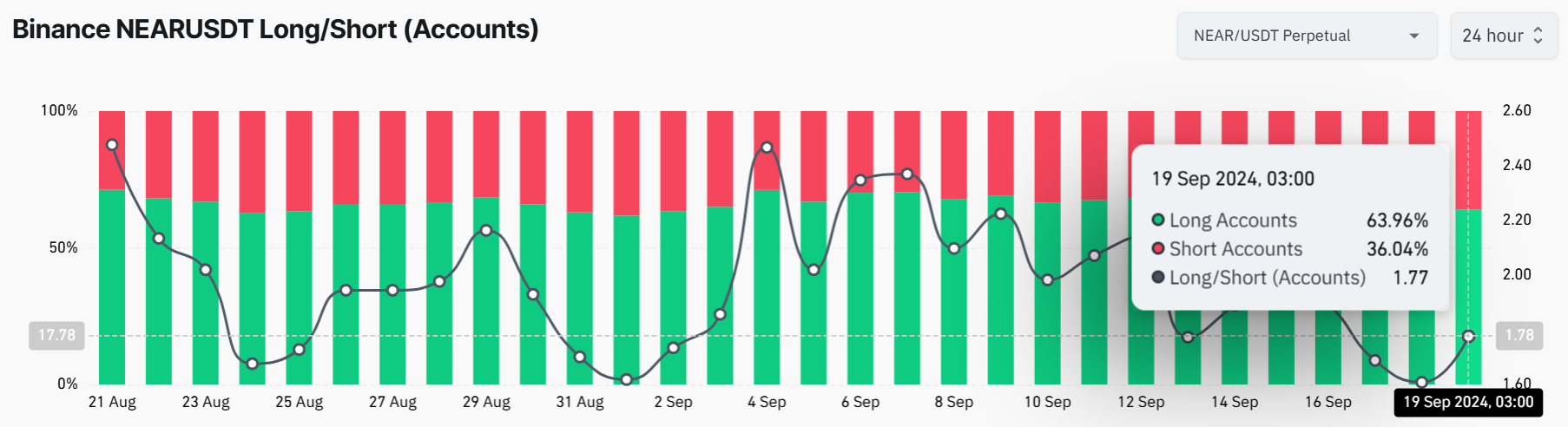

Coinglass showed that traders on Binance have been mostly long NEAR since August, indicating a bullish bias towards the altcoin.

Source: Coinglass

One of the reasons that could be behind the bullish sentiment is the growth of Big Data and AI coins.

Read Near Protocol (NEAR) Price Predictions for 2024-2025

In just one month, the total market capitalization of these coins has grown from $22 billion to $32 billion at press time. CoinMarketCap.

NEAR is currently the largest AI crypto, dominating over 15% of that market cap.