The cryptocurrency market has seen impressive bullish momentum following the US Federal Reserve’s much-anticipated rate cut, leading to increased liquidations.

According to data provided by Coinglass, total cryptocurrency liquidations increased by 46% over the past day, reaching nearly $200 million. Most of the liquidated positions, worth $126 million, are short positions due to market-wide bullish movements.

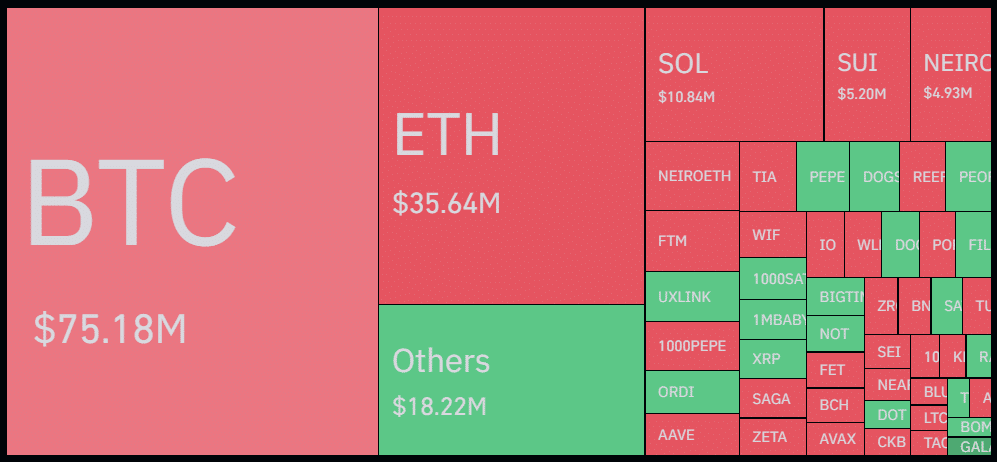

Bitcoin (BTC) leads the way with $75 million in liquidations following a 2.9% price increase. BTC is currently trading around $62,000.

It is worth noting that the largest single liquidation, worth $8.9 million on the BTC-USD pair, took place on the Bybit cryptocurrency exchange, according to Coinglass data. In total, more than 66,000 traders were liquidated in the last 24 hours.

Ethereum (ETH) took second place with over $35 million in liquidations as its price surpassed the $2,400 mark.

Despite the increase in liquidations, total open interest in cryptocurrencies has increased by 4% over the past 24 hours and is currently hovering around $58.7 billion.

Rising open interest is usually a sign of FOMO (fear of missing out) which could potentially increase the number of liquidations, leading to sharp price swings. At this point, investor sentiment has improved significantly.

The increase in liquidations came after the US Fed announced a 50 basis point rate cut at 18:00 UTC on September 18. This was the Fed’s first rate cut since March 2020.

Subsequently, the global cryptocurrency market capitalization increased by 1.9%, reaching $2.23 trillion, according to data from CoinGecko. The daily trading volume exceeded the $120 billion mark. In addition, the US stock market also saw bullish momentum.