- The aerodrome has reached a new all-time high in terms of TVL while its revenues are soaring.

- AERO price action breaks out of a symmetrical triangle.

Aerodrome Finance (AERO) is making waves in the crypto space, competing with major players like Ethereum (ETH) and Uniswap (UNI).

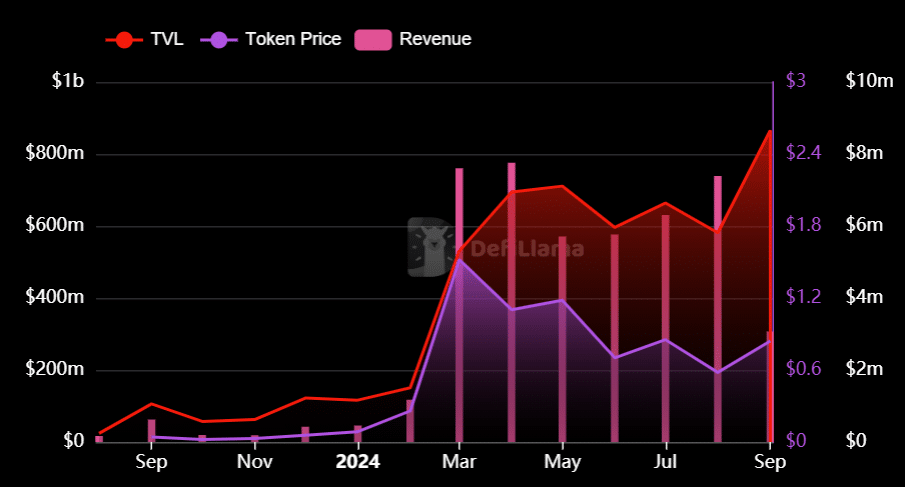

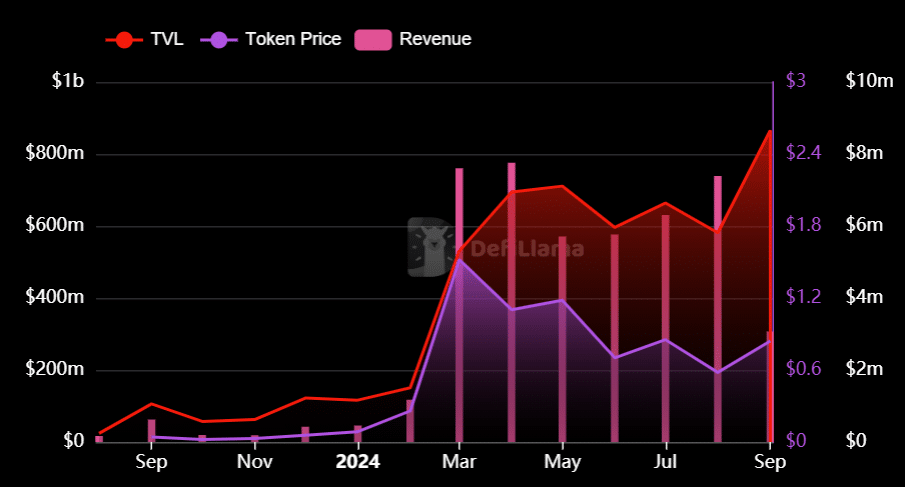

Although AERO is in a correction phase after reaching a high of $2.36, AERO fundamentals suggest that its price could rise. The token’s total value locked (TVL) has reached a new all-time high of $869.73 million and its market cap is $524.3 million.

The 24-hour trading volume stands at $30.22 million, with a fully diluted valuation of $1.069 billion. As TVL increases, this could lead to greater adoption and a higher price for AERO.

Source: DefiLlama

AERO Revenue Distribution

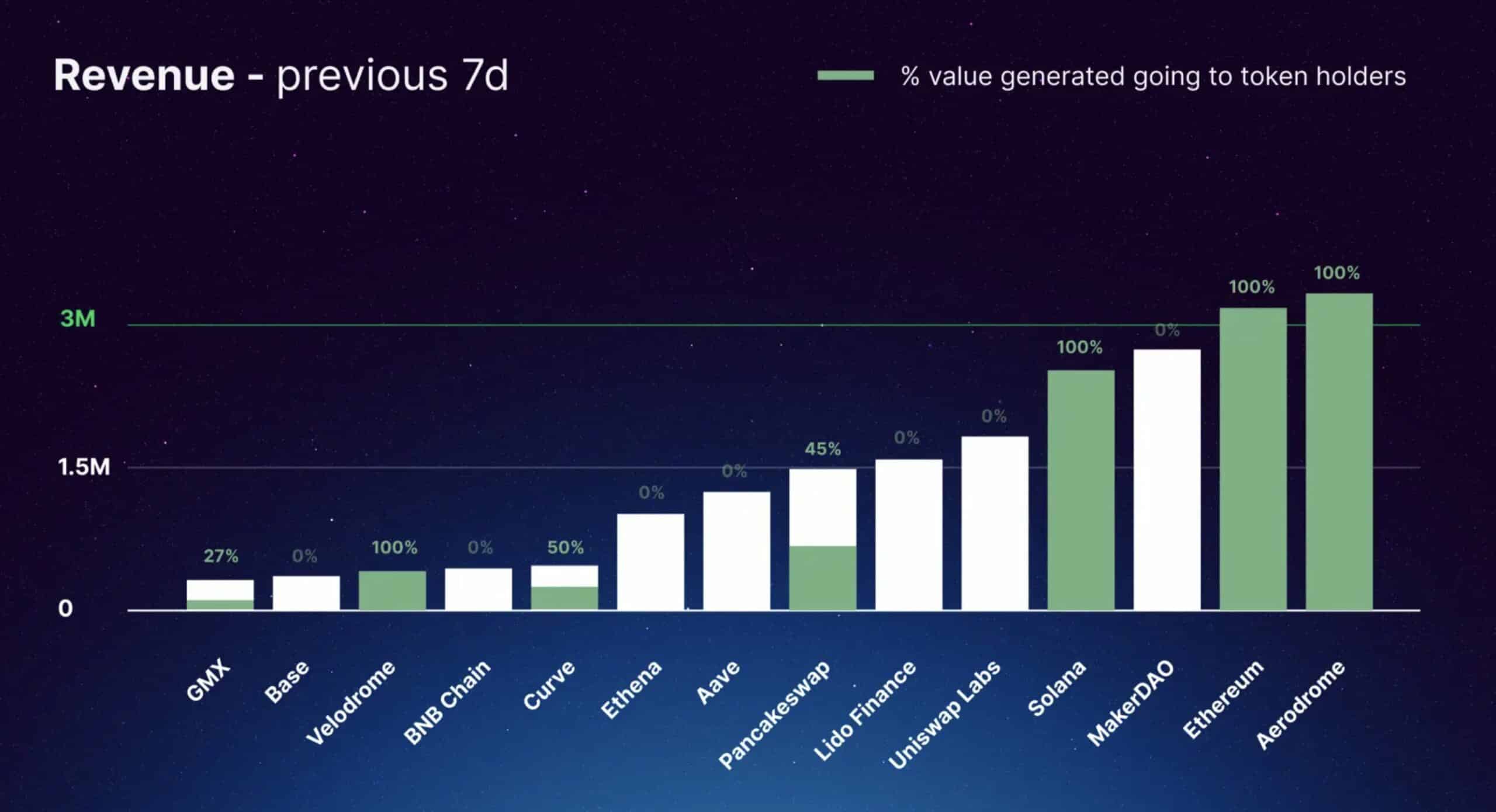

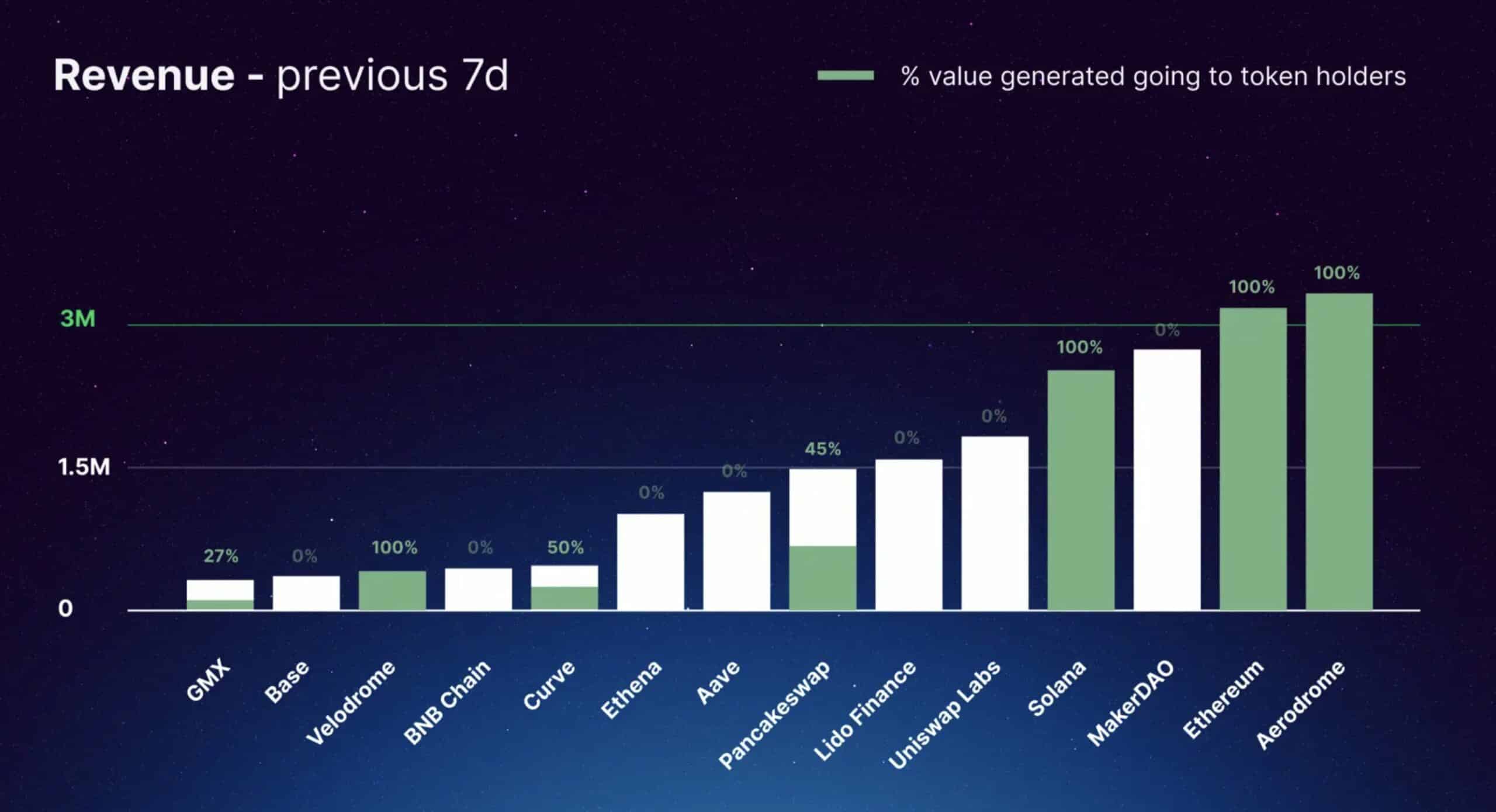

AERO’s revenue distribution is also a key factor in its rise. A significant portion of revenue is directed to token holders, which puts AERO ahead of Ethereum and Solana in terms of the percentage of value returned to holders.

This change highlights a new model of public, permissionless, and transparent token distribution that adds real, immutable utility on-chain.

This makes AERO more comparable to tokens like Bitcoin and Ethereum, rather than Uniswap. These fundamentals are key to driving AERO’s price up.

Source: Messari

Is a recovery of the $1.5 price possible?

The price evolution of AERO seems good…

AERO price has turned bullish. The token recently broke out of a symmetrical triangle pattern and is now trading at $0.85, showing strong momentum.

The Moving Average Convergence Divergence (MACD) indicator signals a bullish trend, with momentum bars turning green.

This suggests that AERO could soon regain the $1 level and, with favorable market conditions, it could even attempt to reach $1.5 in Q4 2024.

Source: TradingView

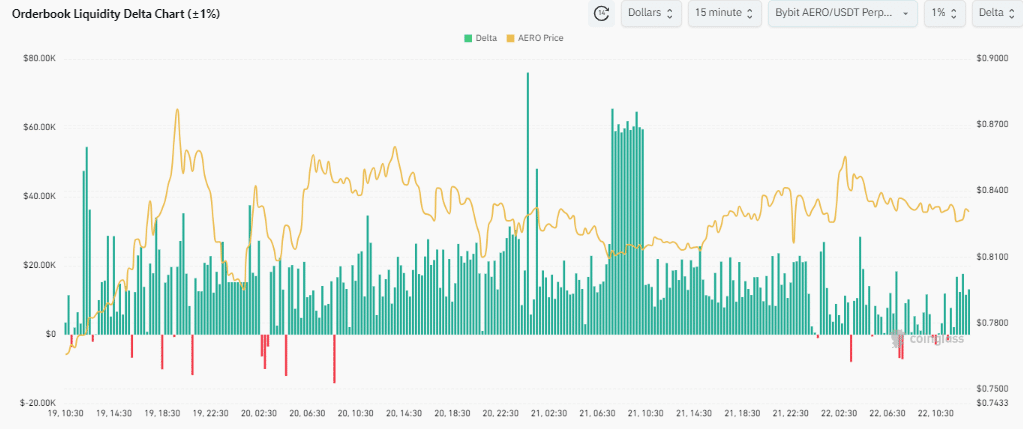

Order book liquidity delta

Another factor supporting a higher price for AERO is the bullish order book liquidity delta chart. This metric indicates that the depth of buy orders is stronger than that of sell orders.

While order book liquidity does not determine price, it adds confluence to the likelihood of AERO stock moving higher. This positive liquidity environment could further support AERO stock’s upward trend.

Source: Coinglass

AERO is poised for growth, with strong fundamentals, growing TVL, and increasing revenue directed to token holders.

The bullish price action, combined with positive order book liquidity, makes a move back to the $1.5 price level possible. As market conditions improve, AERO’s price could continue its upward trend.