- SUI outperformed most coins, securing the spot as the top weekly gainer.

- Therefore, this could challenge LTC’s market positioning if the trend continues. What are the chances?

Sui (SUI) ended the week at the top of the top 25 tokens, up 49% to $1.62. Now at #21, SUI’s rise has analysts speculating about its potential to replace Litecoin, which gained 8% to $68.49.

As SUI targets its March ATH at $2.09, the chances of overtaking Litecoin in the top 20 increase.

EUI defies odds, but there’s a catch

Source: Coinalyze

On the daily price chart, SUI has been posting consistent green candles, starting September on a bullish note. Notably, SUI has gained over 100% since then, despite the overall market volatility.

Meanwhile, LTC bears thwarted the breakouts twice, preventing LTC from moving above $65,000. However, after Bitcoin’s rally, LTC bulls retested the $68,000 ceiling.

In summary, LTC has proven to be more vulnerable to Bitcoin’s movements, while SUI has thrived, suggesting that SUI may have greater future value for stakeholders.

However, the SUI’s rise throughout September was supported by high trading volume, with the RSI peaking in overbought territory, signaling accumulation. Similarly, the CMF also broke above its previous resistance. This growth rate exceeded that seen when the SUI reached its ATH.

Simply put, the high investor interest in SUI coincided with Bitcoin’s return to the $64,000 range, making SUI a more attractive alternative.

If so, this raises questions about SUI’s long-term prospects, calling into question the theory that it would outperform LTC. So was the 49% surge just a momentary spike?

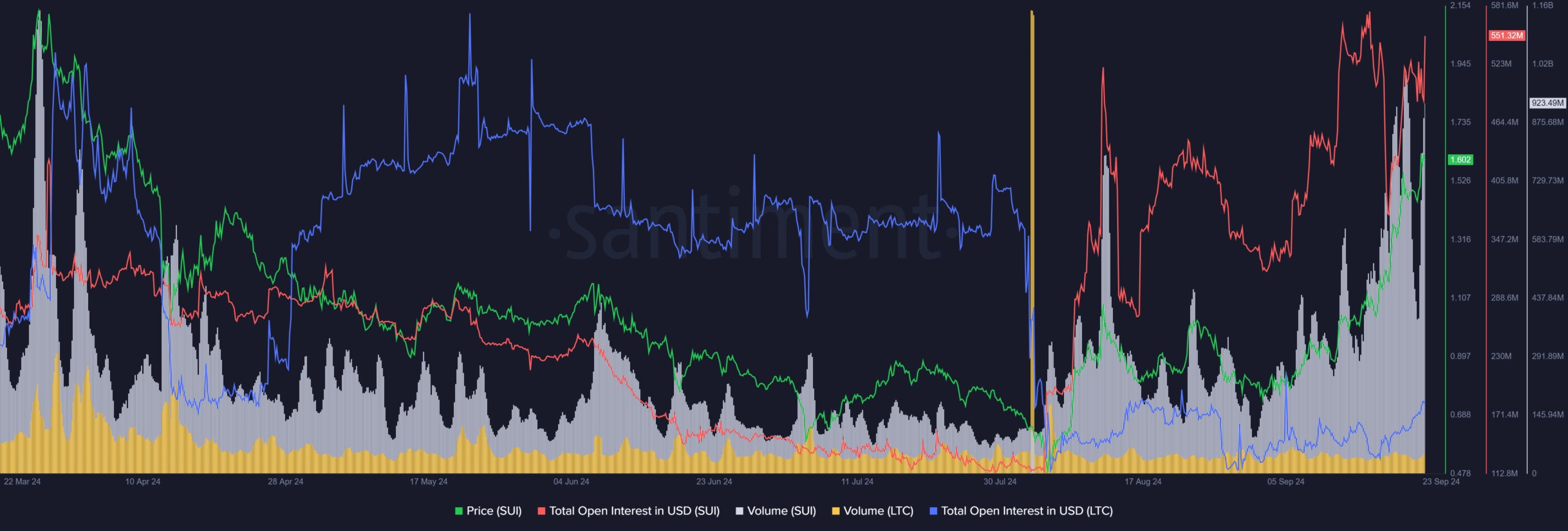

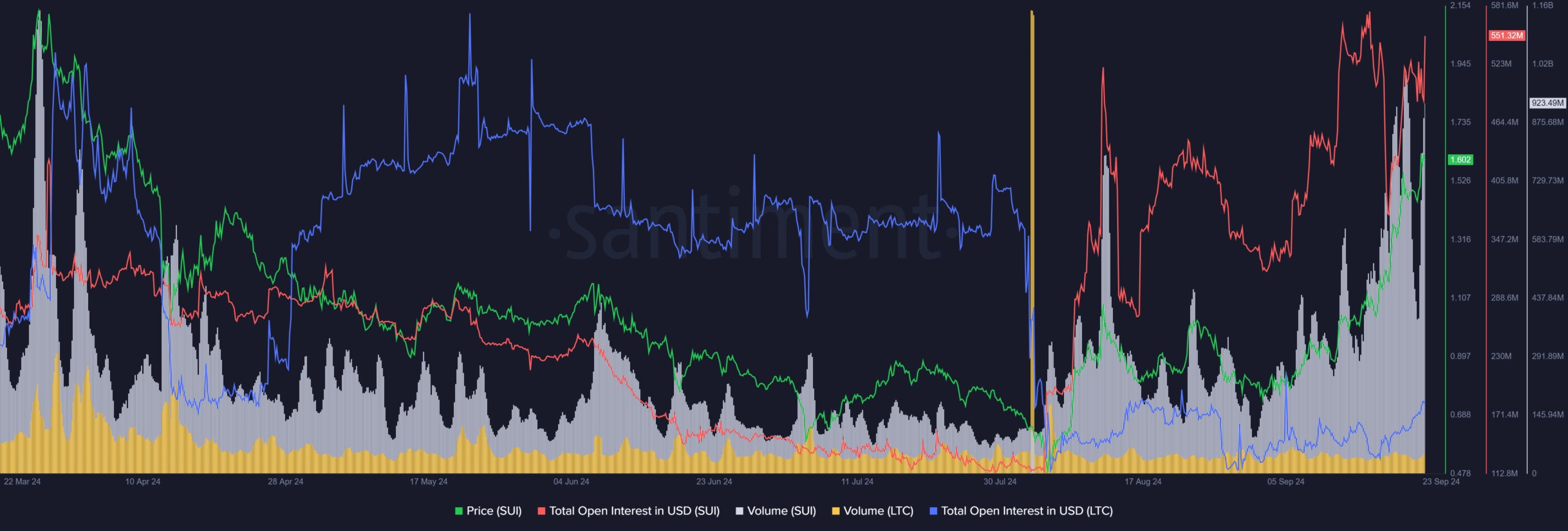

The graph suggests a possible accumulation

As mentioned earlier, SUI’s performance over the past week has secured its position as the top gainer. Surprisingly, this impressive increase has been accompanied by an increased inflow of SUI onto exchanges.

Source: Coinglass

In simple terms, this suggests that SUI has not been entirely unaffected by Bitcoin’s volatility. However, accumulation by holders, as highlighted by the indicators above, has helped avoid a pullback.

While the accumulation is a bullish sign, it could hurt the altcoin in the long term, leading many traders to cash out after locking in their gains, as seen when SUI hit its ATH in mid-March, aligning with BTC’s own peak.

Subsequently, as BTC crashed, SUI dropped even more sharply to $1.06 in just two weeks. Since then, it has been trending lower, with momentum only increasing after more than 180 days.

If this trend repeats, SUI could be just a few days away from a strong retracement. However, if the bulls manage to hold the $1.70 resistance before targeting the ATH, the chances of SUI outperforming LTC will increase. Why?

The growth rate is significant

As the 20th largest cryptocurrency by market cap, LTC has been consolidating in the $60,000-$70,000 range for over a month. Meanwhile, SUI has seen a significant surge during this time.

Despite the high trading volume and low fees of LTC, no substantial results have been observed. In fact, the volume has dropped from over $1 billion in April to $246 million at the time of publication. Additionally, the USD open interest has also halved.

Source: Santiment

Conversely, SUI saw a notable increase in volume and OI, with OI reaching half a billion dollars and volume approaching the billion dollar mark.

AMBCrypto notes that while these indicators indicate growth, they are not reliable indicators of future gains. The focus is on how quickly EUI gains interest compared to LTC.

Read Sui (SUI) price prediction for 2024-25

The result is clear: SUI has broken through the market lows to secure the top spot, gaining ground from holders. Its growth rate has far outpaced that of LTC.

Overall, if bulls can maintain liquidity and hold the $1.70 support while targeting the ATH, SUI has a strong chance of replacing LTC as the 20th largest coin by market cap.