Key takeaways

- Grayscale’s Ethereum Trust led the outflows with over $80 million withdrawn in one day.

- Bitwise’s Ethereum ETF was the only fund with no outflows, gaining over $1 million.

Share this article

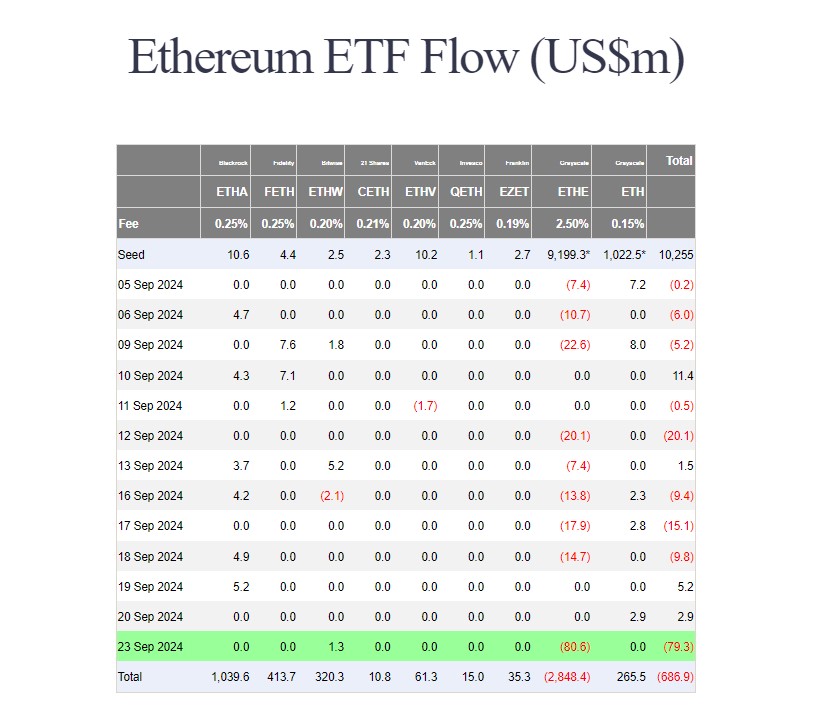

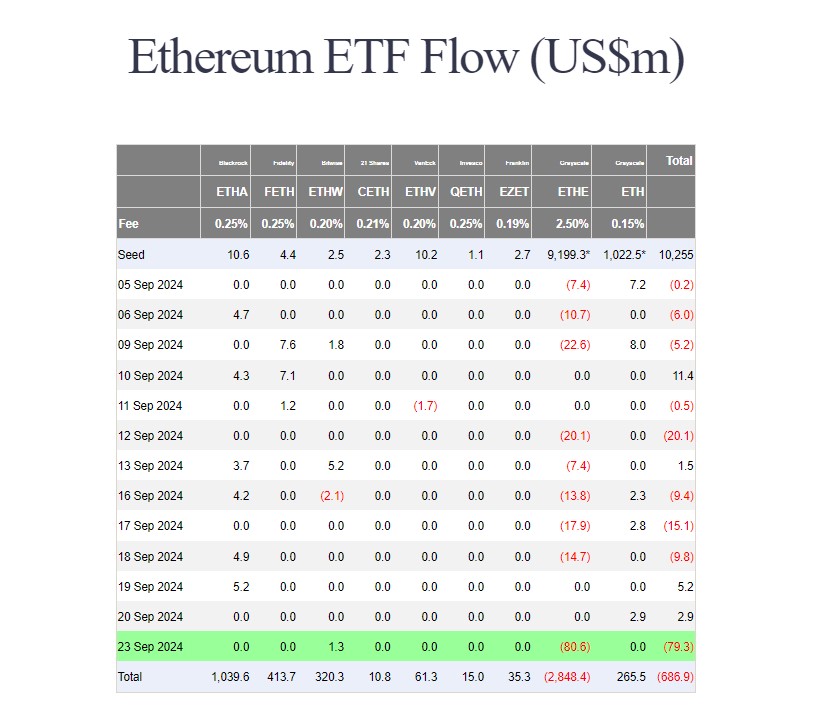

More than $79 million was withdrawn from nine U.S. spot Ethereum ETFs on Monday, the largest single-day outflow since July 29, according to data tracked by Farside Investors. The Grayscale Ethereum Trust, or ETHE, led the redemptions, with investors pulling more than $80 million from the fund.

Since converting to an ETF, the ETHE fund has seen net outflows of over $2.8 billion. Despite continued losses, it remains the largest Ether fund in the world with approximately $4.6 billion in assets under management.

Monday’s outflows ended a brief two-day winning streak for these ETFs. Unlike ETHE, the Bitwise Ethereum ETF (ETHW) was the lone gainer of the day, with most rival funds seeing no inflows. Investors bought over $1 million worth of shares in Bitwise’s ETHW offering.

As of September 23, ETHW net purchases exceeded $320 million, while its Ether holdings exceeded 97,700, worth approximately $261 million at current prices.

Demand for U.S.-listed Ethereum ETFs has continued since they hit the market on July 23. BlackRock’s iShares Ethereum Trust (ETHA) currently leads the way in net inflows and was the first to hit $1 billion in net capital. It is followed by Fidelity’s Ethereum Fund (FETH) and Bitwise’s ETHW.

While Ethereum ETFs faced a slowdown, their Bitcoin counterparts enjoyed a third straight day of gains, collectively adding $4.5 million, according to data from Farside.

Gains from Fidelity’s Bitcoin Fund (FBTC), BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Mini Trust (BTC) offset substantial outflows from Grayscale’s Ethereum Trust.

Share this article