Powell’s rate cuts signal potential changes for the cryptocurrency market. Federal Reserve Chairman Jerome Powell recently outlined his plans for future interest rate cuts. This has sparked discussions about the impacts on digital assets and inflation fears.

Read also: Solana (SOL) Expected to Grow 5x to $776: Here’s When

Understanding the impact of Powell’s rate cuts on boosting the crypto market and inflation fears

Powell’s economic assessment and rate cut plans

At the National Association for Business Economics conference in Nashville, Powell outlined future interest rate cuts. He said further cuts were possible. To reassure people, he also said that they would be smaller than the previous ones.

Powell said:

“Our decision to reduce our policy rate reflects our growing confidence in the strength of the labor market.»

He also said:

“Going forward, if the economy generally develops as expected, policy will shift over time to a more neutral position. But we are not following any predefined course.

Read also: Coinbase to Add Proof of Reserves to Bitcoin Wrapper cbBTC

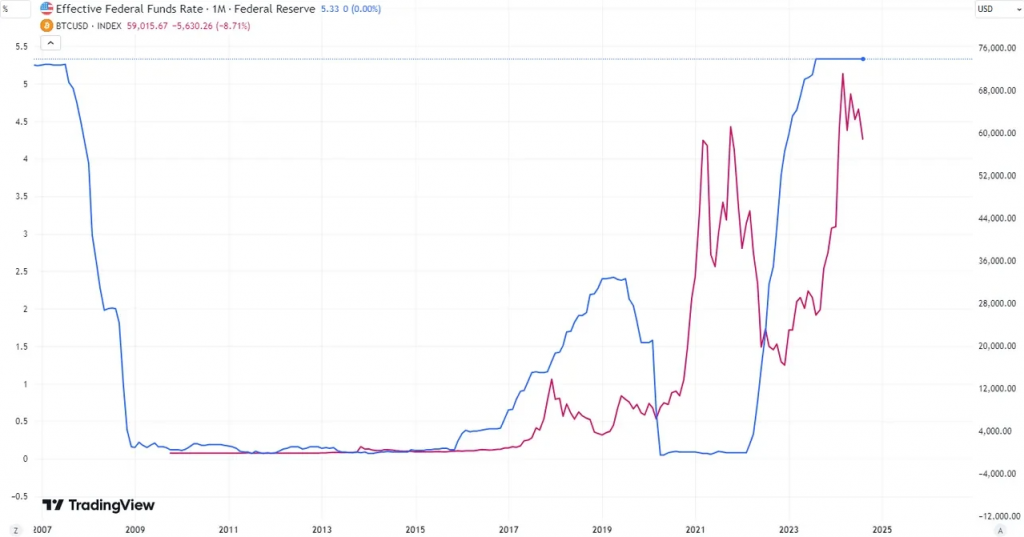

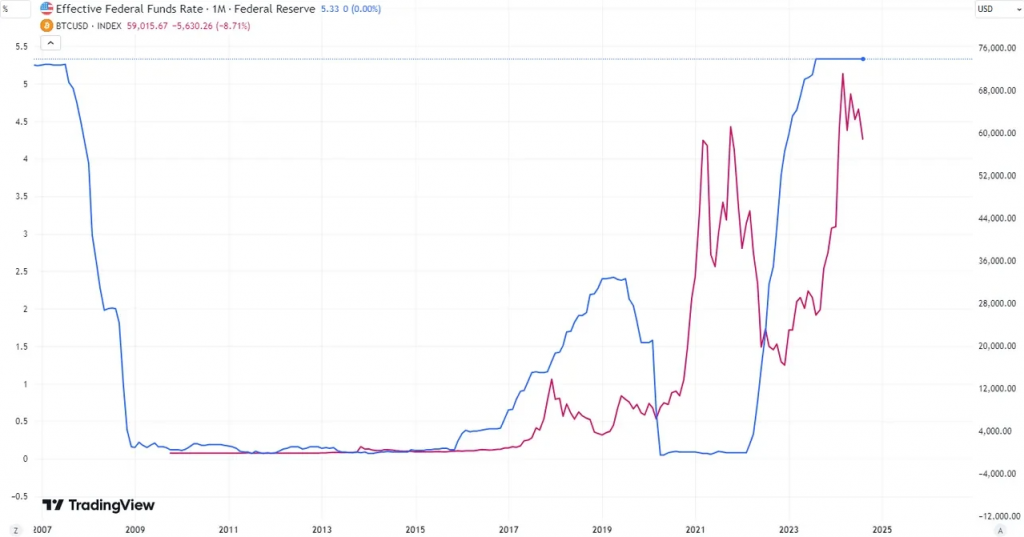

Potential Boost for Crypto Markets

The crypto market could benefit from these planned rate cuts. Recent reductions have already increased trading volumes. Experts predict more positive effects on digital asset prices.

Richard Teng, CEO of Binance, said:

“We expect rate cuts to have a significant impact on digital asset prices. Lower interest rates increase liquidity in the financial system, which drives demand for higher-yielding, higher-risk assets, including cryptocurrencies.

Balancing optimism and caution

Although rate cuts could boost crypto growth, some analysts are calling for caution. Trade Nation’s David Morrison also went on to say:

“If talk returns to recessions, inflation and of course geopolitical tensions, this will push investors towards ‘safe haven’ assets like gold and silver.”

The crypto industry remains cautiously optimistic about Powell’s comments. The short-term benefits of rate cuts are clear. However, a balanced approach may be more effective in the long term.

Read also: Dogecoin: Why DOGE could rally 1,200% to $1.6

As the Federal Reserve manages economic challenges, the crypto market adapts to changing monetary policies.