- WLD is up 10% in the past 24 hours despite mixed on-chain metrics.

- Sentiment remained bearish, as only 11% of holders made profits at the current price.

Worldcoin (WLD) has been one of the best performing players in the crypto market over the past week, posting significant bullish gains.

Data from CoinMarketCap reported that at the time of writing, WLD had jumped around 10% in the last 24 hours alone.

This sharp increase reflects growing interest in WLD as market participants have taken note of recent market dynamics.

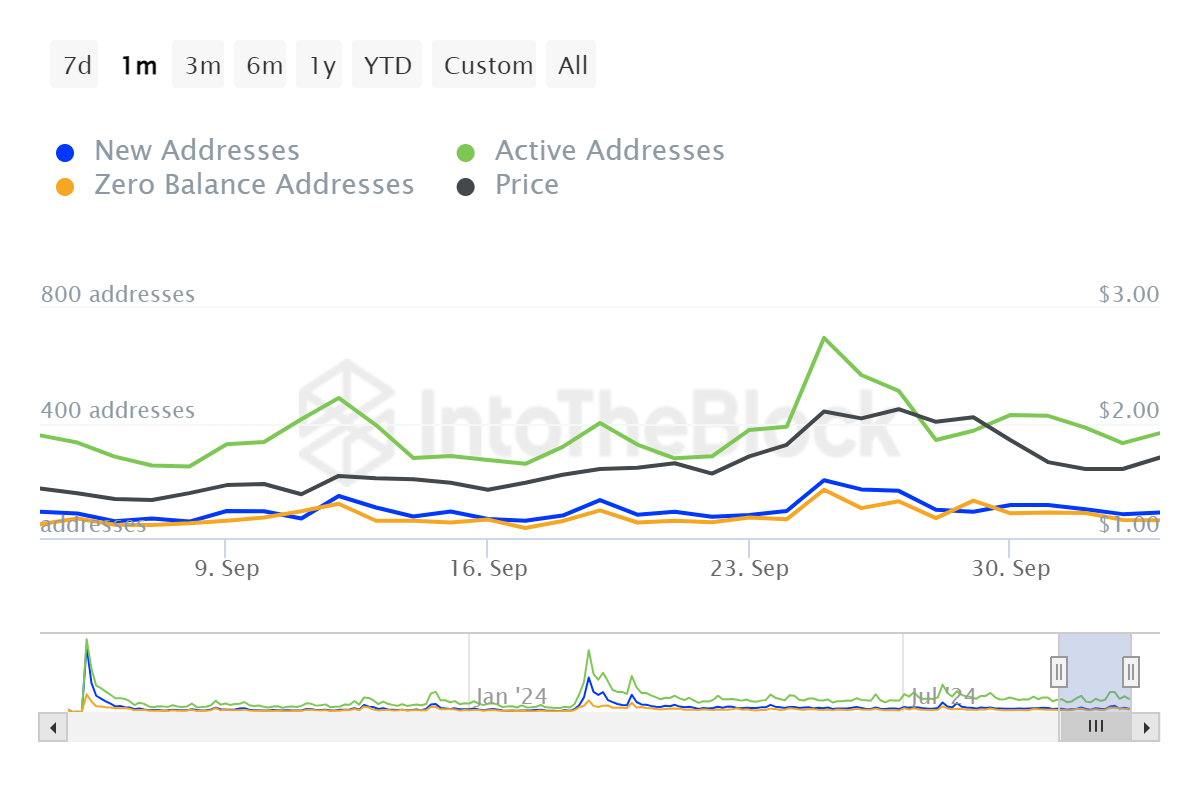

WLD active addresses are on the rise

Worldcoin’s trading activity was also on the rise, which further drove the altcoin’s price action.

Active addresses interacting with the coin increased by 8% in the last 24 hours, signaling increased market participation in the cryptocurrency.

This increase in active addresses generally indicates an increase in buying and selling activities, adding more liquidity to the coin.

Source: In the block

Source: In the block

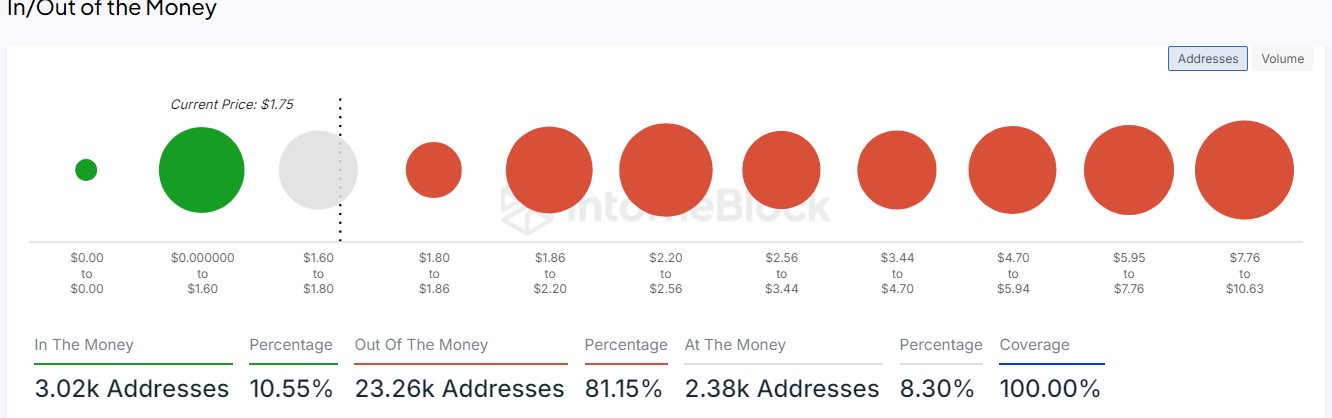

Profitability remains low

Although WLD’s price increased significantly, only 11% of its holders were making profits at press time.

This speaks to broader bearish sentiment, indicating that the majority of investors have not yet broken even on their initial investments.

The contrast between this price increase and profitability levels was a sign of uncertainty in the market.

Source: In the block

Can WLD reach $2?

The main question for many traders now would be whether WLD can sustain this rally and break through the $2 level.

While the increase in active addresses is a positive sign, most on-chain metrics suggest more cautious expectations due to the low profitability rate.

This slight bearish sentiment will likely limit the coin’s upside potential, at least in the near future.

Read Worldcoin (WLD) Price Prediction 2024-2025

The recent 10% increase in WLD has undoubtedly caught the attention of many in the crypto industry, despite its on-chain metrics telling a different story.

With only 11% of holders currently in profit, and with overall bearish sentiment, this rise to $2 may not be straightforward.