- Ethereum has been on a steady decline since falling below $3,400.

- The crowd loses interest in ETH during this period slight crypto collapse.

Ethereum (ETH) showed signs of weakness even after recent gains failed to surpass the $3,400 mark. This has led to fears that ETH may be entering a near-term correction phase, as various metrics suggest.

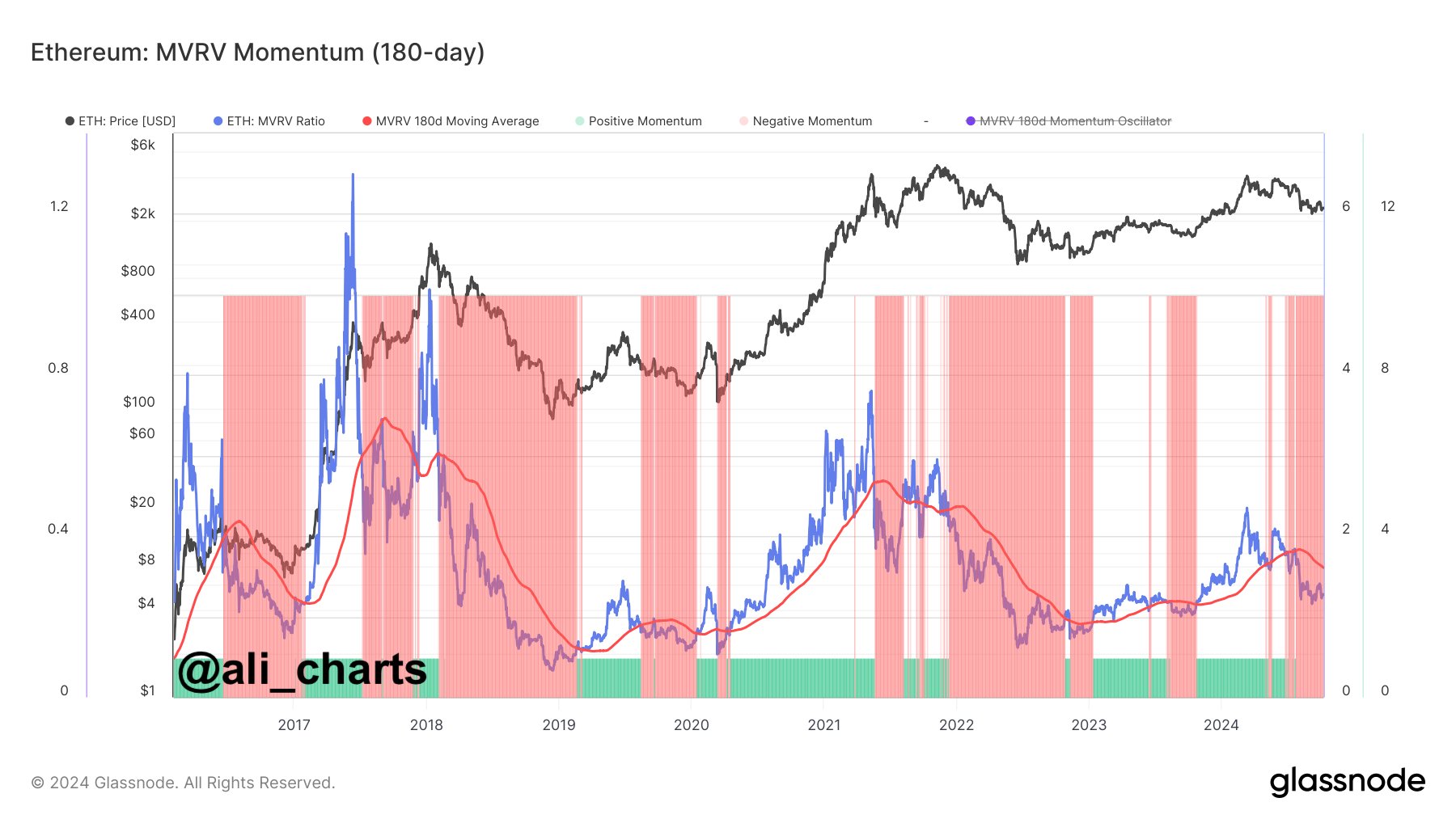

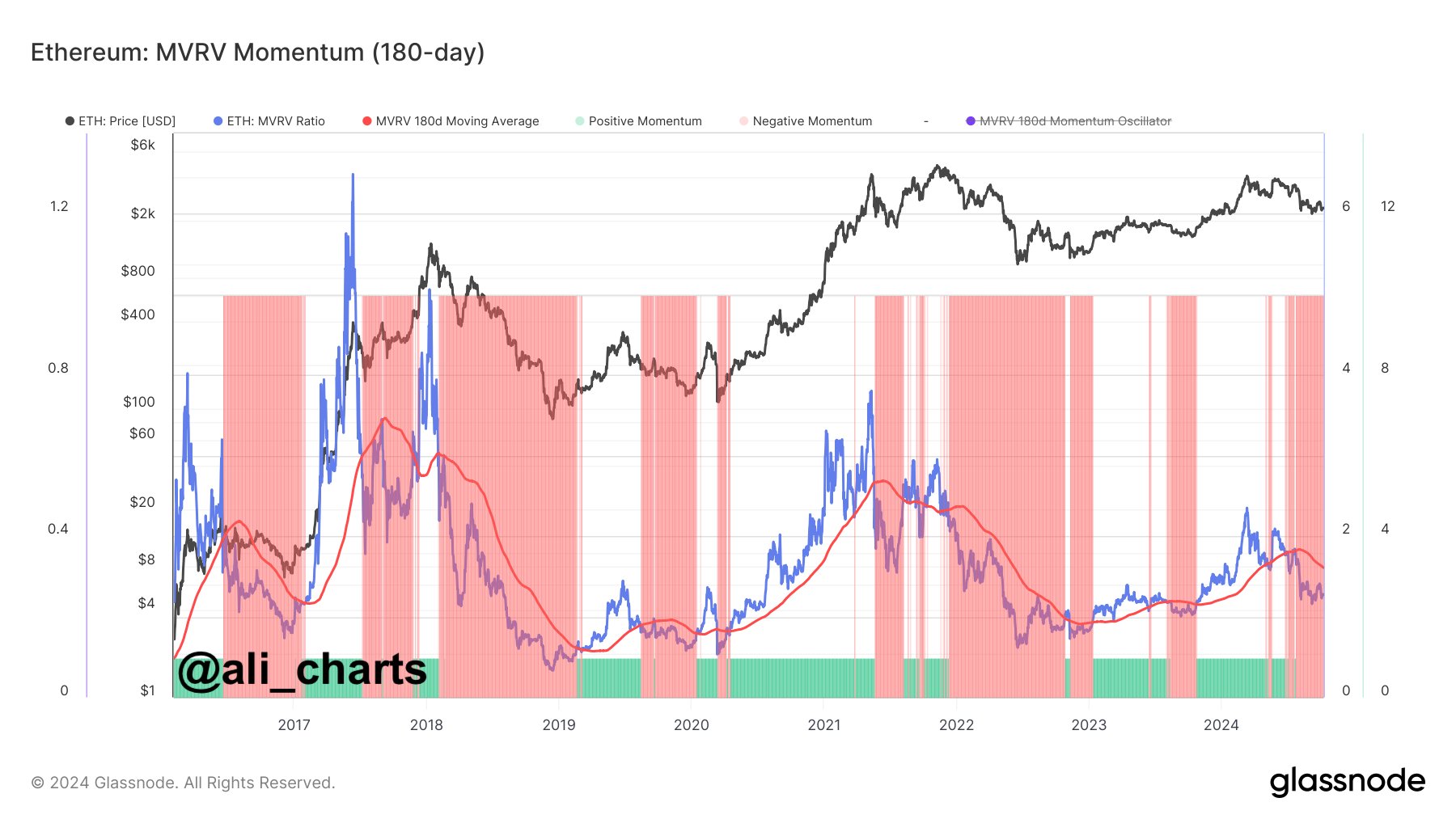

A key indicator, MVRV Momentum, highlights that Ethereum has been in a steady decline since falling below $3,400 on June 23, 2024.

This could indicate a potential downtrend for ETH, making it crucial for traders to be cautious while identifying possible long-term buying opportunities if ETH reverses its current price.

Source: Ali/X

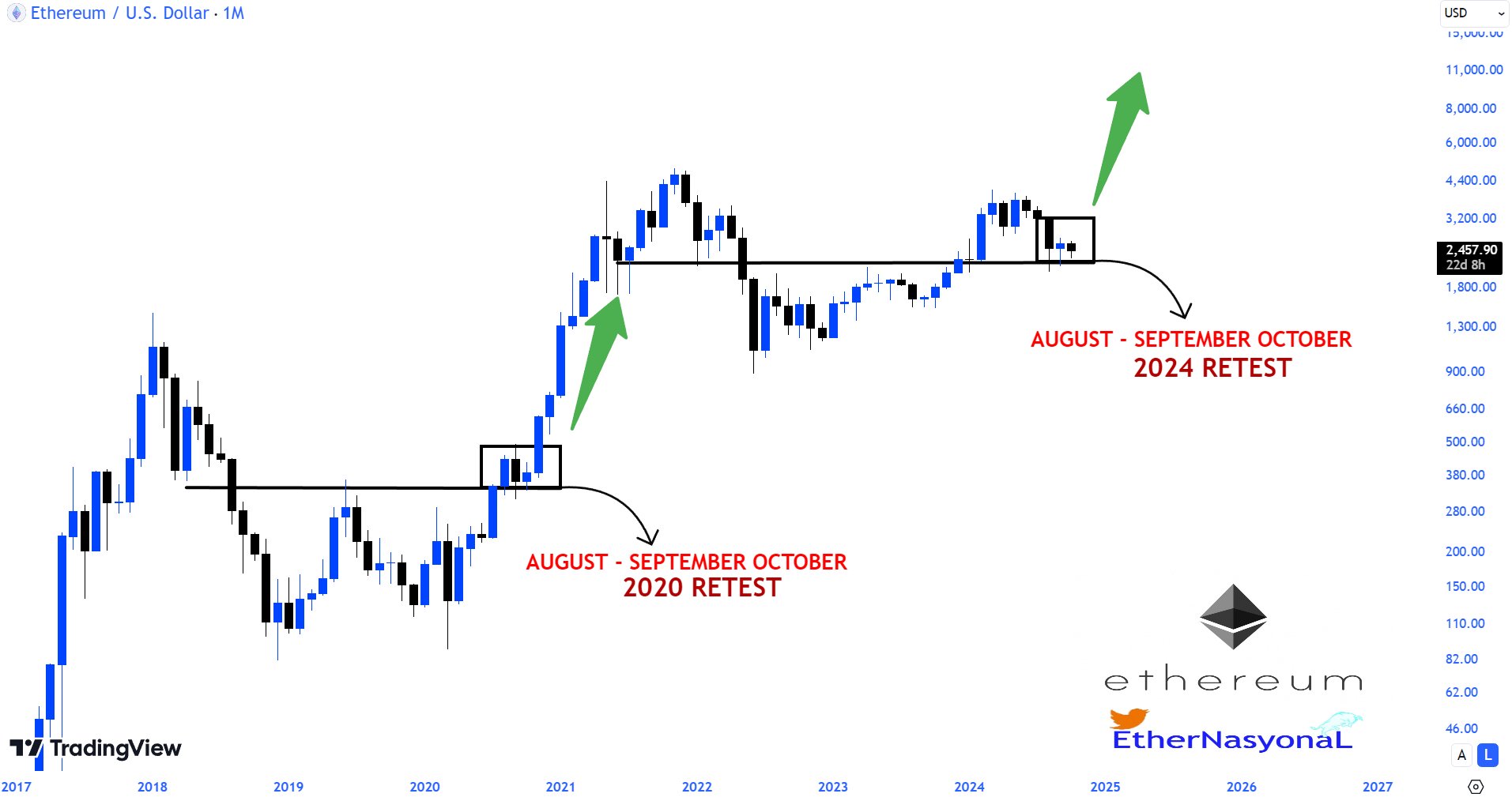

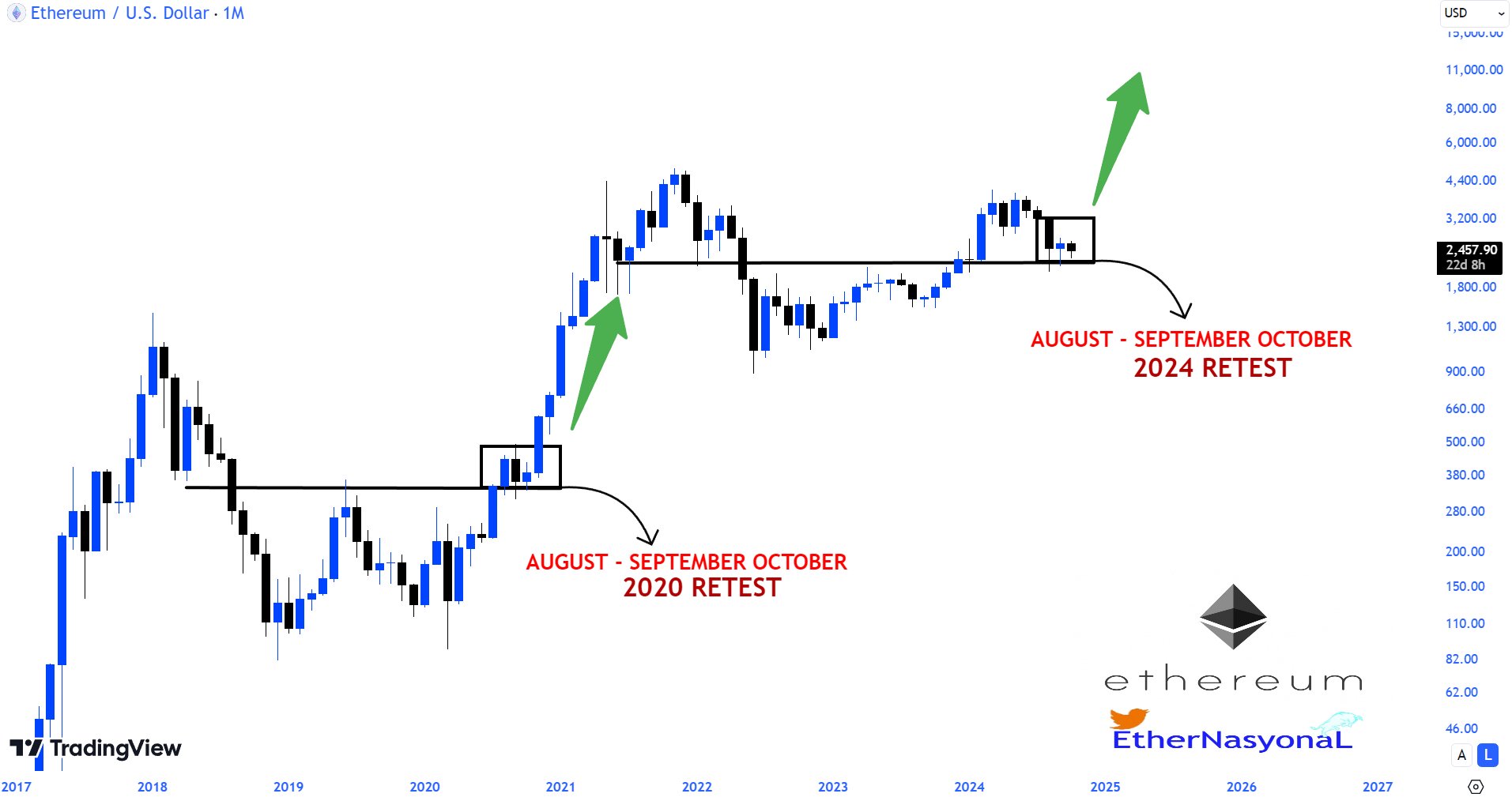

On the monthly time frame, Ethereum hints at the possibility of a mega bull run in 2025. Similar to the 2021 bull market, ETH experienced a retesting and accumulation phase in August, September, and October 2020.

This year, ETH appears to be in a similar stage of retesting and accumulation during these same months.

This trend suggests that while Ethereum could face further declines in October, it could begin to reverse by the end of the year, paving the way for future growth.

Source: TradingView

ETH valuation and social sentiment

Looking at Ethereum’s performance against Bitcoin (BTC), it appears that the downward trend could continue.

The valuation of ETH against BTC fell to 0.000295, falling below the 0.0004 mark, which was previously considered a key support level.

This reinforces the idea that Ethereum could face further declines in the near term as BTC continues to outperform ETH on most time frames.

Source: In the cryptoverse

Another factor contributing to Ethereum’s bearish outlook is its place in the social sentiment rankings.

Ethereum ranked second, just behind Chainlink, in the list of assets with the most negative crowd sentiment during this period of market uncertainty.

Historically, assets with strong bearish sentiment have often seen the best chance of price gains. While this drop in confidence could lead to further price declines, it also presents the potential for a turnaround.

Source: Santiment

If bearish sentiment subsides, it could spark a rally that propels ETH to higher levels, possibly hitting new highs in 2025.

Read Ethereum (ETH) Price Forecast 2024-2025

Although Ethereum is currently in a downtrend, the potential for a reversal exists, especially with the 2025 bull market on the horizon.

Traders should remain cautious in the short term but keep an eye on key support levels, as they could provide the first signals of a bullish reversal.