This article is also available in Spanish.

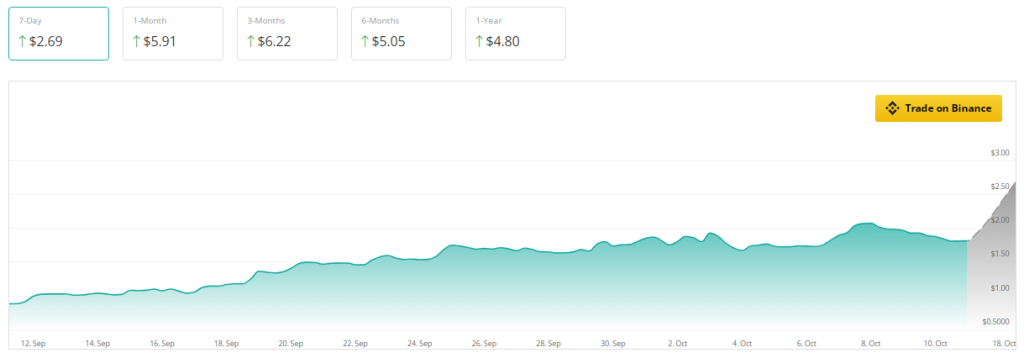

Over the past 30 days, Sui (SUI) has been on a roll, tripling its market cap and showing exceptional growth. An increase in value of over 100% brought the token’s market capitalization to over $5 billion. But as is always the case with cryptocurrencies, what goes up must come down at least momentarily.

Source: Coingecko

Related reading

The coin’s rise is showing signs of stagnating after weeks of growing momentum. Traders are now closely watching what may happen next for this once hot asset. According to crypto price prediction site CoinCheckup, SUI is selling 220% below its forecast price for next month, suggesting possible undervaluation.

Price Sliding and Declining Market Activity

SUI was trading at $1.84 at press time after losing 5% of its value in just 24 hours. According to CoinMarketCap, trading volumes also fell by 4%. This drop in activity suggests, at least for the moment, a waning interest in the token.

The technical signs don’t seem much better. Tracking the flow of money into and out of an asset, the Chaikin Money Flow (CMF) has also seen a downward slope over the past seven days. This indicates that money is fleeing the SUI, which typically leads to price stability issues. Additionally, the CMF has entered negative territory, suggesting that buying interest is currently subordinate to selling pressure.

SUI: slowdown in momentum but potential rebound

The token began selling off as its relative strength index (RSI) fell below a key signal line, indicating a decline in momentum. There is still a positive aspect here. If the RSI shows positive movement once again, this could indicate a buying opportunity for those who believe the SUI has long-term promise.

If the selling continues, analysts say SUI could test support at $1.70; this may not be a negative result. Strong support levels attract buyers who see value at lower levels, providing the basis for further price increases. SUI will need to work its way past resistance at $2, a fundamental psychological and technical barrier, if it is to break out of its current downturn.

Cooling of interest

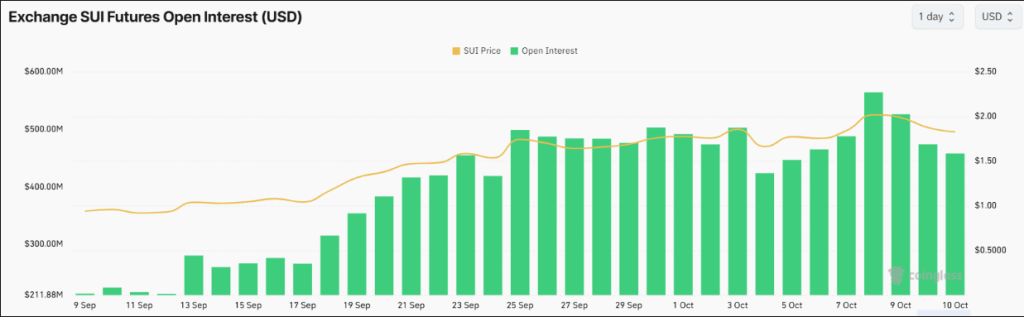

Meanwhile, SUI, which has seen explosive growth recently, also appears to be calming down. From an all-time high of $560 million to $450 million, open interest decreased by 10% in the last 24 hours. This implies that traders close their positions as enthusiasm wanes, helping to explain the general selling pressure on the coin.

Some traders would see falling open interest rates as a sign of opportunity, even with this cooling. Falling prices always mean buyers will re-enter the market, especially if they believe the SUI price is undervalued.

Related reading

SUI still has long-term promise. Over the next three months, analysts predict a possible price increase of 240%; over the next year, an increase of 160%. For SUI, especially from a long-term perspective, the future looks promising even if the road ahead could be strewn with pitfalls.

Featured image from ThoughtCo, chart from TradingView

Source: Coingecko

Source: Coingecko