- A stellar annual event has sparked mild interest in its native token XLM.

- Will September’s trend repeat and extend XLM’s rally to 10%?

Stellar The blockchain, known for its strong cross-border payment support, saw an uptick in its native token, XLM, following its Meridian 2024 conference concluded in London, UK.

The annual event always highlights the development of the chain and new partnerships, particularly in the payment ecosystem. However, despite recent collaborations with MoneyGram, Paxos and others, XLM only saw a modest 8% jump.

Can XLM move forward?

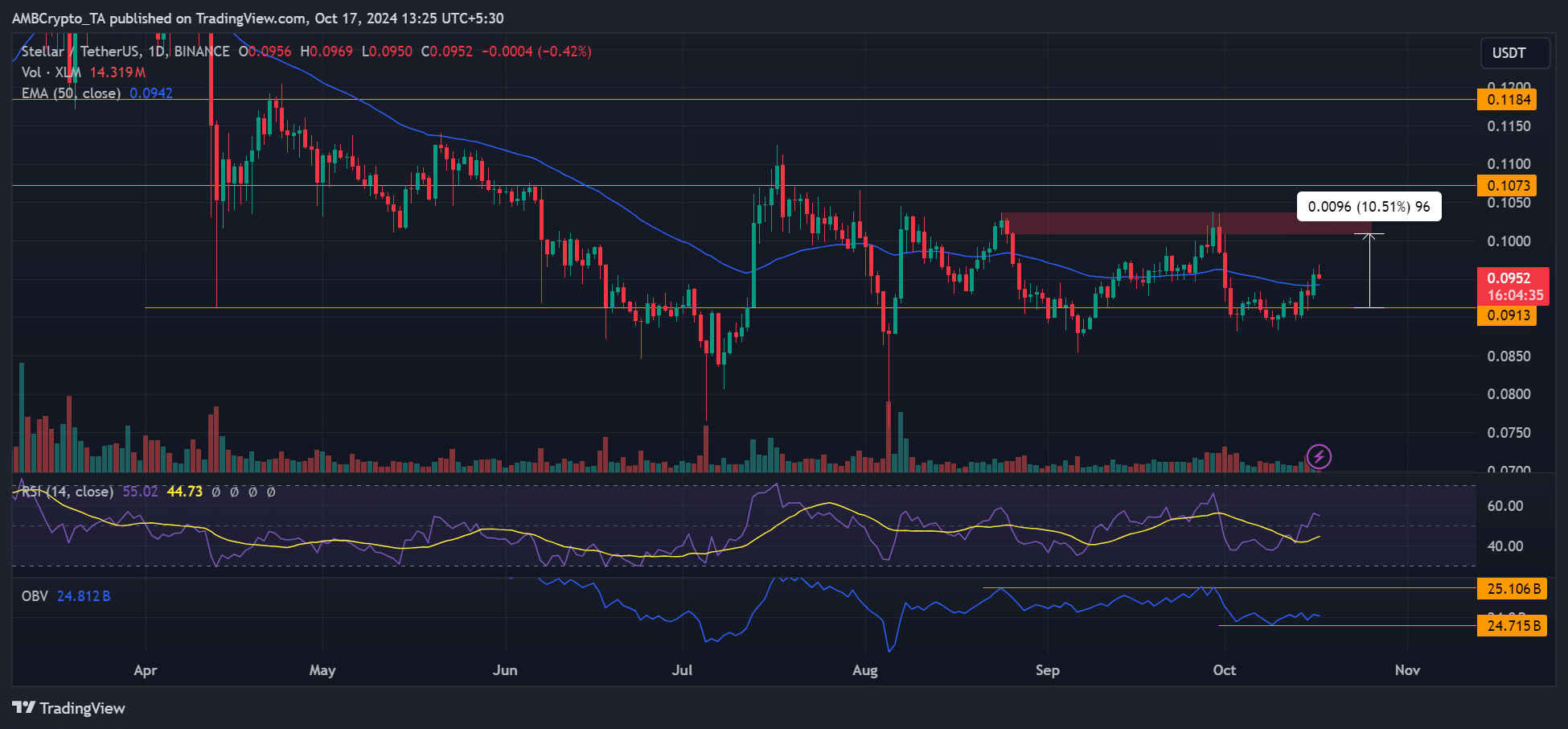

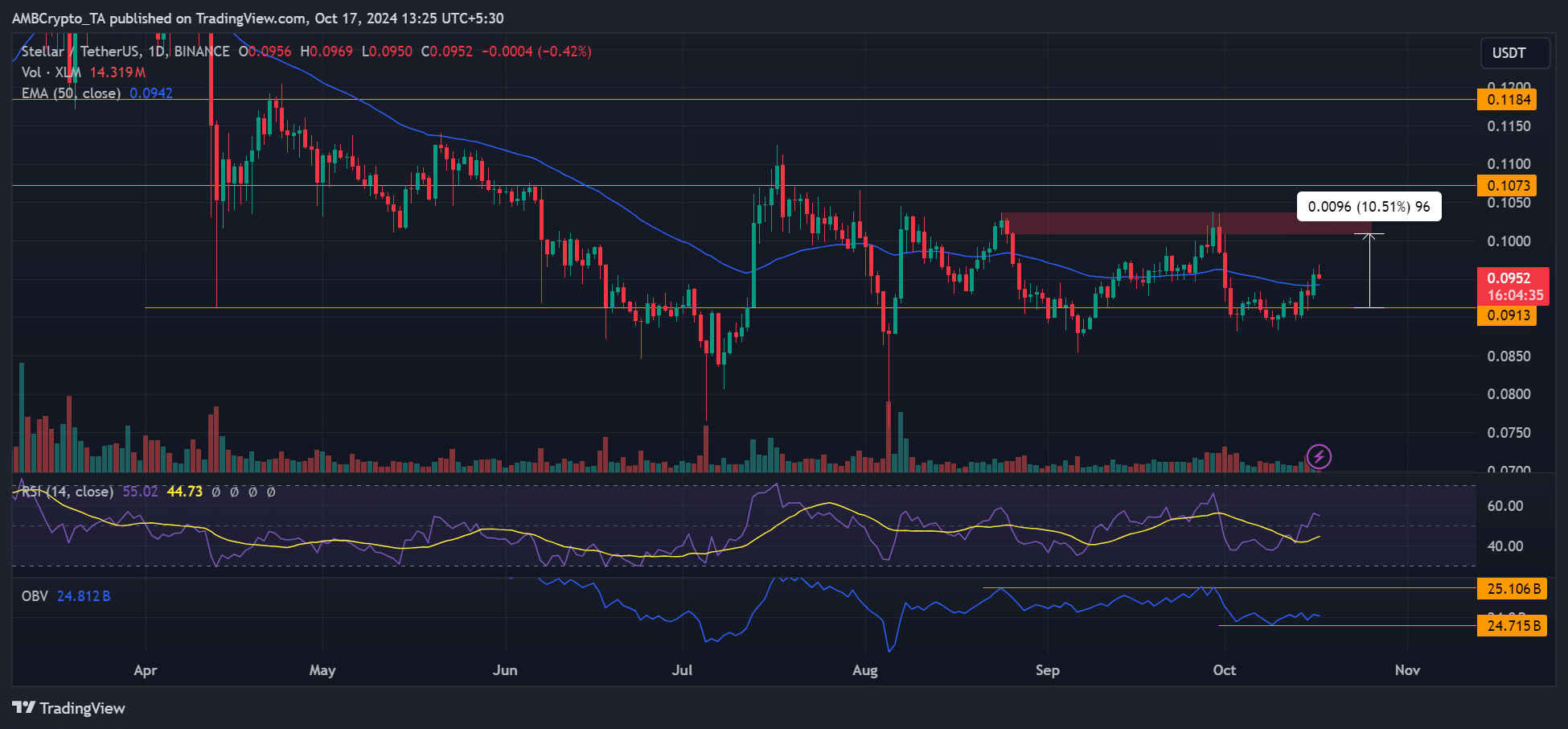

Source: XLM/USDT, TradingView

Since the August sell-off, XLM has been stuck in a tight range between $0.09 and $0.10. During the same period, $0.10 has been a local supply zone (marked in red).

At press time, XLM had reclaimed the 50-day EMA (Exponential Moving Average). The latest XLM regained dynamic support in September; it consolidated nearby for a while before climbing towards the local supply zone at $0.1.

If the trend repeats, XLM could hover near the 50-day EMA before extending its October rally to 11%. The RSI’s northward movement indicates slow but steady increasing buying pressure for the altcoin, supporting the bullish outlook.

However, on-balance volume (OBV) was weak and below the September high, indicating that strong bullish sentiment was not evident.

Impact of a stellar event

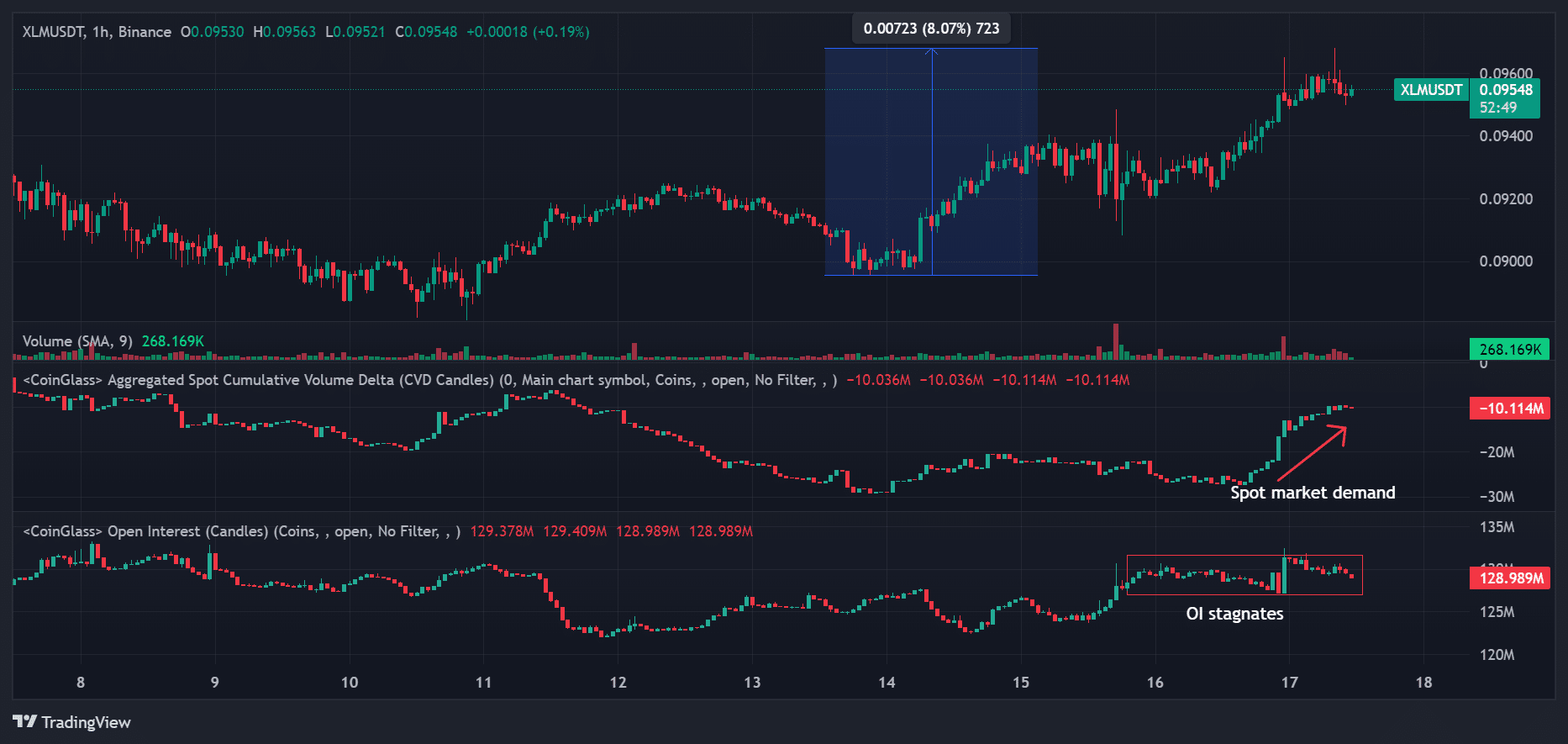

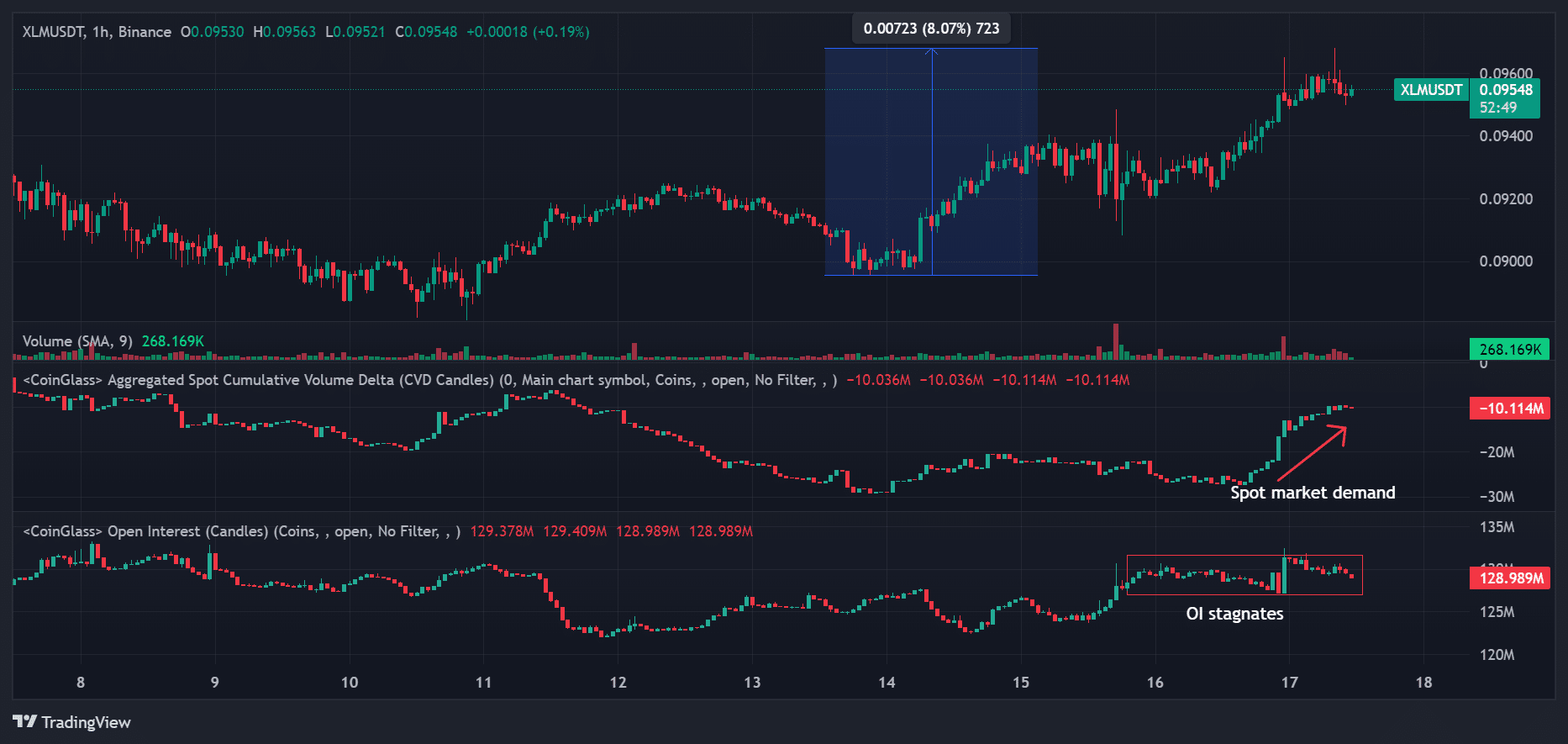

Source: XLM/USDT, TradingView

During the annual Stellar event, held October 15-17, demand in the XLM spot market and interest in the futures market increased significantly.

The CVD (Cumulative Volume Delta) has peaked, illustrating increased demand in the spot market.

Likewise, open positions increased from $123 million to $132 million, indicating strong interest among speculators in the futures market. In short, the event could have slightly boosted the XLM market.

Read Stellar (XLM) Price Prediction 2024-2025

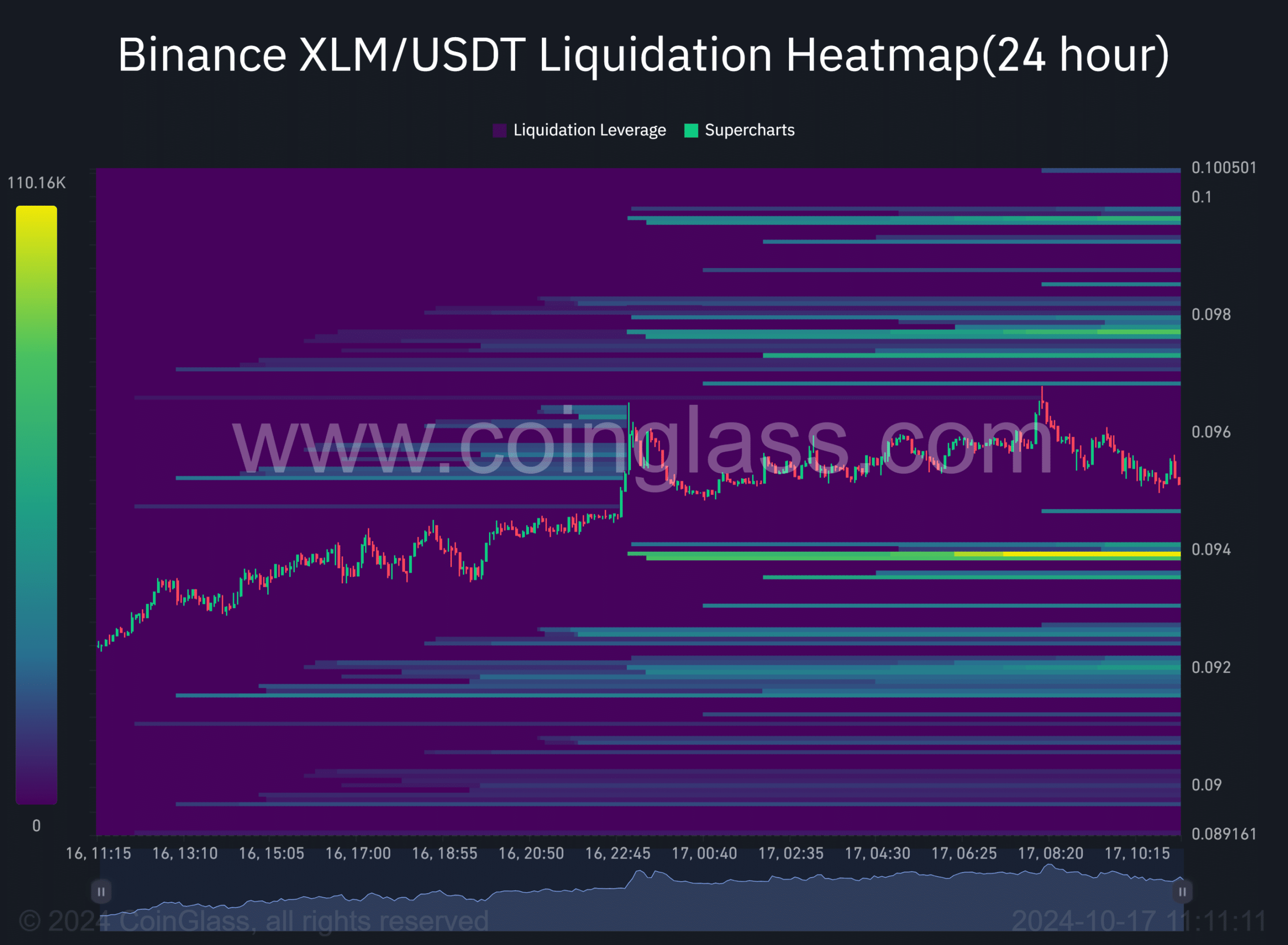

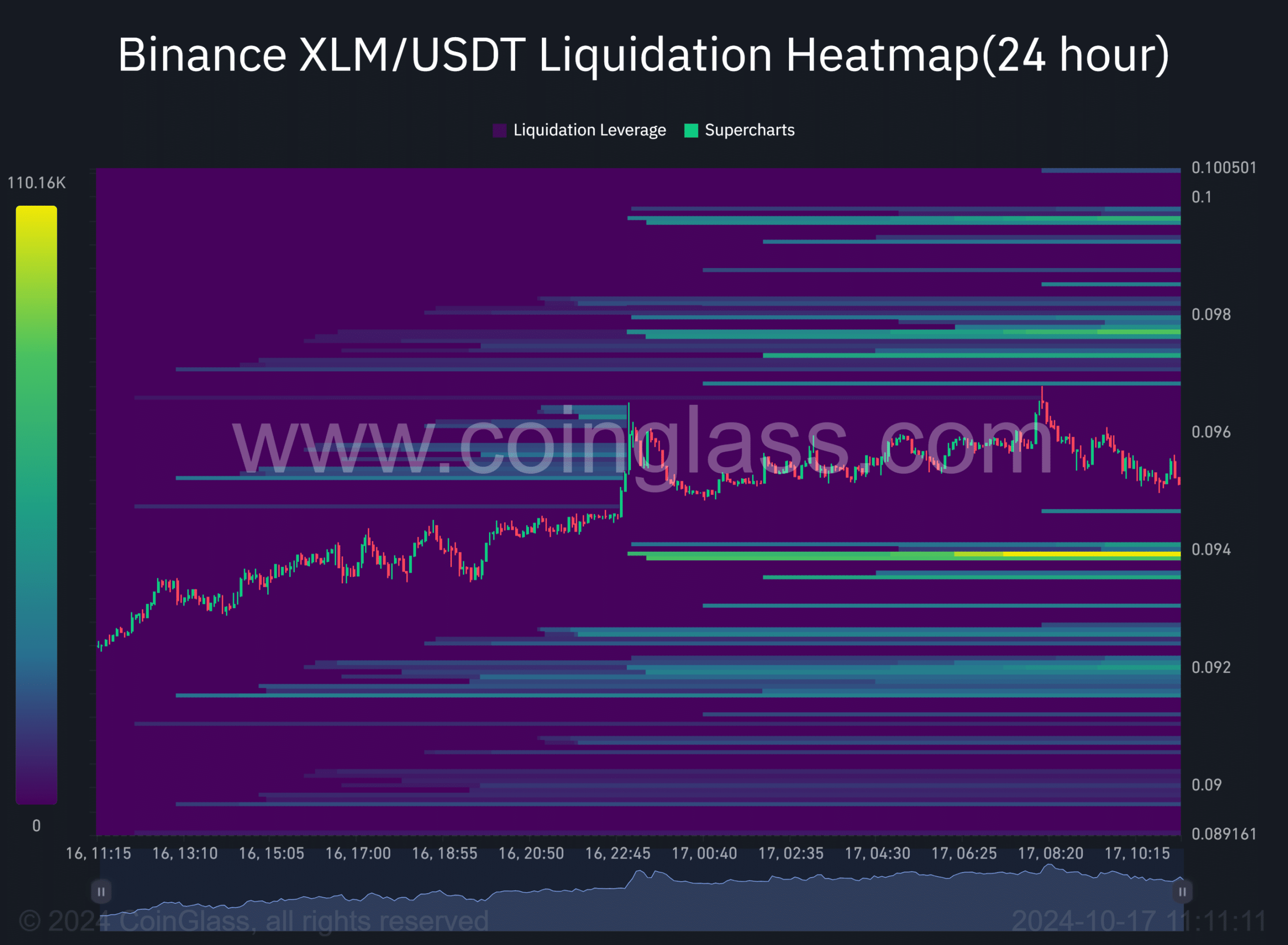

That said, the XLM liquidation heatmap confirmed the price analysis results. Notably, massive long positions (bright cluster) at $0.094 coincided with the 50-day EMA. This meant that the level could act as short-term support.

Likewise, the overhead levels of $0.1 and $0.098 had increasing short positions, which were conceded with the local supply zone. These were therefore key objectives to follow in the short term.

Source: Coinglass