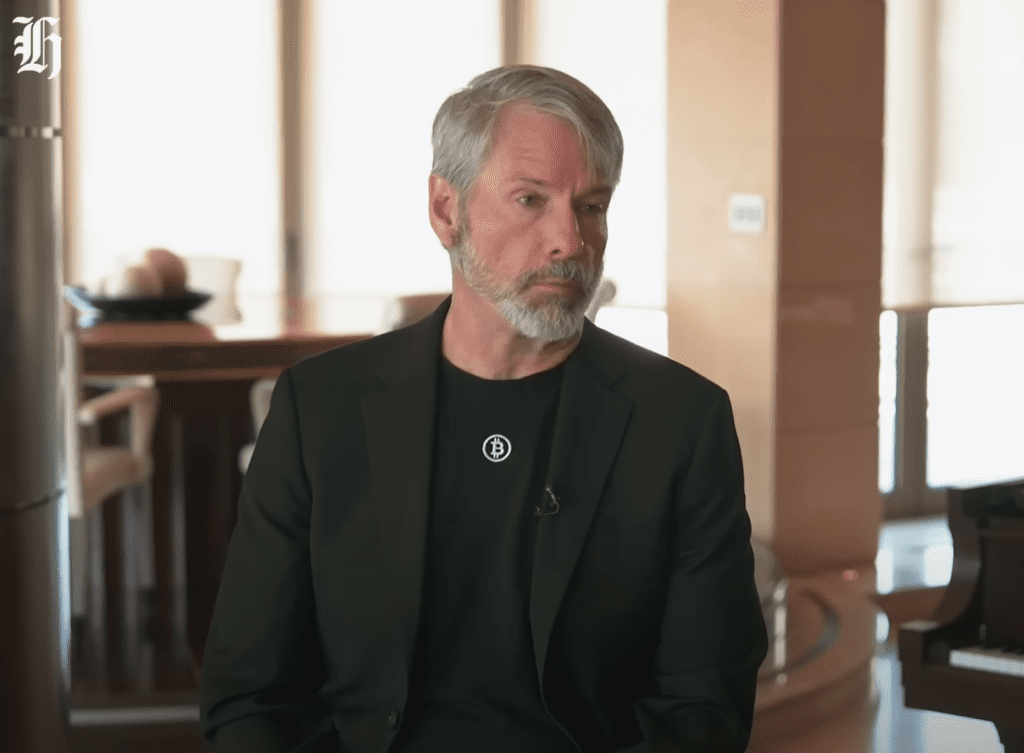

In a recent interview with journalist Madison Reidy, MicroStrategy CEO Michael Saylor sparked huge controversy within the Bitcoin community with his remarks on custody and regulation. The discussion focused on the risks associated with large institutions holding significant amounts of BTC and the potential for government seizure or confiscation, recalling historical events like the confiscation of gold under Executive Order 6102 in 1933 .

Asked about the risks of holding a significant amount of BTC by third-party custodians and large institutions, Saylor dismissed fears of increased seizures or confiscations. He argued that BTC is safer in the hands of regulated public entities like BlackRock, Fidelity and JP Morgan than among unregulated private holders. Saylor suggested that when Bitcoin is owned by “crypto-anarchists” who operate outside of government regulations and tax systems, it poses a greater risk of government intervention.

“I think it’s the opposite. I think when Bitcoin is owned by a group of crypto-anarchists who are not regulated entities, who don’t recognize the government, don’t recognize taxes, or don’t recognize reporting requirements, it increases the risk of seizure.

He emphasized that regulated institutions provide stability and reliability. “When regulated public entities like BlackRock, Fidelity, JP Morgan and State Street Bank own the asset, all lawmakers and law enforcement are vested in those entities. It’s not possible for every senator and congressman to grab the assets of Fidelity, BlackRock, or Vanguard, because that’s where all their retirement money is invested.

Reidy cited the confiscation of gold under Executive Order 6102 during the Great Depression as a historical precedent for possible government seizure. Saylor dismissed the comparison, calling it a “myth and trope” propagated by paranoid “crypto-anarchists.” He argued that the circumstances were fundamentally different because at that time the United States was using the gold standard and the government needed to control gold to devalue the dollar.

“Today we are not on the gold standard or the Bitcoin standard,” Saylor said. He argued that the U.S. government has no greater incentive to seize held BTC than it would to seize stocks or real estate. “I don’t think we should be worried about the government seizing Bitcoin in custody any more than we should be worried about the government seizing your Apple stock,” Saylor said.

Reaction from the Bitcoin community

Saylor’s remarks did not sit well with many in the Bitcoin community, who view decentralization and self-custody as core principles. Jack Mallers, CEO of Strike, responded on X: “Calling self-custody “crypto-anarchism” oversimplifies what Bitcoin accomplishes. It’s about freedom: freedom of speech, property rights, and protecting your right to own what’s yours. We must not ignore it because freedom is not promised: it must be fought for and protected. »

He acknowledged his respect for Saylor but stressed the importance of diverse viewpoints in a free market. “My goal is simply to uphold the principles that I believe make Bitcoin powerful: freedom and the ability for everyone to engage with it as they see fit,” Mallers added.

Sina Nader, co-founder of 21st Capital, criticized Saylor’s position: “Terrible look at Saylor for becoming an accomplice of the government and the banking system and calling real Bitcoiners paranoid. Saylor is on a mission to relegate Bitcoin to an investment pet and end its use as currency.

Samson Mow, CEO of JAN3, warned: “A government does not need to physically confiscate your Bitcoin. It can simply lock the custodian BTC forever with approved custodians, aka “institutional Bitcoin”. Although a government that does not adhere to a Bitcoin standard technically should not have an incentive to confiscate BTC, it actually still has an incentive to degrade and attack Bitcoin.

Mow suggested that governments may seek to undermine Bitcoin because it represents a “harder, superior currency” that could diminish the value of fiat currencies. He urged the community to “plan accordingly” with a self-custody solution and “expect (a)6102,” referring to the historic executive order.

At press time, BTC was trading at $67,707.

Featured image created with DALL.E, chart from TradingView.com