- Solana’s daily active addresses have reached record levels amid growing DeFi activity.

- Solana DeFi TVL also hit a 34-month high of $6.48 billion.

Solana (SOL) has gained 7% over the past seven days and 16% over the past two weeks to trade at $165 at press time.

Although the bullish trend in the broader cryptocurrency market has contributed to SOL’s rally, the network’s growth has also been a catalyst for recent gains.

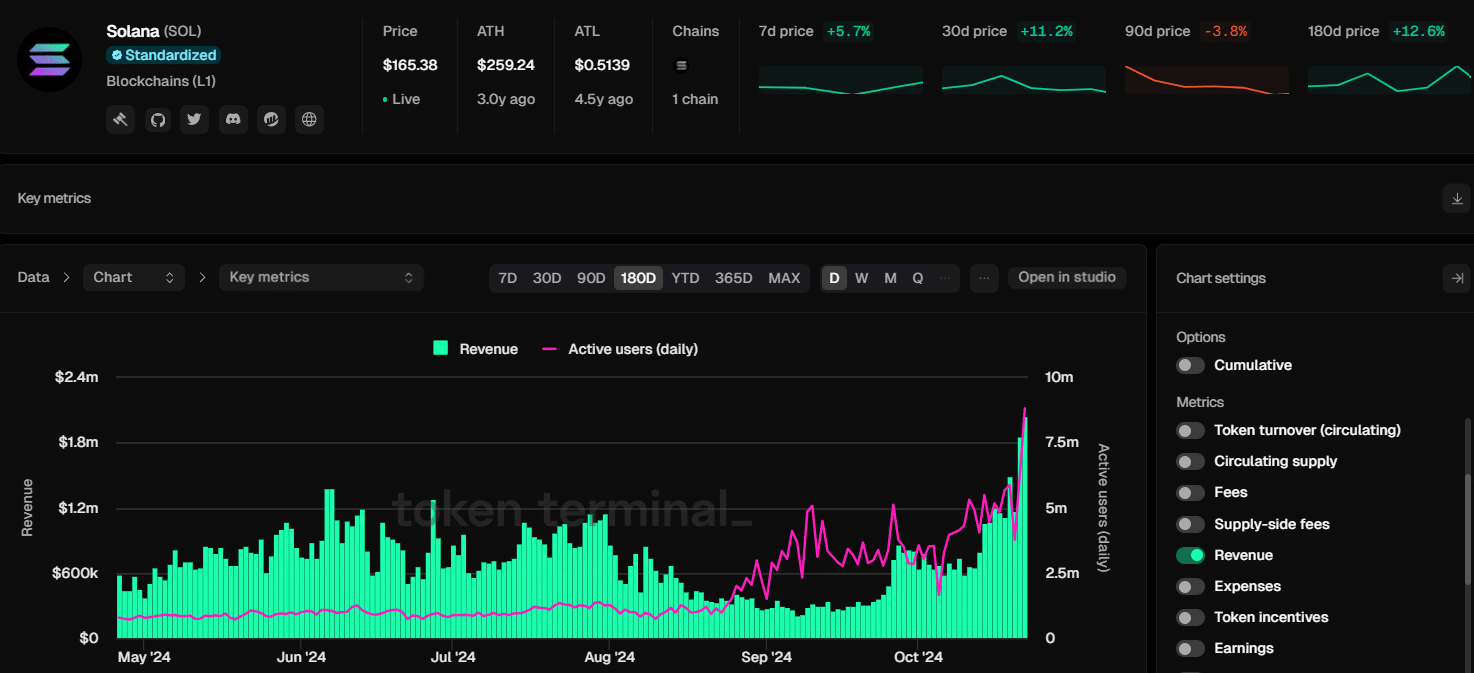

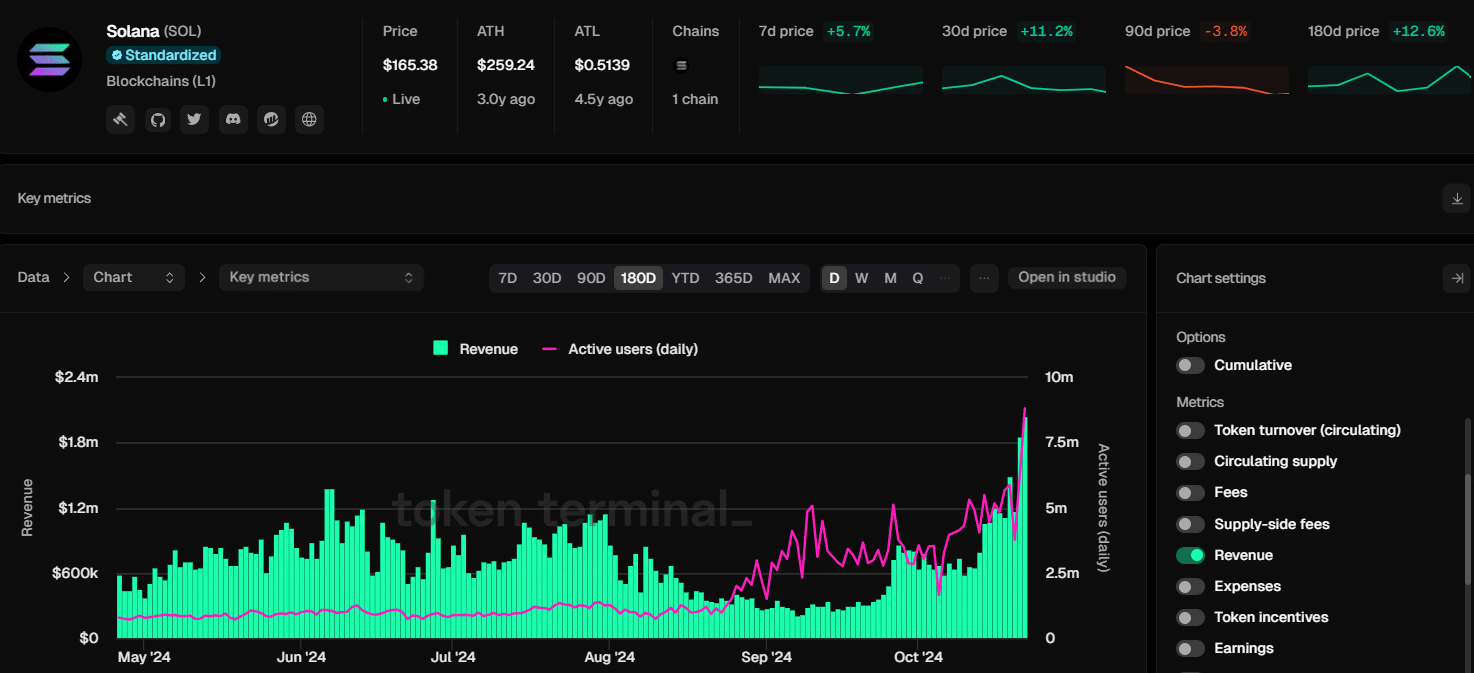

Data from Token Terminal shows that Solana’s daily active addresses have been increasing gradually and are currently reaching all-time highs.

This shows positive sentiment towards Solana as users trade SOL or interact with decentralized applications (dApps) created on the blockchain.

Solana’s daily revenue also recently reached $2 million, the highest level in six months, highlighting the growing demand for blockchain.

Source: Token Terminal

Will Solana topple Tron by DeFi TVL?

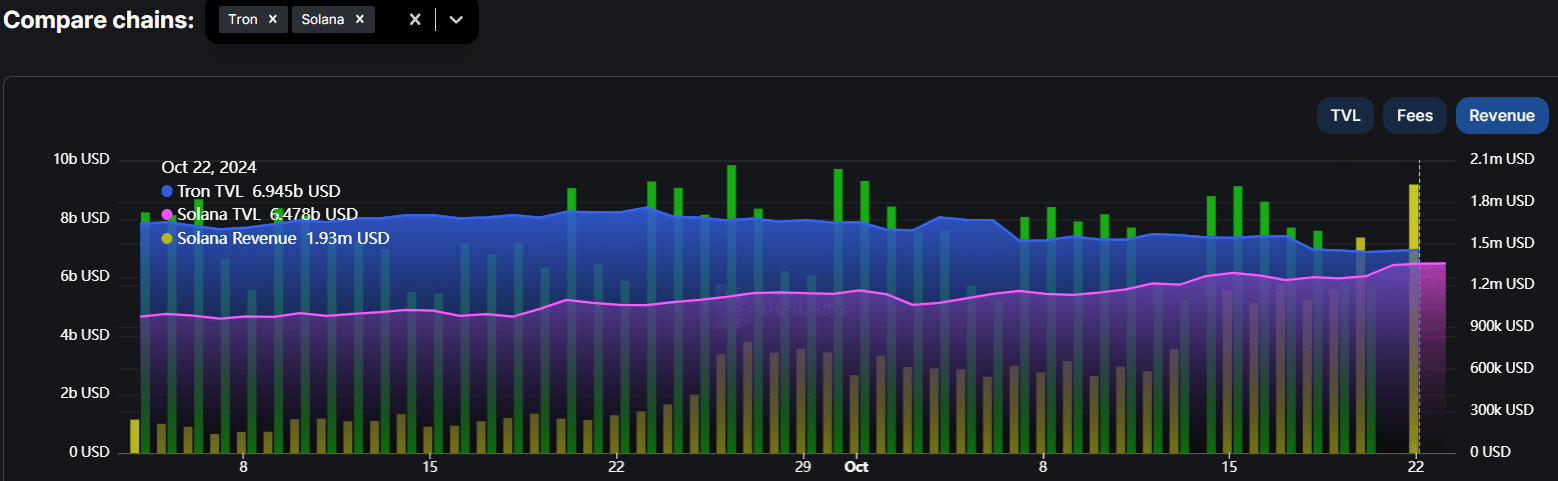

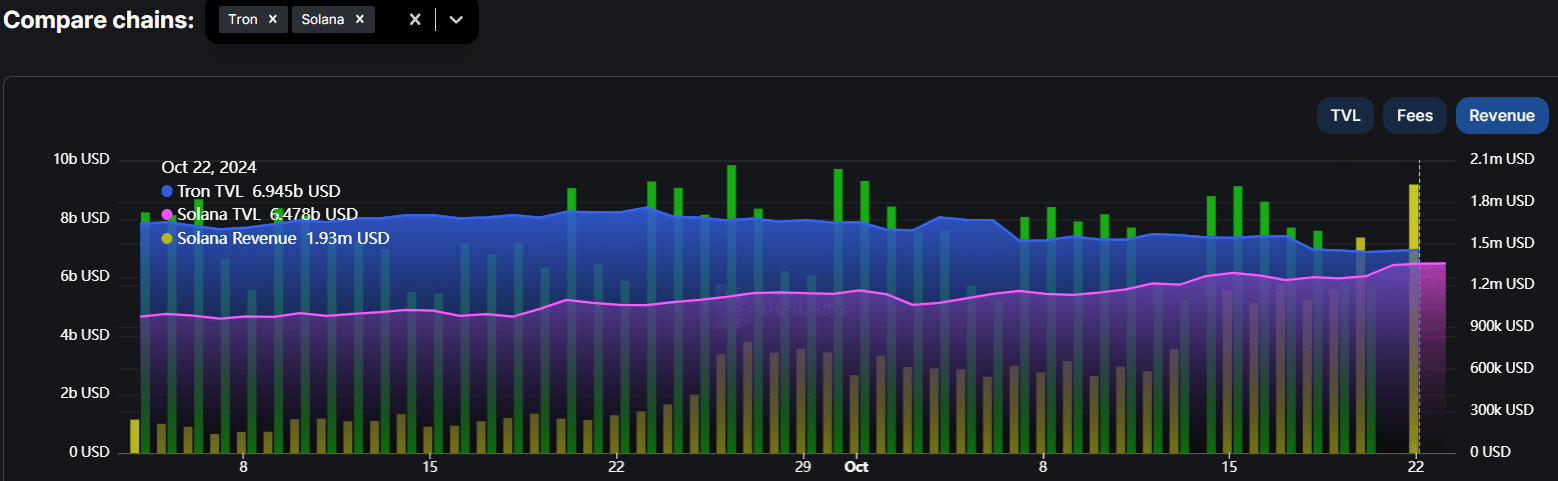

One of the sectors where the Solana network is seeing increasing usage is decentralized finance (DeFi). Data from DeFiLlama shows Solana’s DeFi total value locked (TVL) hits a 34-month high of $6.48 billion.

At the same time, Tron (TRX) TVL fell to $6.94 billion. If Solana’s TVL continues to increase, the network could unseat Tron and become the second largest blockchain by this metric.

Solana DeFi revenue also increased to its highest level since March, further showing growing usage.

Source: DeFiLlama

The growth of a blockchain network is often considered bullish and could fuel a price rise. Furthermore, several technical indicators show that despite the recent pullback, SOL’s uptrend is strengthening.

Technical indicators show bullish signs

At its current price, SOL is 36% off its all-time highs, and several bullish signs are aligning that could see SOL surpass $200 and aim for a new all-time high.

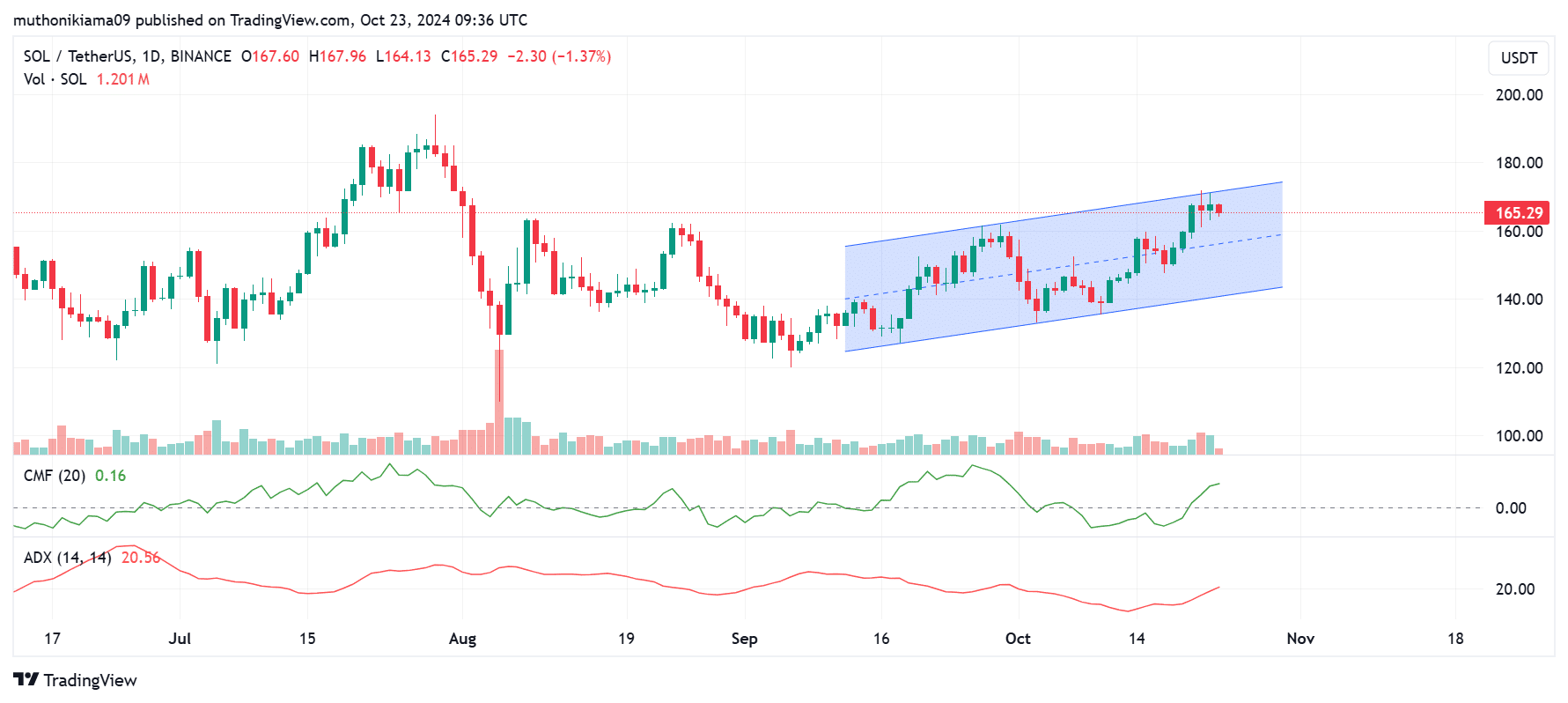

Solana is trading within an ascending parallel channel on the daily chart, which confirms that an uptrend is in play.

The altcoin is also facing resistance at the upper trendline, showing that sellers booked profits as Solana approached this level.

Source: TradingView

The Chaikin Money Flow (CMF) is not only positive, but it has also shifted significantly northward. This shows strong bullish momentum as capital inflow into Solana is high.

The Average Directional Index (ADX) is also sloping upward, indicating that the uptrend is strengthening.

As these bullish signals align, SOL could target the next resistance level at $171. If it reverses this level, SOL will have exited the ascending parallel channel, opening the way for more gains.

Read Solana (SOL) Price Prediction 2024-2025

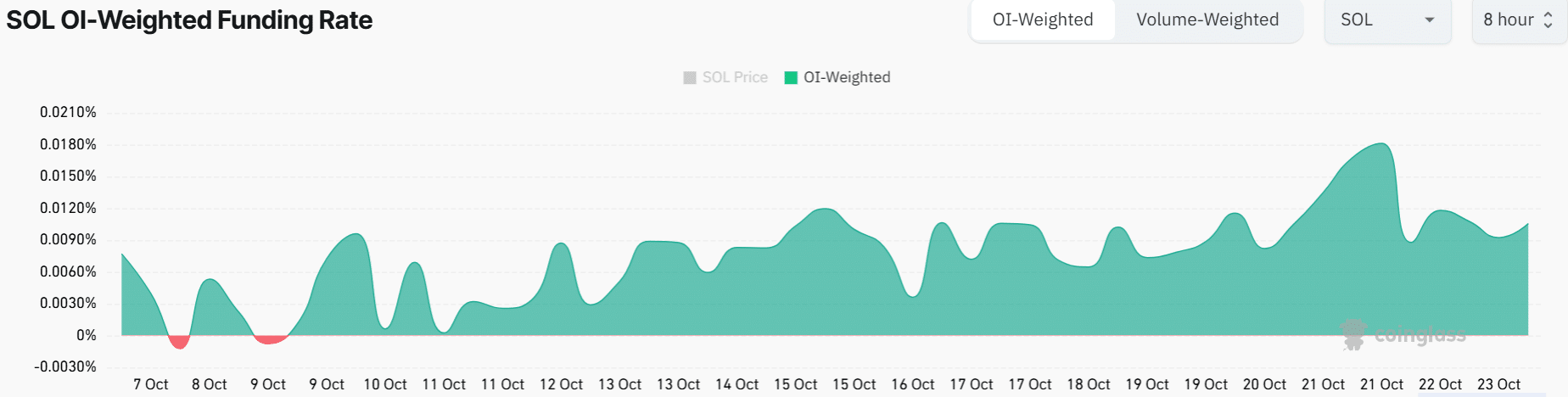

The bullish signs have also caught the attention of long traders, as Solana funding rates have been positive for the past two weeks.

This shows that longs are willing to pay fees to maintain their positions, reinforcing the bullish thesis.

Source: Coinglass