One of the most prolific investors in the cryptocurrency industry, OKX Ventures, backs technologies that expand decentralized finance and the use of cryptocurrencies.

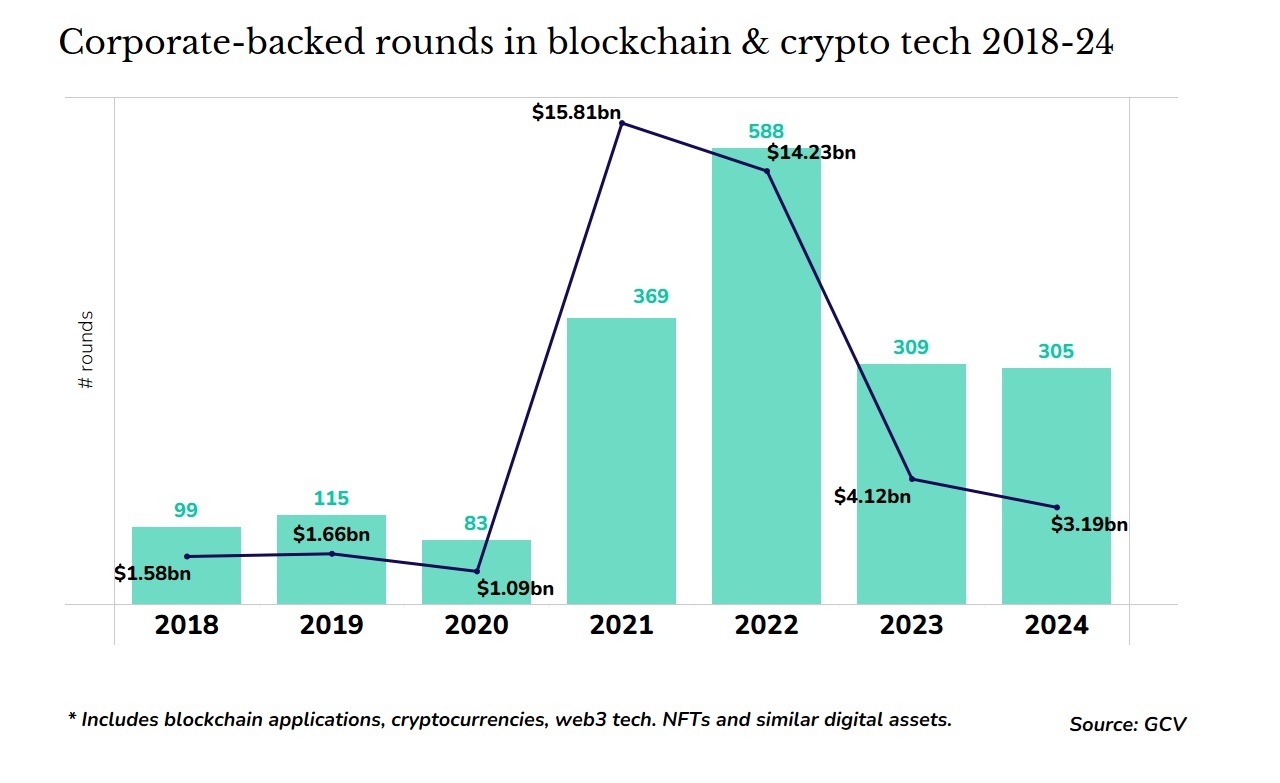

While investor enthusiasm for blockchain technologies has waned recently, no one gave Jeff Ren, who runs OKX Ventures, the memo. The venture arm of cryptocurrency platform OKX is investing at a rapid pace.

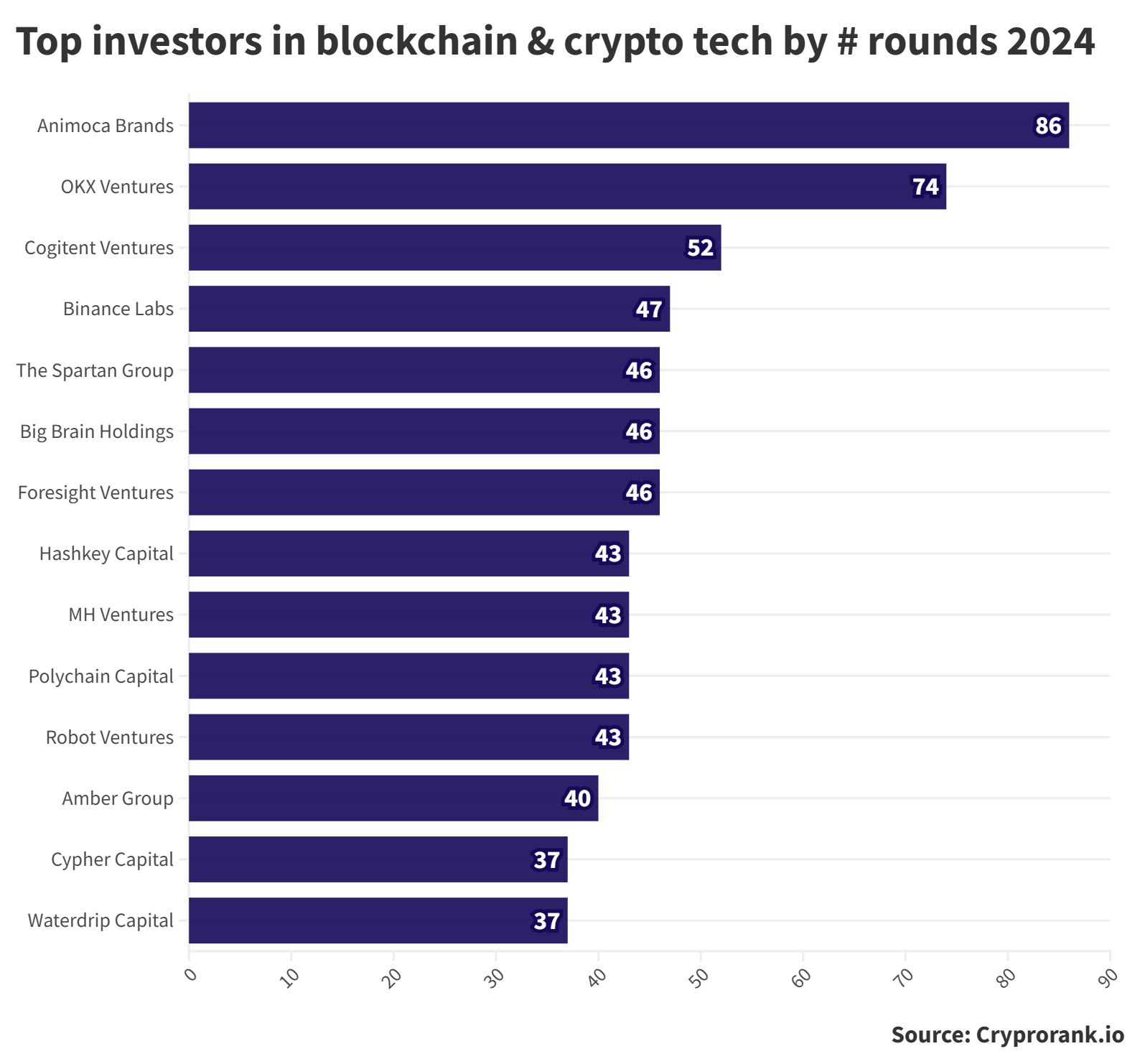

In fact, OKX Ventures is among the largest investors in crypto and blockchain startups this year. According to Cryptorank data, which dates back to 2023, the team is the second most prolific investors in the industry, having completed 74 deals in 2024 so far.

Ren is optimistic about the future of cryptocurrencies, which he says have demonstrated popular resilience despite scandals involving bad actors in the sector like FTX, the cryptocurrency exchange that collapsed in 2022 at the following massive fraud.

“Based on the number of users and the volume of transactions, one should not believe that we have not seen a decline. Every government is making progress in regulating crypto. Crypto is here to stay. It is not created by governments and therefore cannot be killed by governments,” he says.

If anything, Ren expects to see the crypto market, estimated at around $2.5 billion, grow in value as innovations in the sector allow cryptocurrencies to be used in new ways.

“We want to integrate more real-world assets into the blockchain,” says Ren. “We are looking at blockchain technology that can solve the real bottleneck issues for these assets.”

For example, Ren believes that intellectual property and other proprietary rights will increasingly be placed on the blockchain so that they can be transformed into assets to trade. Blockchain technologies are ideal, for example, for tracking licensing agreements, he says.

Another, newer idea is to place ownership of enterprise-grade computing power – the same that cryptocurrencies use in large quantities – on the blockchain so that it can be traded and made available for fractional ownership. OKX Ventures invested in June in Compute Labs, a Singapore-based startup that offers this type of tokenization of graphics processing units, or GPUs.

The State of Crypto

Ren and OKX are not the only ones bullish on cryptocurrencies. The recently released State of Crypto 2024 report by venture capital firm a16z, or Andreessen Horowitz (admittedly a big investor in crypto and Web3), struck a cautiously optimistic note. The number of active cryptocurrency wallet users grew rapidly in 2024, reaching a record 29 million worldwide. The use of cryptocurrencies – once a heavily US-centric activity – is going global, with rapid adoption in large emerging markets such as Nigeria and India.

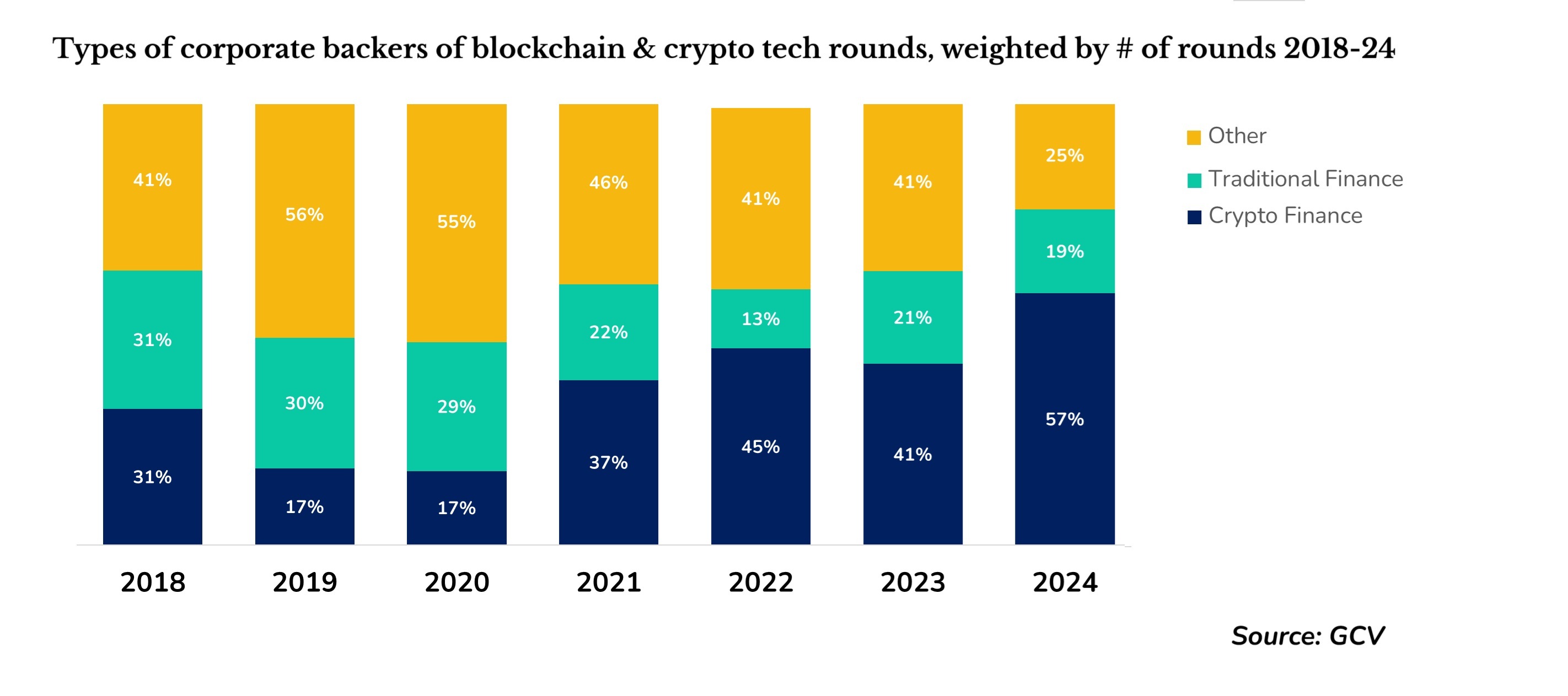

At the same time, traditional financial investors have continued to invest in cryptocurrencies and Web3, from providing cryptocurrency custody services such as SC Ventures’ Zodia Custody to Deutsche Bank’s investment in blockchain clearing and settlement company Patrior.

Financial institutions tend to focus more on digital currencies and use blockchain to digitize traditional financial instruments, says Ren.

“We’re happy to see more innovation and more adoption.” But that’s not really our goal. Our main goal is really to bring more assets on-chain,” he says.

Another development that makes Ren optimistic about crypto expansion concerns the recent innovations in Bitcoin. Bitcoin is the most valuable cryptocurrency in the world, but it was considered limited because it lacked the ability to be used for smart contracts. This has prevented Bitcoin holders from participating in the rapidly growing decentralized finance (DeFi) economy. However, over the past year, several startups have created solutions for creating smart contracts on Bitcoin.

“Since the beginning of last year, more innovations have been able to be created for Bitcoin and all these assets. Bitcoin is digital gold, but now we can get even more returns from it,” says Ren.

Many of OKX Ventures’ recent investments have been in companies developing these new Bitcoin capabilities, such as US startup SatLayer, a Bitcoin staking platform, and Solv Protocol, a Singapore Bitcoin staking protocol.

OKX Investment Style

OKX Ventures, established in 2021, invests from a $100 million fund and has a very broad mandate for what it will support. Like many cryptocurrency exchanges, it is investing to help build the ecosystem around its own platform and around the Web3 ecosystem in general.

“We make direct investments. We also back some funds as anchor LPs,” says Ren, who is a lawyer by training and worked as an investment banker before venturing into investing in the cryptocurrency sector. The company also creates its own crypto startups.

The Corporate Venture team has around 20 people and has made around 400 investments to date.

OKX invests in gaming companies that use cryptocurrencies – for example, it backed gaming startup Web3 Curio in August. For businesses like these, OKX will provide hands-on, hands-on support. “We support them by providing them with numerous industrial resources and investment avenues. So we’re not just sitting back and being a capital provider,” says Ren.

In other cases, the company may invest in major Web3 platforms and development companies to ensure it has a vision of what comes next.

“We invest in the biggest developers to get closer to them. They are the builders and they dictate where the whole ecosystem goes,” says Ren. The unit, however, is careful not to influence the direction these developers take. “We try to behave as decentralized as possible. We don’t want to go too far. We don’t want to come in and become another corporate investor.

The company also recently established an accelerator in collaboration with blockchain developer Aptos Labs to facilitate access to early-stage startups.

Become mainstream?

There have been few exits so far for cryptocurrency investors, but Ren believes these will occur as the sector matures.

“Even though today’s market has seen fewer releases, this environment allows for deeper innovation and stronger foundations. I believe that as projects mature and demonstrate their potential, exit activities will naturally increase. I am optimistic that the next wave of successful releases will follow as the ecosystem evolves.

For now, Ren’s main goal is still to increase the use of cryptocurrencies and make them more mainstream.

“At OKX Ventures, our primary focus is not just exits; we prioritize supporting the long-term growth of the blockchain and crypto space. We invest in projects that demonstrate real-world use cases and provide value to their users and communities,” explains Ren.

At first, crypto was a bit like a cult of believers, he says.

“Now it’s very different. They’re not just crazy,” he says. “You have many financial instruments linked to Bitcoin. You have ETFs. This is already a very industrial production. It’s a very mature product.

And while there have been a few bad actors, like FTX, it hasn’t, according to Ren, derailed the industry. Scandals happen “all the time when you have new boys in town,” he says. “There have been bad actors in a particular company.” Banks have already been fined heavily for wrongdoing – a $249 million fine for a leaked stock sale at Morgan Stanley earlier this year – Ren points out. This did not end the financial services industry.

“It doesn’t change anything,” he assures. “If anything, I think it (helped) the public identify and understand where the real risk is.”