- Only half of TIA’s +$1 billion from token unlocking could hit the market.

- Will Reducing Liquidation Risk Boost TIA’s Outlook?

According to an OTC (over-the-counter) dealer, Celestia’s over-the-counter 1 billion dollars value of TIA token the unlock may not experience as intense selling pressure as previously expected.

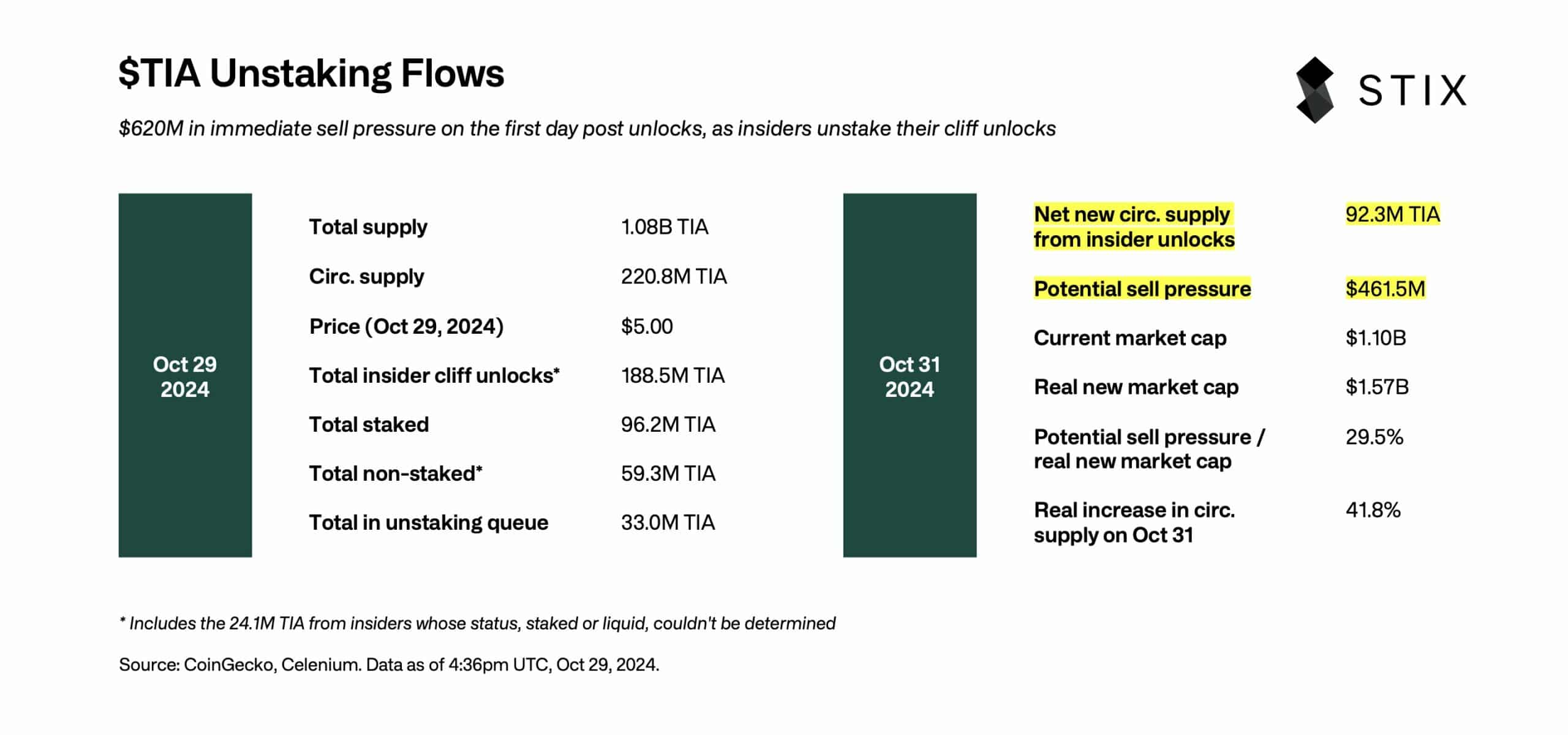

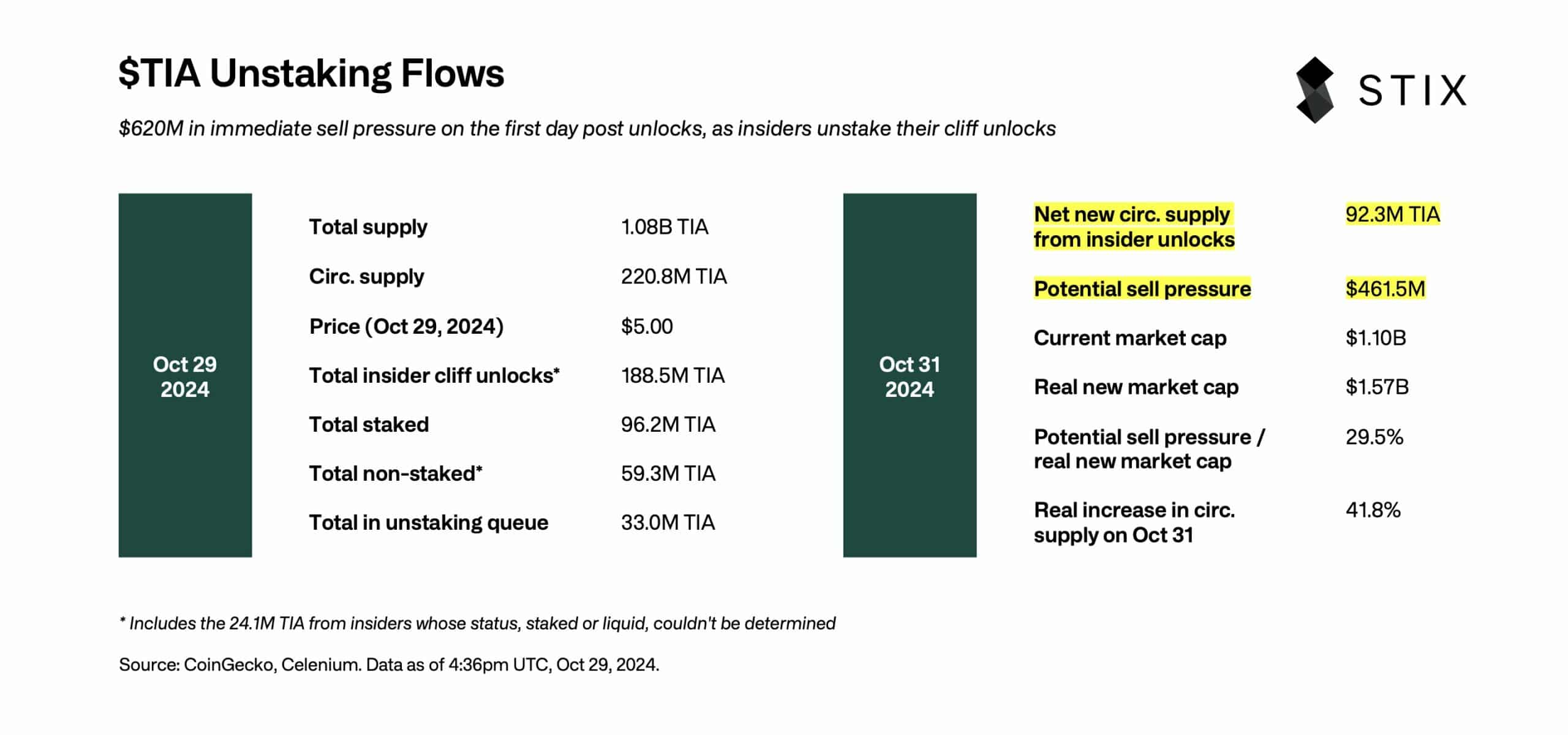

Taran Sabharwal, founder of OTC crypto company Stix, predicted that the selling pressure could be half of the unlocked tokens (188.5 million tokens), as only half were not put up for sale on October 31 . He said,

“We have summarized that a total of $92.3 million TIA will be liquid after unlocking, which would be the upper limit of the overall spot selling pressure.”

He added,

“This equates to peak selling pressure of approximately $460 million. What’s also interesting here is that this represents less than 50% of the total cliff unlocks, meaning the selling pressure is half of what people expected.

Source: STIX

Better for the TIA price?

Commenting on the potential impact of the unlock on the TIA price, Sabharwal said it would be a bullish signal for spot buyers as more shorts opened in the first unlock would unfold.

“We expect many of these shorts to continue to decline, negating some of the pressure from spot sales. This funding reset could be a bullish signal for cash buyers.

Other users echoed the bullish outlook and expected any potential decline to be a good comeback for long positions. A note,

“With the releases being absorbed by the market and the shorts starting to cover, this could be one of the best entries on $TIA for those who are bullish on the ETH scalability narrative.”

Another user, Simon Dedic, partner at crypto VC Moonrock Capital, acknowledged TIA’s short-term volatility, but noted that it was an overall bullish setup. He said,

“While we may see some short-term volatility, this could ultimately result in a huge bullish setup. With Celestia positioning itself as the go-to data availability layer, $TIA may well be preparing for its own $SOL-like move.

But Ignas, a DeFi analyst, note that prolonged bleeding could not be excluded. This might even be complicated by the ongoing FUD that Celestia has only generated $15,000 since its debut (October 2023).

Market positioning

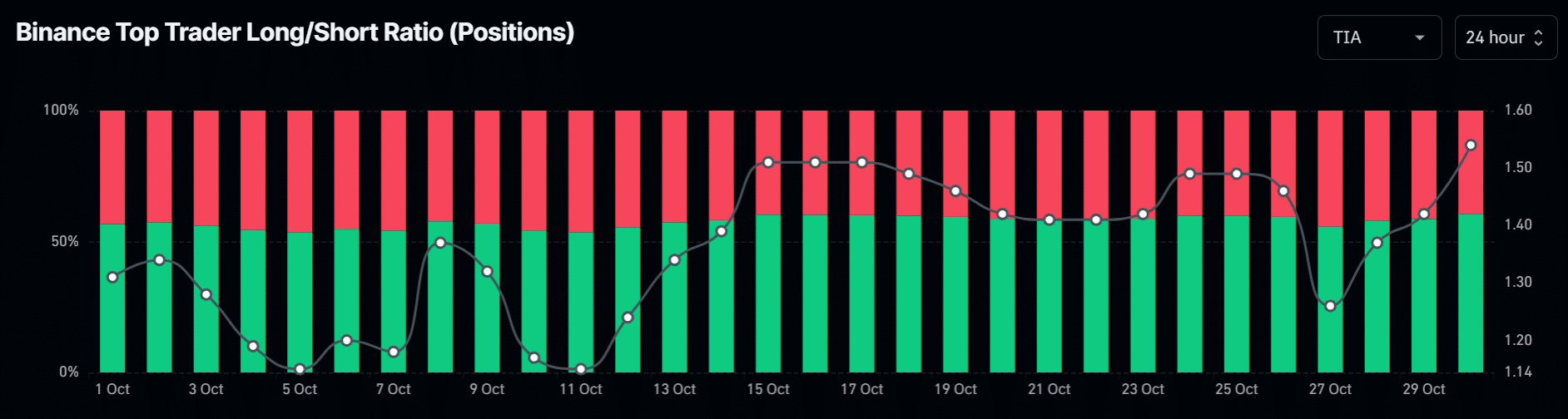

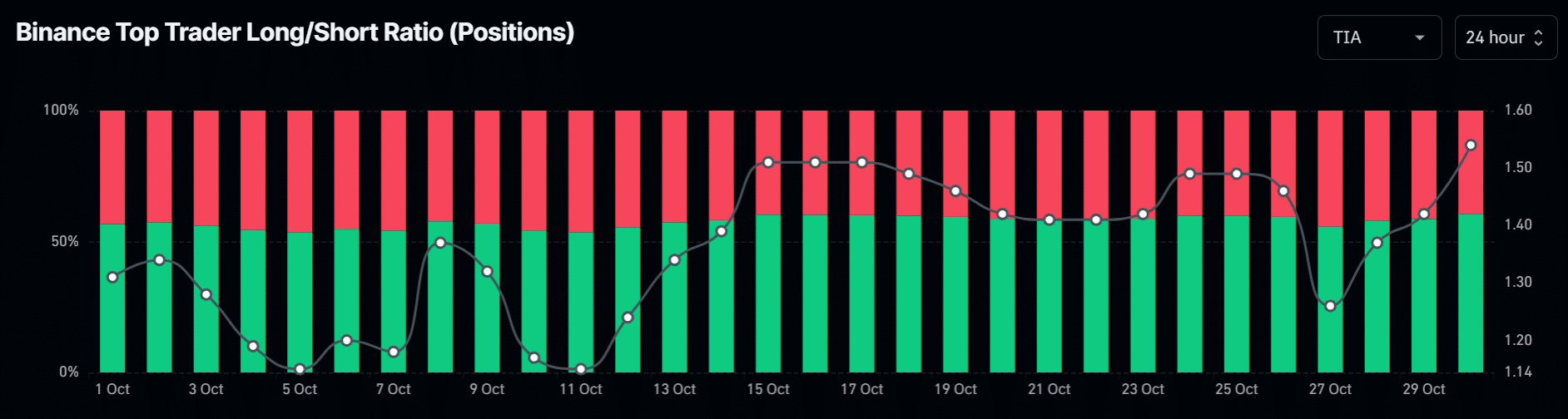

Source: Coinglass

That said, at press time, the marketing positioning on Binance was geared towards bullish bets. In fact, long positions have increased over the past three days, from 55% to over 60%. This shows that traders were expecting a potential rebound in TIA.

Read Celestia (TIA) Price Prediction 2024-2025

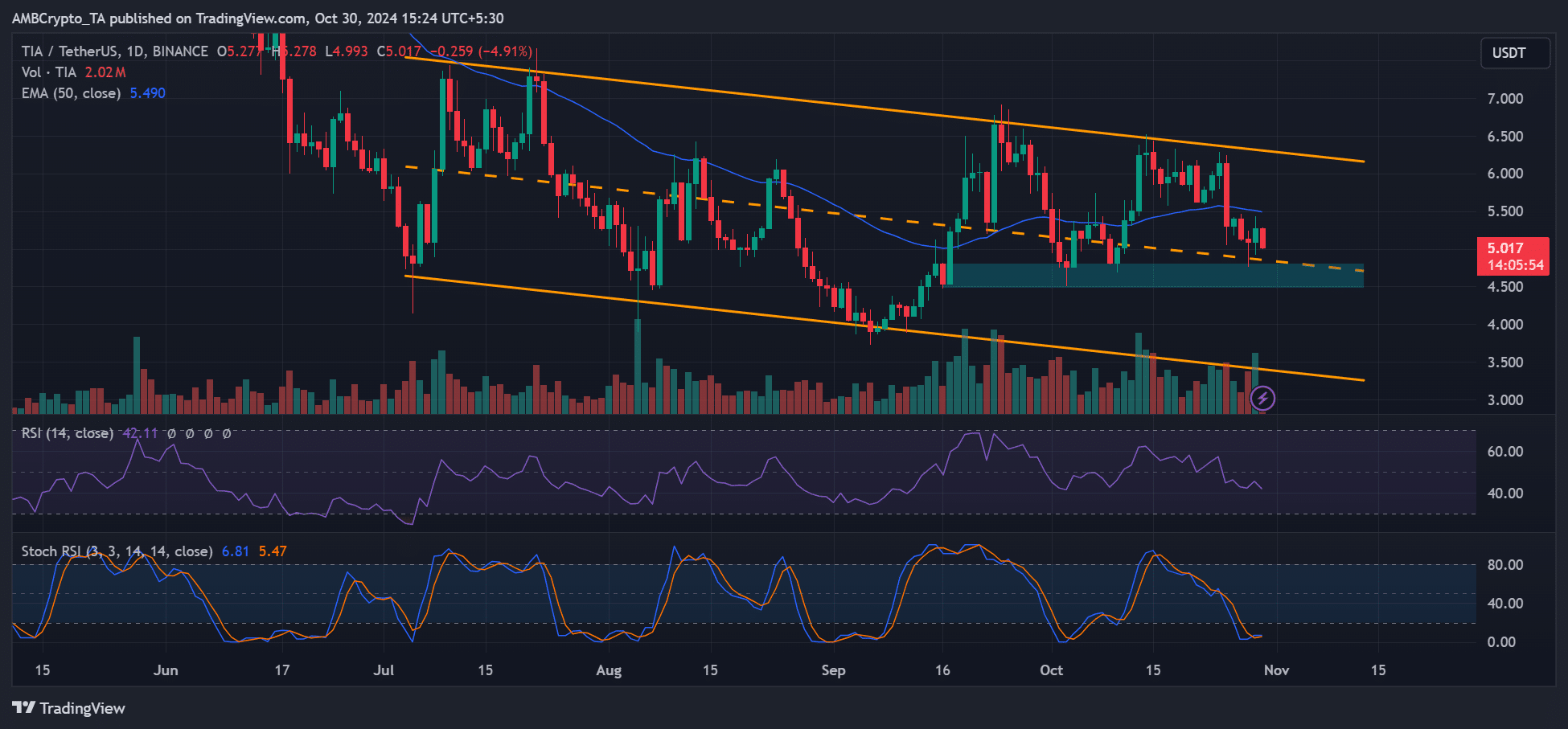

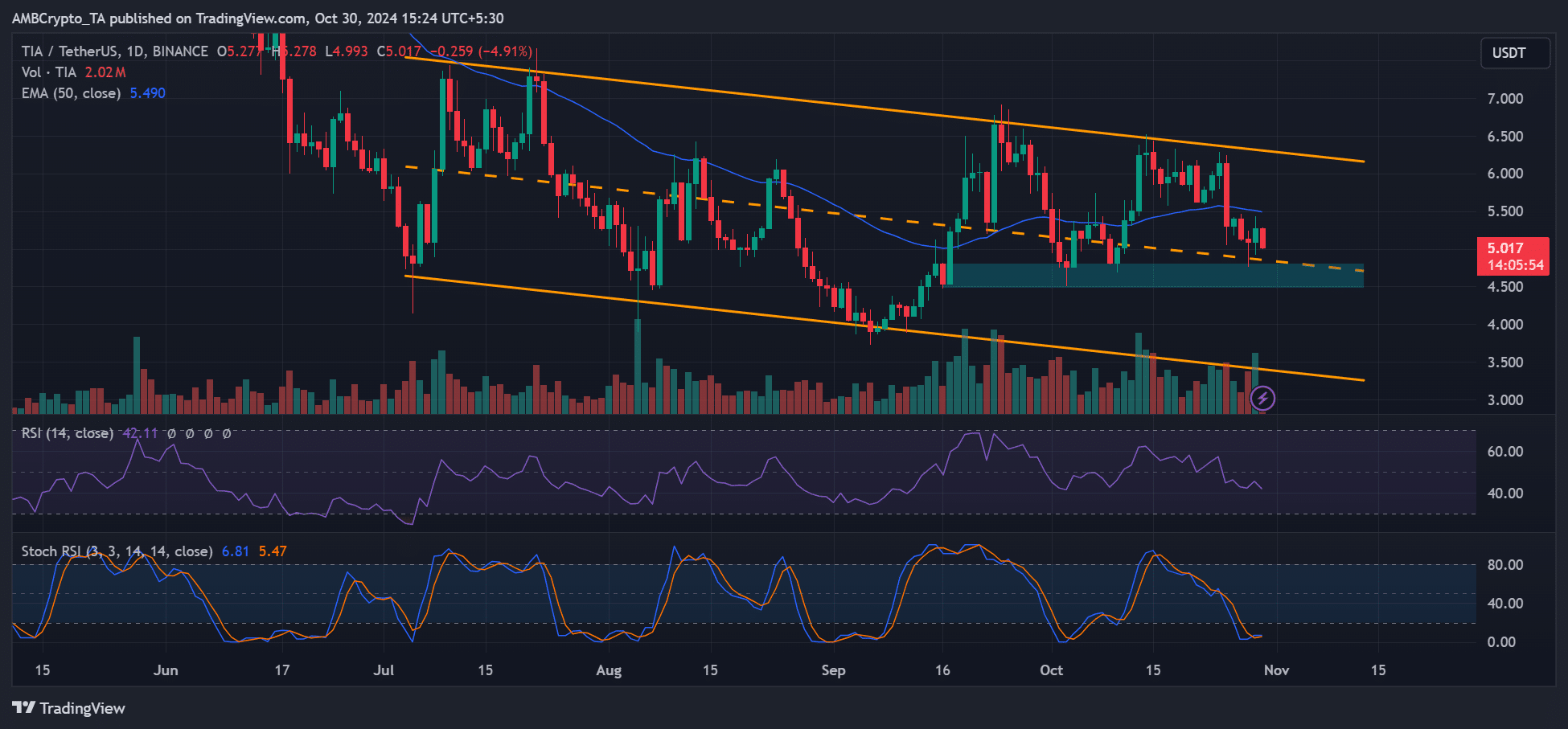

Meanwhile, $4.5 was a key target to watch in the near term, as it halted recent pullbacks since early September. Any crack below could take TIA to a low near $3.5.

Source: TIA/USDT, TradingView