This article is also available in Spanish.

Bitcoin has been trading in a tight 4-hour range between $71,300 and $73,300 since Tuesday, setting the stage for a significant move in the coming days. Analysts and investors are closely watching this range as BTC approaches its all-time high (ATH).

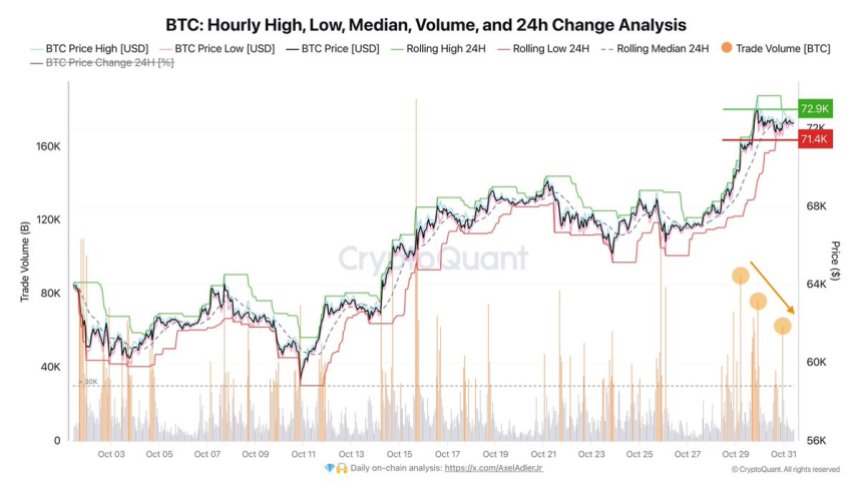

Leading analyst Axel Adler recently shared key data from CryptoQuant, noting that trading volume has been steadily declining as Bitcoin remains at these levels. Typically, this drop in volume signals consolidation, a phase often preceding a significant price change.

Related reading

Anticipation is growing as the US elections on November 5 approach. Market sentiment is optimistic and many expect Bitcoin to break out of this range soon, either hitting new highs or experiencing a healthy retracement to fuel further growth.

The next few days will be crucial for Bitcoin’s trajectory as traders evaluate whether the consolidation period will lead to a breakout into uncharted territory. As BTC flirts with its ATH, the stage is set for a decisive decision that could shape the direction of the market until the end of the year.

Bitcoin price is about to move

Bitcoin finds itself at a defining point in this cycle, nearing the end of a 7-month accumulation period and poised to test new all-time highs. CryptoQuant analyst Axel Adler noted in recent analysis on a gradual decline.

According to Adler, this reduction in volume in the Bitcoin restricted zone portends an imminent breakout. However, a new catalyst appears needed to drive this change and launch BTC beyond its previous highs.

The upcoming US elections could be that catalyst, with potential impacts on markets depending on the outcome. Market sentiment suggests that a Trump victory could spur bullish sentiment in financial markets, which could positively influence Bitcoin’s price trajectory.

Investors are viewing this crucial event as a possible trigger to push BTC past the $73,794 mark, its all-time high, into uncharted price territory.

Related reading

A successful breakout of the current range could send Bitcoin into price discovery mode, where FOMO (fear of missing out) could lead to buying pressure, amplifying the upside. On the other hand, if BTC fails to reach a new high, it could fall back towards lower support levels, and potentially consolidate further until necessary momentum builds.

BTC flirts with ATH

Bitcoin is holding above $72,000, closing in on its all-time high (ATH) and entering a price discovery phase. Price discovery usually sets the stage for significant gains as new highs fuel market optimism and buying pressure.

However, BTC has yet to decisively surpass its previous ATH of $73,794, and a temporary dip below $70,000 remains a possibility if demand does not strengthen soon.

The $71,000 support level now serves as a critical base for BTC. If price sustains above this mark in the coming days, momentum will likely be built for a strong attempt to breach the ATH, potentially triggering a new wave of bullish sentiment.

Traders and investors are closely monitoring BTC’s performance at these levels, knowing that any sustained move above $73,794 could signal the start of a powerful uptrend as Bitcoin enters uncharted territory.

Related reading

Meanwhile, a brief return to lower support levels could provide the liquidity needed to propel BTC past its current resistance. Whether through a direct push or a minor pullback, Bitcoin’s resilience above $72,000 sets the stage for an imminent test of the ATH, with price discovery and new highs on the horizon.

Featured image of Dall-E, chart by TradingView