This article is also available in Spanish.

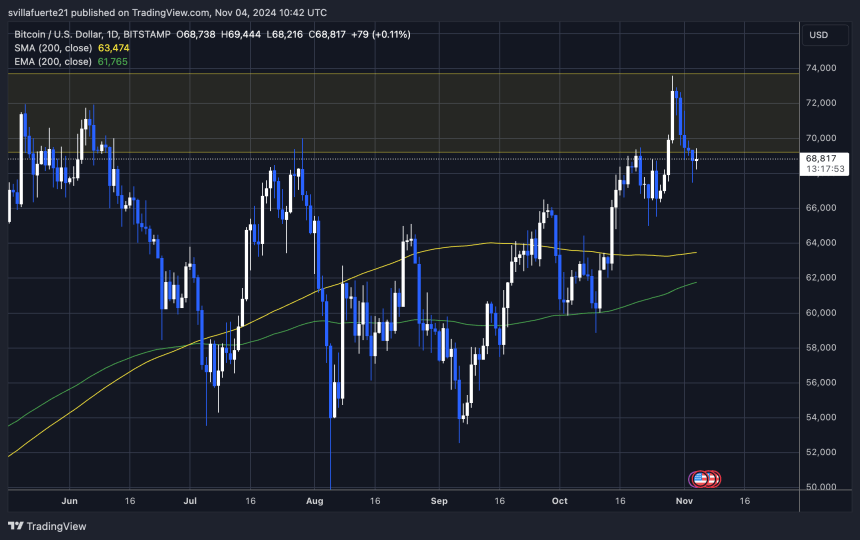

Bitcoin has faced significant volatility and uncertainty heading into a pivotal week, with tomorrow’s US elections expected to play a key role in determining price action. BTC is holding above the $68,000 mark, a critical level that has moved from resistance to a solid demand zone. Analysts view this level as key to maintaining bullish momentum, especially with high-stakes events looming on the horizon.

Key data from Coinglass reveals a notable drop in open interest for Bitcoin, suggesting many investors are closing their positions amid uncertainty surrounding the election and the Federal Reserve’s upcoming interest rate decision on Thursday. This drop in open interest reflects a cautious market stance as traders anticipate the election outcome and its potential influence on broader financial markets and Bitcoin’s trajectory.

Related reading

While BTC manages to hold above this demand zone, the next few days will be crucial in confirming its direction. A sustained hold could strengthen BTC’s outlook, setting it up for a possible breakout. Conversely, increased selling pressure linked to market reactions could put this level to the test. The coming week could be a defining moment for Bitcoin price action as macroeconomic events unfold.

Bitcoin Investors Prepare for This Week

Bitcoin is gearing up for what could be the most defining week of this market cycle. Approaching all-time highs, BTC faces increased volatility as two critical events unfold: the US presidential election and the Federal Reserve’s interest rate decision.

These events are poised to impact Bitcoin and global financial markets, and could potentially shape global trade policies and economic stability.

Recent data from Coinglass highlights that investors are bracing for a turbulent week as open interest in Bitcoin has declined significantly, with many traders opting to close their long and short positions ahead of the election.

This pullback in open interest signals caution as the crypto market expects significant volatility stemming from the election results and the Fed’s rate decision. Coinglass shared an analysis on

This week is a crucial one for Bitcoin and the global economy as a whole, with analysts suggesting that the elections could set the tone for international economic policies and trade relations in the years to come. The Fed’s rate decision, expected just days after the election, adds further uncertainty, as it could dictate the direction of monetary policy and market liquidity.

Related reading

As BTC nears all-time highs, investors are closely watching these events for market direction. Whether Bitcoin reaches new highs or experiences a pullback depends largely on how the economic landscape evolves. For now, Bitcoin remains jittery, with investors ready for a week that could define its trajectory for months to come.

BTC tests crucial liquidity

Bitcoin is trading at $68,800 after failing to reach its all-time high last week. This week promises increased unpredictability for BTC price action, driven by major events in the global economy. It will be essential to monitor key levels: if Bitcoin manages to hold support above $68,000, it will likely pave the way for another attempt to surpass its all-time high.

However, volatility could test this support, potentially undermining “weak hands” ahead of any significant upward momentum. If BTC falls below $68,000, further pullbacks could follow, allowing institutional buyers to accumulate before another surge.

If Bitcoin manages to surpass its all-time high of $73,794, it will enter a price discovery phase, where the lack of resistance can trigger a FOMO (fear of missing out) fueled rally among investors. This upward momentum in a price discovery zone often results in rapid price increases as more buyers enter the market.

Related reading

As Bitcoin reaches this level, market participants remain vigilant, anticipating a potential breakout that could redefine broader market sentiment and set new highs for the cycle.

Featured image of Dall-E, chart by TradingView