- Bitcoin miners face increasing costs and operational challenges.

- As a result, miners are exploring AI technology to improve their efficiency.

In the rapidly evolving world of Bitcoin (BTC) mining, operators are facing increasing costs and increasing technical requirements. As mining becomes increasingly capital intensive, the need for specialized equipment, reliable power sources and expert management has never been greater.

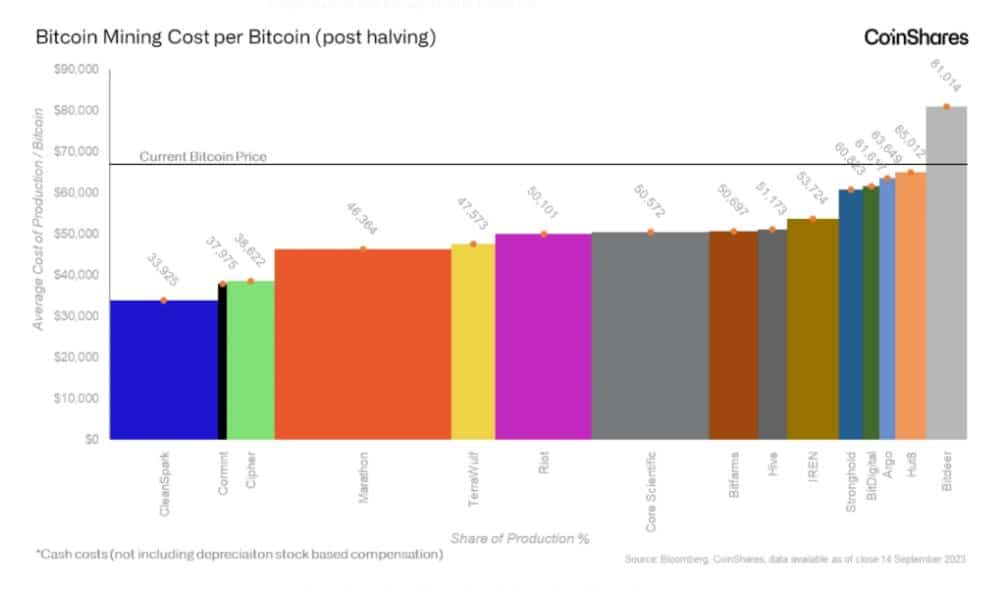

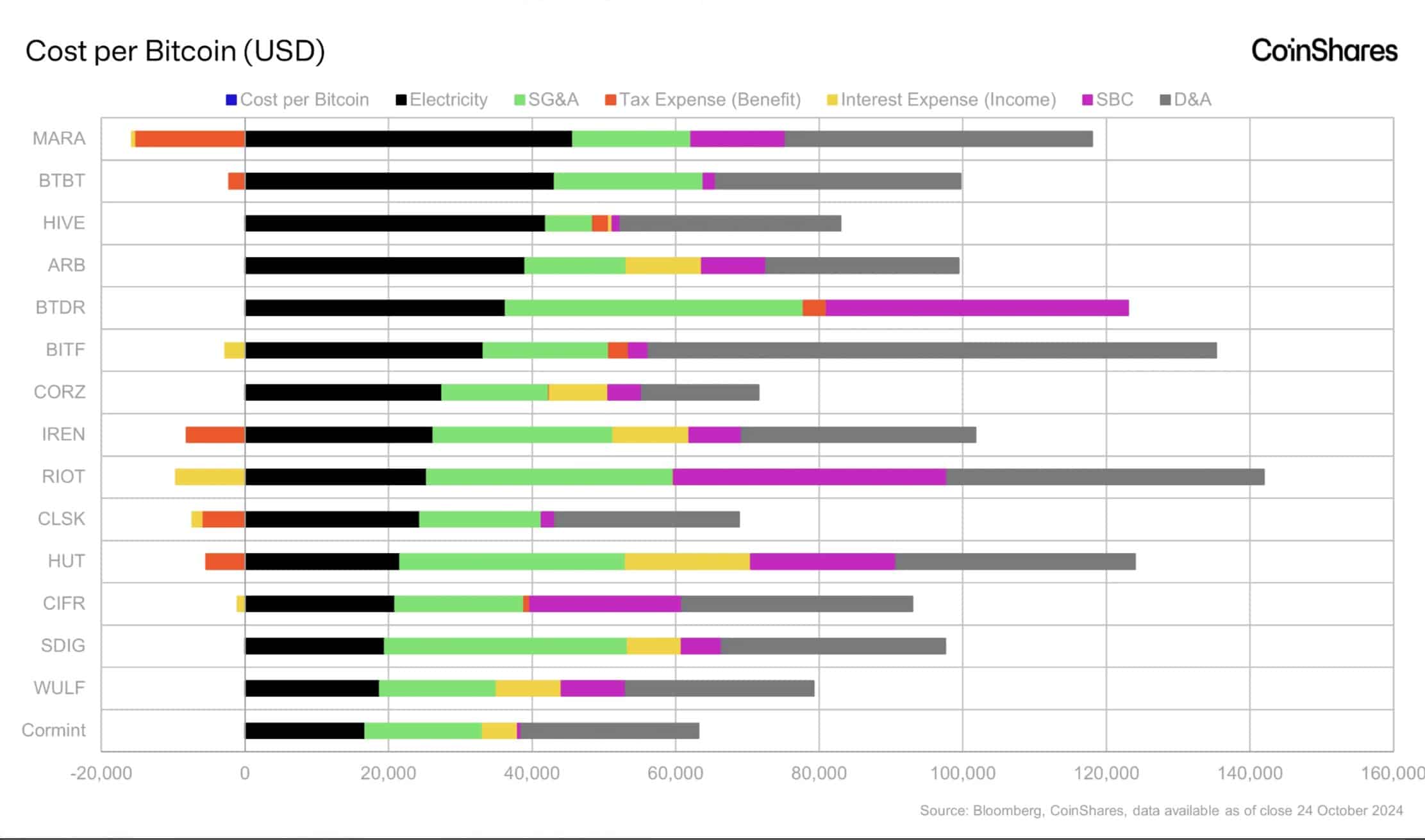

Data shows mining spending has increased, with average costs now exceeding $49,500, while cash flow pressures are compounded by rising interest rates.

In this context, mining companies are exploring AI as they seek to overcome financial hurdles and improve operational efficiency in a volatile market.

Growing financial pressures threaten profitability

-

Source: Coinshares

-

Source: Coinshares

The Bitcoin mining industry is grappling with rising production costs, with spending per Bitcoin post-halving often exceeding current market prices. Rising operational costs – driven largely by electricity, general, administrative and administrative costs and interest costs – are weighing on the profitability of mining companies and amplifying pressures on cash flow.

Without significant capital reserves or alternative revenue streams, mining companies may struggle to maintain operations or scale effectively in the face of tightening profit margins.

Bitcoin mining and price volatility: a double-edged sword

Bitcoin’s recent price surge, driven by ETF anticipation, briefly boosted miners’ revenue per coin. However, after the latest halving, which doubled production costs, profitability remains heavily dependent on volatile market conditions.

For many mining companies, high debt and operational expenses limit their ability to take advantage of price surges as rising interest costs eat into potential profits.

In this environment, volatility is both an opportunity and a risk: while price increases can improve margins, sudden declines threaten cash flow and may force some mining companies to scale back operations or sell assets .

Adopt AI

Many Bitcoin miners are changing their strategies to increase their revenue by holding Bitcoin tokens and exploring AI applications. AI can help streamline mining operations, allowing miners to optimize processes and better manage energy consumption.

By using advanced analytics, they can improve efficiency and reduce costs, making it easier to adapt to market changes. This AI integration not only diversifies revenue streams but also allows miners to succeed in a competitive landscape.

Reducing Bitcoin’s Carbon Emissions Through Sustainable Practices

Source: Coinshares

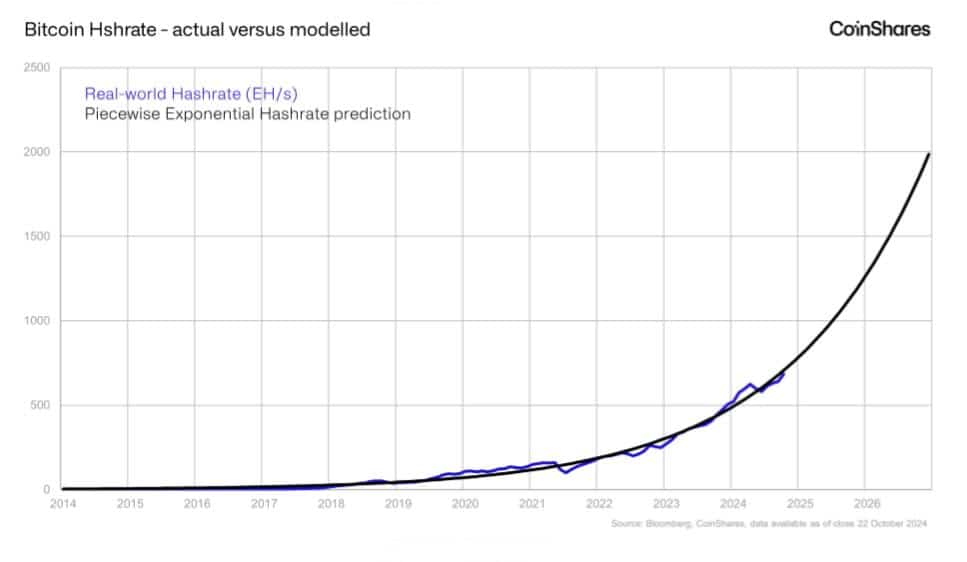

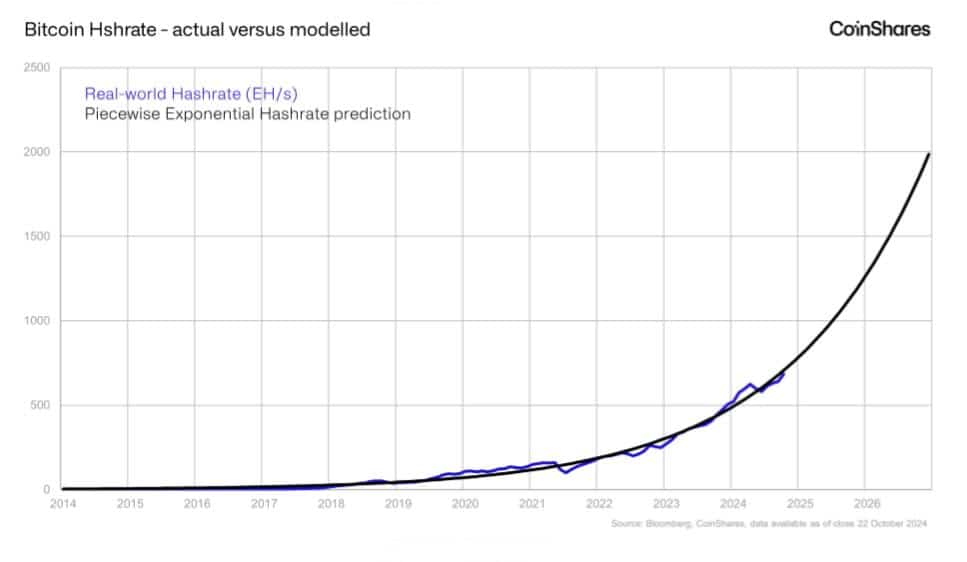

The Bitcoin network’s growing hash rate – expected to reach 765 EH/s – continues to increase electricity demand, intensifying environmental concerns. As mining operations expand to maintain network security and compete for block rewards, the associated energy consumption draws widespread criticism regarding its carbon footprint.

A strategic shift toward alternative energy could reduce Bitcoin’s carbon emissions by up to 63% by 2050, according to industry forecasts.

Read Bitcoin (BTC) Price Forecast 2024-25

For miners, renewable energy offers a path to long-term profitability. By investing in solar, wind or hydroelectric power, mining companies could protect themselves from the volatility of electricity prices and mitigate regulatory risks.

This shift could become crucial to both profitability and public perception, allowing the industry to adapt to changing environmental expectations.