- RUNE saw a sharp 15% decline, likely triggered by a large whale’s panic selling.

- Price action has started a recovery and an increase in volume could trigger a real rebound.

RUNE, THORChain’s native token, saw a sharp 15% decline in the past 24 hours at press time, likely triggered by panic following a major whale sell-off on Kraken.

At press time, the whale had withdrawn 2.85 million RUNE, worth approximately $12.35 million, and sold some of it through ThorSwap for Bitcoin (BTC).

The whale has since converted 9.69 BTC, which was entirely transferred to Kraken, while the remaining 2.7 million RUNE tokens were sent to Binance.

Source: Objectif Onchain

Impact of the whale sale on the price of RUNE

The sale of the whales had an immediate effect, lowering the price of RUNE. However, this does not appear to pose a significant long-term threat to the future value of the token.

THORChain, being a Layer 1 Blockchain DEX with great usability, has continued to support cross-chain exchanges, especially for major Layer 1 blockchains, thus maintaining its strong adoption potential.

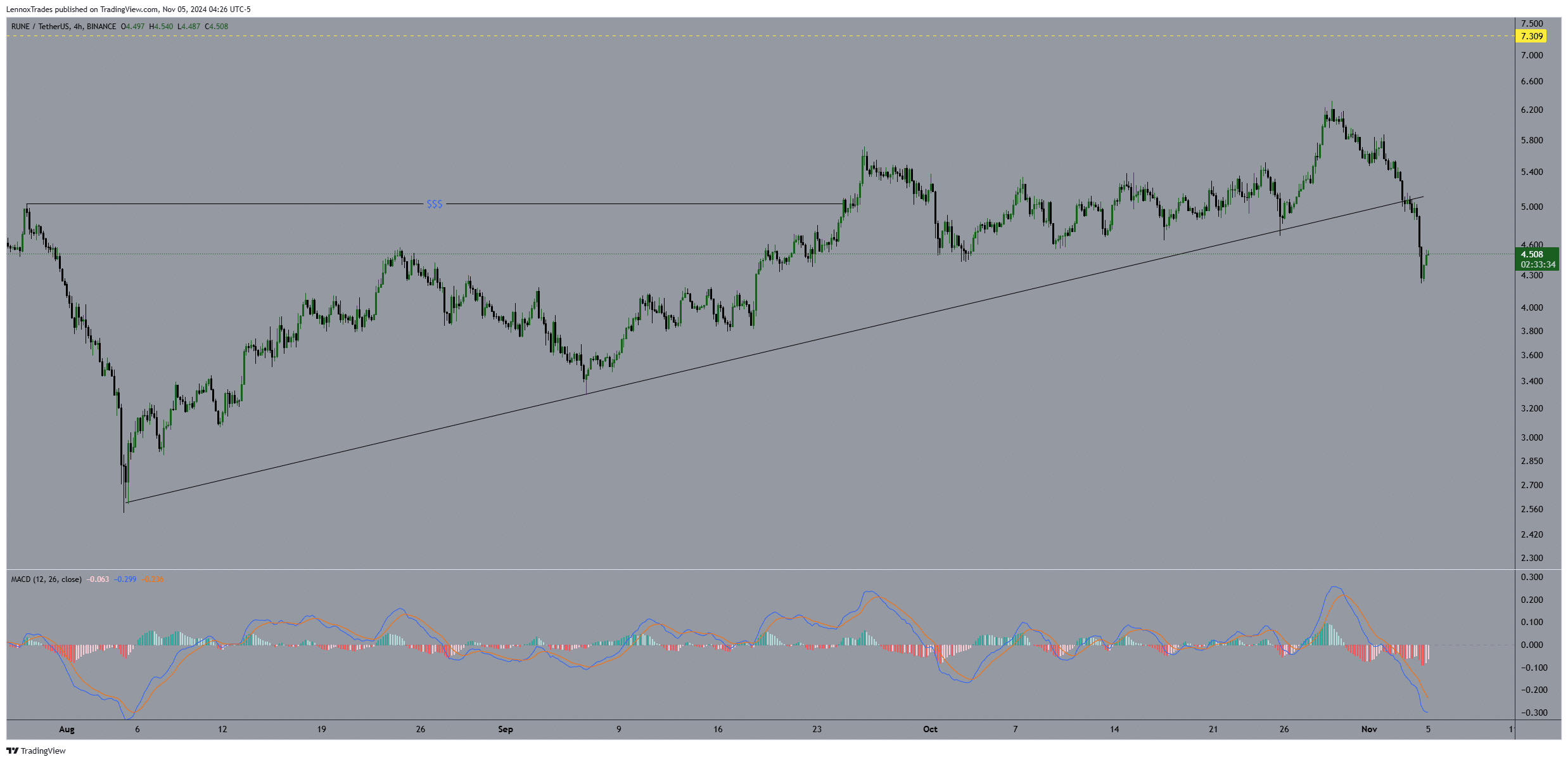

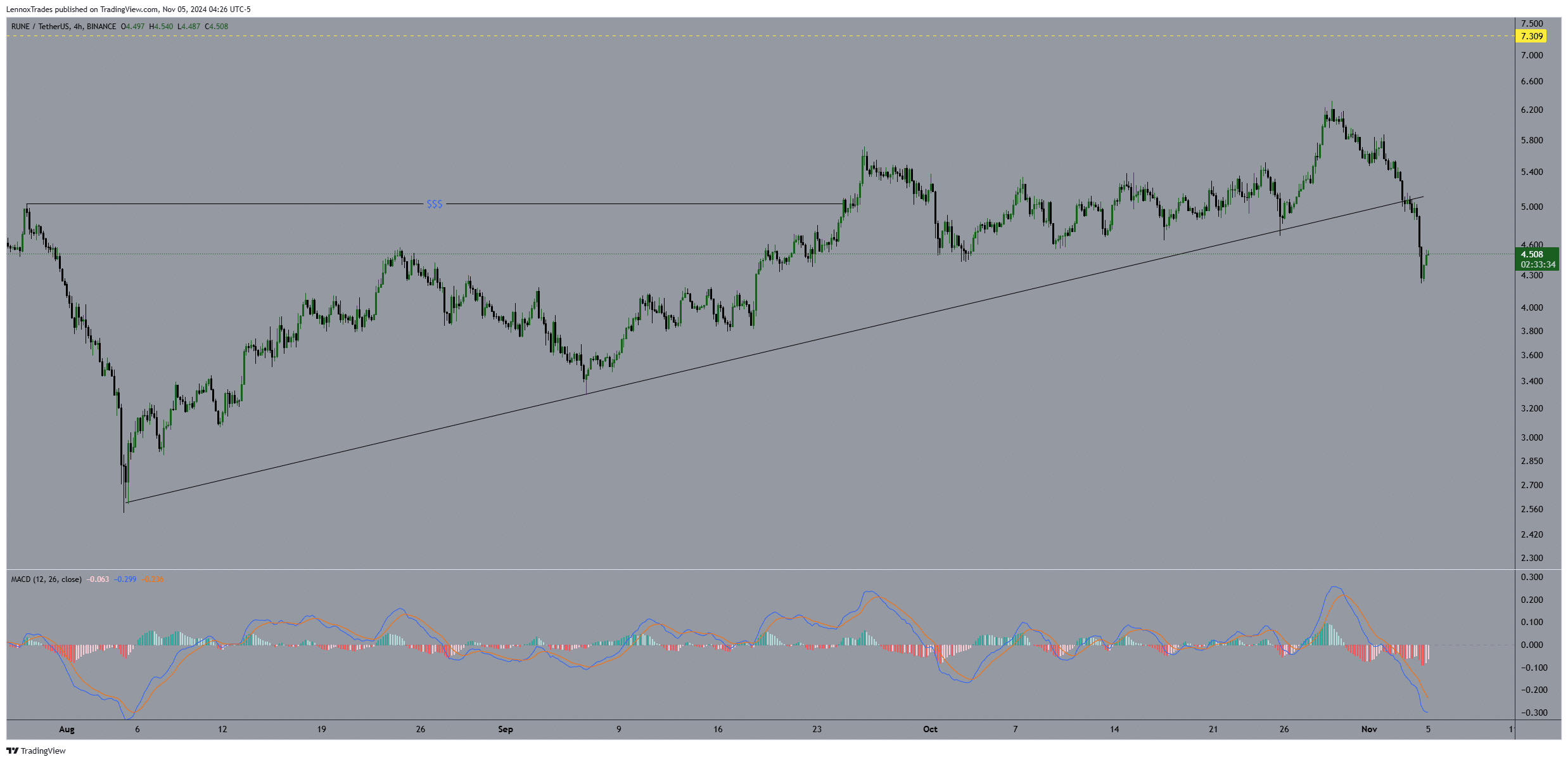

RUNE price on a 4-hour time frame has started to show signs of recovery despite the lack of a clear signal from indicators, which often react more slowly to sudden price changes.

RUNE/USDT hinted at a recovery attempt after bouncing from the $4.50 range, highlighting early buying interest. A suggestion that this level could serve as a new support region.

After failing to hold support at the ascending trendline, RUNE fell below the $5 level and later stabilized around $4.50.

Source: Commercial View

The MACD indicator showed a negative crossover, confirming that bearish pressure had dominated recent market action.

Nonetheless, recent histogram bars indicated a potential slowdown in sales momentum, giving investors hope for a gradual recovery.

However, the previous ascending trendline, which once served as a support level, turned into resistance, and now RUNE must regain momentum and break above this level to signal a bullish reversal.

If RUNE manages to sustain a rise above $5.5, it could possibly climb as high as $7.30, its previous high. However, a confirmed reversal would require greater buying volume and a clear break of these resistance levels.

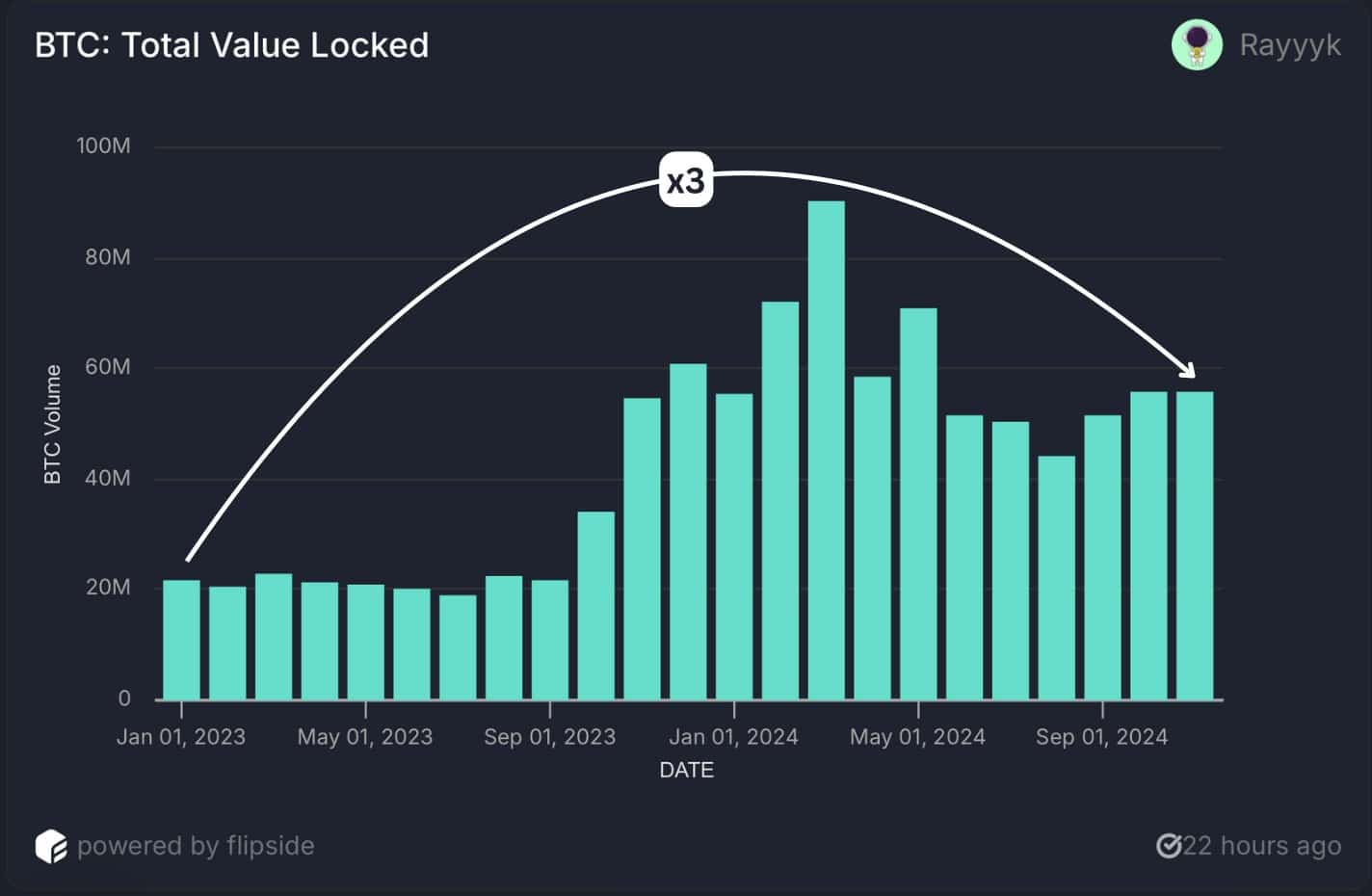

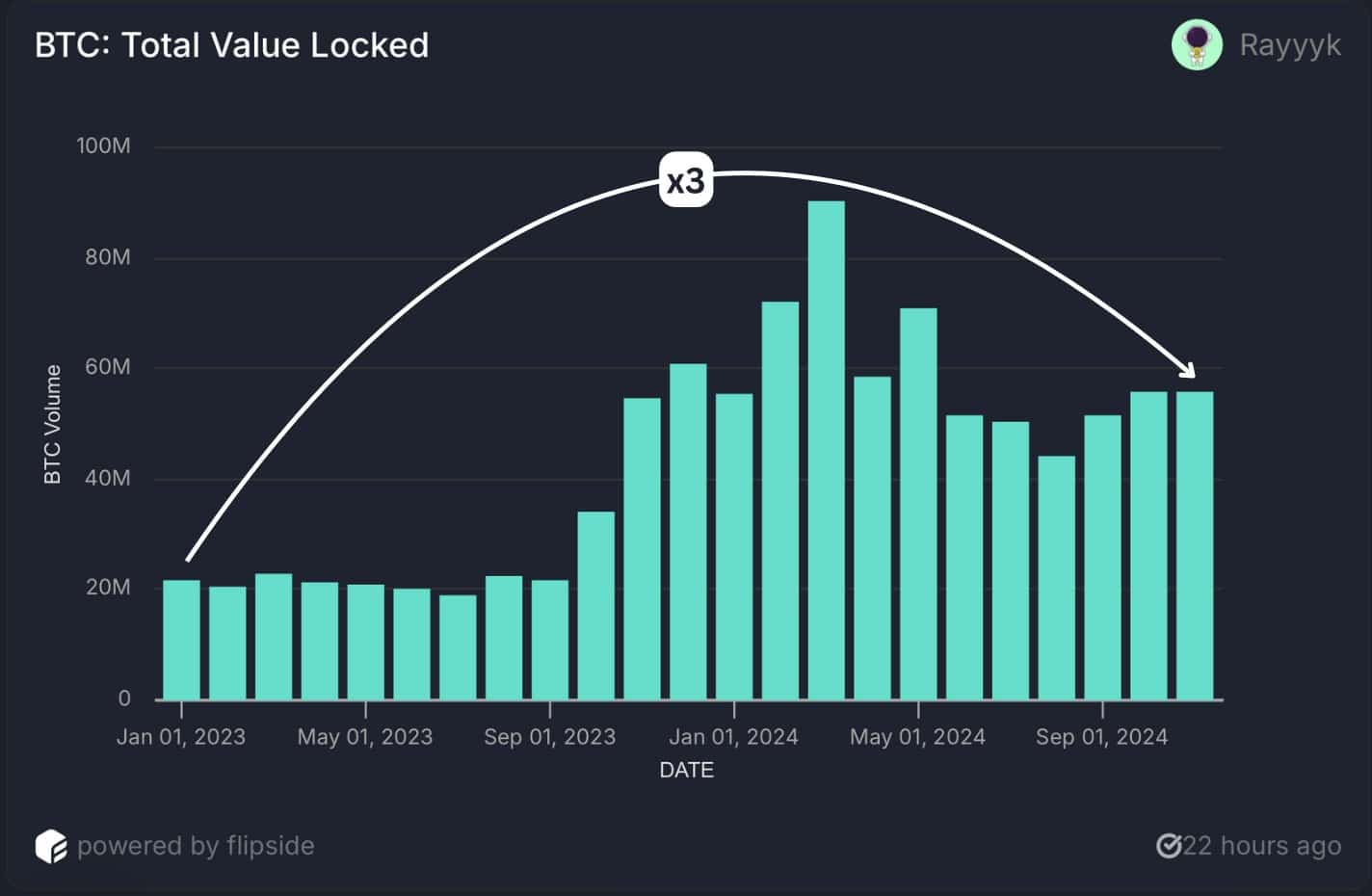

Volume and TVL

At the same time, RUNE’s weekly trading volume reached an all-time high of $78 million, reflecting growing market interest despite recent volatility.

Additionally, the total value locked (TVL) of Bitcoin on THORChain has tripled since 2023, highlighting the growing adoption of THORChain’s cross-chain liquidity services.

These factors suggest that although RUNE faced short-term selling pressure, long-term fundamentals remained intact and future price action could benefit from renewed market confidence.

Source: Flipside