Bitcoin is rising at spot rates, hovering above $60,000 and confirming the gains of September 13. Judging from the price action on the daily chart, buyers appear to be back in the spotlight. The sentiment follows the US Federal Reserve’s (Fed) decision to cut rates by 50 basis points on September 18.

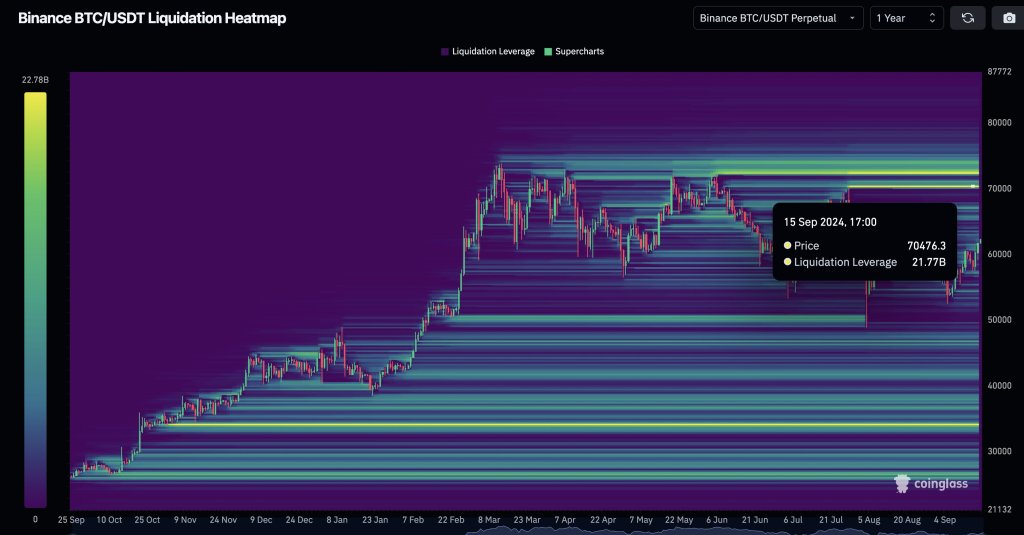

Over $21 Billion in Shorts Will Be Liquidated If Bitcoin Surpasses $70,500

As buyers redouble their efforts, rushing towards BTC, observing the sharp increase in trading volume over the past day, an analyst at X has identified an interesting observation if the bulls continue to dominate. Citing market data and Binance’s perpetual liquidation chart, the analyst said that if Bitcoin flies above $70,500, over $21 billion in shorts will be liquidated.

Liquidation occurs in the perpetual market, where leveraged traders seek to reduce market volatility to make profits. There are longs, or traders betting on upside to push prices higher, and shots, who bet on prices falling.

In both cases, these positions are leveraged, meaning they borrow funds from the exchange. The collateral, in this case margin, acts as “insurance” for the exchange. Therefore, it will forcibly sell it if the market moves against the trader.

Looking at the price action on the daily chart, Bitcoin needs to rise by about 11% from the $70,500 spot rates to be reached. The immediate liquidation level is around $66,000, which is in line with the August highs.

If this level is broken and the upside leads to increased trading volume, the resulting rally could easily serve as a base for bulls to overcome the intense liquidation pressure around $70,000 and $72,000.

$70,000 and $72,000 resistance zone is crucial for BTC traders

Bitcoin bulls have struggled to break above $72,000 since the June retest. As a result, any firm and decisive close above $70,000 may trigger a short squeeze. Therefore, it is very likely that BTC will retest $73,800 and even reach new all-time highs.

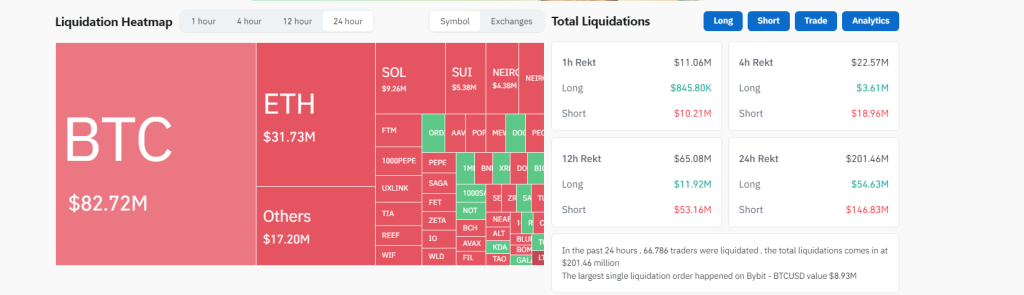

Coinglass data from September 19 shows that over $69 million in leveraged short positions were liquidated in the past 24 hours. Meanwhile, over $13 million in long positions were also forcefully closed due to market volatility.

Over 66,000 crypto traders were liquidated over the past day, and the largest leveraged BTCUSD position worth over $8.9 was closed on Bybit, a perpetual trading platform, during that period.