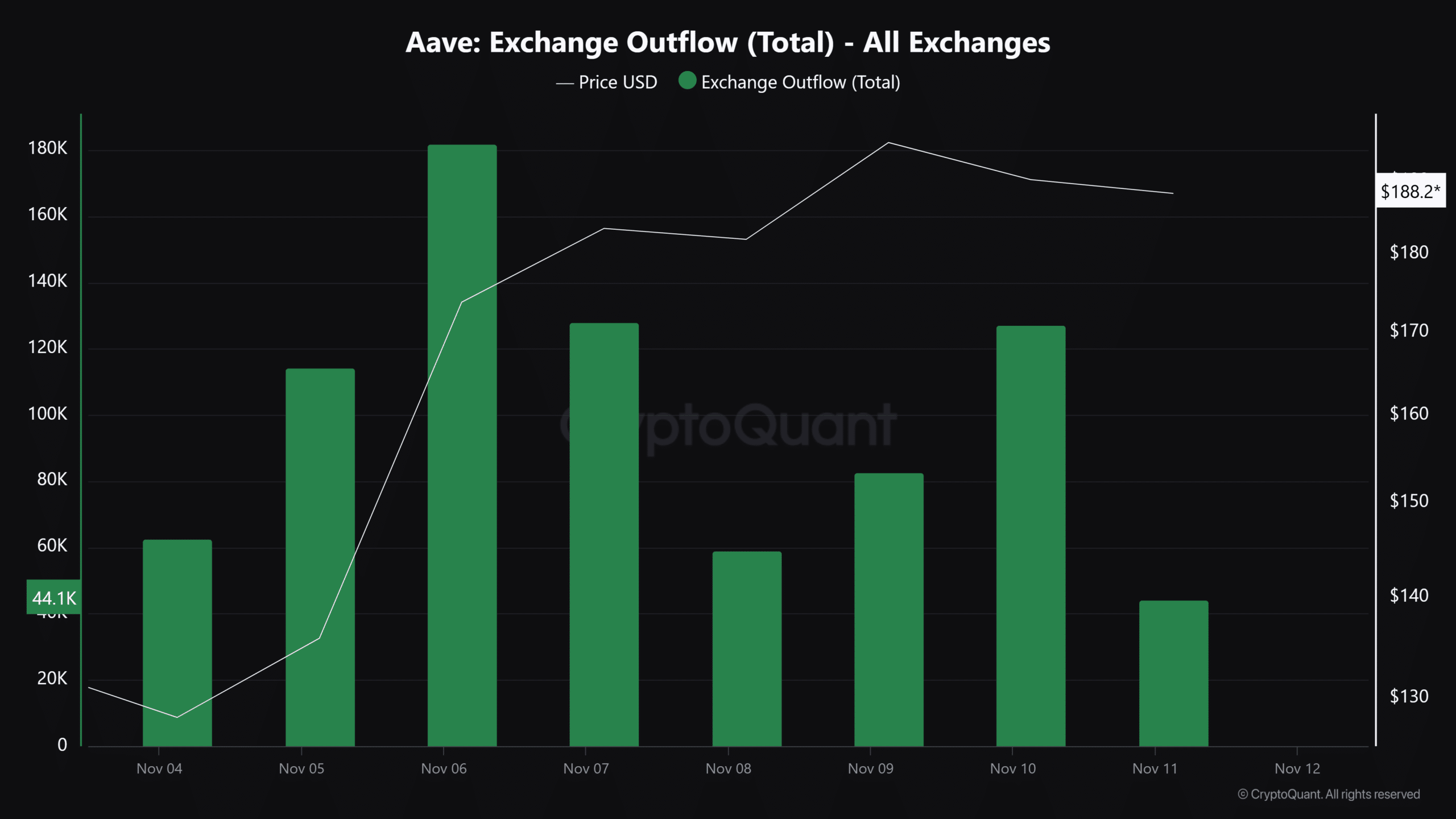

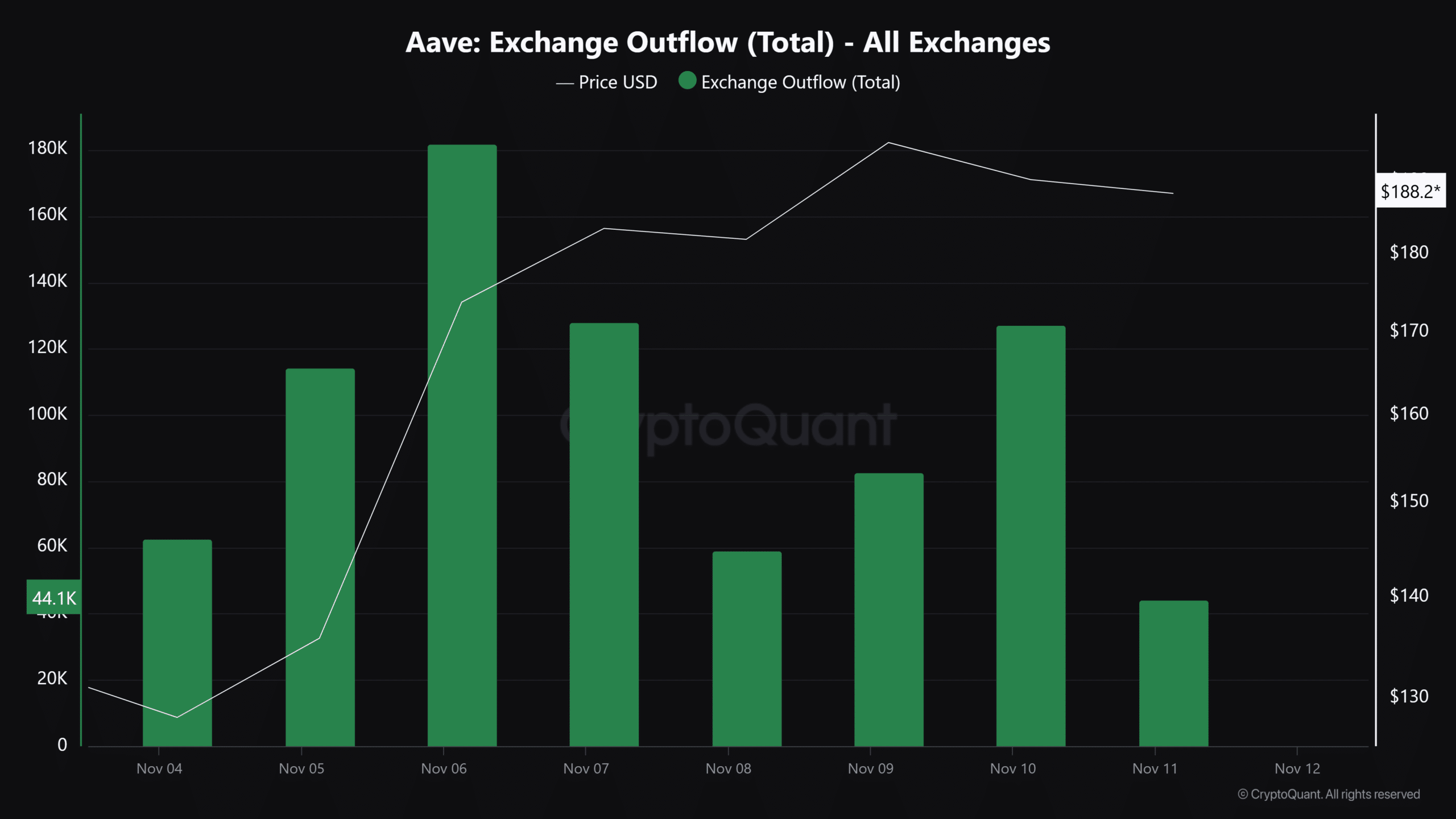

- AAVE’s foreign exchange outflows gradually increased after the US election results.

- A move towards long positions portends growing market optimism, with 64% of active addresses currently in profit.

Following the US election results, foreign exchange outflows from Aave (AAVE) saw a notable decline. This decline once again indicates the cautious stance of investors regarding the implications of possible regulatory changes.

However, over the past three days, currency outflows from AAVE have started to increase steadily. This upward trend could indicate some sense of activity and perhaps renewed confidence among market participants.

Additionally, rising FX outflows may indicate that traders are taking short-term profits and re-taking positions for strategic opportunities.

Source: Cryptoquant

Bulls gradually take control

AMBCrypto’s analysis of Coinglass’s long/short ratio data reveals several fluctuations in the AAVE market. Although some indecision between long and short positions previously existed among traders, there has recently been a notable bias towards long positions.

This change marks the start of a wave of optimism in the market, as traders begin to expect prices to rise, likely after recent market corrections.

The gradual movement towards long positions demonstrates a collective feeling of anticipation of a possible upward trend in price.

Source: Coinglass

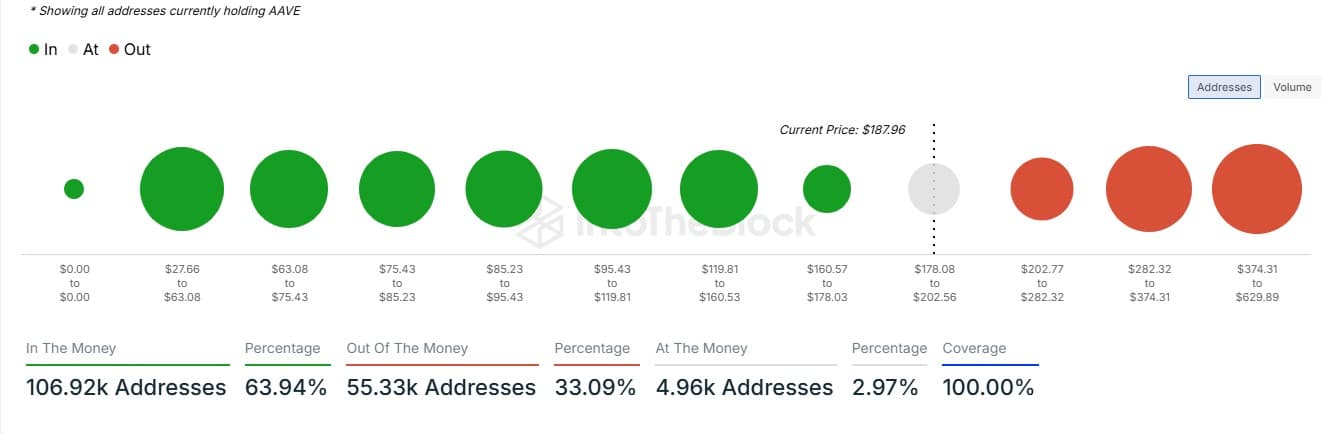

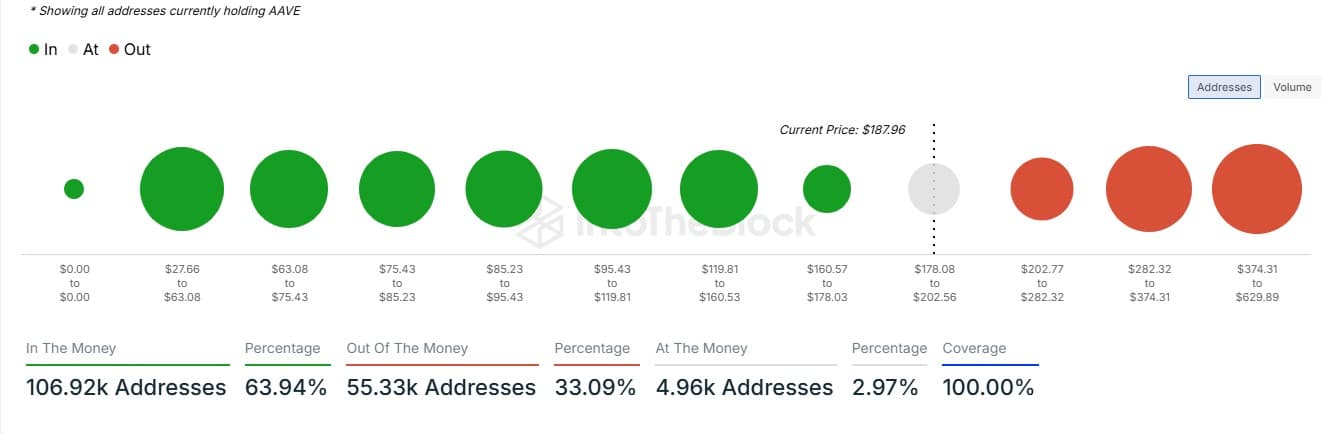

Incumbents prepare for strategic positions

The profitability of active addresses adds another layer to this evolving market picture. According to data from IntoTheBlock, in total, 64% of active AAVE addresses are profitable at the current price.

This is a strong indication of market health, as most participants are profiting from their positions despite recent volatility and market fears.

Source: In the block

Putting it all together

The interplay between increased FX outflows, switching to long positions, and high profitability of active addresses correlates with AAVE price action. Initially in decline after the election, the Aave market is now showing signs of life.

Read Aave (AAVE) Price Prediction 2024-2025

This combination of indicators suggests cautious optimism, with traders gradually starting to take measured risks. The resilience of the AAVE community and strategic positioning may suggest that exciting times may be upon us.

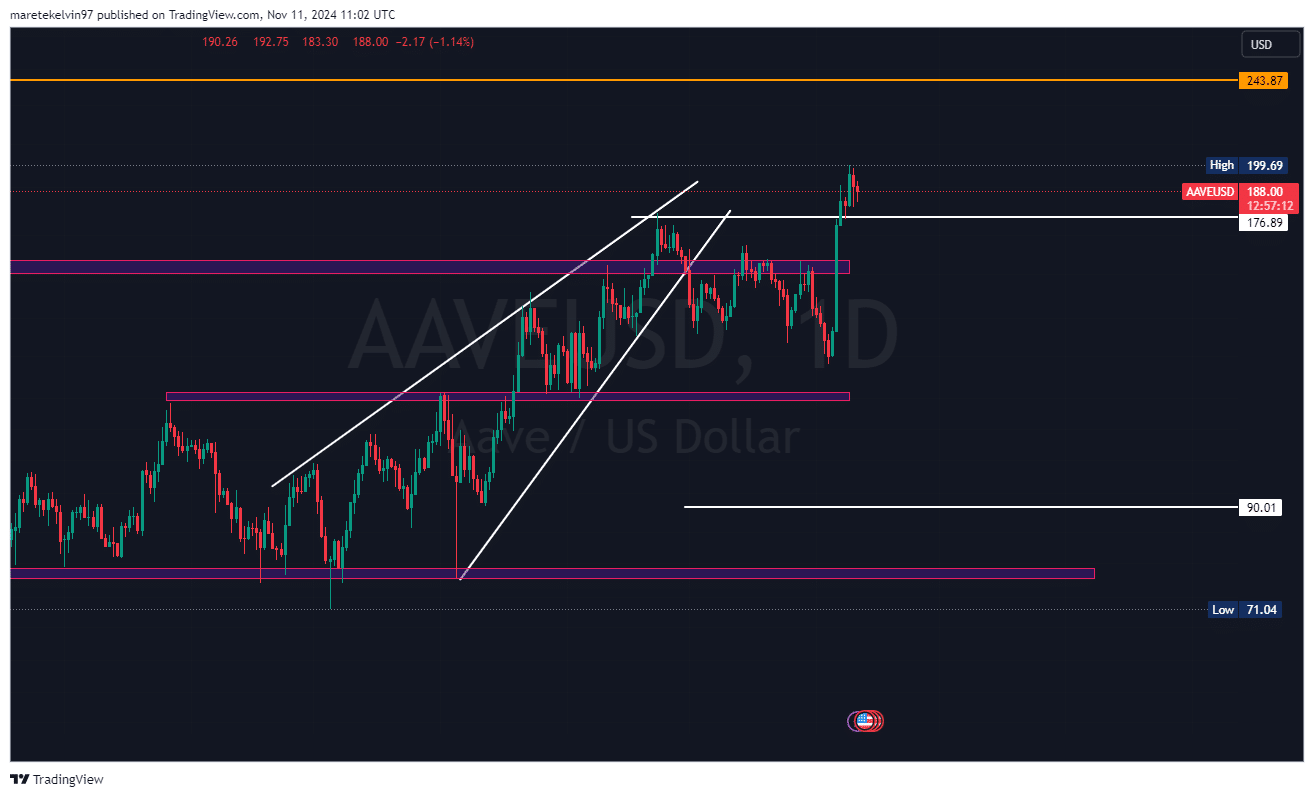

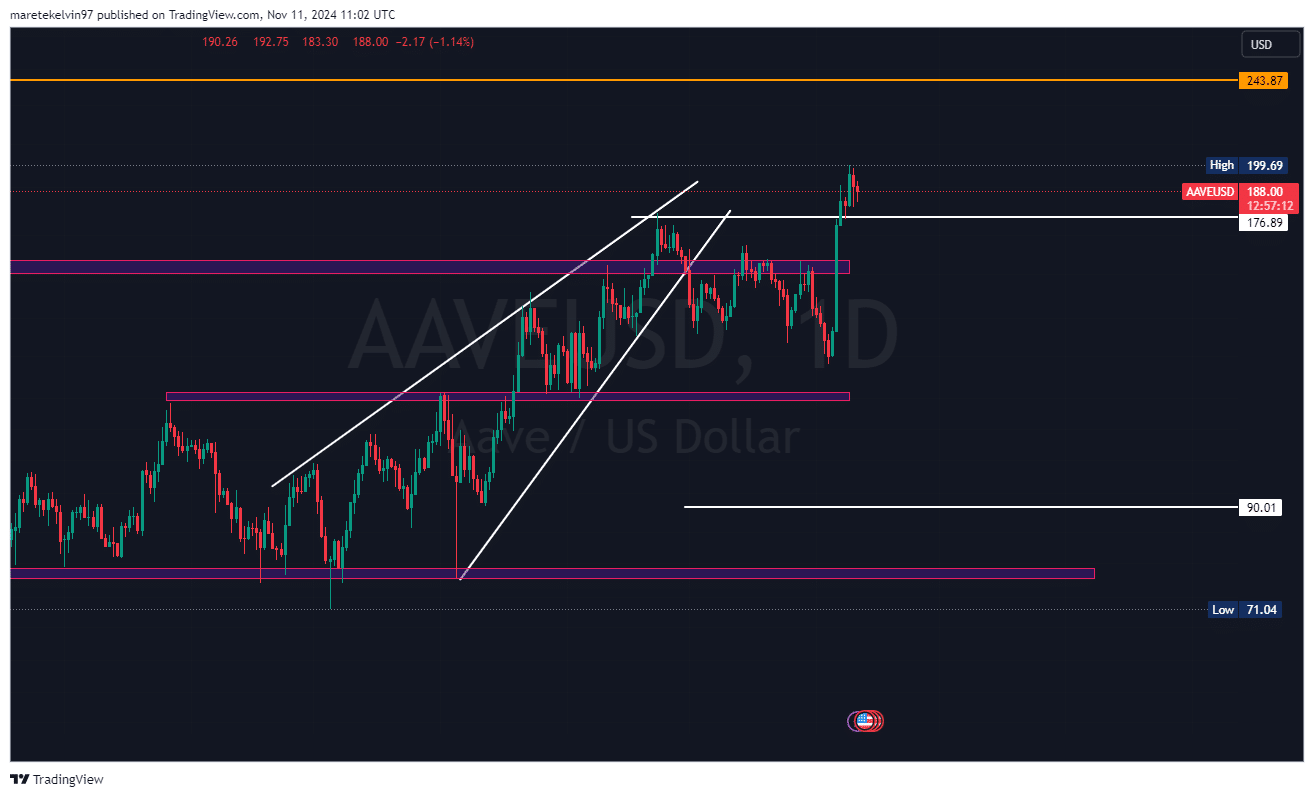

AAVE price may simply undergo a short-term correction to the key support level of $177 ahead of a planned rally to test higher resistance levels.

Source: Tradingview