Coinbase Global (Coin) is one of the first companies that people consider by thinking of cryptocurrency. In recent years, he has led a wave of institutional adoption and retail following his end-to-end negotiation platform for investors and cryptographic traders. With a solid performance in 2024, the story of the company’s remarkable growth was solidified by increasing commercial activity and adopting the increase in high -margin services such as warning and guard. Beyond the fundamental principles of the company, Coinbase could now be in a privileged position to benefit from a seismic change in the American regulatory landscape.

Discover the best actions and maximize your wallet:

Following The re -election of President Trump, the decision -makers pivoted towards a more friendly position in the cryptography sector. A recent decree entitled “Strengthen American leadership in digital financial technology” seems to be set to establish a clear framework for digital assets and potentially build a national cryptographic asset reserve. This decision could change the situation for companies like Coinbase and, in turn, make me a corner bull.

The growing legitimacy of cryptography helps currency

We rarely have a quiet week in cryptographic space, but with the sector proving troubled and annoying for many clear political initiatives and transparent legislation are a must for investors who seek stability in industry. The lack of clarity in recent years has probably bothered institutional investment and has favored a game mentality among individual investors. I think that the structured monitoring of a support regulator could be the right balance, potentially working on the advantage of Coinbase in three key ways.

First, taking into account the discussions of the US Congress concerning clear directives on the stages and wider cryptography markets, I think that the development of a well -defined regulatory framework can trigger institutional confidence, possibly strengthen the coinbase as a exchange confidence and consistent with such transactions.

Secondly, Coinbase is struggling with a dry sales trial on potentially not recorded security sales for some time now. However, the recent decision of an American district judge to proceed will bring a certain hope that a final conclusion will be drawn rather than maintaining continuous uncertainty. A Court of Appeal also ordered the SEC to explain why a tailor -made cryptographic regulatory request has been refused, which suggests that the legal world could also align with the objectives of the company in certain respects.

Finally and above all, the tendency to see the dry approving various Bitcoin and Solana ETF allows the institutional investors of trust that the crypto market is in the process of being in safety, security and legitimate. With Coinbase already well established on the booming cryptography market, trading volumes will probably increase and childcare services will increase over time.

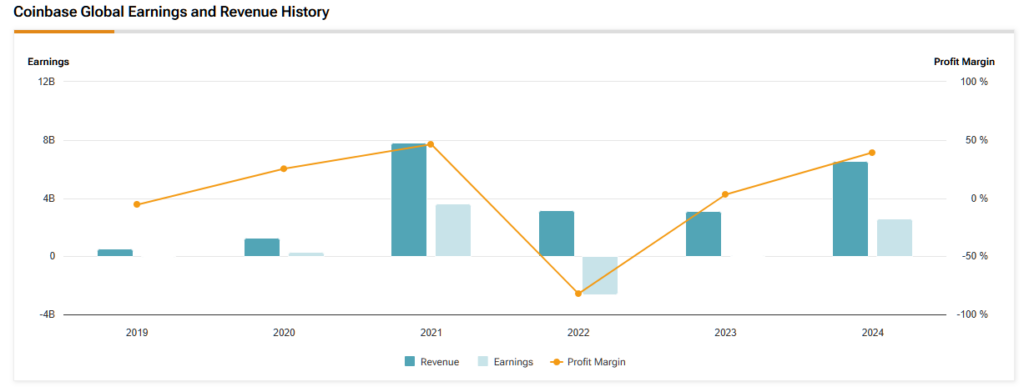

Coin commercial performance shines

In its most recent figures, Coinbase impressed with resilience and real success in a difficult and unpredictable environment. While Bitcoin and the wider market jumped, the management widened the quarterly revenues from 172% to 2.3 billion dollars. The fast -growing services segment also increased by $ 641 million to $ 641 million, with Coinbase One, the Premium Coin Subscription Service, showing strong absorption.

As the greater regulated exchange in the country, Coinbase remains the essential platform of many American institutions that seek to draw from the crypto. While competition in cryptographic space occurs, the advantage of the first corner engine should buy enough time for the company to develop its customer infrastructure and settle as the favorite gateway in all digital assets for companies and individuals.

However, with any crypto investment, the risks are still present. A notable question is the rise in decentralized exchanges such as Binance. These exchanges offer lower fees and more independence, which can use suspicious investors of regulatory or government intervention in cryptocurrency assets. If these companies were to gain in popularity, it could seriously hinder the base of Coinbase users.

Is Coinbase a purchase, a conservation or a sale?

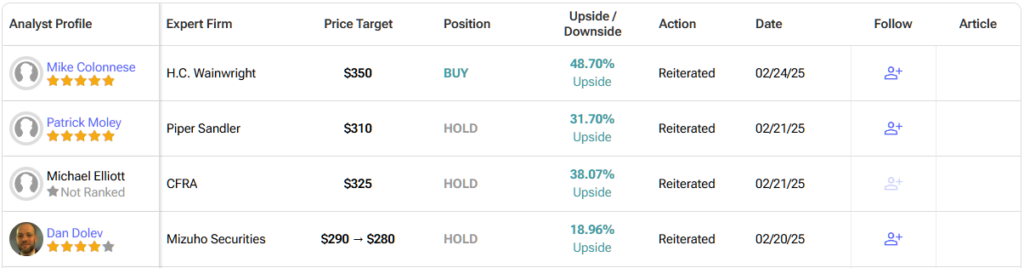

At Wall Street, Coin Stock obtains a rating of moderate purchase consensus based on ten buy, eleven hold and zero sells notors in the last three months. The average corner price of $ 350.47 per share implies an increase of 49% in the next twelve months.

A promising future in the volatility of cryptography

Last year pointed out why investors are delighted with cryptocurrency and Coinbase stock. The American government gradually establishing a clearer regulatory framework, there is a potential for subsequent growth. If Coinbase’s management continues to strengthen user confidence and strengthen its leading cryptocurrency platform position, the company could have a very successful future.

With the cryptography market quickly passing from an unregulated entity full of suspicion to a regulated by winning criticisms day by day, Coin could be a superb add to investor wallets, given the exposure to cryptography legitimized that the action provides. If investors are looking for an exposure to cryptography, this is only worth doing it via companies that already set up this new investment class.