- Polygon’s Ahmedabad hardfork boosts network activity with a 20.59% increase in active addresses.

- Despite bullish fundamentals, FX flows and a short ratio of 57.93% signal caution.

The recent upgrade of Ahmedabad hardfork Polygon (POL) is generating excitement with its successful launch on mainnet.

With the implementation of critical protocol enhancements through PIP-30, PIP-36 and PIP-45, Polygon aims to increase the contract size from 24 KB to 32 KB and improve the efficiency of the plasma bridge.

At press time, the price of POL stands at $0.4346, one Increase of 3.88% in 24 hoursreflecting a positive market reaction to these improvements. Will these improvements lead to sustainable growth, or is market enthusiasm temporary?

On-chain data: the bulls are on the move

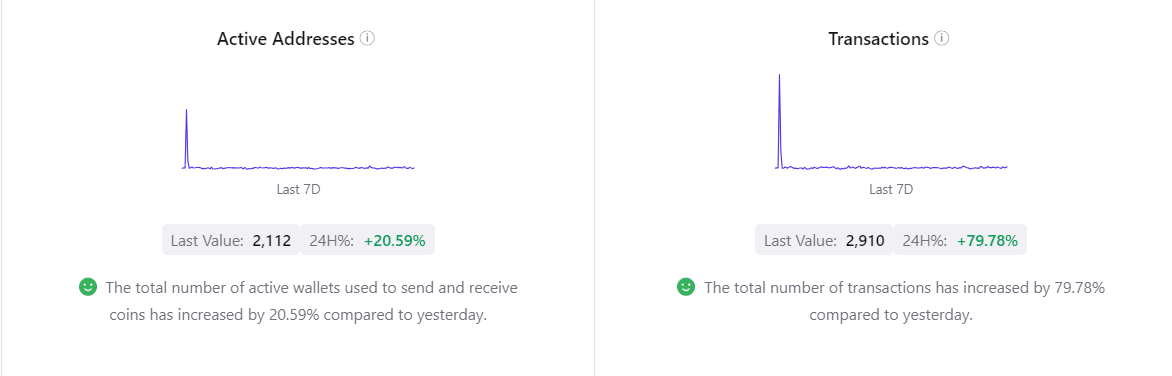

On-chain data offers crucial insights into the effects of the Ahmedabad hardfork. Active addresses have seen a 20.59% increase in the last 24 hours, now reaching 2,112. This increase suggests that the network is experiencing increased engagement.

Additionally, the number of transactions soared by 79.78%, with 2,910 transactions recorded in the last day according to CryptoQuant.

Therefore, the increased activity demonstrates the improved usability and scalability of the network, which has encouraged greater participation. Therefore, the hardfork appears to have spurred significant network growth.

Source: CryptoQuant

Netflow Exchange: a warning sign?

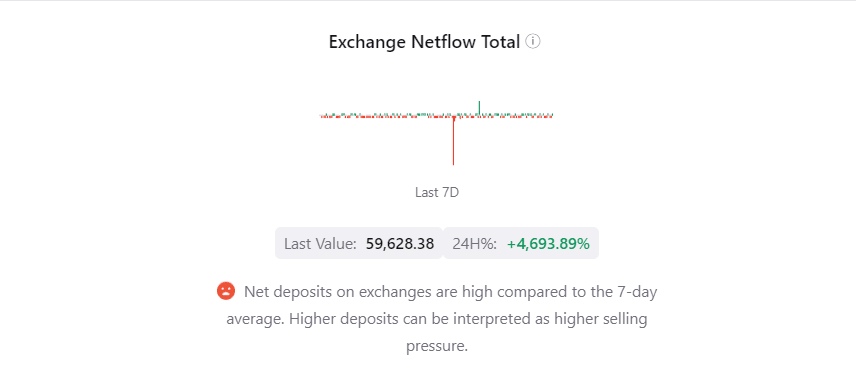

However, despite the encouraging on-chain data, net trade flow reveals a more cautious outlook.

According to CryptoQuant, net deposits on exchanges jumped 4,693.89%, totaling 59,628.38 POL at press time, signaling potential selling pressure.

Historically, large deposits often precede large sell-offs, indicating that some investors may be preparing to take profits after the recent price surge.

Therefore, this suggests that caution is required in the coming days as selling pressure could increase, impacting the token’s near-term performance.

Source: CryptoQuant

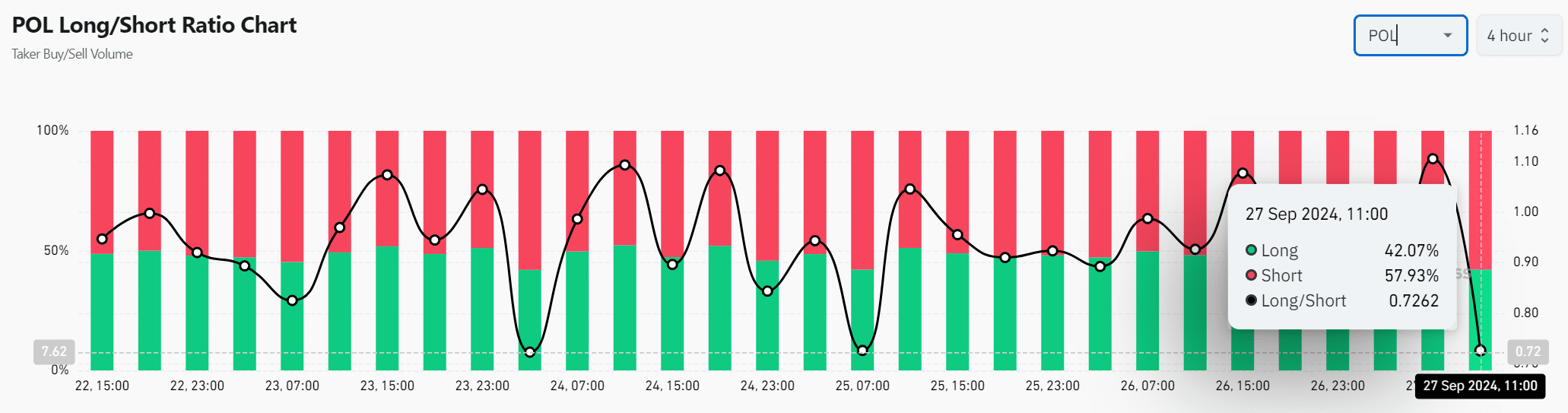

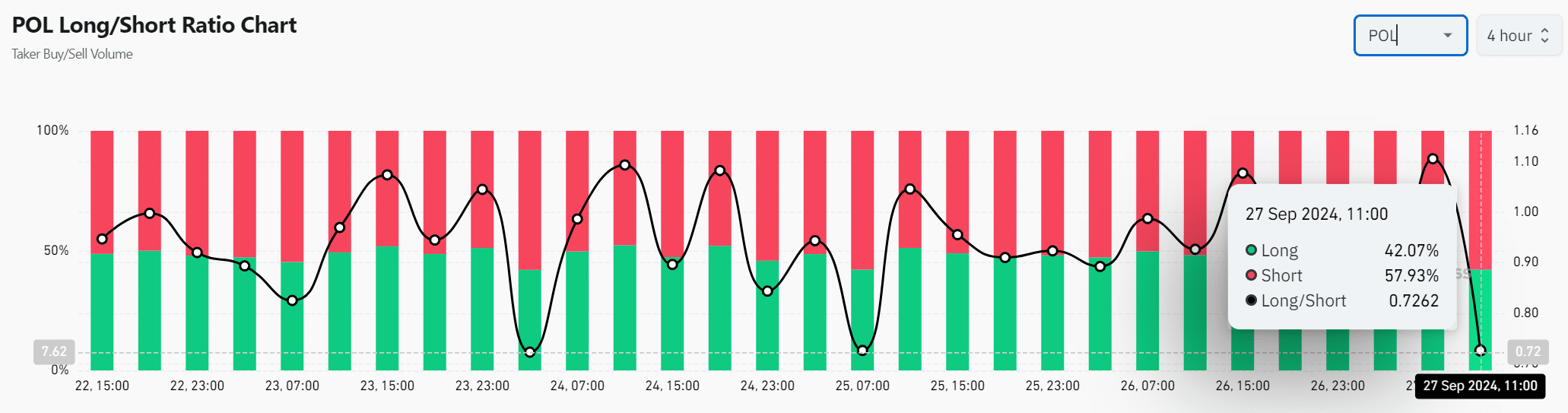

Long/short ratio: bears are always hiding

Additionally, the long/short ratio adds another level of complexity to the situation. Currently, 57.93% of traders are short, while only 42.07% are long.

Therefore, despite the channel’s bullish activity, many market participants remain wary of a potential correction.

Market sentiment reflects uncertainty and traders may hedge their positions in anticipation of a pullback.

Source: Coinglass

Bulls in control, but remain vigilant

The Ahmedabad hardfork has undoubtedly generated a positive response for Polygon. Therefore, the increase in active addresses, transactions and prices reflects strong fundamental growth.

Is your wallet green? Check out the POL profit calculator

However, given the significant currency inflows and bearish sentiment in the futures market, caution remains in order.

The bulls appear to have the upper hand, but investors should remain vigilant as a near-term correction could still be on the horizon.