In recent years, artificial intelligence (AI) has taken the spotlight in various industries. From art generated by AI to chatbots in customer service, each sector is apparently ready to disrupt.

It is not only in your news feed every day-the venture venture capital, while CEOs are impatient to declare their “IA-ST” companies. But for those who remember the noble promises of other technologies that have since disappeared from memory, there is a strange feeling of already seen.

In 2017, it was the blockchain that promised to transform each industry. The companies have added the “blockchain” to their names and looked at the actions of the actions soaked, that the technology was really used or how.

Now a similar trend emerges with AI. What takes place is not only a wave of innovation, but an example of a manual of a technological media threshing cycle. We have been here several times before.

Understanding the Media Threshing Cycle

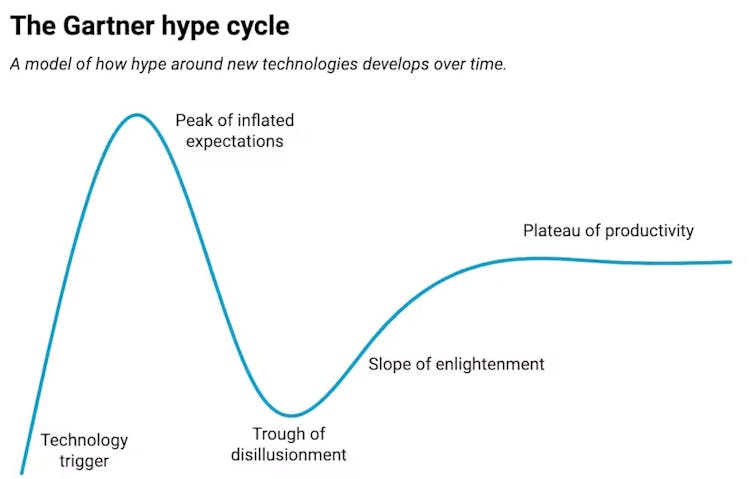

The technological braking cycle, first defined by the Gartner research firm, describes how emerging technologies increase on a wave of swollen promises and expectations, crash into disillusionment and, ultimately, find a more realistic and useful application.

The conversationCC by-ND

Recognizing the signs of this cycle is crucial. It helps to distinguish authentic technological changes and the ways of passage drawn by speculative investments and good marketing.

This can also make the difference between making a good commercial decision and a very expensive error. Meta, for example, has invested more than $ 40 billion US dollars in the metachered idea while continuing its own manufactured media threw, to abandon it later.

Read more: why the metavese is not ready to be the future of work still

When Buzz goes beyond reality

In 2017, the blockchain was everyone’s attention. Presented as a revolutionary technology, the blockchain offered a decentralized means of recording and verifying transactions, unlike traditional systems that are based on central authorities or databases.

Us Soft Drinks Company Long Island Iced Tea Corporation became a long blockchain Corporation and saw its actions increase by 400% of the day, despite no blockchain product. Kodak launched a cryptocurrency wave called Kodakcoin, sending his stock market course.

These developments were less innovation and more speculation, chasing short -term gains pulled by media threshing. Most blockchain projects have never offered real value. Companies rushed, motivated by the fear of missing and the promise of technological transformation.

But the technology was not ready, and the solutions he would have proposed were often ill -aligned by real industry problems. Businesses have tried everything, monitoring pet food ingredients on blockchain, launching loyalty programs with cryptographic tokens, often without clear advantages or better alternatives.

In the end, around 90% of Blockchain Enterprise solutions failed in mid-2019.

The generator has already seen

Quick advance until 2023, and the same model began to play with AI. Digital media company Buzzfeed has seen its stock jump more than 100% after announcing that it would use AI to generate quiz and content. Financial services company Klarna has replaced 700 workers with an AI chatbot, saying that it could manage millions of customer questions.

The results were mainly negative. Klarna quickly saw a drop in customer satisfaction and had to resume her strategy, by rehiring humans for customer support this year. Buzzfeed’s Pushed AI content has failed to save her belongings in difficulty, and her division of short stories then closed. The CNET technological media company has published articles generated by AI-A-Truffés de errors, damaging its credibility.

These are not isolated incidents. These are signals that AI, like blockchain, was too excited.

Why do companies hunt technological media threw?

There are three main forces at stake: swollen expectations, short -term view and erroneous implementation. Technological companies, under the pressure of investors and media stories, overpromised what AI can do.

The leaders present vague and utopian concepts of “transformation” without the infrastructure or plan to save them. And many rush to implement, on the wave of media threw.

They are often hampered by a short -term vision of what alignment with the new technological media threw can do for their business, by ignoring the potential drawbacks. They deploy non-tested systems, underestimate the complexity or even the need, and hope that the novelty alone will stimulate the return on investment.

The result is often a disappointment – not because technology lacks potential, but because it is applied too much, too early, and with too little planning and surveillance.

Where from here?

Like blockchain, AI is a legitimate technological innovation with real and transformer potential.

Often these technologies simply need time to find the right application. While initial media threw has blurred, technology has found a practical niche in fields such as “tokenization of assets” on the financial markets. This makes it possible to represent assets such as real estate or the company to represent by digital tokens on the blockchain, which allows easier, faster and cheaper trading.

The same reason can be expected with a generative AI. The current threshing cycle seems to be shrinking, and the consequences of precipitated or poorly thought out implementations will likely become more visible in the years to come.

However, this decrease in media threw does not point out the end of the relevance of the generative AI. Rather, it marks the start of a more anchored phase where technology can find the most appropriate applications.

So far, one of the clearest dishes is that AI should be used to improve human productivity, not replace it. People who postpone against the use of AI to replace them, at AI, making frequent and costly mistakes, human surveillance associated with productivity improved by AI is increasingly considered to be the most likely path.

Recognition of technological threshing models is essential for making smarter decisions. Instead of rushing to adopt each new innovation based on swollen promises, an approach measured and focused on problems leads to more significant results.

Long -term success comes from reflected experimentation, implementation and clear goal, not from the pursuit of short -term trends or gains. Media should never dictate the strategy; The real value lies in solving real problems.