On-chain data shows that US-based platforms have recently expanded their Bitcoin holdings. Here’s what this could mean for the price of BTC.

Bitcoin US/Rest Reserve Ratio Has Increased Recently

As CryptoQuant founder and CEO Ki Young Ju explains in a new article on X, BTC appears to have recently moved from other countries to US exchanges.

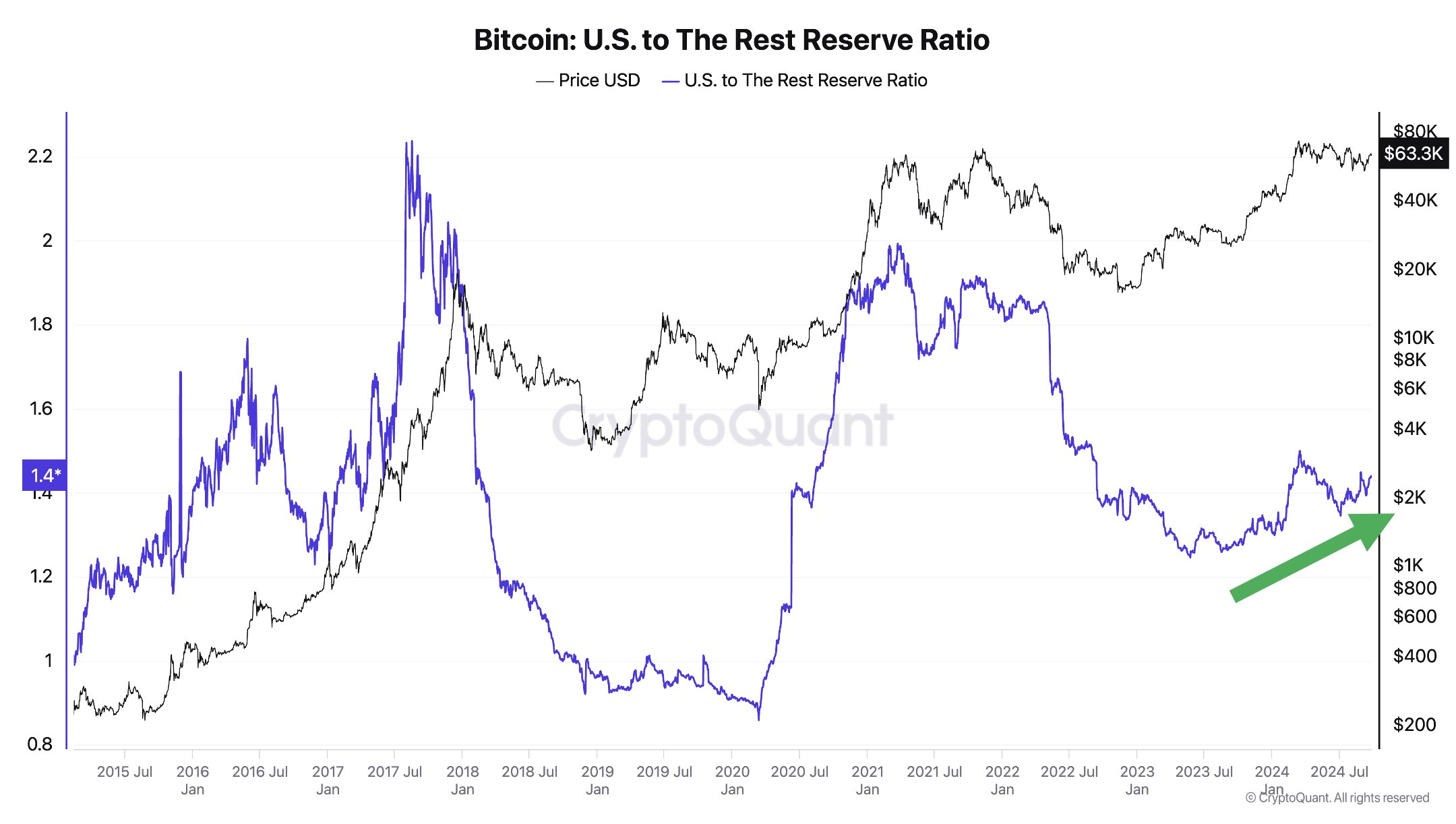

The on-chain metric of interest here is the “US to The Rest Reserve ratio,” which tracks the ratio between the total amount of Bitcoin held by central US-based entities, such as exchanges and funds, and the one that the country’s platforms. the rest of the world owns it.

When the value of this metric increases, it means that the cryptocurrency is moving to US-based platforms rather than the rest of the world. On the other hand, recording a decline suggests that the dominance of global platforms is on the rise.

Now here is a chart that shows the trend of the Bitcoin US/Rest Reserve ratio over the last decade:

The value of the metric appears to have been riding an uptrend in recent months | Source: @ki_young_ju on X

As shown in the chart above, the Bitcoin US/Rest Reserve ratio saw a sharp drop during the 2022 bear market and bottomed out in 2023. This suggests that a massive shift in BTC supply has took place, with tokens. moving into wallets attached to offshore platforms.

However, in this year 2024, the indicator seems to have finally experienced a turnaround, since its value has instead increased, which means that American platforms are regaining part of their lost dominance.

The main reason for this trend is simple: spot exchange-traded funds (ETFs). Spot ETFs are financial instruments that provide exposure to Bitcoin price movements in a way familiar to traditional investors.

These funds finally gained approval from the U.S. Securities and Exchange Commission (SEC) earlier this year and have since gained popularity.

The US/The Rest Reserve ratio naturally also includes these new funds in its calculation and since they did not exist before, it is logical that their value would see a slight increase after their appearance this year.

Now, what could this uptrend mean for Bitcoin, if anything? From the chart, it is visible that the last two times BTC saw a significant uptrend in the indicator coincided with the last two bull runs.

The rally to the all-time high (ATH) price earlier in the year also saw a rapid increase in the indicator, although its magnitude was much lower than the growth seen before the 2017 and 2021 bull runs.

Given past precedent, it is possible that Bitcoin will also benefit this time from this shift in supply to US exchanges.

BTC Price

After watching its recent bullish momentum continue over the past day, Bitcoin finally moved back above the $65,000 level.

Looks like the price of the coin has been on the rise for a while now | Source: BTCUSDT on TradingView

Featured image of Dall-E, CryptoQuant.com, chart from TradingView.com