Real Vision analyst Jamie Coutts believes that Bitcoin (BTC) and other digital assets could be about to break out of a bearish phase as the flagship cryptocurrency reclaims the $63,000 level.

Coutts says increasing global liquidity and a healthy crypto ecosystem suggest the market correction could be coming to an end before a year-long bull run begins.

“I acknowledge that this may be premature given the global geopolitical state and the fact that technicals (price action) are still bearish. However, I believe we are in the final stages of the big wave of the last few months, which for allocators will make the fourth quarter crucial for 12-month forward returns.”

Coutts is also closely monitoring the Altcoin Season Index, which measures the profitability of digital assets relative to BTC. He says the indicator is trending upwards.

“We are seeing a strong rally in the altcoin season indicator (altcoins are outperforming BTC). Without a sustained rally in Bitcoin, which requires an all-time high (above its all-time high), this phenomenon could be short-lived. But I suspect we are in the final throes of the bearish surge.”

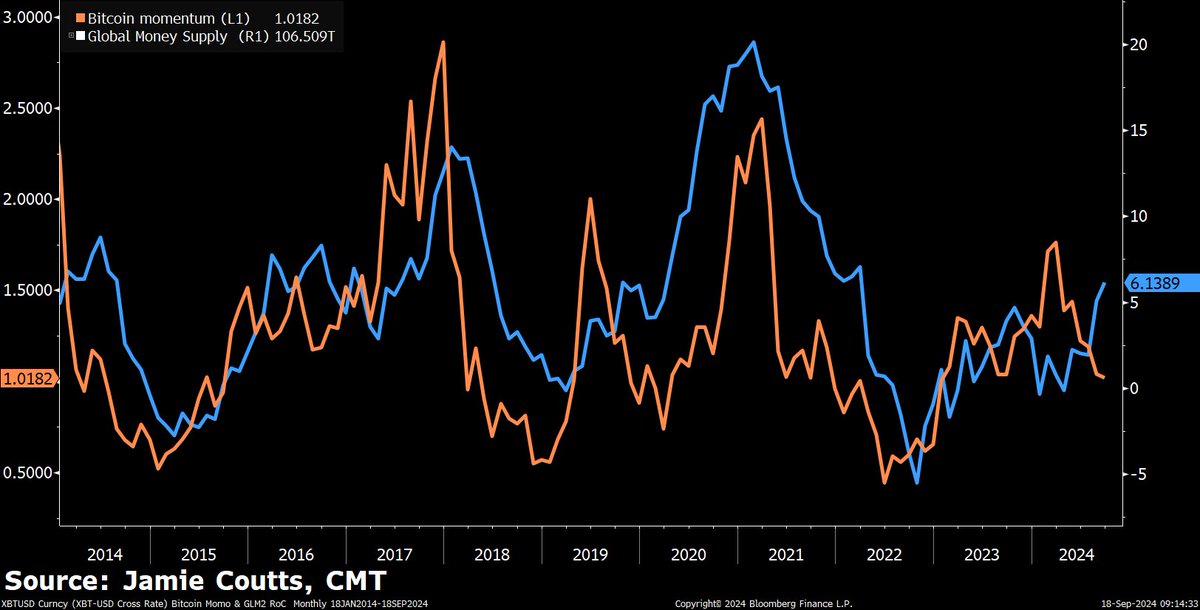

Coutts claims that an increase in the money supply paves the way for BTC’s next rise, citing a historical relationship between the two.

“Ultimately, it’s liquidity that drives everything, and that has now become decidedly bullish.”

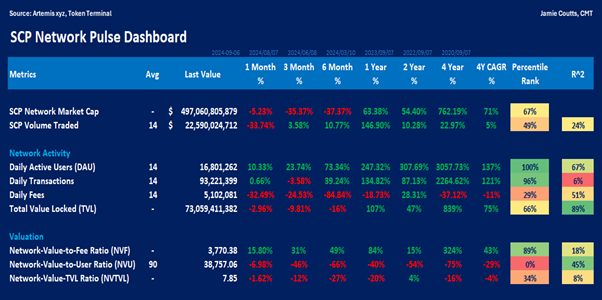

He adds that data from analytics platform Artemis shows that smart contract platforms have seen strong network activity over the past six months. Coutts says the rise in metrics such as daily active users and daily transactions during a market correction is a positive sign for digital assets heading into the fourth quarter.

“Key fundamental indicators of the crypto ecosystem have performed well during the six months of price decline.”

At the time of writing, Bitcoin is trading at $63,343, up more than 6% in the past 24 hours.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check price

Follow us on XFacebook and Telegram

Surf the Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/prodigital art