- Global liquidity has increased in anticipation of a likely increase in the US money supply

- Given BTC’s historic surge amid liquidity surge, is another rally likely?

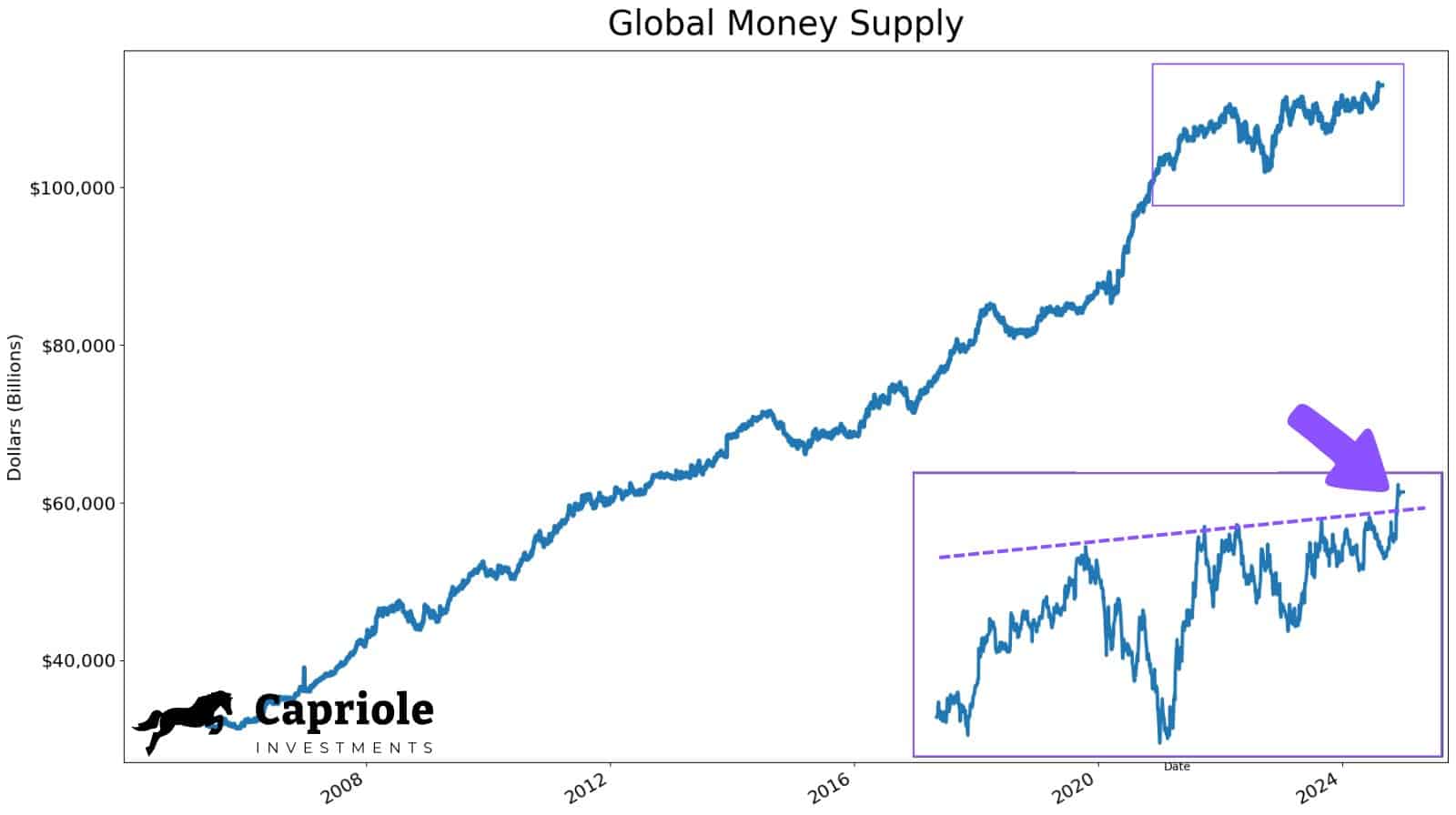

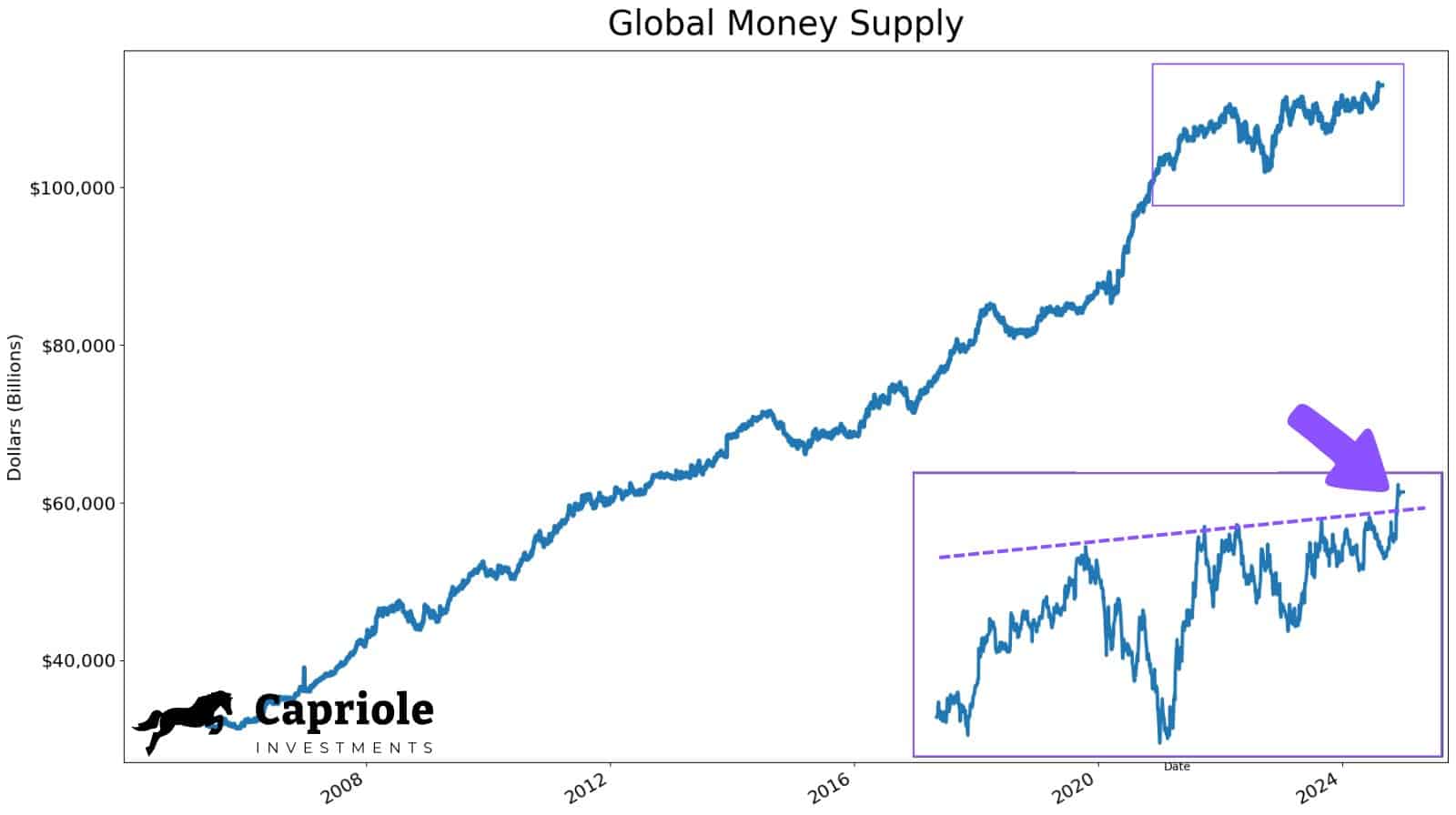

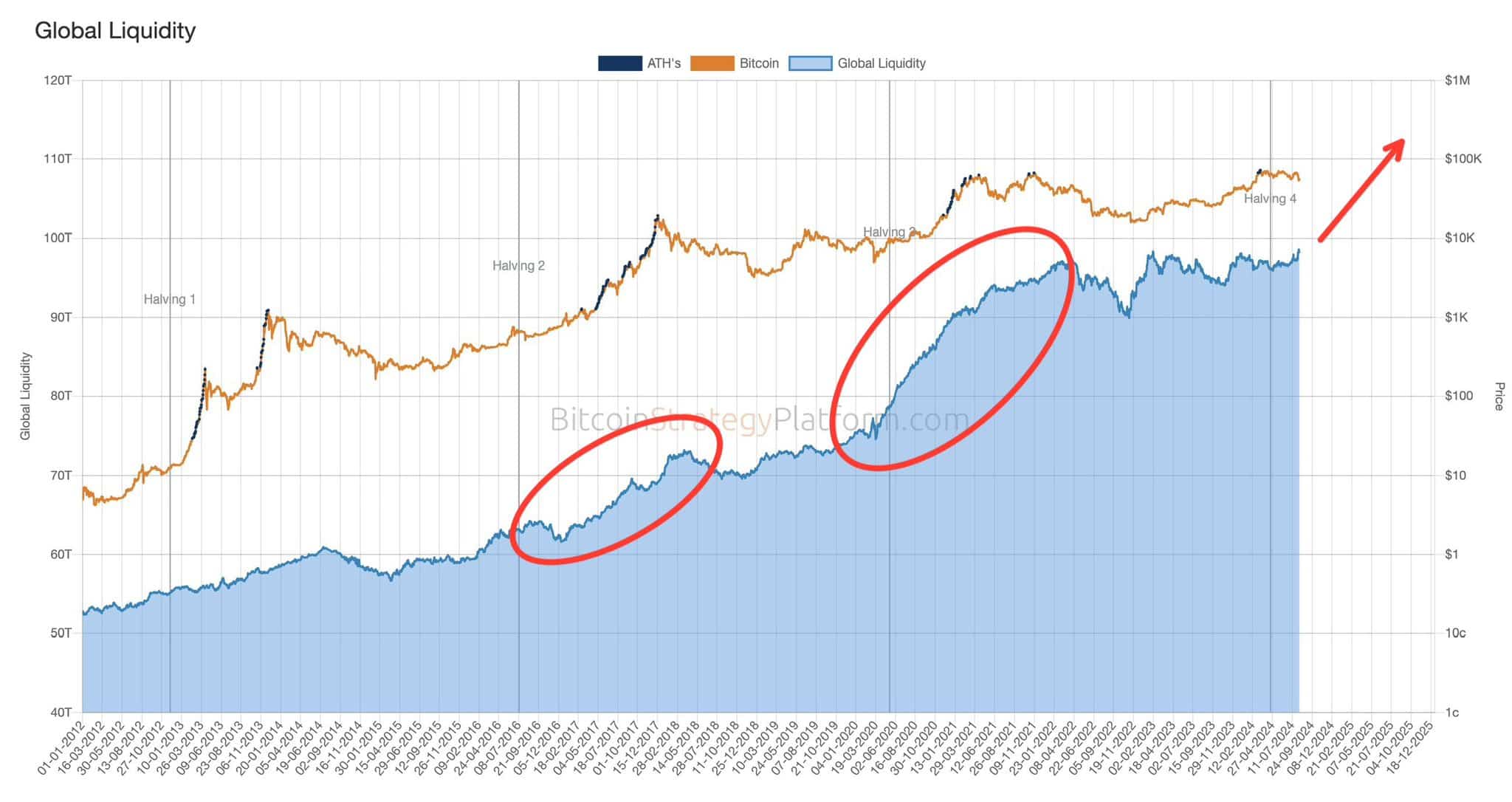

The macroeconomic backdrop is increasingly favorable for Bitcoin (BTC), particularly from a liquidity (money supply) perspective. In fact, according to Charles Edwards, founder of crypto hedge fund Capriole Investments, overall global liquidity has exploded above a 4-year consolidation level now.

“The global money supply is exploding. Plus, we just came out of a massive 4-year consolidation. What do you think this means for Bitcoin?”

Source: Capriole Investments

While there are several factors that can affect Bitcoin prices, the world’s largest digital asset is a well-known liquidity addict. Such an increase in global liquidity could pave the way for Bitcoin’s upside potential.

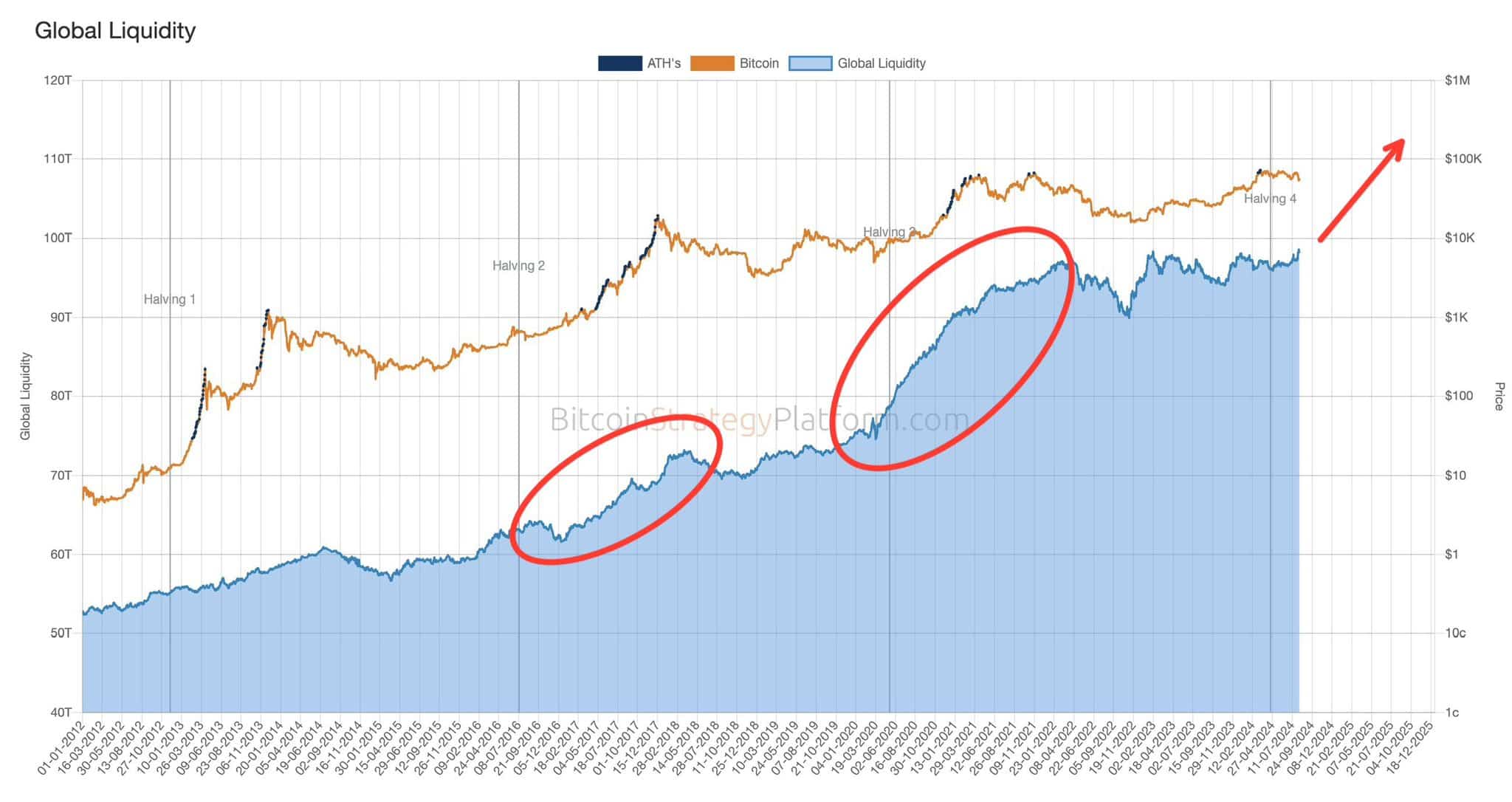

To put this into context, the cycle peaks in 2017 and 2021 coincided with a rise in global liquidity, note by a market analyst – François Quinten.

“Global liquidity is about to increase. And so is #Bitcoin 💥”

Source: X/Quinten

US Liquidity to Fuel BTC Prices

The recent increase in global liquidity is not surprising, given the onset of quantitative easing, with central banks lowering interest rates. Canada and the United Kingdom, among others, have also cut interest rates.

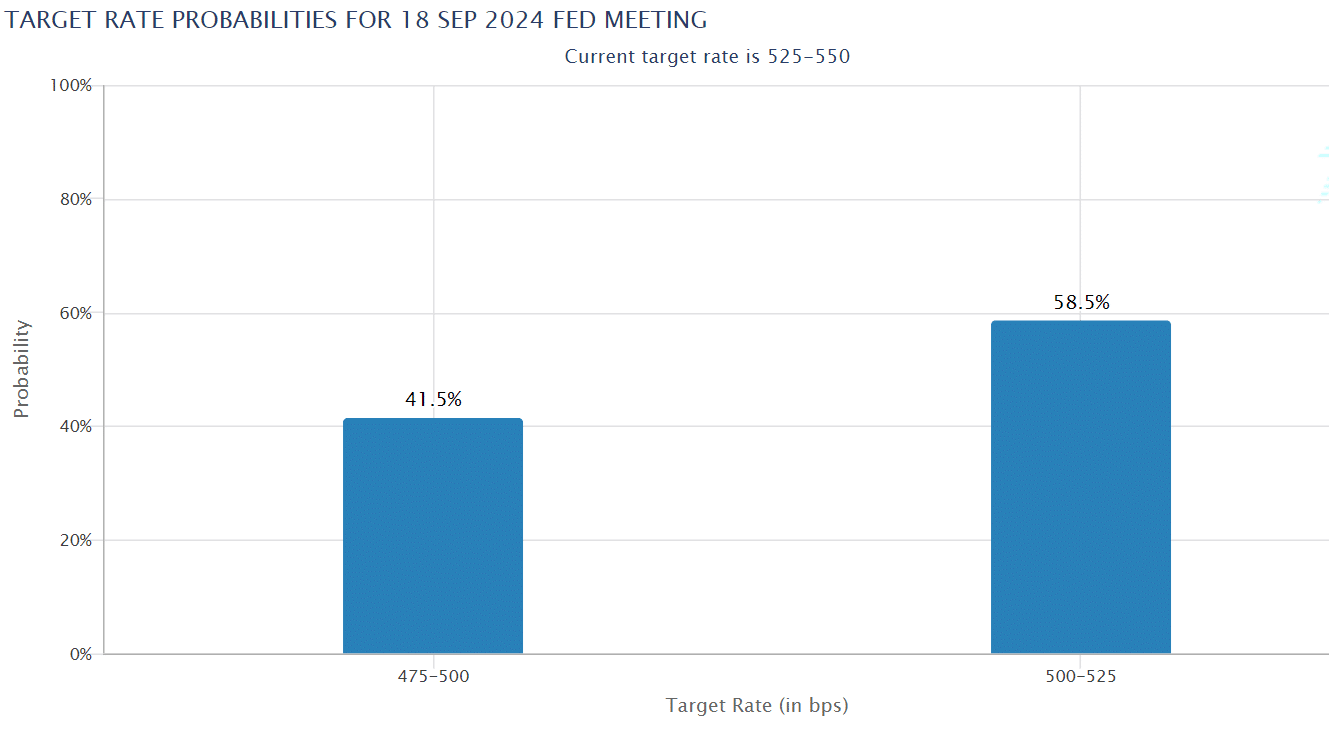

The US is expected to start cutting Fed rates by September, which could further increase global liquidity and impact cryptocurrency prices. At press time, interest rate traders were pricing in a Fed rate cut of nearly 60% to 40%, or 25 and 50 basis points, respectively.

In other words, traders are now very convinced of a Fed rate cut in September.

Source: CME Fed Watch tool

In addition to the Fed’s rate cut, the injection of liquidity into the United States would come from the more than $300 billion in Treasury bonds that the U.S. Treasury Department will issue by the end of the year.

For the uninitiated, Treasury bonds are used by the government to raise funds to cover budget deficits needed for aggregate spending. In short, positive net issuance of Treasury bonds will increase U.S. liquidity.

According to BitMEX founder Arthur Hayes, this American liquidity facility would push BTC to $100,000 and break its downward sideways trajectory.

“I expect the cryptocurrency to break out of its downward sideways trajectory starting in September.

In short, BTC price could see massive appreciation starting in September.

Meanwhile, at the time of writing, the world’s largest cryptocurrency was trading at $60.8k, while BTC was facing a short-term sell wall at $63k.