A closely followed crypto strategist and trader believes an Ethereum (ETH) competitor is preparing for a breakthrough.

Pseudonymous analyst Inmortal tells his 223,100 followers on social media platform

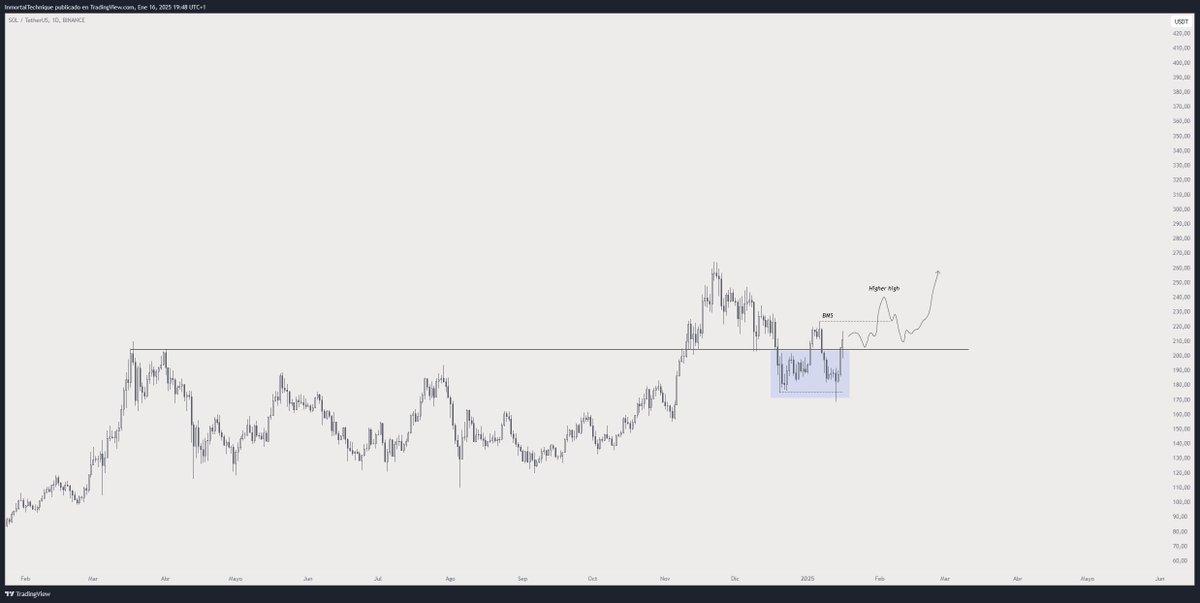

“If you ask me, SOL is starting to look good again. The only thing we need now is a higher high (price) to confirm a breakout in MS (market structure.)”

Looking at his chart, the trader suggests that SOL will climb to $240 and return to around $210 before resuming its uptrend around its all-time high of $263.

Solana is trading at $219 at the time of writing, up 4.7% in the last 24 hours.

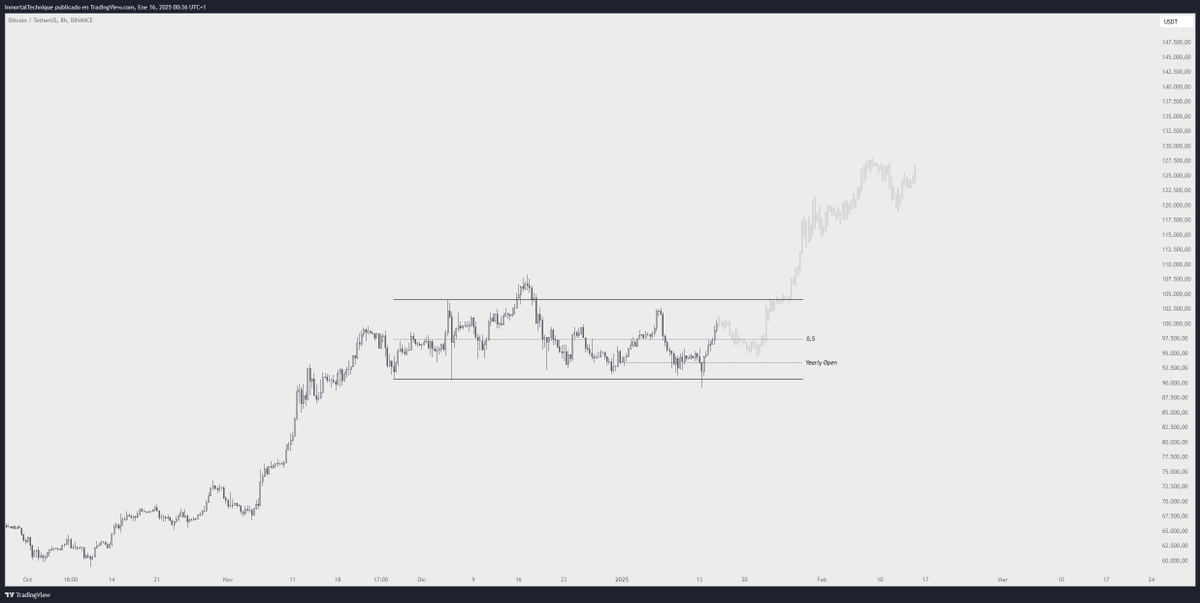

Next, the trader looks at Bitcoin after BTC reclaimed the $100,000 range this week, following a correction to $89,000 on Monday.

“Are you telling me it was as simple as waiting?”

Looking at his chart, the trader suggests that Bitcoin could fall as low as $95,000 later this month on the eight-hour chart before climbing as high as $127,000 in February.

Bitcoin is trading at $104,569 at the time of writing, up 5% in the last 24 hours.

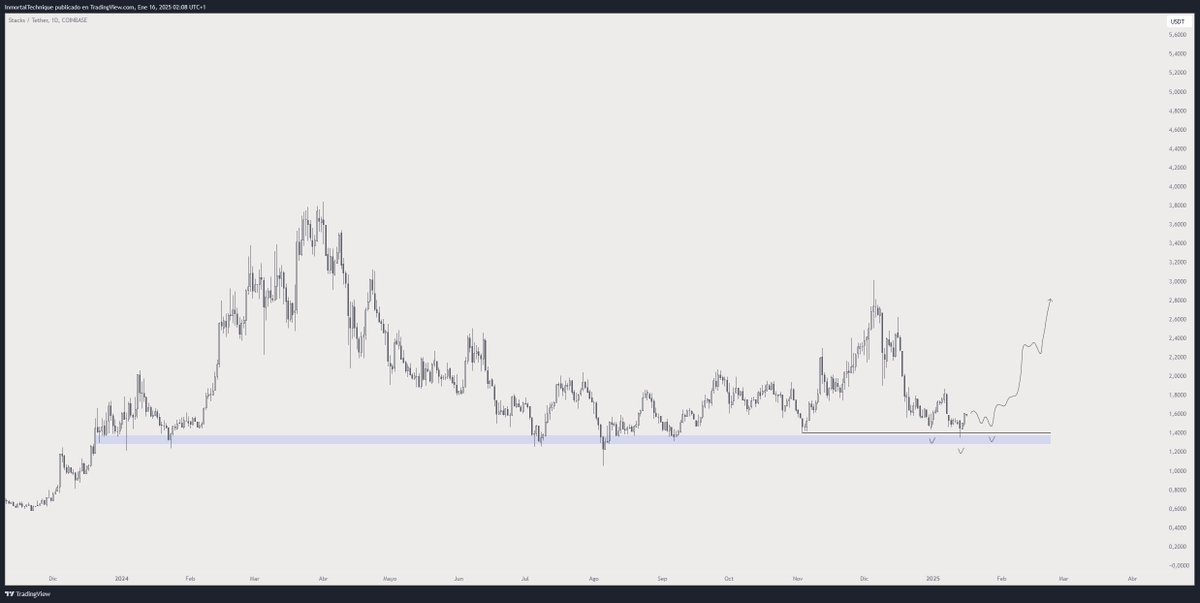

Finally, the analyst claims that Bitcoin Layer 2 Project Stacks (STX) may have just experienced a swing failure pattern (SFP) after bouncing from $1.40 on the daily chart.

SFPs are often looked to by traders as potential reversal points.

“You don’t have to be a genius to realize that the STX chart appears to have bottomed out. SFP + tested demand + (reverse head and shoulders model). This might take a while, but it’s a high probability setup for me.

Looking at its chart, it suggests that STX could reach around $2.80.

STX is trading at $1.68 at the time of writing, up 7.9% in the last 24 hours.

Don’t miss a thing – Subscribe to receive email alerts straight to your inbox

Check Price Action

Follow us on XFacebook and Telegram

Surf the daily Hodl mix

Disclaimer: Opinions expressed on The Daily Hodl do not constitute investment advice. Investors should conduct due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and transactions are at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: halfway