- POPCAT appeared to have a bullish market structure on the daily time frame

- Shorter time frames showed bullish sentiment was weak

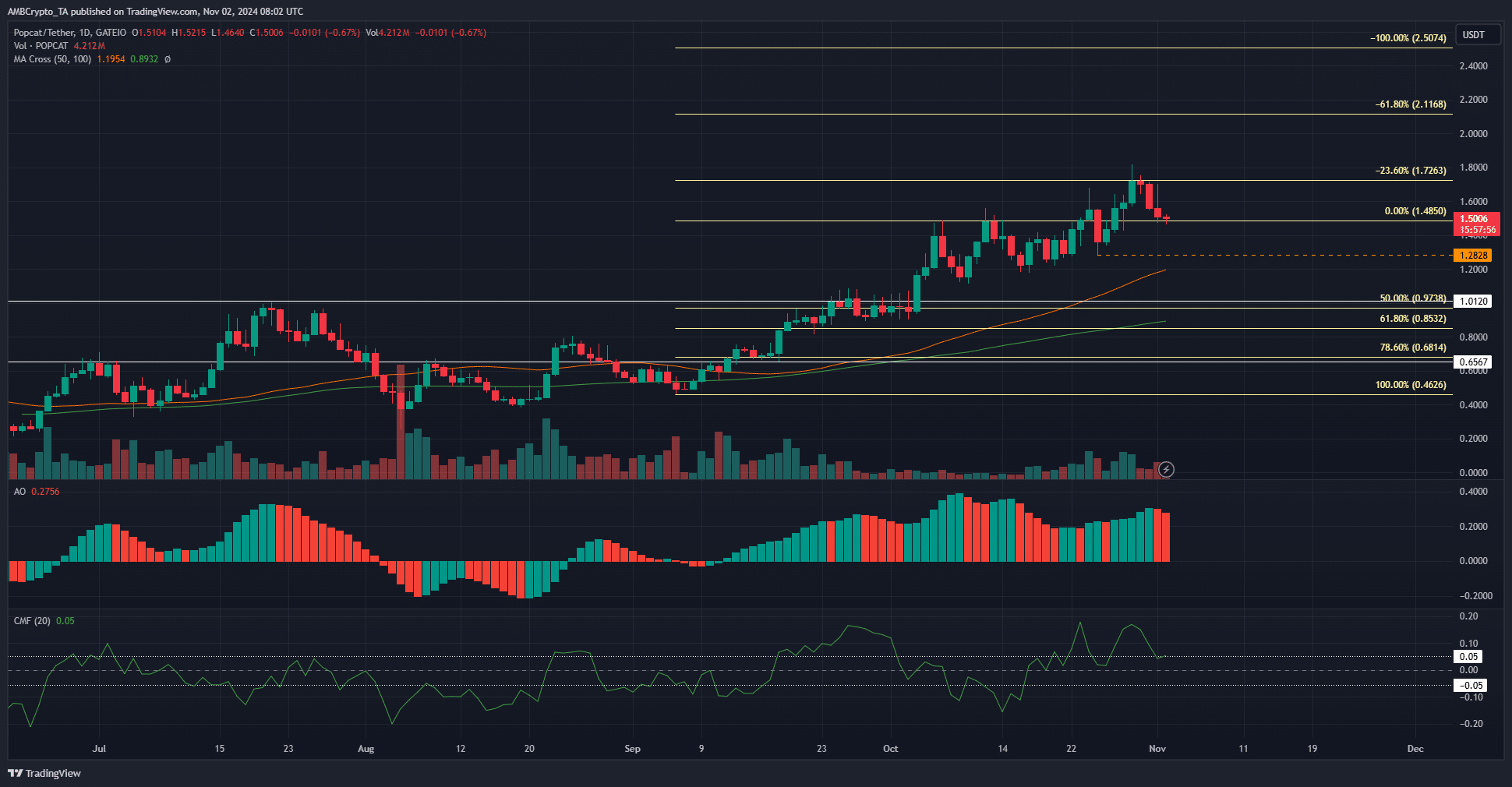

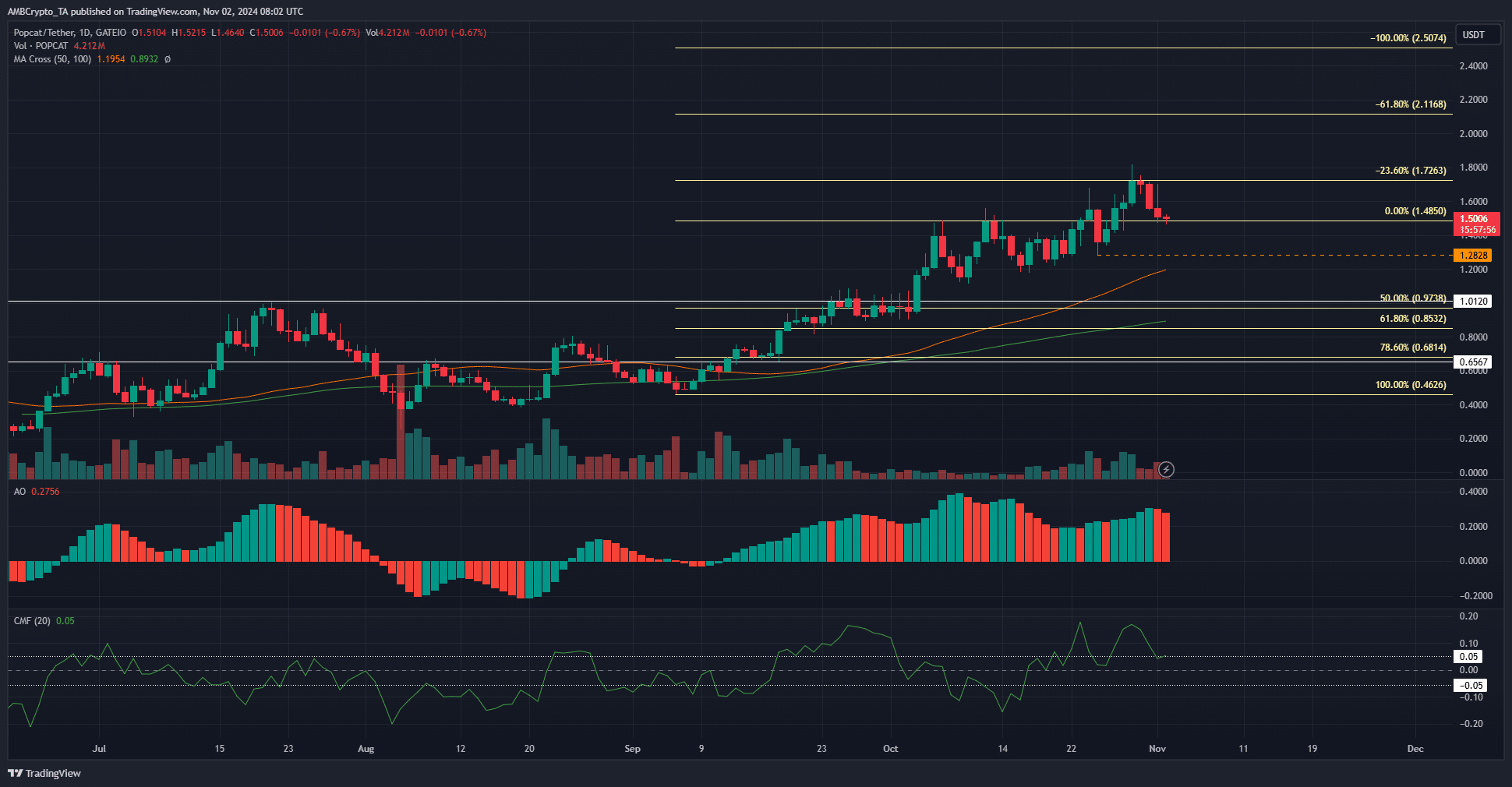

POPCAT was trending upward on the daily chart and recorded a low of $1.28 on October 25. Its momentum seemed to slow down around that time, but it managed to reach a higher peak in recent days.

Bitcoin’s (BTC) correction to $72.7k has caught many overenthusiastic bulls offside. POPCAT also recorded a decline of 14.45% over the last three days, but it is likely to continue its upward trend.

Market Structure Favors POPCAT Bulls

Source: POPCAT/USDT on TradingView

The Fibonacci extension level of 23.6% was tested and the correction took place from there. The higher highs and lows meant the market structure remained bullish. A daily session closed below $1.28 would reverse the structure to the downside.

To reverse the downward trend, a new high and a new low must be set subsequently. Such a scenario would mean that POPCAT is preparing for a pullback, potentially below the $1 mark.

At the time of writing, this scenario seemed unlikely. The CMF was at +0.05 to denote significant capital flows to the market. The Awesome Oscillator also highlighted the bullish momentum behind memecoin since the second week of September.

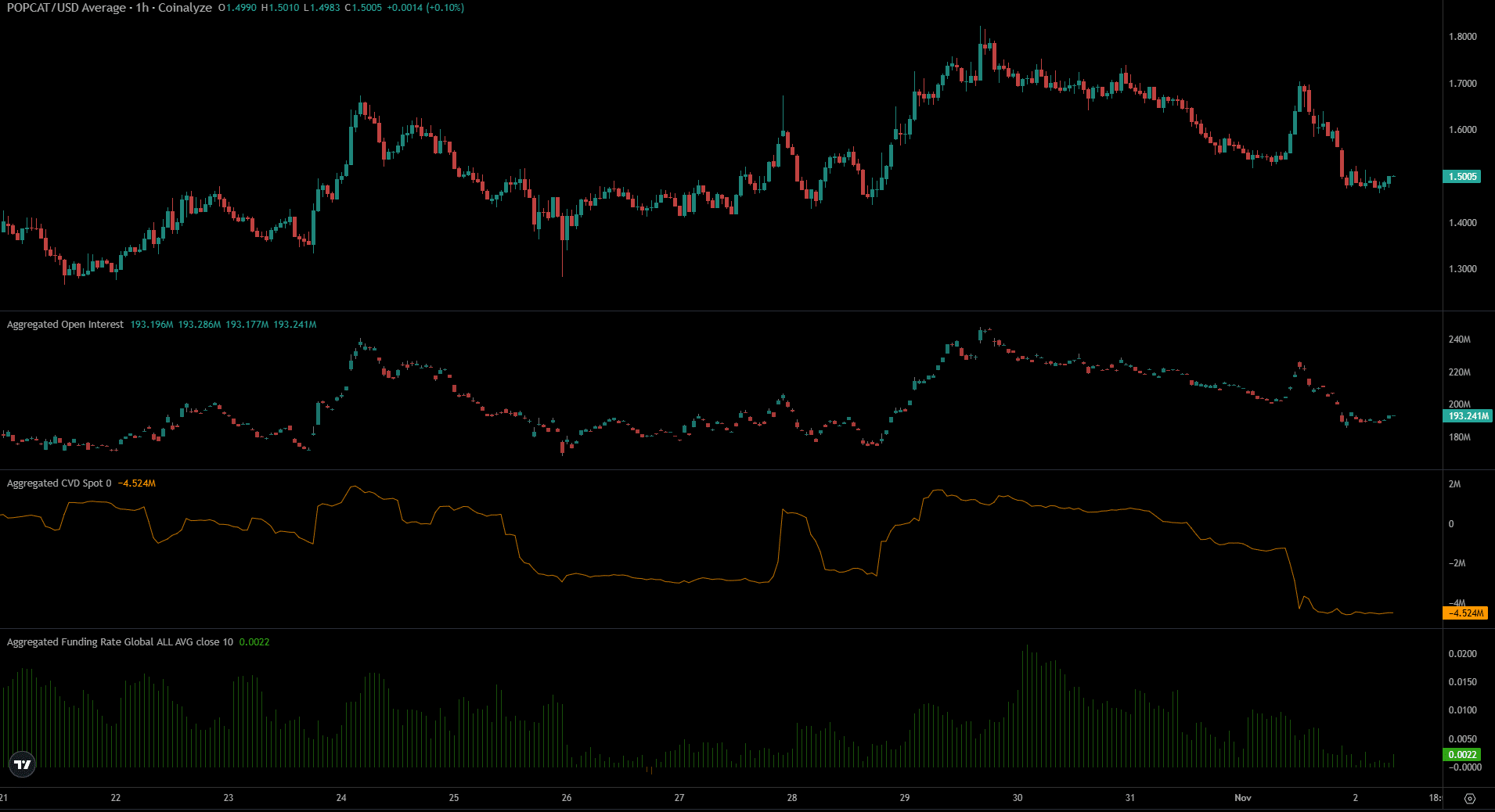

Diminishing open interest hints at doubts

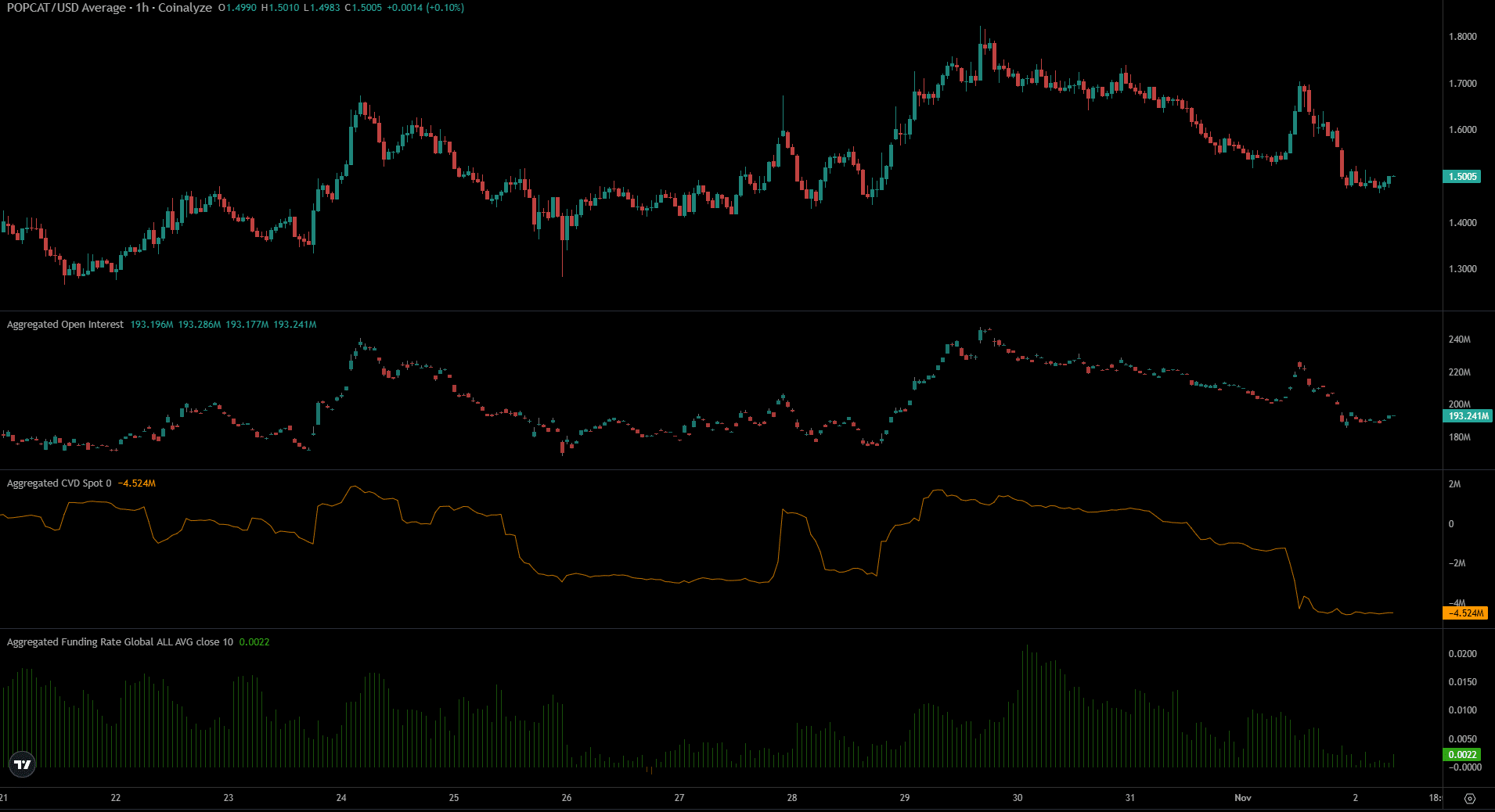

Source: Coinalyse

The price rebounded past $1.50 a week ago, which saw open interest slowly increase. However, the October 30 correction saw OI fall alongside price. This indicates bearish sentiment in the futures market.

Spot CVD also fell significantly during the same period. This combination of lukewarm interest from buyers in the spot and futures markets showed short-term bearish sentiment, although price action over a longer time frame signaled an uptrend.

Is your wallet green? Check the Popcat Profit Calculator

The funding rate was close to zero – Another sign of a weak uptrend. Overall, traders should exercise caution in the coming week. The 2024 U.S. election represents some uncertainty that the market hates. Clearer price trends are likely to be established after this major event is decided.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.