- Bitcoin and Ethereum aim to absorb Solana’s liquidity, because the largest blockchain is launching new layer 2 solutions.

- Ethereum Price has reached a 12 -day summit this week, Solana observed a drop of $ 772 million in liquidity.

- The frenzy of memes currency was faced with high -level carpet prints and controversies surrounding the tokens of Memes Balance and Melania earlier this week.

Solana (soil) is down more than 40% compared to its summit of $ 295.83, negotiating Thursday at $ 172.98 when writing the editorial’s time. The competitor of Ethereum LED Bitcoin Bitcoin Bull Market in 2024. However, recent developments overshadowed the gains of the soil ecosystem.

Ethereum reaches a 12 -day high because Solana loses liquidity

Ethereum Price reached a 12 -day summit of $ 2,849.50 this week, while Solana lost $ 772 million in liquidity. The two competitors were shoulder to shoulder in terms of metrics Dex since the launch of Pump.fun, a launch of the memes piece on Solana.

This week, the controversy of the Balana and Melania had a negative impact on the Mesmes tokens category on Solana and has erased millions of market capitalization of the chain. After months of underperformance compared to the largest cryptocurrency, Ethereum has shown signs of recovery and probability of a rally this week, according to data from the derivative market.

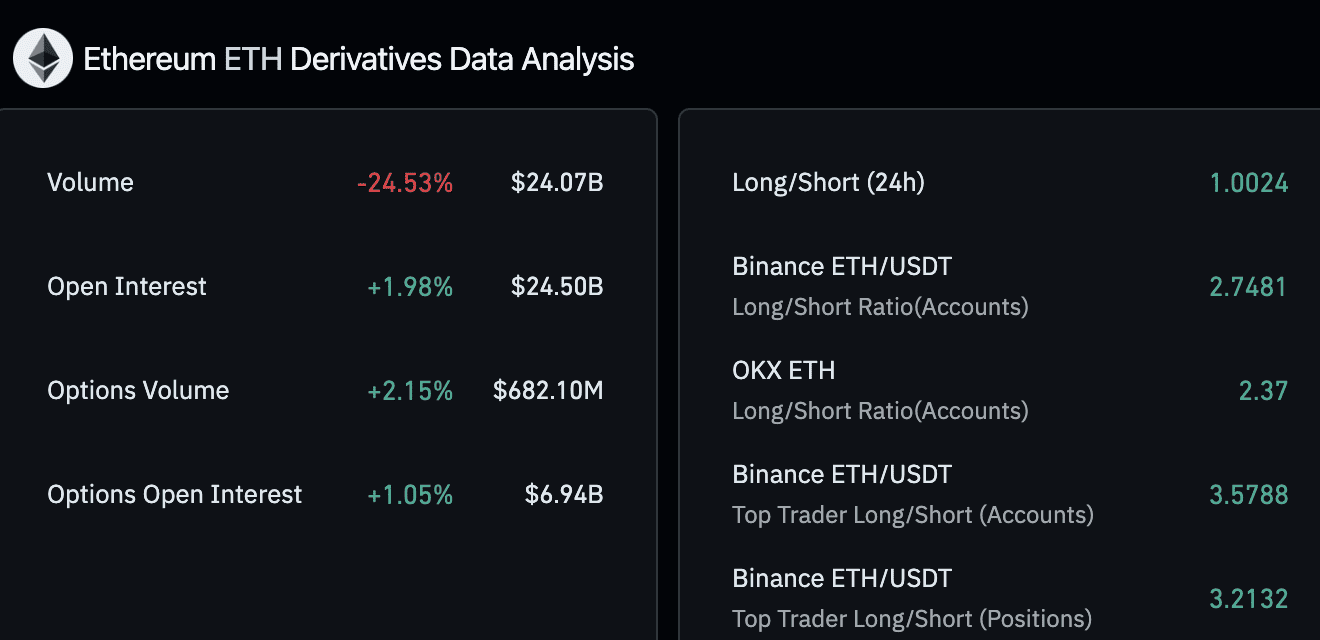

The 24 -hour / short ratio between the discussion of derivatives exceeds 1, on the basis of quince data. Derivative merchants are optimistic about ether and expect Altcoin prices to increase in the Binance and OKX markets.

Ethereum derivative data analysis | Source: Coringlass

While the funds negotiated in exchange for Bitcoin (ETF) have maintained their advance on the market, the data show that the ETHEREUM ETHEREM have recorded an increase in institutional adoption. In “The Institutional Crypto Newsletter”, Coin Stack notes that the institutional property of the Ether has increased QOQ and that the overall property of the Ether Ether rose from 4.8% to 14.5%.

The latest deposits 13F show that ETHEREUM ETHERE has also observed an increase in institutions’ demand.

The institutional property of ETH ETH has increased the Qoq, while the FNB BTC remained the same:

– ETH ETFS Global institutional property:

– Q3: 4.8%

– Q4: 14.5%– BTC ETFS Global institutional property:

– Q3: 22.3%

– Q4: 21.5%– Juan Leon (@ singularity7x) February 14, 2025

With the emergence of layer 2 protocols on the Bitcoin blockchain, BTC has joined the race to absorb liquidity and DEFI demand. While Defi was synonymous with Ethereum and its network of intelligent contracts for years, the emergence of layer 2 chains which tries to scale and tackle the low speed of transactions on the blockchain Ethereum could see the creation of a similar ecosystem on the BTC channel.

Expert comments on coins’ developments, Bitcoin and Ethereum DEFI RACE

Dom Harz, co-founder of Bob (“Build on Bitcoin”), spoke of coins and controversies that made the headlines this week. Harz said,

“We cannot deny the wide appeal of coins, but after a few high-level problems, maybe the frenzy of the same may have started to cool a little. The accusation of rug-shit this week surrounding the Argentine president, the $ javier Milei’s $ balance token, as well as previous controversies like $ Trump by Donald Trump, $ Melania and $ Barron and Hawk Tuah Girl’s $ Hawk, may have be made of serious damage to the same Bullrun.

While same will always be relevant for a section of the community, their domination in media stories and the attention of investors argue. This had a direct training effect on Solana, as we see with the reduction in the liquidity of the chain. »»

Ethereum’s price trend remains a cause of concern among traders expecting better performance of this Altcoin cycle. Bitcoin layer 2 chains and protocols DEFI on the chain could still intensify competition for liquidity and value captured by the two chains.

Harz said:

“… Despite disappointing performances in this bull race, Ethereum has maintained its reputation as a reference chain for manufacturers; Because manufacturers, like investors, follow the opportunity. With the upgrading of Pectra on the horizon, developers and investors can see the same era end and refocus on Ethereum.

However, the real change in the crypto does not concern Solana or Ethereum – it is Bitcoin. With innovations like Bitvm and Bitcoin Defi accelerating in 2025, the long-standing hypothesis that investors need to look beyond Bitcoin opportunities for opportunities. The most exciting developments in space are currently occurring on Bitcoin, and this trend will only intensify because more manufacturers, investors and institutions flock to a safest and precious asset of crypto. »»