- Bitcoin Bear Market could start if BTC breaks below key support levels.

- The BTC bouncing from $ 94,000 to $ 96,200, volatility is high.

Bitcoin (BTC) briefly plunges under $ 94,000 before rebounding $ 97,200, volatility remains high.

In this climate, a potential risk of the Bitcoin Bitcoin market persists if the key investor groups are currently seated on unpaid profits, are starting to sell.

Key levels to monitor

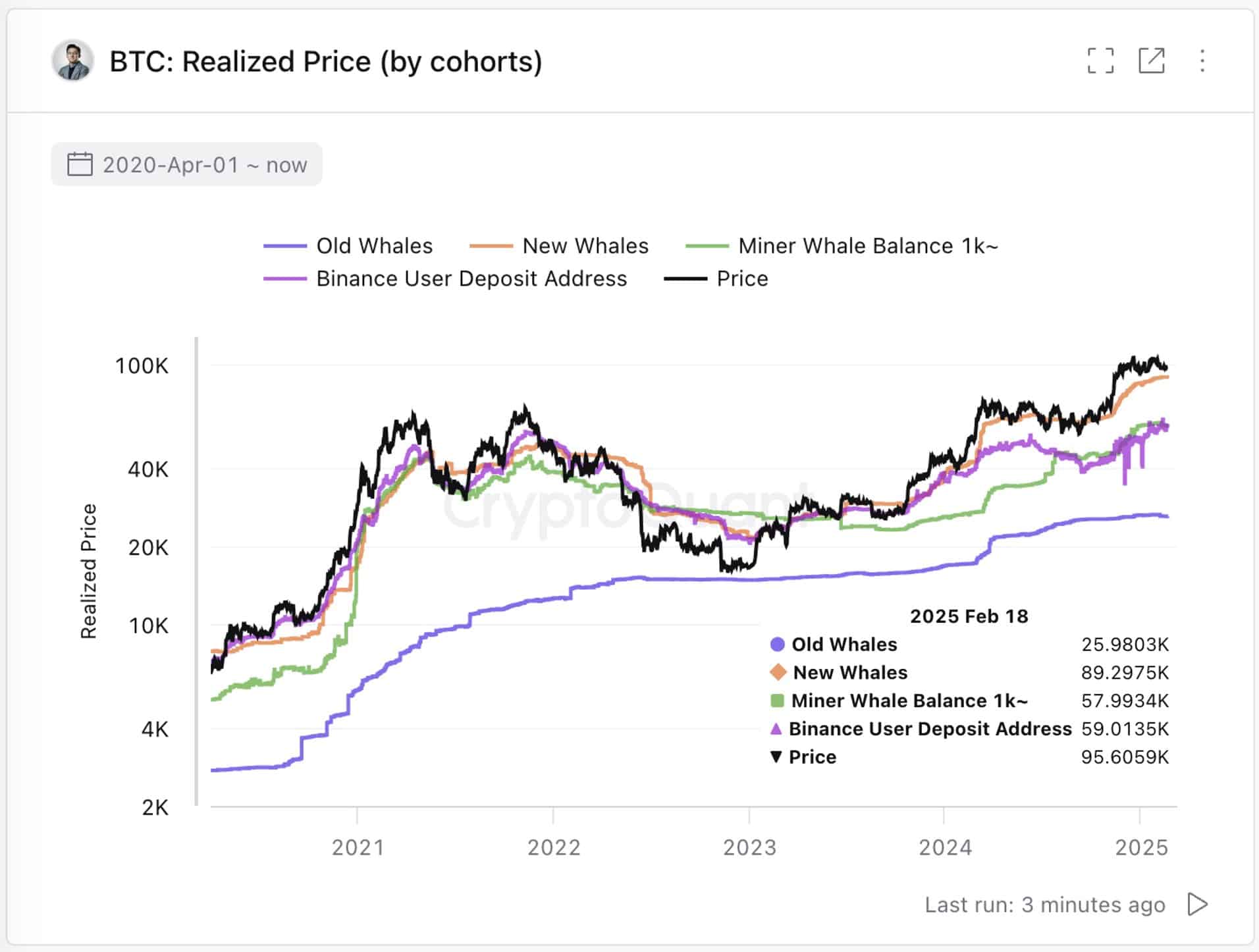

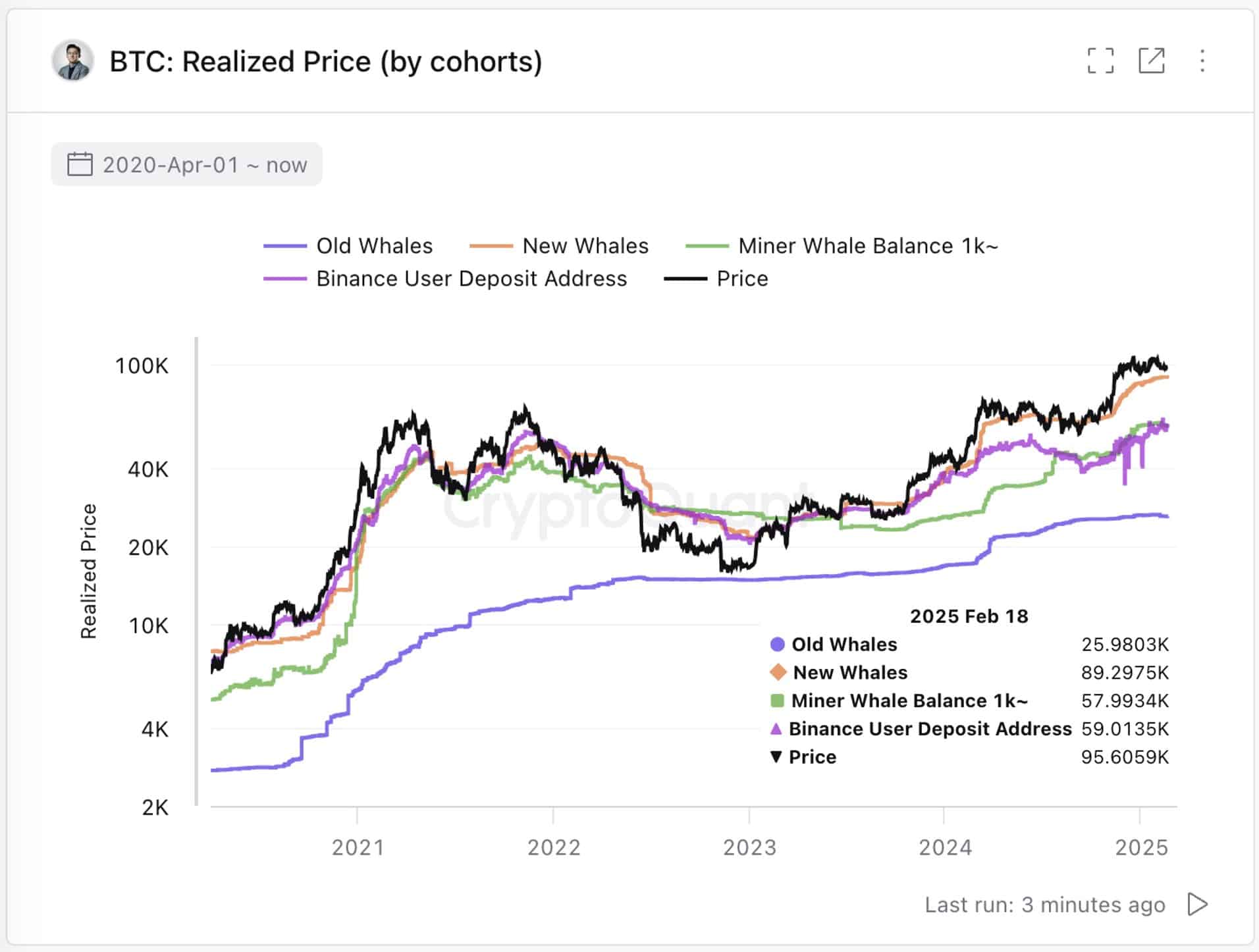

If the BTC loses momentum, a drop below $ 89,300 could trigger profits from short -term holders (more than 1,000 BTC, detained <155 days) whales, increasing the sale pressure.

However, the key level to be monitored remains $ 58,000 – the price made from minor whales (portfolios of mining companies which contain more than 1,000 BTC).

Source: cryptocurrency

Historically, the rupture below this brand has confirmed the cycles of the Bitcoins market, making it a long -term critical support.

While BTC has a safety margin for the moment, sustained volatility could test these levels. Holding above them is crucial to maintain the structure of the bullish market.

Will bulls prevent a Bitcoin market?

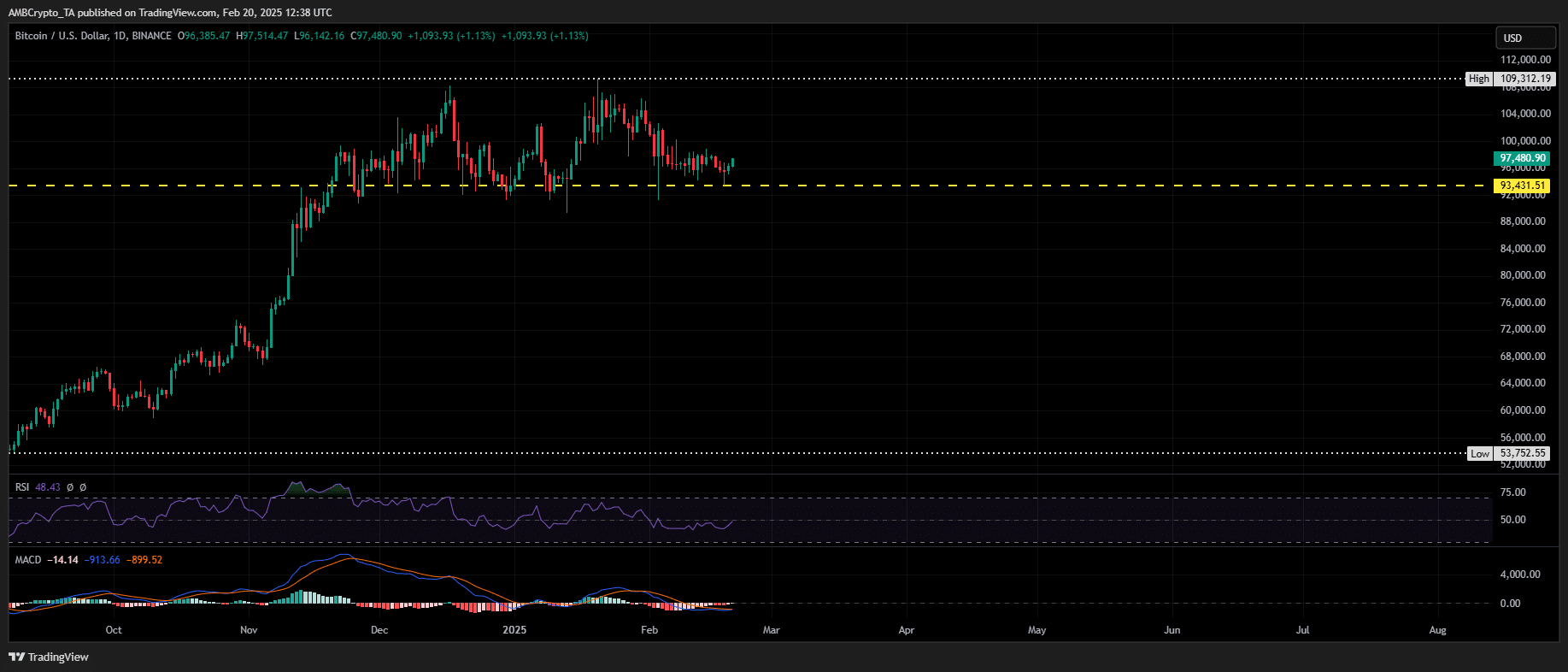

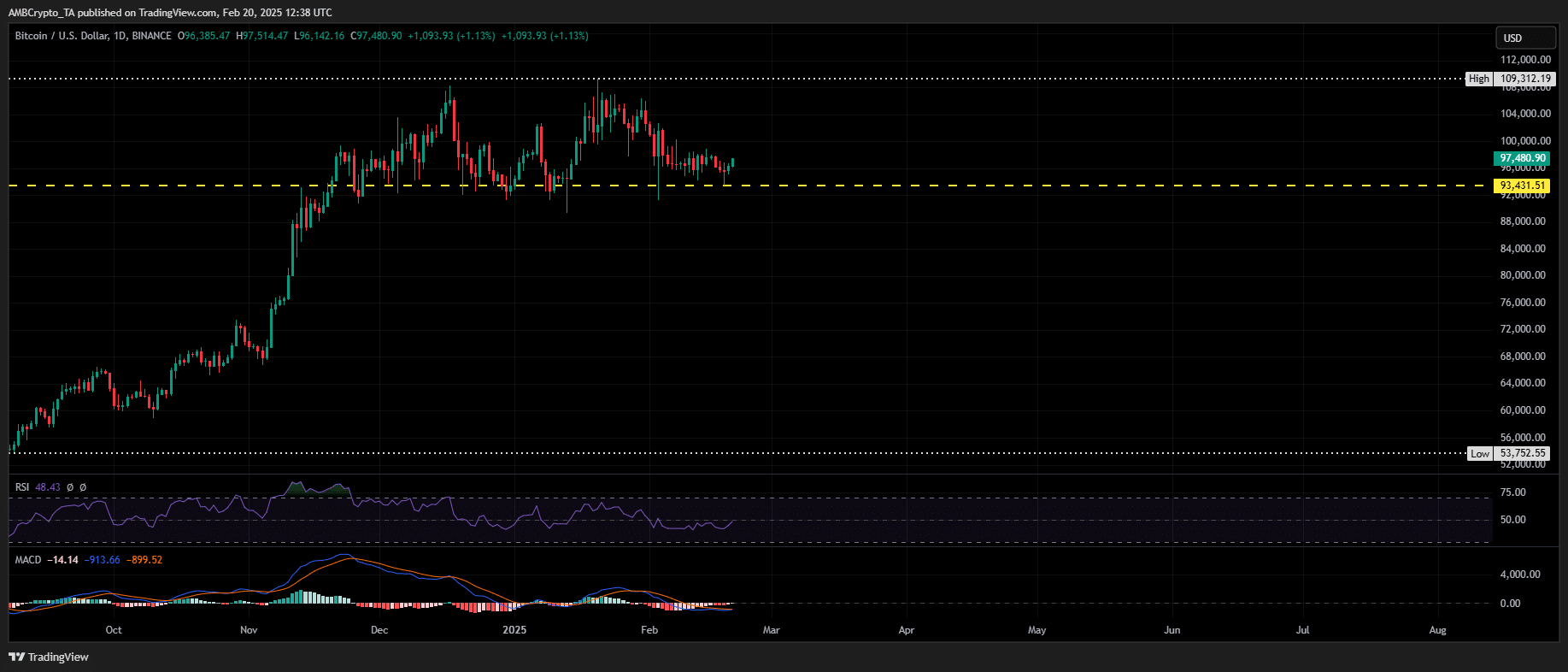

Despite a Macro Bellicine backdrop in the United States, bulls have avoided a Bitcoin Bear market by defending the level of $ 90,000 for more than a month, reporting high demand.

Source: tradingView (BTC / USDT)

However, prolonged consolidation near the resistance suggests a potential liquidity trap.

If the BTC violates $ 99,000 without high demand for a point, Long leverages positions could close, triggering liquidation waterfalls.

A drop at $ 90,000 would then be a key test. The loss of this level could push the BTC to $ 89,300, where STH whales can start to unload, increasing the pressure downwards.

Although a Bitcoin market is not confirmed, low FNB entries, the discoloration of the FOMO and the activity of the downward network could trigger a net reversal, annihilating billions of leverage.