Yesterday, Bitcoin (BTC) surged more than 6% after Federal Reserve Chairman Jerome Powell announced a policy adjustment and a possible 25 basis point rate cut at the upcoming policy meeting on September 18. This unexpected news has fueled Bitcoin’s recent volatility, with prices fluctuating unpredictably over the past few weeks.

Related Readings

Crucial on-chain data from CryptoQuant brings a glimmer of optimism. According to the data, traders are positioning for further price appreciation.

As the market digests the Fed’s new stance, all eyes are on Bitcoin to see if this could mark the start of a new bullish phase.

Bitcoin Data Shows Market Optimism

Bitcoin is trading above $63,000 and gaining momentum as it prepares to break the critical $65,000 mark.

CryptoQuant’s on-chain data reveals growing market optimism, highlighting a significant trend that could drive prices higher. Specifically, Bitcoin Exchange Reserves Centralized exchanges have dropped to an all-time low. Since late July, the supply of BTC on exchanges has dropped from over 2.75 million to around 2.67 million, which is a 3% drop in just 30 days.

This decline indicates that fewer BTC are available for trading on exchanges, which could create a supply shock, a situation in which demand exceeds supply, leading to a potential price spike. As Bitcoin availability on exchanges decreases, the likelihood of a price increase increases.

As Bitcoin begins to gain strength, the market is closely monitoring this trend, potentially pushing Bitcoin into new bullish territory.

BTC Price Evolution: $65,000. What Next?

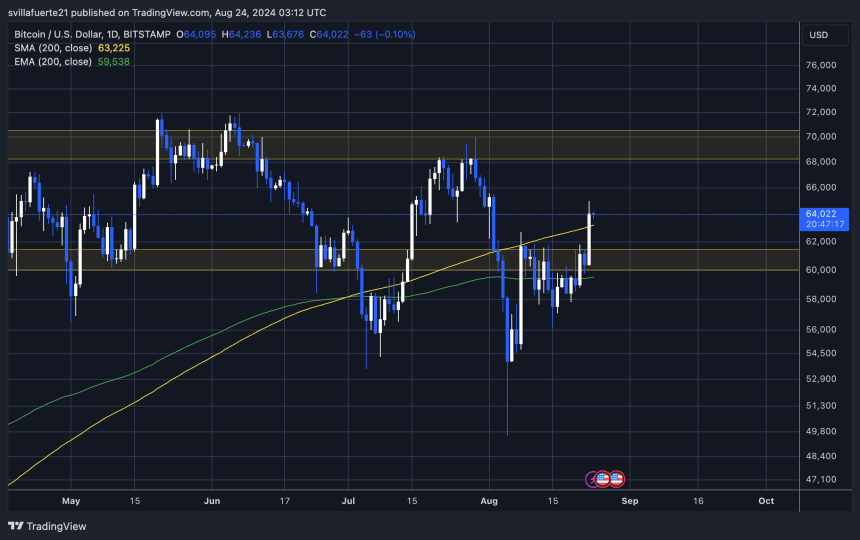

After two weeks of volatility and consolidation, Bitcoin is currently trading at $64,100 at the time of writing, holding above the crucial daily level of $200. Moving Average (MA).

This level is essential for the bulls to sustain the uptrend in a longer time frame. For the price to break above $65,000, it needs to confirm its bullish structure by holding above the $57,500 level. Ideally, it is best to stay above the daily 200 exponential moving average (EMA), which is located at $59,538.

These levels are essential to establish continued bullish momentum. Holding above these levels would signal market strength, boosting confidence among traders and investors. Data on Bitcoin’s declining exchange reserves and the central bank’s policy announcement have been met with optimism. Investors are increasingly expecting a Bitcoin rally in the coming months, fueled by these bullish indicators.

Cover image by Dall-E, chart by TradingView.