Bitcoin price recorded another positive performance over the past seven days, looking to end the month and start October on even stronger footing. Continuing its resurgence over the past few weeks, the top cryptocurrency surged as high as $66,000 on Friday, September 27.

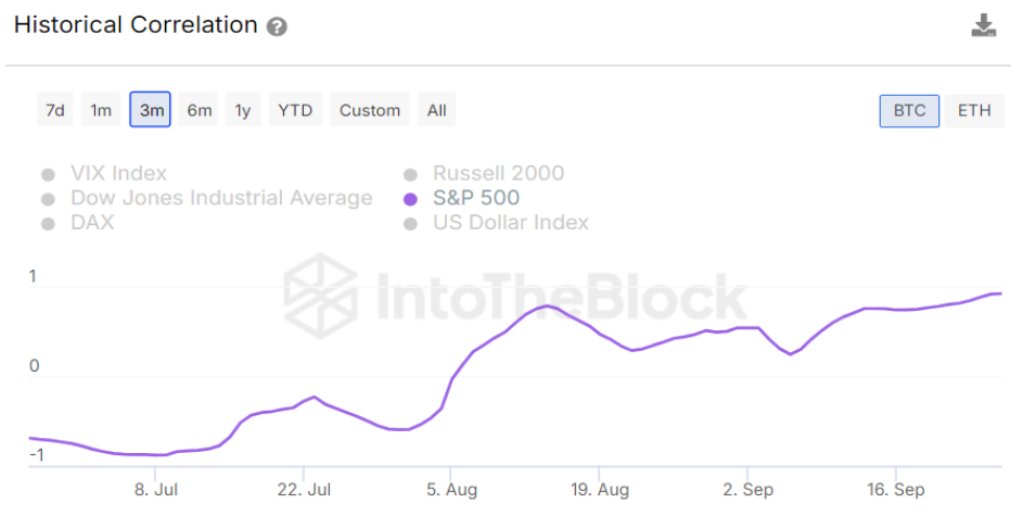

Recent data shows there may be a growing correlation between the performance of the US stock market and the value of the world’s largest cryptocurrency. The question here is: how might this influence investor behavior?

How Did Bitcoin and S&P 500 Perform in September?

In a recent article on Platform two years. For clarity, the S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States.

The price of Bitcoin recorded a surprisingly positive performance in September, a historically bearish month for the flagship cryptocurrency. According to data from CoinGecko, the value of BTC has increased by more than 11% over the past month.

Source: IntoTheBlock/X

At the same time, the S&P 500 index saw a rapid and strong recovery, reaching a new all-time high after an initial decline earlier this month. Data from TradingView shows the index is up almost 4% in September.

The relationship between the stock market and the cryptocurrency market has always been intriguing, as investors seek to take advantage of opportunities offered by either market. However, a high correlation between these two asset classes is believed to reduce the diversification opportunities they offer to investors.

At the time of writing, the Bitcoin price stands at around $66,024, reflecting an increase of just 1.1% over the past 24 hours. Meanwhile, the S&P 500 index continues to hover around 5.8K, up 0.4% over the past day.

Global liquidity increases by $1.426 trillion in one week

Popular crypto expert Ali Martinez took to Platform X to share that there has been a notable increase in the volume of capital in global financial markets. Data provided by Martinez shows that global liquidity jumped by $1.426 trillion last week.

Global liquidity jumped by $1.426 billion this week, reaching $131.6 trillion. #Bitcoin and other risky assets are rising, although this increase in liquidity could last until October. pic.twitter.com/PtFDjkR7wU

– Ali (@ali_charts) September 27, 2024

Bitcoin and other risky assets have been the main beneficiaries of the increase in global liquidity, as their value has increased due to the increased inflow of capital. Martinez also noted that this liquidity boost could extend into October.

The price of BTC breaks above $66,000 on the daily timeframe | Source: BTCUSDT chart from TradingView

Featured image from iStock, chart from TradingView