Data shows that Bitcoin market sentiment almost turned into extreme greed as the price of the cryptocurrency hit the $68,000 mark.

The Bitcoin Fear & Greed Index is currently in the greed region

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment among traders in the Bitcoin and broader cryptocurrency markets. This index uses data from the following five factors to determine sentiment: trading volume, volatility, social media sentiment, market cap dominance and Google Trends. Once found, it represents market mentality as a score between 0 and 100.

When the metric has a value above 53, it means that traders as a whole currently share a sense of greed. On the other hand, being below 47 implies the dominance of fear in the market. The territory in between is a neutral mentality on the net.

Besides these three main feeling zones, there are also two special regions called extreme fear and extreme greed. The former occurs at ages 25 and younger, while the latter occurs at ages 75 and older.

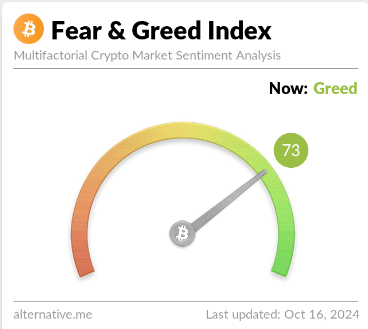

Now, this is what the latest value of the Bitcoin Fear & Greed Index looks like:

As seen above, the indicator has a value of 73, which suggests that investors are currently showing great greed. This is a notable change from the market sentiment last week, when the index fell into the fear zone.

The chart below shows how the value of the Bitcoin Fear & Greed Index has changed over the past year:

The chart shows that this latest rise in sentiment, resulting from the asset’s rally to $68,000, brought the index to its highest value since late July. At the time, high sentiment values led to a high for the cryptocurrency. This type of pattern is something that has been observed throughout history.

It turns out that Bitcoin tends to move in the opposite direction than the crowd expects and the likelihood of such a contrary move increases the more traders lean to one side.

In extreme regions, this probability is strongest, so ups and downs often form when investors share these sentiments. The current value of the index sits just outside the extreme greed zone, so a top could become likely for the asset if investor mentality continues to improve.

It may not even be necessary for sentiment to improve further for such a scenario to play out, since the July peak occurred when the index had a reading of 74, just one unit of more than the current one.

BTC Price

At the time of writing, Bitcoin is trading at around $68,000, up more than 9% from last week.