The latest insights from Glassnode’s “Week Onchain” newsletter reveal a major shift in Bitcoin market dynamics, with long-term holders (LTHs) and large investors appearing to return to an accumulation pattern. This trend marks a departure from the extensive distribution seen earlier this year, providing a potential bullish outlook for Bitcoin, despite continued volatility in the broader market.

The Bullish Case for Bitcoin

The Bitcoin market has experienced a challenging environment in recent months, marked by significant distribution, particularly after the all-time high (ATH) reached in March 2024. This distribution phase, which saw active participation from portfolios of all sizes, is now showing signs of reversal. Of particular note is the behavior of large portfolios, often associated with institutional investors and exchange-traded funds (ETFs), which are now moving towards accumulation.

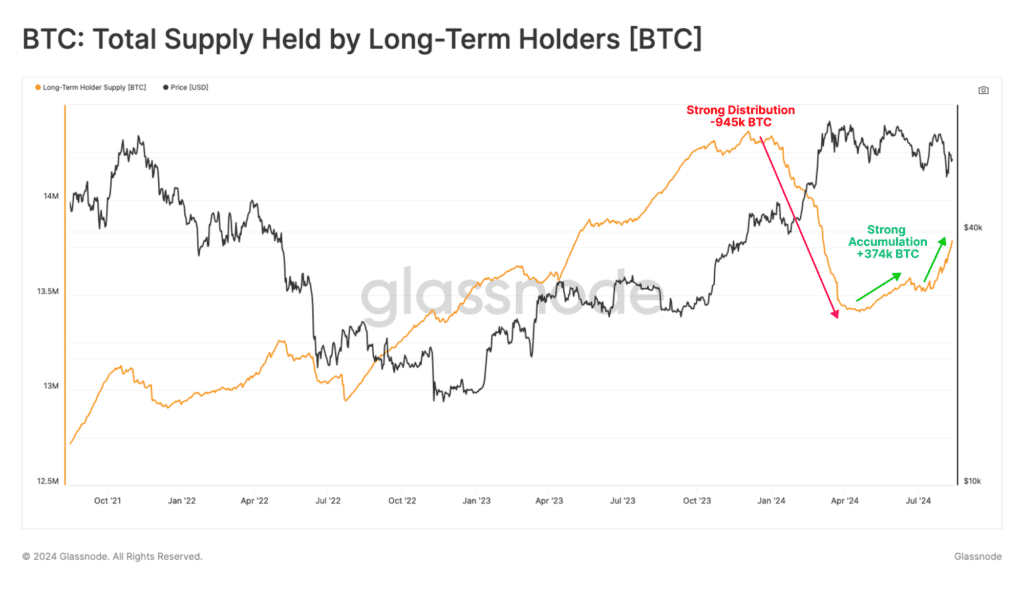

The Accumulation Trend Score (ATS), a metric that assesses changes in market-weighted balances, has reached its peak value of 1.0, signaling significant accumulation over the past month. This increase in accumulation is also reflected in the activity of long-term holders (LTH), who, after a period of significant divestment, have added approximately 374,000 BTC to their holdings over the past three months.

LTH, which plays a crucial role in the Bitcoin ecosystem, is once again expressing a strong preference for holding its coins. The 7-day evolution of LTH supply has returned to positive territory, highlighting a reduced propensity to sell and an increased focus on accumulation. Despite the aggressive distribution from April to July, Bitcoin spot price has managed to stay above the Active Investor Cost Basis, a critical threshold that delineates bullish and bearish investor sentiment.

“The market’s ability to find support near this level is indicative of underlying strength,” the report notes, “suggesting that investors generally still anticipate positive market momentum in the near to medium term.”

The bearish arguments

The market is not without its challenges. The cumulative volume delta (CVD) metric, which estimates the net balance between buying and selling pressure in cash markets, indicates persistent net selling pressure. The median spot CVD value has fluctuated between -$22 million and -$50 million over the past two years, reflecting a consistent selling bias.

Interestingly, the adjusted variant of the CVD measure, which accounts for this bias, has shown potential confluence with the recent failure to break above the $70,000 resistance level. This suggests that weak spot demand has contributed to this technical resistance, but a recovery in demand could be signaled if the adjusted CVD returns to positive values.

The continued accumulation of LTH, despite volatile price action, indicates a resilient and patient holder base. The percentage of Bitcoin network wealth held by LTH remains elevated compared to previous ATH breaks, indicating that these investors are unwilling to sell at current prices and may be waiting for higher levels before increasing their distribution.

The LTH sell-side risk ratio, a metric that measures realized profits and losses relative to the market’s realized market capitalization, remains lower than in previous cycles. This suggests that profit-taking by LTHs is relatively limited, further implying that these holders are not yet inclined to liquidate their positions.

The return to accumulation by Bitcoin holders, especially LTH, is a potentially bullish indicator for the market. The combination of resilient holder behavior, high network wealth held by long-term investors, and a strategic focus on accumulation despite recent market volatility indicates strong underlying conviction among investors. These developments could pave the way for significant upside in Bitcoin.

At press time, BTC was trading at $59,138.

Featured image created with DALL.E, chart from TradingView.com