On-chain data shows that Bitcoin has been moving from other exchanges to Coinbase. Here’s what that has historically meant for the asset.

Bitcoin Coinbase Flow Pulse Recently Returned to Green

As CryptoQuant author Axel Adler Jr. explains in a new article on X, Coinbase has recently resumed its flows from other exchanges. The relevant metric here is the “Coinbase Flow Pulse,” which tracks the net amount of Bitcoin flowing between Coinbase and other cryptocurrency exchanges.

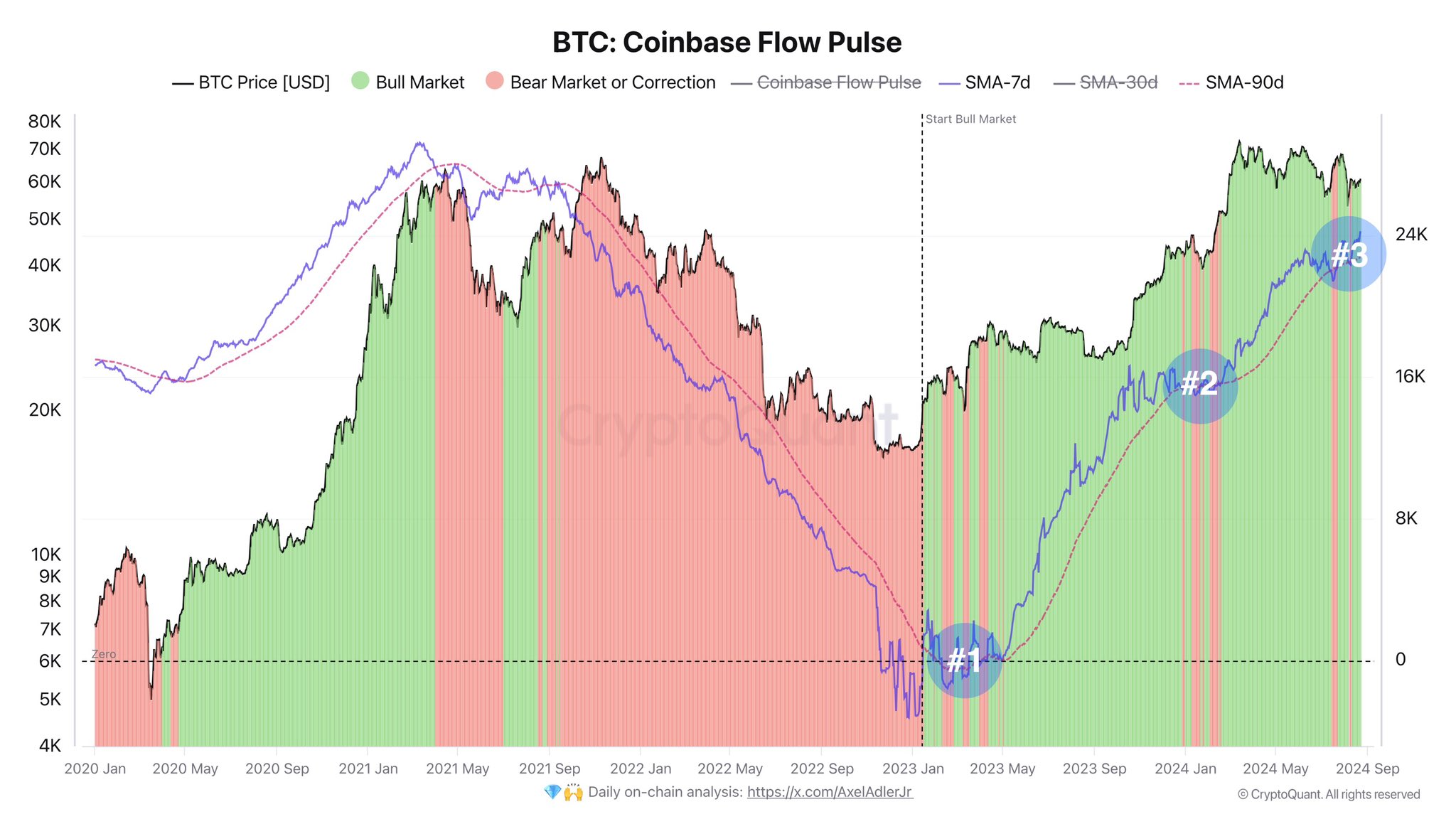

Below is the chart shared by the analyst that shows the trend of the 7-day moving average (MA) of this indicator over the past few years.

Looks like the value of the metric has been heading up in recent days | Source: @AxelAdlerJr on X

As the chart shows, the Bitcoin Coinbase Flow Pulse has been positive since mid-2023, meaning that Coinbase has received net inflows from other centralized exchanges.

However, the indicator’s trend around its 90-day moving average is more relevant, as shown in the same chart. The analyst defined two zones for BTC based on the position of the 7-day moving average relative to this long-term moving average.

When the 7-day moving average crosses below the 90-day moving average, BTC is likely to exhibit bearish action, which is why periods like this are classified as a “bear market or correction” (highlighted in red). Similarly, the measurement above this line implies a “bull market” (green).

From the chart, it is evident that the 7-day moving average of the Coinbase Flow Pulse had fallen below the 90-day moving average just earlier, but now the two have crossed, implying that demand to transfer coins to Coinbase has picked up.

The last time this pattern formed for the cryptocurrency was just before the rally to the new all-time high (ATH). So, this signal may also be bullish for the price this time around.

As for why Coinbase might be relevant in this way for the asset, the answer may lie in the fact that the platform is the known destination for US institutional entities. As such, a flow of coins from other exchanges to Coinbase could imply demand from these US-based whales.

While the market outlook looks positive from the Coinbase Flow Pulse perspective, another indicator from on-chain analytics firm CryptoQuant might not be as bright.

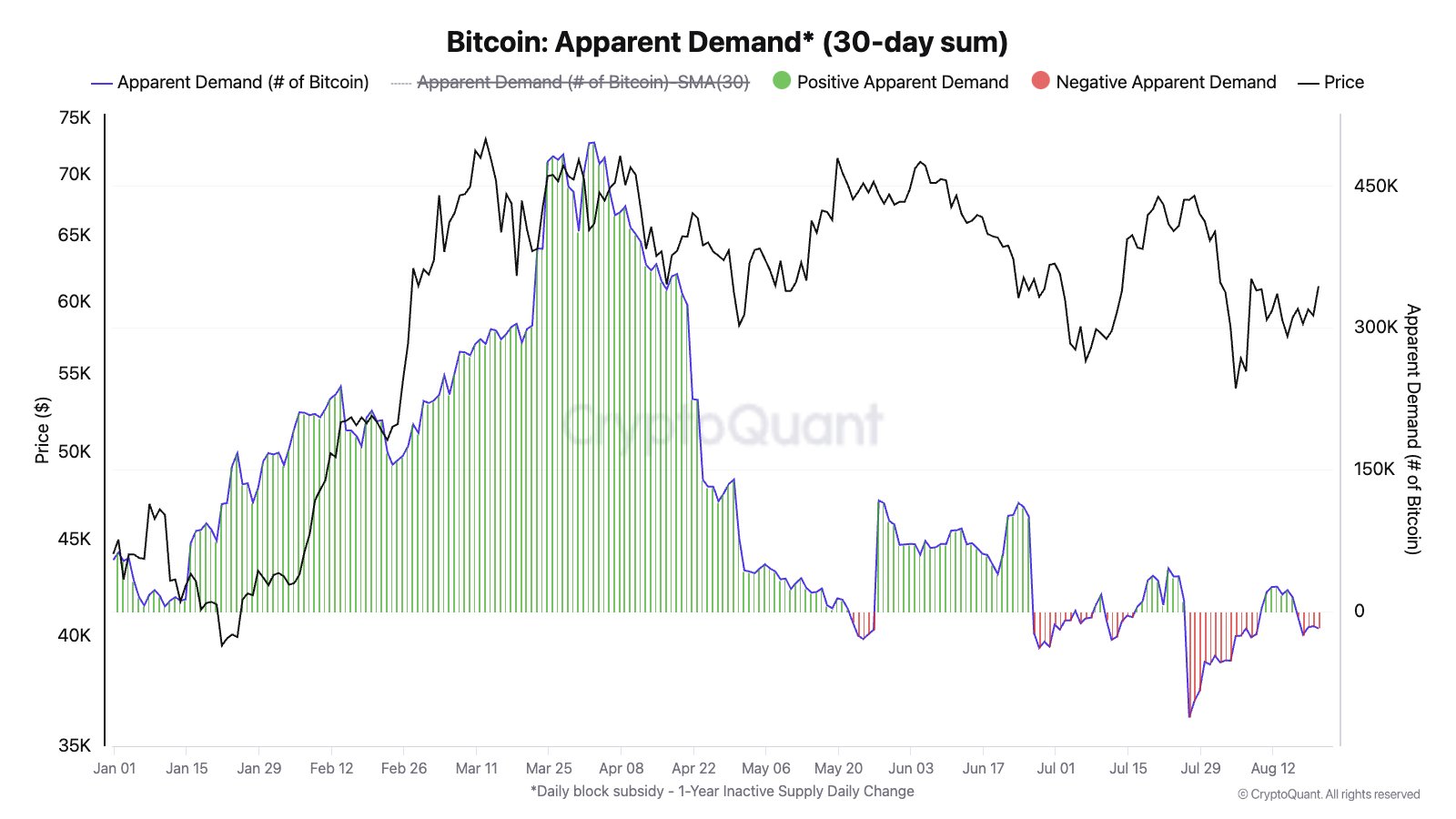

As Julio Moreno, head of research at CryptoQuant, explained in an X article, demand for Bitcoin is still low if we consider the “apparent demand” metric, which attempts to estimate the demand present in the entire market and not just in a part of it like the Coinbase Flow Pulse.

The value of the metric appears to have been neutral recently | Source: @jjcmoreno on X

While demand for Bitcoin was at significant levels earlier in the year, it appears to have fallen sharply after the long consolidation streak, as apparent demand is currently at more or less neutral values.

BTC Price

At the time of writing, Bitcoin is trading at around $61,000, up more than 5% over the past week.

The price of the coin seems to be slowly making its way up | Source: BTCUSD on TradingView

Featured image by Dall-E, CryptoQuant.com, chart by TradingView.com