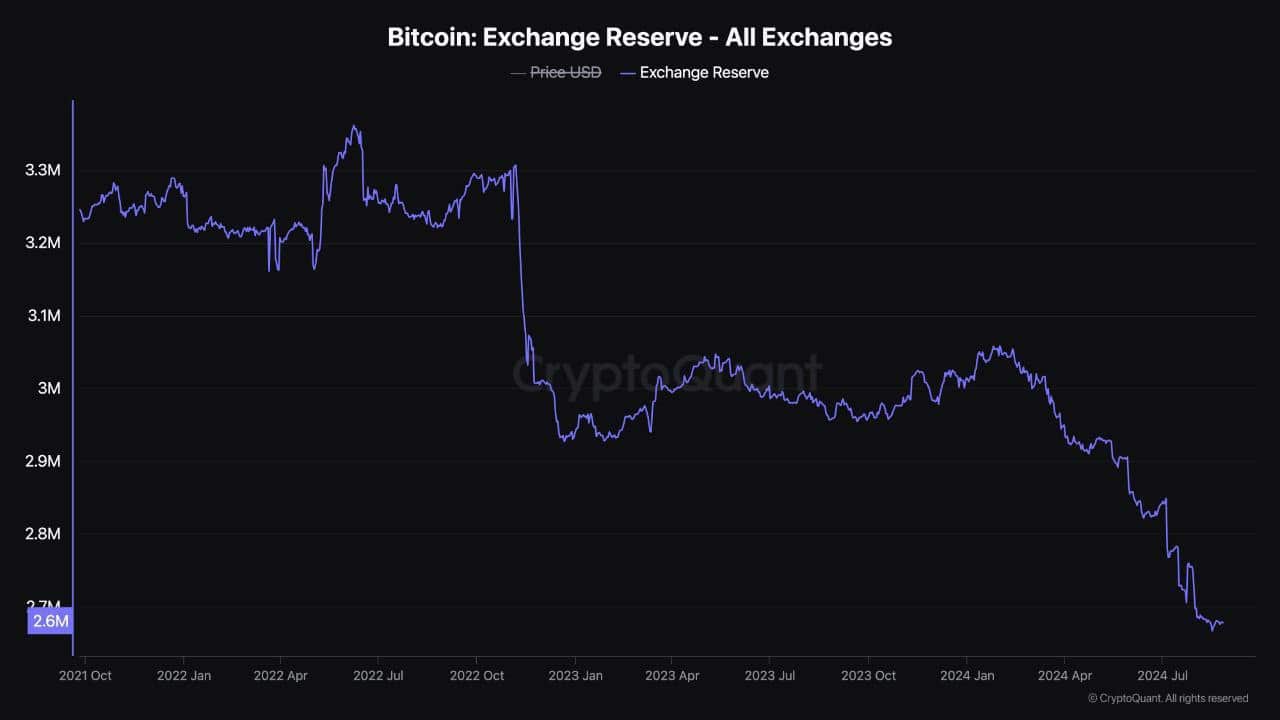

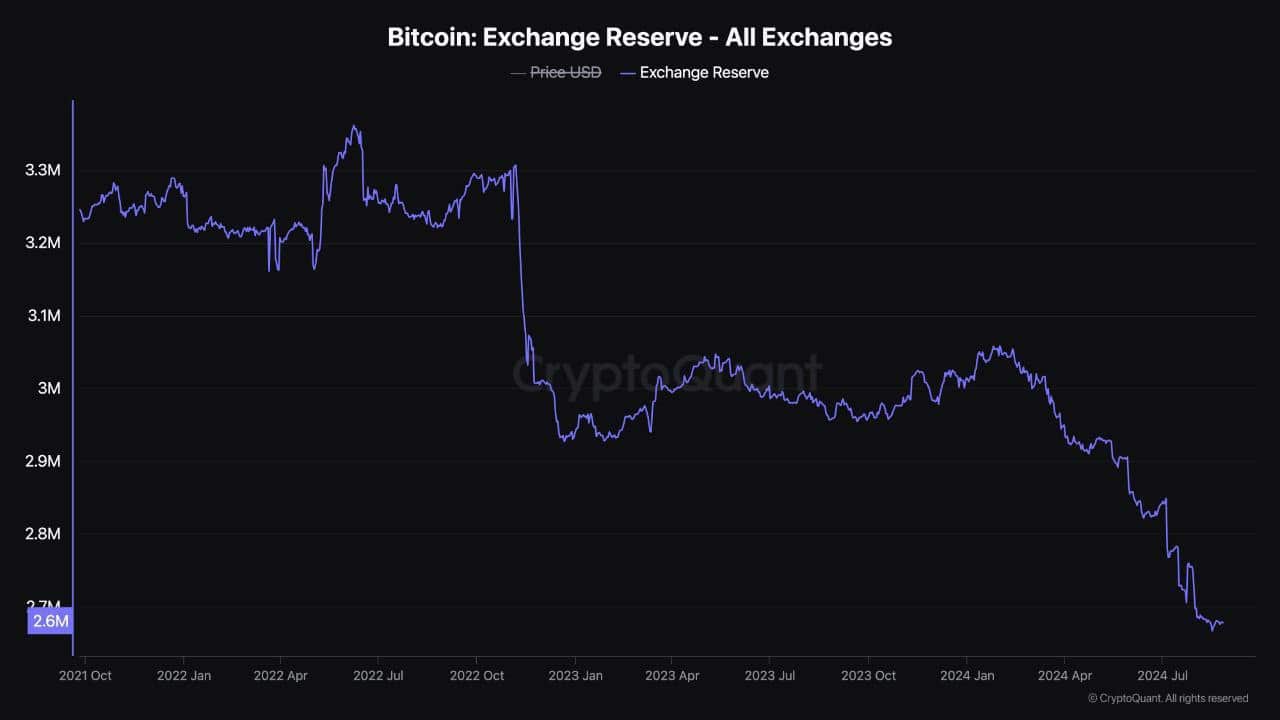

- A significant amount of Bitcoin has been removed from exchanges.

- Bitcoin showed strength as the market anticipated a bullish end to the year.

Bitcoin (BTC) continues to show resilience as the crypto market prepares for a potentially bullish final quarter of the year.

At press time, Bitcoin was trading at $64,000, following a high of $66,000 three days ago. The recent slight decline suggests a brief correction, but on-chain data shows BTC being moved from exchanges to cold wallets.

This behavior indicates that investors are accumulating BTC in anticipation of a rally, signaling increased confidence in Bitcoin’s long-term price stability.

Source: CryptoQuant

Bitcoin Reverses Bullish Support Band Every Week

Bitcoin’s move away from exchanges supports the bullish outlook, with BTC now trading above the bull market support band.

BTC fluctuated around this key level, but closed above the band for the second week in a row.

If Bitcoin maintains this momentum, it could leave the support band behind and trigger a larger upward move that could potentially break the ATHs.

Source: TradingView

Historically, Bitcoin’s strongest fourth quarters have followed a bullish September. In 2024, it has already gained more than 8% in September.

This sets the stage for a potential rise to new highs in November, as predicted by AMBCrypto.

This performance strengthens the case for a bullish outlook, with BTC likely to rise even further in the coming weeks.

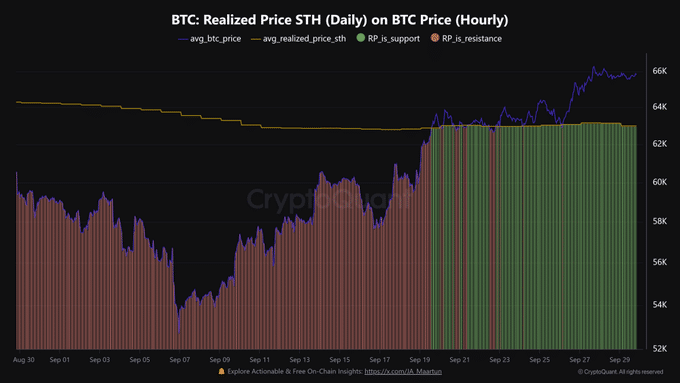

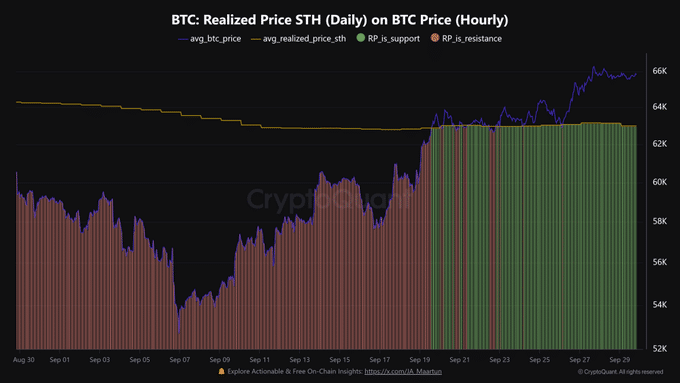

Short-term holders regain their profits

Bitcoin’s recent price action has also allowed short-term holders to return to profits. These investors, who have moved their BTC over the past 155 days, are now seeing gains as the price trades above the $63,000 level.

This price level should act as a support level, potentially pushing BTC higher.

The renewed profitability for short-term holders aligns with the broader trend of Bitcoin leaving exchanges, further strengthening the bullish outlook.

Source: CryptoQuant

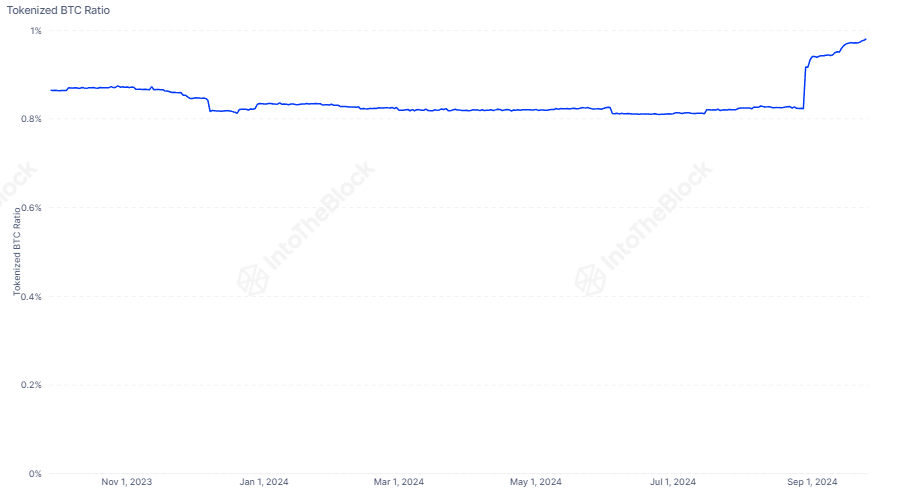

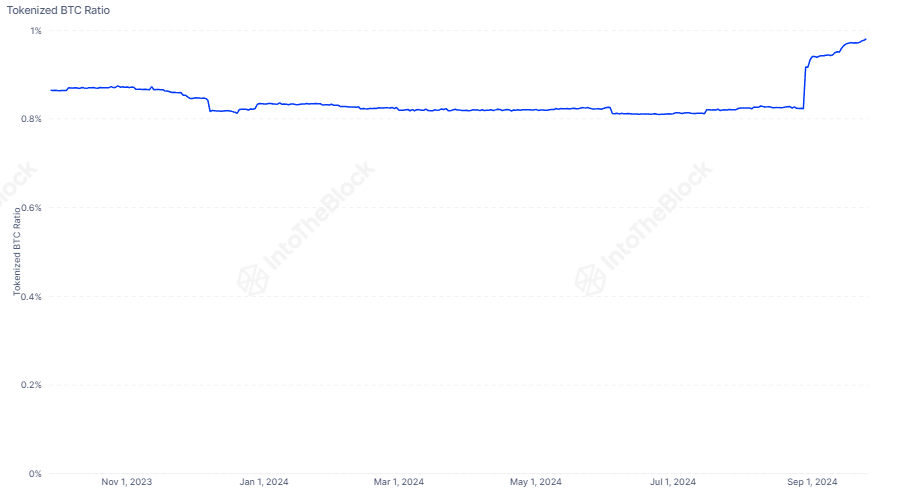

Bitcoin Locked in DeFi

Another factor supporting Bitcoin’s bullish momentum is the growing demand for BTC in decentralized finance (DeFi). Currently, 1% of the total Bitcoin supply is locked in DeFi protocols.

This trend is driven by the growing demand for Bitcoin-based yield and the launch of Coinbase’s new Bitcoin-related token, cbBTC.

As more Bitcoin is locked in DeFi, its scarcity in spot markets increases, which could drive the price higher.

The reduced availability of BTC on exchanges, combined with its growing use in DeFi, creates an environment in which Bitcoin could see significant price increases in the coming months.

Source: In the block

These developments add confidence in the bullish outlook as markets head into the final quarter of the year.

Read Bitcoin (BTC) Price Forecast 2024-2025

Bitcoin’s current strength, increased accumulation, and growing demand for DeFi suggest a positive trajectory for its price.

If BTC manages to maintain these trends, it could reach new highs before the end of the year. Investors are watching closely, expecting Bitcoin to perform even higher as the market enters a historically strong quarter.