- The Bitcoin Hodlers came out of the cycle after conceding huge gains.

- Is the dawn of a “new cycle” near or are we witnessing its end?

Bitcoin (BTC) started the month of November at $ 68,000, but barely two months later, it reached a new historic summit of $ 109,000, a massive increase of 60 %.

With such gains, profits were inevitable and, in December, investors collected the amazing sum of $ 3 billion.

The market is now awaiting a recovery. Otherwise, even hold Bitcoin at $ 100,000 could become a nightmare.

FOMO or GREED: which camp will dominate?

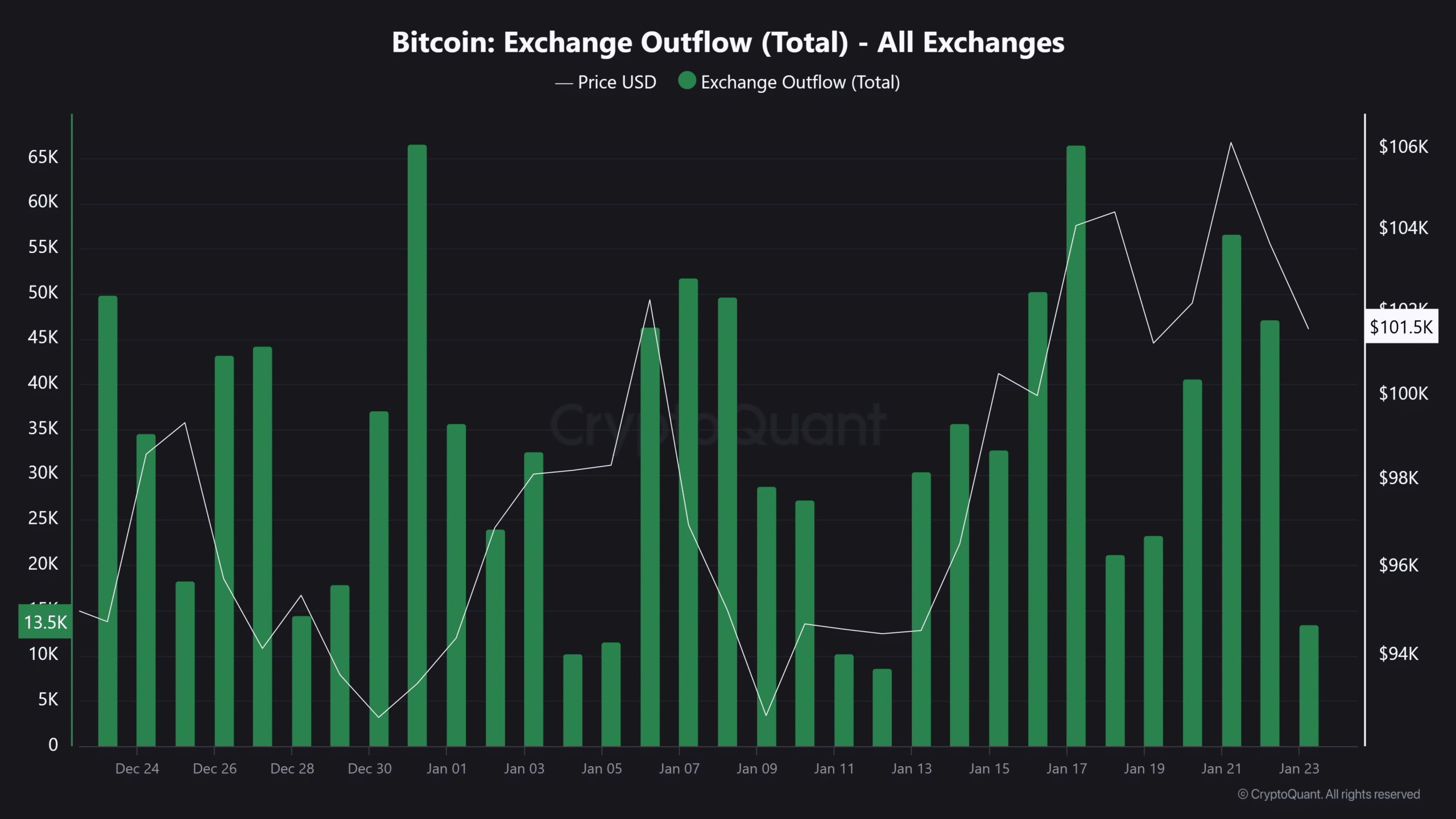

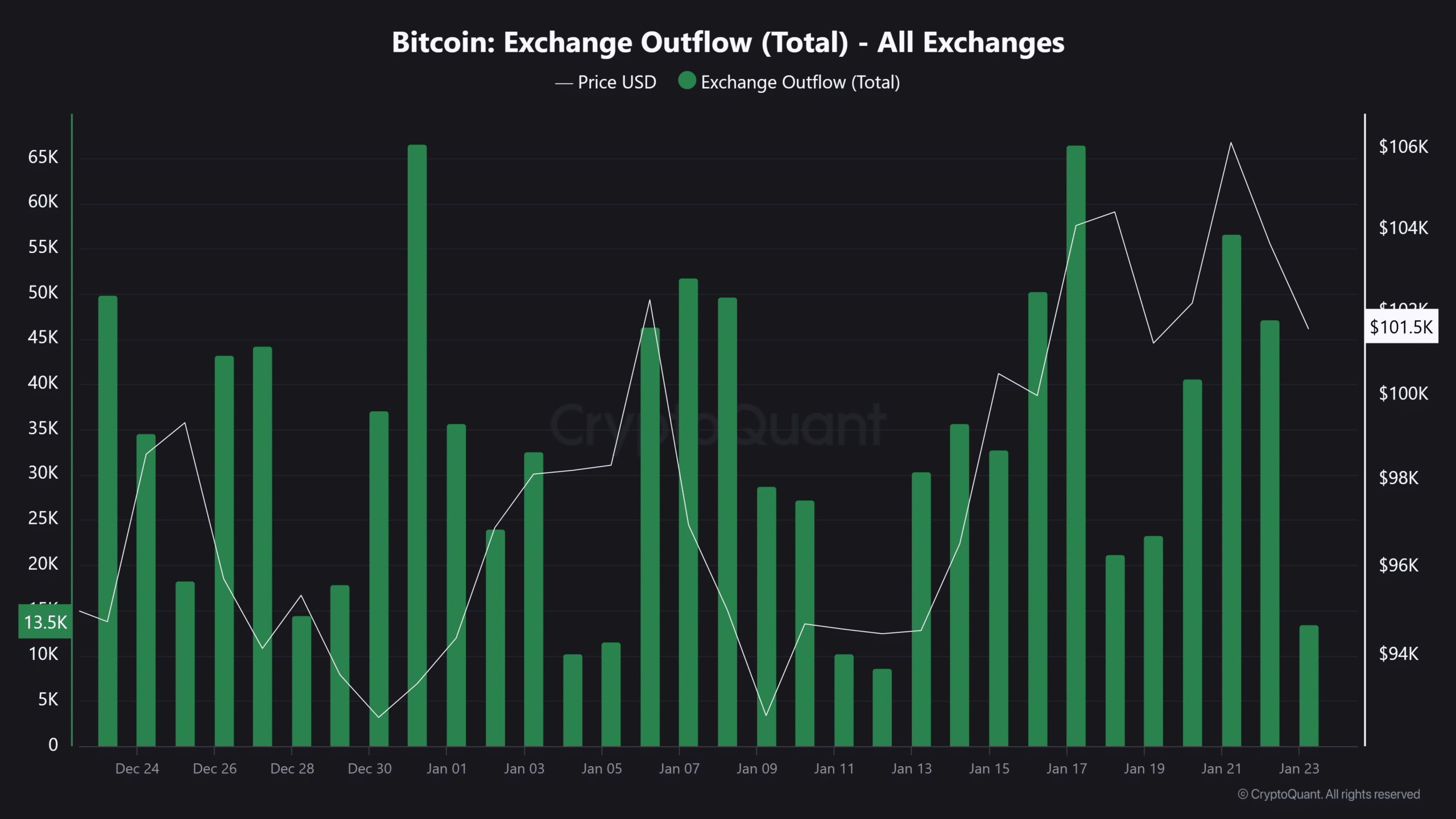

Traders take less risks on the derivative products market, where the lever ratio decreases rapidly. This shows that they do not know where the price of Bitcoin will then go. In addition, fewer and fewer people withdraw scholarships.

In fact, the currency outings experienced an astonishing fall of 16 % in a single day.

Source: crypto

Together, these factors suggest that Fomo fades. However, greed has rebounded from “extreme” levels – a bullish sign. For what? Profits could approach their peak, as indicated by a Glassnod report.

According to the report, profits are down, going from $ 4.5 billion in December to only $ 316 million today, a drop of 93 %. According to Ambcrypto, if Fomo returns as excessive greed fade, this could open the way to a significant increase in prices.

A look at the Bitcoin market

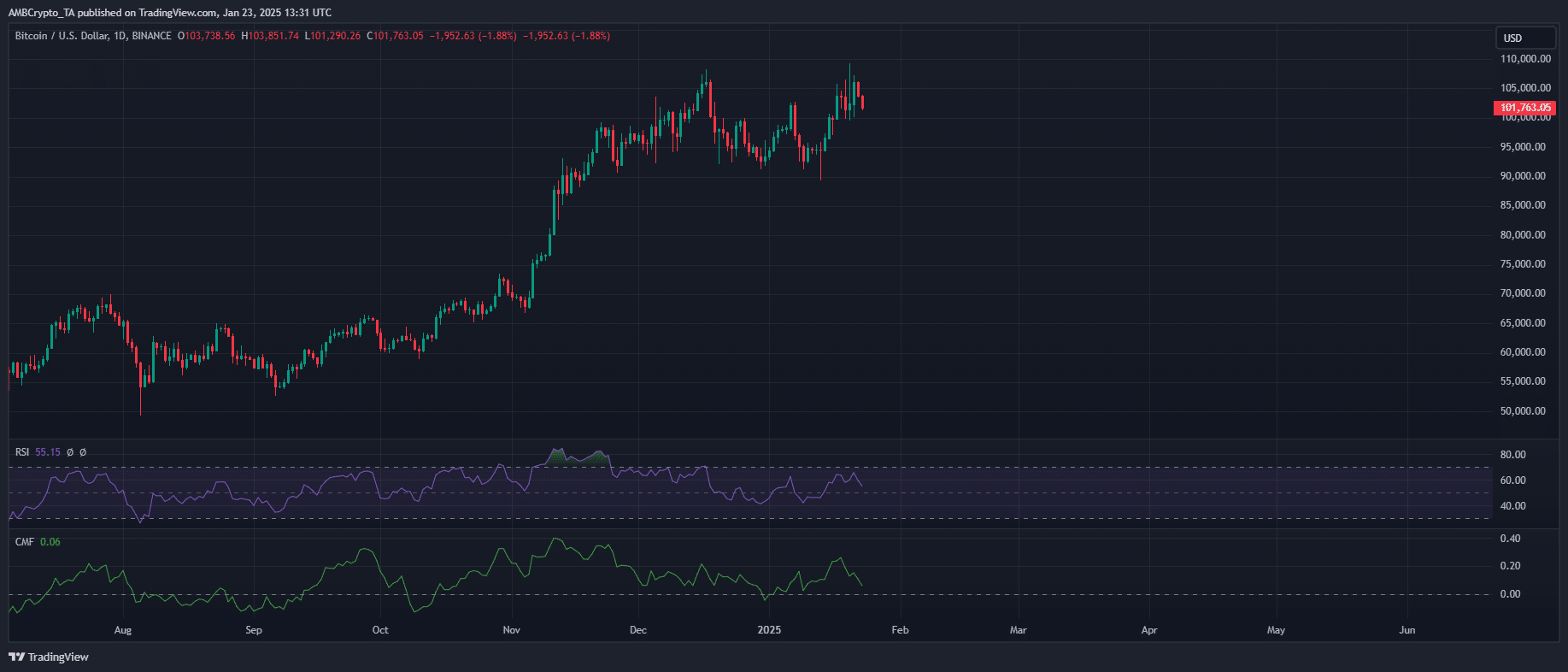

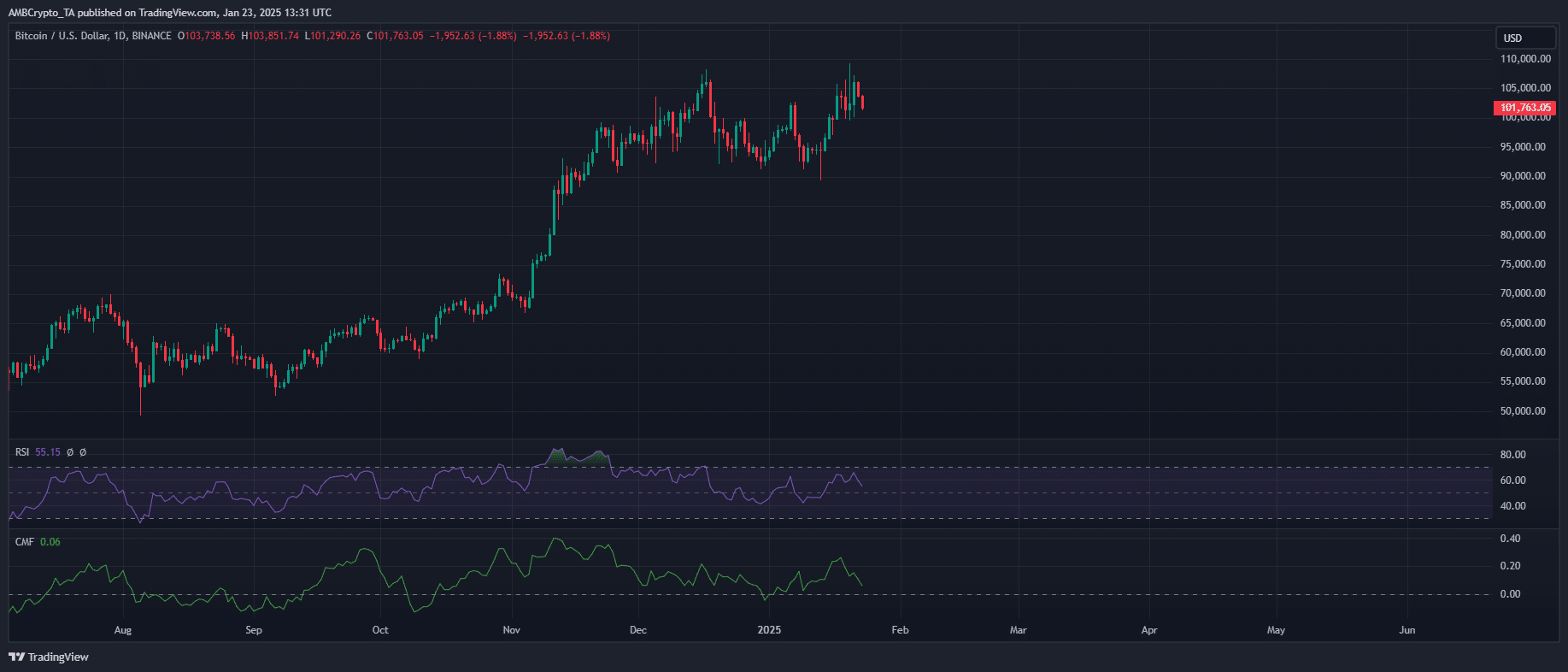

Bitcoin dropped 3.26 % in one day, but the market does not overheat. This means that strong purchases, probably supplied by FOMO, are necessary to bring the price back.

Source: tradingView

However, the next FOMC meeting may have a significant impact on the resumption of Bitcoin. Only a week from Reunion, uncertainty should persist, which would make a strong short -term rebound less likely.

It is interesting to note that this consolidation period could be a positive sign. This could allow institutions to quietly accumulate bitcoin while the market stabilizes after a period of significant profits.

The key is what the Fed does. If they lowered the rates, things might become interesting. But if they surprise us, Bitcoin could still drop.

Read the Bitcoin price forecasts (BTC) 2025-2026

For the moment, the market shows signs of life. Cupidity is back and profits are cooling. This could trigger a new purchasing frenzy, especially once the Fed dust will fall.

Keep an eye on the American economic calendar – it will determine in the end if extreme greed will take over or if the FOMO will return.