Key takeaways

- Bitcoin’s rise above $69,000 marks a new high, influencing a broad market rally.

- This rally is driven by increased institutional interest and positive regulatory developments.

Share this article

Bitcoin is back in the spotlight after surpassing $69,000 on Sunday. The latest rally sparked a broad-based rally in the crypto market, with altcoins rising over the past 24 hours.

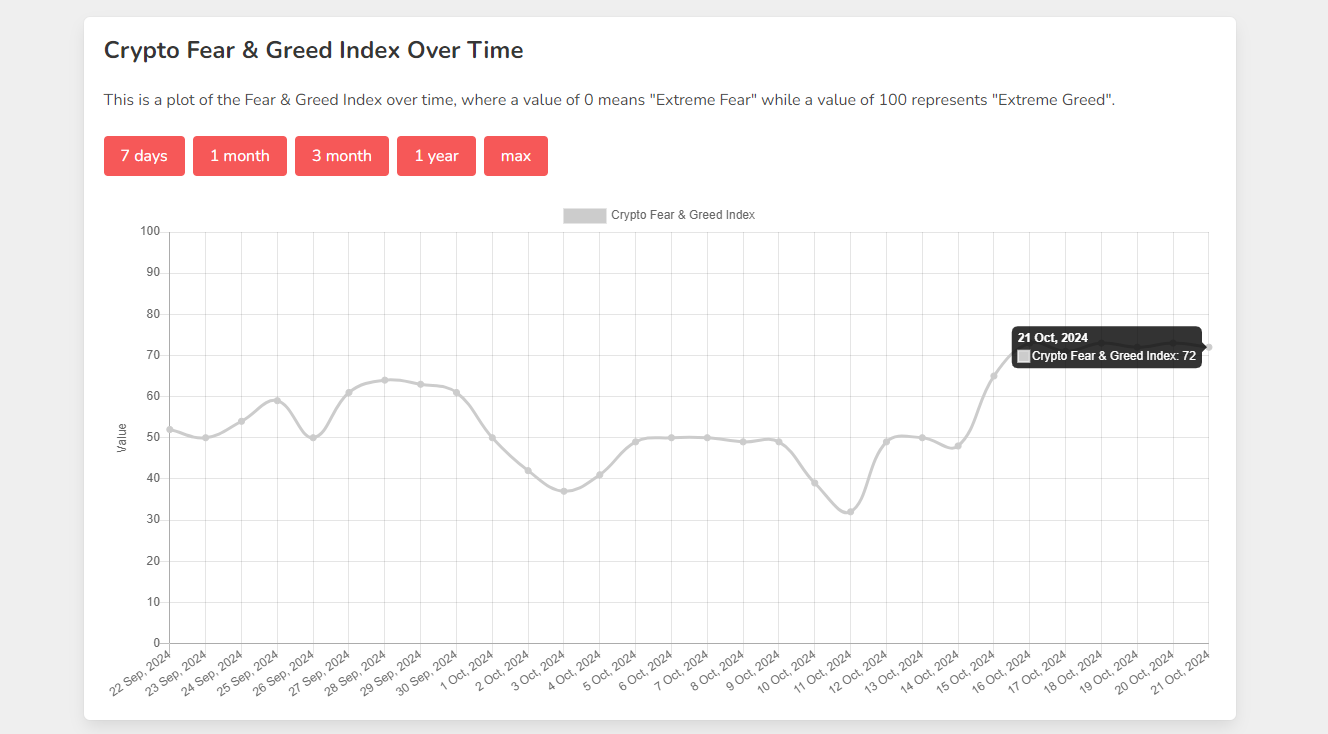

The flagship crypto rose almost 2% in a day, now trading at around $69,400, according to CoinGecko data. It appears poised to hit $70,000 amid continued optimism in the market, while the Crypto Fear & Greed Index, which analyzes the sentiments of market participants, remains in the “greed” zone.

Bitcoin’s strong performance inspired a market-wide rally. Several altcoins, which began their ascent yesterday, continued to post gains, while the majority now mirror Bitcoin’s upward trajectory.

ApeCoin (APE) is the biggest gainer in the last 24 hours, up over 60%. This increase comes after the launch of ApeChain, a new layer 3 blockchain developed by ApeCoin DAO. Not only does the launch drive up the price of APE, but it also triggers a surge in its market volume, which saw an increase of almost 3,000%, surpassing the $1 billion mark.

Ethereum (ETH), the second-largest crypto asset, made 4% gains after crossing the $2,700 mark on Saturday, data showed.

Ethereum layer 2 tokens have also seen a substantial increase over the past 24 hours. Optimism (OP), Arbitrum (ARB), and Starknet (STRK) each rose more than 8%. Immutable (IMX) saw a 6% increase, while Polygon rose 4%.

Besides Bitcoin and Ethereum, major coins like Binance Coin (BNB) and Solana (SOL) have also made major progress. BNB reclaimed the $600 mark while SOL climbed to $170.

Coins in the field of artificial intelligence, one of the most promising stories of this season, are once again in the spotlight. Bittensor (TAO) leads the AI tokens, climbing 7% to $600 on the day.

The widespread crypto rally has pushed the total market cap to $2.5 trillion, up 1% in the past 24 hours.

Bitcoin hits new highs ahead of US presidential election

According to Standard Chartered, Bitcoin could revisit its previous all-time high of $73,800 before the next US president is chosen. The bank expects the price of Bitcoin to rise as institutional interest in Bitcoin ETFs increases and Donald Trump’s election chances improve.

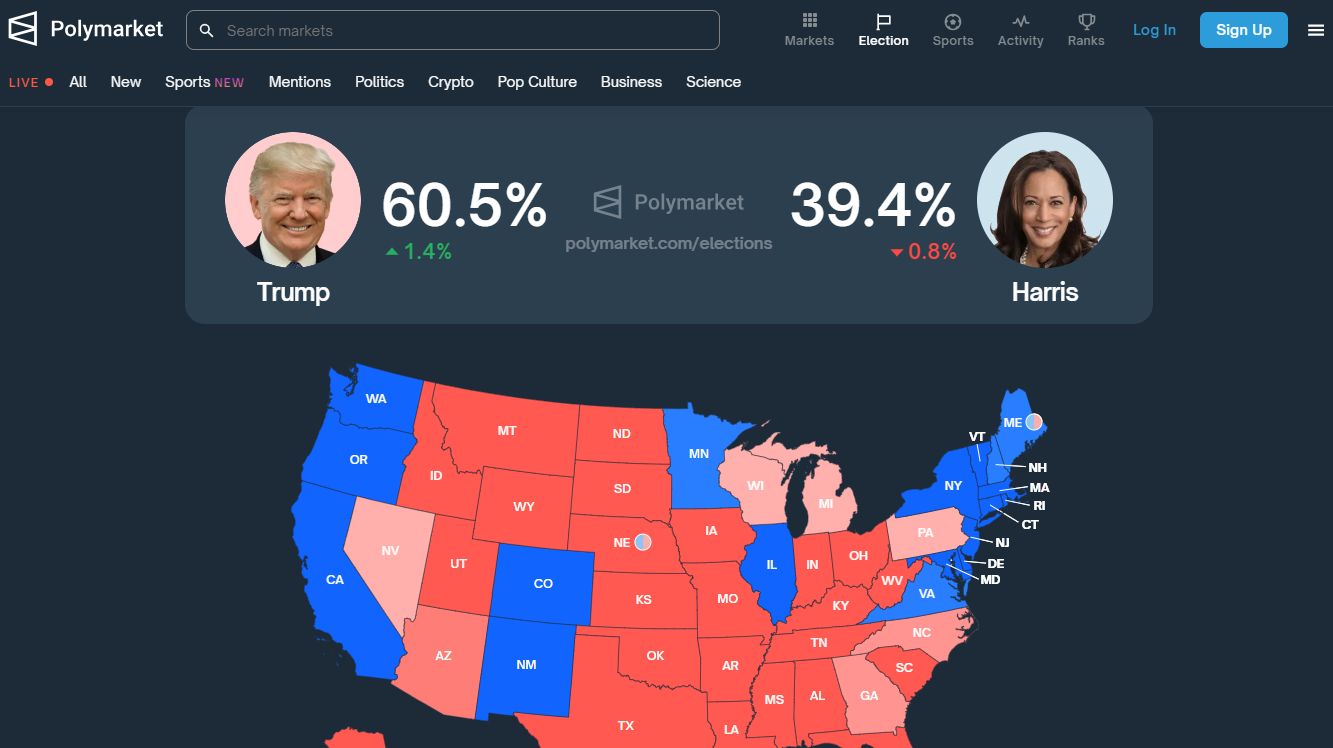

Polymarket data indicates that traders prefer Trump over Kamala Harris for the next US president. Trump currently leads the poll with more than a 60% chance, while Harris’ chances are around 39%.

The value of Bitcoin could increase in the short term if Trump wins, suggests Standard Chartered. Trump has moved away from his previous anti-crypto stance and positioned himself as one of the more pro-crypto candidates, while Harris has only just started showing support.

Matt Hougan, CIO of Bitwise, also considers the upcoming elections and strong demand for ETFs, coupled with other key factors such as increased whale accumulation, post-halving supply reduction and global economic factors, as bullish catalysts for Bitcoin price movements.

As of Oct. 20, U.S. spot Bitcoin ETFs had seen more than $21 billion in net inflows, a milestone that took gold ETFs years to reach.

Share this article